The Best Accounting Software for the Self-Employed

If you’re in business, accounting software can make your life so much easier. Even if you work solo and have no employees to pay, accounting software is still important. But whether you’re self-employed, a sole proprietor, or a thriving small business, accounting software is not a luxury. It’s a necessity.

If you’re looking for accounting software for your small business, remember that not all software applications are created equal. Some applications are better suited to self-employed individuals or sole proprietors than they are to small businesses that have several employees or are in a growth state.

What’s the best accounting software for self-employed individuals? It depends on what type of business you own and what features are important to you. If you’re self-employed and intend to stay that way, why not check out our self-employment software picks and see what each has to offer?

8 top self-employed software options:

- FreshBooks

- Zoho Books

- AccountingSuite

- OneUp

- QuickBooks Online

- Xero

- Sage Business Cloud Accounting

- Wave Accounting

What to look for in a great self-employed accounting software

If you’re looking for the best accounting software for sole proprietors and the self-employed, there are a few features you should pay particular attention to. For example, if you sell products, you’ll want an application that offers inventory management, while those that offer services will find time-tracking capability a major plus.

But no matter what type of business you own, the following should always be taken into consideration when looking for accounting software, or any software application for your business.

1. Cost

Cost is perhaps the most important thing self-employed business owners need to consider. Do you have a budget for accounting software, or are you looking for a free application? Are all of the features you need only available in a more expensive plan? Do you have to pay for support, or is it included in the cost of the application?

2. Ease of use

Ease of use is subjective. I might find Product A awesome, while you may think it’s the worst software you’ve ever used. That’s why it's more important that you feel comfortable using the application. The best way to determine that is to download demos of the applications you’re interested in and give them a test drive. You’ll likely know within minutes if it’s a good fit.

3. Available features

Any accounting software application you purchase should include double-entry accounting capability, a good support system, and easy invoicing. It’s up to you to determine what other features you’re looking for. Once you know, seek out the applications that offer those features.

Our top 8 picks for self-employed accounting software

If you know nothing about accounting, you’re probably wondering how you’ll know what accounting software application is best for your business. After all, aren’t they all pretty much the same?

Yes and no. While all of our top eight accounting software applications for self-employed business owners offer double-entry accounting, invoicing capability, and cash management features, they also contain a lot more. Some include a desktop timer that lets you track the time spent on any job. Others have an inventory feature that can manage product sales and inventory levels. Still others offer excellent bill payment capability.

Only you can determine which features are important and whether the products you’re interested in include them. That said, here are our picks for the best accounting software for self-employed individuals.

1. FreshBooks

FreshBooks is a good fit for self-employed business owners, but, with four plans available, it can also grow along with you. And because FreshBooks does not offer a payroll plan, it remains a terrific option for self-employed individuals and sole proprietors who don’t have a staff to pay.

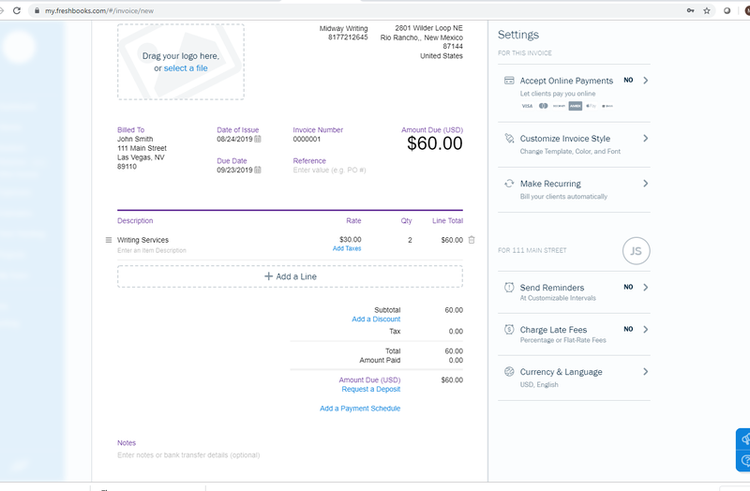

FreshBooks can create professional invoices with numerous invoice settings and options available. Image source: Author

FreshBooks offers excellent invoicing capability even if you have no idea how to write an invoice. The platform also recently added an ACH payment option that makes it easy for your customers to pay you online. And for self-employed attorneys or accountants, FreshBooks includes a retainer feature that makes it easy to bill your clients a retainer fee.

Other features available in FreshBooks include:

- Custom invoicing with branding capability

- Bank connectivity

- Time-tracking, including a desktop timer

- Project management

- Client estimates and proposals

- Payment management

- Integration with more than 100 apps

- Live support options

Reporting options are adequate for self-employed business owners, and the reports page lets you manage your favorite reports for easy future access.

FreshBooks’ pricing structure has recently been updated, with four plans available. They include the Lite plan, which runs $13.50/month and includes five billable clients.

If you have more clients, you can opt for the Plus plan, which is $22.50/month. Both offer unlimited expense tracking and invoicing and include a mobile app for Android and iOS devices. Also available are the Premium plan, which is $45/month and supports up to 500 clients, and the Select plan with custom pricing for more than 500 clients.

One of the biggest benefits of using FreshBooks is that it has the features self-employed individuals need without a lot of unnecessary fluff. You can easily track expenses, bill clients, and manage your bank accounts.

Read The Ascent’s full FreshBooks review

2. Zoho Books

If you know nothing about accounting, Zoho Books is the right software for you. A great fit for self-employed individuals, Zoho Books offers three plans, all with a ton of features. Particularly well-suited for businesses that sell products and need to manage inventory, Zoho Books also works with several online payment gateways for easy customer payment.

All three Zoho Books plans include the following features:

- Automated workflows

- Bank connectivity and reconciliation

- Custom invoicing, including company branding

- Expense tracking

- Projects and timesheets

- Recurring transactions

- Mobile app for iOS and Android devices

Zoho Books includes a dashboard, where you can view important business metrics such as accounts payable and accounts receivable totals, as well as income and expense totals for the current year. If you choose to use the Professional plan, you’ll also have access to purchase orders, sales orders, inventory, and a client portal, where you can share documents and invoice clients directly.

Zoho Books offers three plans. The Basic plan is $9/month and supports up to 50 clients/contacts and two users; the Standard plan, which is $19/month and supports up to 500 contacts/clients and three users; and the Professional plan, which is $29/month and supports more than 500 contacts and up to 10 users.

Zoho Books offers a portal where you can easily share invoices and other correspondence with your customers. Image source: Author

Zoho Books includes good reporting options with a variety of standard reports available, and all reports are able to be exported using a CSV format or Microsoft Excel.

One of the major benefits Zoho Books offers new users is its extensive help sections that will take you step by step through each process you need to complete. This is especially useful for those struggling to learn Accounting 101. And, with three plans available, you can also scale up should you find your business is growing.

Read The Ascent’s full Zoho Books review

3. AccountingSuite

AccountingSuite is not as well-known as its competitors, but it offers many of the same features designed for the small business owner, including self-employed individuals and sole proprietors. A great fit whether you’re selling products or services, AccountingSuite includes excellent sales and inventory management capability, plus a time-tracking feature.

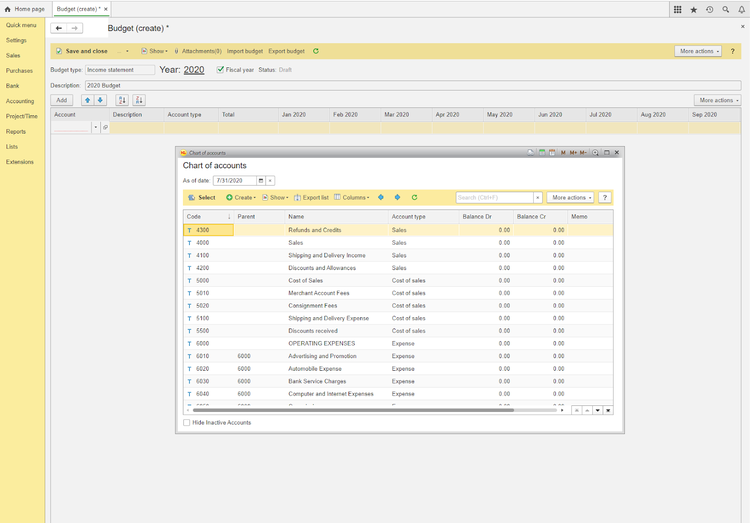

One feature that sets AccountingSuite apart is its budgeting capability, which allows you to create a current or future year budget with the ability to choose the accounts you wish to include. To see how accurate your budget is, run the Budget report, which compares budgeted totals to actuals.

AccountingSuite offers a rare commodity in small business software, which is excellent budgeting capability. Image source: Author

Other features AccountingSuite offers include:

- Advanced accounting features, such as period closing capability and recurring journal entries

- Sales quotes and sales orders

- Custom invoicing

- Cash receipts

- Purchases

- Customizable extensions that fit your business

- Inventory management

- E-commerce integration (Pro with e-Commerce plan only)

AccountingSuite also includes good reporting options, with reports easily customizable to better suit your needs.

AccountingSuite currently offers four pricing levels. The Start Up plan at $19/month is perfect for those just starting out and offers banking, accounting, projects, time tracking, and reports. The Business plan, at $25/month, also including sales, purchases, and sales tax management. A Professional plan at $55/month and a Pro with an e-Commerce plan at $129/month are also available.

Another asset of AccountingSuite is its ability to integrate with e-commerce platforms. While the Pro plan is not cheap, AccountingSuite will completely integrate your accounting platform to your online business, eliminating the need to enter information twice and saving you a lot of time in the process.

Read The Ascent’s full AccountingSuite review

4. OneUp

OneUp is another accounting software application that is less well-known than its competitors. A good fit for self-employed business owners and sole proprietors, OneUp offers lead management and a solid inventory management module, making it a particularly good choice if you’re selling products.

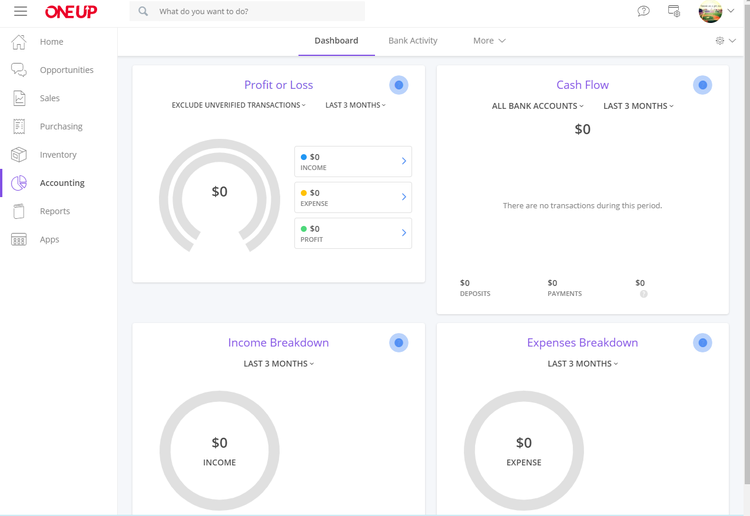

OneUp makes it easy for you to get around, with an intuitive user interface and an informative dashboard that provides a quick look at vital data, such as profit and loss, cash flow, and income and expense summaries.

OneUp also includes easy product and service setup, as well as the ability to link bank accounts and other financial institutions with the application.

The OneUp dashboard offers a quick look at profit and loss, cash flow, income, and expenses. Image source: Author

Other features available in OneUp include the following:

- Multi-location inventory management

- Purchase order management

- Customer quotes

- Customer prepayments

- Custom invoicing

- Opportunities, with the ability to convert a lead directly into a quote

- Mobile accessibility

Reporting options in OneUp are good, with reports available in three categories -- accounting and financial reports, expense reports, and inventory reports. Purchase order and project reports are also available.

OneUp offers five plans, with all plans including the same features and pricing based solely on the number of users. A perfect fit for self-employed business owners is the Self plan, which supports one user and is $9/month with all features included. There’s a Pro plan for two users that runs $19/month, and Plus, Team, and Unlimited user plans are also offered.

The big benefit with OneUp is that every plan includes all features, so you won’t have to move up to a more robust (and expensive) plan to access the features you want.

Read The Ascent’s full OneUp review

5. QuickBooks Online

QuickBooks Online is ideally suited for small and growing businesses, although it’s also a good choice for self-employed business owners and sole proprietors looking for a more robust accounting application.

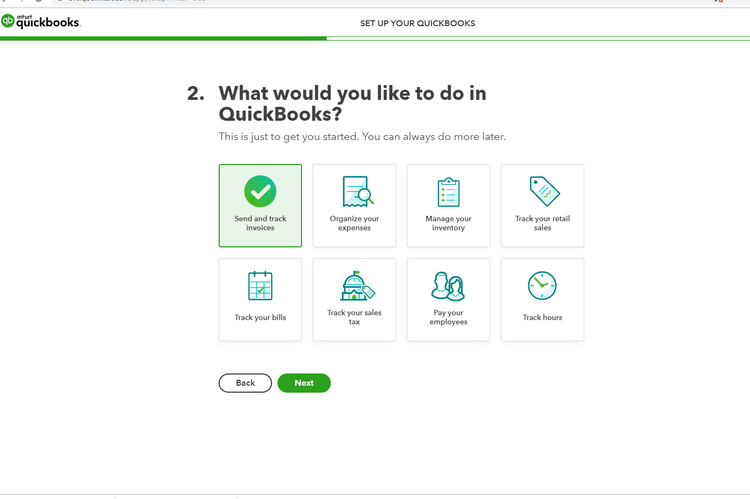

When setting up your business in QuickBooks Online, you can choose to activate as many or as few of the available features as you like, with the option to return to activate these features should you need them.

The availability of features in QuickBooks Online is dependent on the version you subscribed to, although basic features such as bank connectivity, income and expense tracking, and cash flow management are included in all plans. The user dashboard now includes a new cash flow widget for better cash management.

QuickBooks Online offers easy setup options. Image source: Author

Other available features include:

- Custom invoicing

- Payment acceptance

- Customer estimates

- Sales tax tracking

- Bill payment (Plus plan)

- Time tracking (Plus plan)

- Inventory management (Plus plan)

- Mobile app for iOS and Android devices

QuickBooks Online’s reporting options are good, and all reports are fully customizable. You can export reports to Excel or save them as a PDF.

QuickBooks Online is one of the more expensive options on our list. Pricing begins at $12.50/month for the Simple Start plan, which goes up to $25 after three months. For access to more comprehensive features, you’ll likely need the Plus plan, which starts at $35/month for three months and then goes to $70/month, which may be too steep for self-employed individuals on a limited budget.

One of the advantages of using QuickBooks Online is its ability to integrate with numerous apps, as well as the ability to grow with your business. However, if you’re planning on remaining self-employed, you can probably find a more affordable choice.

Read The Ascent’s full QuickBooks Online review

6. Xero

Xero is a good choice for self-employed individuals, as well as those with small and growing businesses. Xero works well in niche markets and is particularly well-suited for online sellers who conduct business globally.

Xero offers a wide range of features, including complete custom invoicing, expense and inventory management, and bill payment options, along with a multi-currency option. However, feature availability depends on the plan.

Xero allows you to add bank accounts and manage them from a single screen. Image source: Author

The following features can also be found in Xero:

- Custom invoices

- Customer quotes

- Bill payment

- Inventory management

- Bank account connectivity

- Project management

- Contacts

- Mobile app for iOS and Android devices

Xero also contains budgeting capability so you can create an organizational budget as well as a departmental budget or project budget if needed. There is also an option to import budget details from another application if necessary.

Reporting options in Xero are decent, and reporting options are continuing to improve after each product update.

Xero currently offers three plans. The Early plan is $9/month for the first two months and then jumps to $18/month. It includes up to 20 invoices and five bills, along with bank reconciliation capability. If you need to send more than 20 invoices or process more than five bills, you’ll need to look at the Growing plan, which is $30/month for the first two months and then goes to $60/month.

If you want access to the multi-currency or project management features, you’ll need to move up to the Established plan, which will run $120/month after introductory pricing, likely putting it out of reach of very small businesses.

One of the greatest benefits you can derive from using Xero is its ability to integrate with more than 700 apps in a variety of categories, which is a major plus for niche businesses.

Read The Ascent’s full Xero review

7. Sage Business Cloud Accounting

Formerly Sage One, Sage Business Cloud Accounting is an excellent option for self-employed business owners. The application, suitable for those selling products or services, currently offers two plans, although the lower tier plan offers very limited features and therefore is suitable for only very small businesses.

Both Sage Business Cloud Accounting plans include invoicing, tracking, and bank connectivity, with the full version of the application offering the following features:

- Custom invoicing options

- Accounts receivable tracking

- Bank connectivity

- Customer estimates and quotes

- Purchase order invoice management

- Online payment acceptance

- Online bill payment

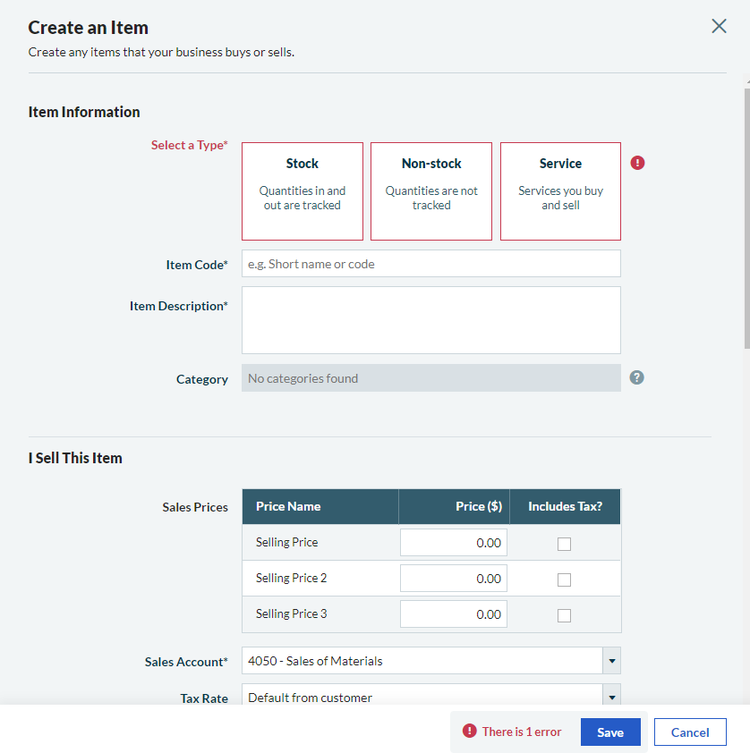

Sage Business Cloud Accounting lets you manage both products and services. Image source: Author

Sage Business Cloud Accounting offers good product and services management so you can track both stock and non-stock inventory items or set up services that you currently offer to your customers. In addition, the inventory management feature offers multiple pricing levels and easily handles all sales tax management for products and services sold.

Reporting options are good, and there is a wide selection of standard reports, although they offer limited customization capabilities. If customization is required, you can export any report as a CSV file if desired.

Sage Business Cloud Accounting offers two plans: Accounting Start, which is $10/month and offers limited features, and Accounting, which runs $25/month and includes a much better feature selection. You can upgrade to another plan or cancel your subscription at any time.

One of the benefits of using Sage Business Cloud Accounting is that it provides access to Sage Marketplace, which offers apps in a variety of categories. Another benefit is the ability to accept online payments and pay vendor bills electronically, an option many competitors don’t offer.

Read The Ascent’s full Sage Business Cloud Accounting review

8. Wave Accounting

If you’re looking for good accounting capability at a price you can afford, look no further than Wave Accounting. A perfect choice for self-employed individuals and sole proprietors, Wave is 100% free, with no costly plan you need to upgrade to in order to access additional features. Once you sign up for Wave, you have complete access to all of its features.

However, if you choose to use Wave Payments, you’ll have to pay a small fee for credit card processing, which is the same fee you’d pay with any application. You’ll also have to pay if you use the payroll option, but that’s not an issue if you’re self-employed.

Wave Accounting is completely free unless you subscribe to a payment or payroll plan. Image source: Author

Wave offers a good selection of features, including the recent addition of double-entry accounting so you can keep your books properly organized.

Additional features found in Wave Accounting include:

- Customer estimates

- Custom invoice creation

- Recurring invoice processing

- Wave payments (additional fees charged)

- Bill payment management

- Bank connectivity

- Mobile app for iOS and Android

In addition, all new Wave Accounting users receive chat support for 60 days. After that initial period, only payment and payroll subscribers will have access to chat support, although email support is available to all users.

Reporting options are limited in Wave Accounting, with only 12 reports available. You can export reports in a CSV format available for customizing if desired.

A subscription to Wave Accounting is free. If you opt to subscribe to Wave Payments, the cost is the same as credit card processing from any vendor -- 2.9%, plus a $.30 per-transaction fee -- while ACH payments are 1% of the total processed.

For self-employed individuals, a major benefit of using Wave Accounting is that it’s 100% free, so you can get started managing your business without any additional out-of-pocket expenses required.

Read The Ascent’s full Wave Accounting Review

Self-employed individuals still need to manage their business

Self-employed bookkeeping and accounting software can make a world of difference for you and your business. Using accounting software helps to make sure expenses are accounted for properly, customers are invoiced promptly, and financial statements are accurate.

If you’re still in the weeds looking for an accounting software application for your business, check out our full reviews, maybe download a few demos, and find the application that’s best for your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles