Used by business owners, banks, and investors, the times interest earned ratio, also known as the TIE or interest coverage ratio, measures the long-term solvency of a business by calculating the ability of the business to pay off debt and interest expenses. Learn why this ratio can be useful for your small business.

Overview: What is the times interest earned ratio?

Accounting ratios are used to identify business strengths and weaknesses. When used consistently over time, accounting ratios help to pinpoint trends and provide useful information to business owners and investors about the financial health and stability of a business.

All accounting ratios require accurate financial statements, which is why using accounting software is the recommended method for managing your business finances.

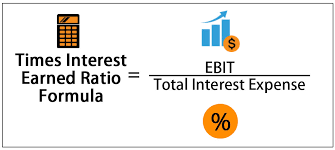

The times interest earned ratio formula divides EBIT by interest expense. Image source: Author

Designed to measure solvency long-term by determining how many times your business can pay its current interest expense, the times interest earned (TIE) ratio measures the amount of income available to cover long-term debt.

For example, if you have any current outstanding debt, you’re paying interest on that debt each month. The TIE ratio uses that total interest expense in its calculation.

When used consistently, the times interest earned ratio can identify trends and provide insight into whether a business needs to reexamine internal processes in order to remain solvent, or if they’re at risk for bankruptcy.

How to calculate the times interest earned ratio

Like most accounting ratios, the times interest earned ratio provides useful metrics for your business and is frequently used by lenders to determine whether your business is in position to take on more debt.

The times interest earned ratio uses earnings before interest and taxes (EBIT) along with your interest expense, both found on your financial statements, in order to calculate TIE. There are two ways you can calculate EBIT for your business. The direct EBIT formula is:

Total Revenue - Cost of Goods Sold - Operating Expenses = EBIT

If you don’t have a cost of goods sold number, you can use the net income or indirect method which adds interest and tax to net income. The formula to calculate the indirect method is:

Net Income + Interest + Taxes = EBIT

This formula may create some initial confusion, since you’re adding interest and taxes back into your net income total in order to calculate EBIT.

Once your EBIT is calculated, you’re ready to calculate the times interest earned ratio using the TIE formula:

Earnings Before Interest and Taxes (EBIT) ÷ Interest Expense = Times Interest Earned Ratio

Barb’s Books

Income Statement

December 2018

| Earnings Before Interest and Taxes (EBIT) | $121,000 |

| Interest Expense | $ 35,000 |

Using the income statement for Barb’s Books, we’ll calculate the ratio for the year ending 2018:

$121,000 ÷ $35,000 = 3.45 times

This means that in 2018, Barb’s Books was able to cover its total interest payments for 2018 3.45 over.

The TIE ratio is always reported as a number rather than a percentage, with a higher number indicating that a business is in a better position to pay its debts. For example, if your business had a times interest earned ratio of 4 times, it would mean that you would be able to repay your interest expense four times over.

Businesses with a TIE ratio of less than two may indicate to investors and lenders a higher probability of defaulting on a future loan, while a TIE ratio of less than 1 indicates serious financial trouble.

Because this number indicates the ability of your business to pay interest expense, lenders, in particular, pay close attention to this number when deciding whether to provide a loan to your business.

It is also possible to have too high a TIE. If your business has a high TIE ratio, it can indicate that your business isn’t proactively pursuing investments.

Can you have a negative times interest earned ratio?

If you’re reporting a net loss, your times interest earned ratio would be negative as well. However, if you have a net loss, the times interest earned ratio is probably not the best ratio to calculate for your business.

Examples of the times interest earned ratio

Let’s explore a few more examples of times interest earned ratio and what the ratio results indicate.

Example 1

Let’s look at Barb’s Books subsequent TIE for the following two years. With EBIT declining in both 2019 and 2020, Barb’s times interest earned ratio will decline as well.

Barb’s Books

Comparative Income Statement

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Earnings Before Interest and Taxes (EBIT) | $ 121,000 | $ 99,500 | $ 59,000 |

| Interest Expense | $ 35,000 | $ 35,000 | $ 35,000 |

An abbreviated income statement shows declining earnings for three years.

$99,500 ÷ $35,000 = 2.84 times

While this is down from 2018, 2.84 is still a good TIE. It’s when we calculate TIE for 2020 that Barb’s decline in sales becomes problematic:

$59,000 ÷ $35,000 = 1.68

While Barb’s TIE is still more than 1, she’s clearly running into the danger zone, particularly when you look at the trend across the three years.

This is why running TIE over a period of years can be helpful. As you can see, Barb's interest expense remained the same over the three-year period, as she has added no additional debt, while her earnings declined significantly.

This puts Barb’s bookstore in a precarious position, because the only way she will likely be able to save her store is with an influx of cash from a lender or investor, but the steep decline in both EBIT and TIE makes her a risky investment.

Example 2

Our second example shows the impact a high-interest loan can have on your TIE ratio.

Harold’s Hardware

Comparative Income Statement

| 2018 | 2019 | |

|---|---|---|

| Earnings Before Interest and Taxes (EBIT) | $ 45,000 | $ 51,000 |

| Interest Expense | $ 400 | $ 12,250 |

Harold’s times earned interest ratio for 2018 was:

$45,000 ÷ $400 = 112.50 times

That means that, in 2018, Harold was able to repay his interest expense more than 100 times over. That all changed in 2019, when Harold took out a high-interest-rate loan to help cover employee expenses.

$51,000 ÷ $12,250 = 4.16 times

While 4.16 times is still a good TIE ratio, it’s a tremendous drop from the previous year. While Harold may still be able to obtain a loan based on the 2019 TIE ratio, when the two years are looked at together, chances are that many lenders will decline to fund his hardware store.

Final thoughts on times earned interest ratio

The times interest earned ratio is not necessary for every business. If you’re a small business with a limited amount of debt, the times interest earned ratio will likely not provide any new insight into your business operations.

However, if your business currently has debt, and you are considering taking on more, the times earned interest ratio can provide you and potential creditors or investors with a snapshot of your business risk and how likely it is you’ll be able to pay back any funds that are offered.

Like any accounting ratio, if comparing results to other businesses, be sure that you’re comparing your results to similar industries, as a TIE ratio of 3 may be adequate in one industry but considered low in another.

You may not need to calculate your times earned interest ratio today. However, as your business grows, and you begin to turn to outside resources for funding opportunities, you’ll likely be calculating your times earned interest ratio on a regular basis.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.