Xero Alternatives: Which One Is Right for Your Business?

Xero accounting software is one of the most widely used small business accounting software applications on the market. No. 2 only to QuickBooks, Xero is well suited for sole proprietors, freelancers and small and growing businesses.

But what if Xero isn’t the right accounting tool for you? Not to worries. There are plenty of other applications to choose from.

Here are the top alternatives to Xero accounting software:

- QuickBooks Online

- Sage Business Cloud Accounting

- Zoho Books

- OneUp

- FreshBooks

- QuickBooks Desktop

- Sage 50cloud Accounting

- AccountEdge Pro

- Kashoo

- Wave Accounting

What to look for in a great Xero alternative

What should you look for in an accounting software application? Easy invoicing? Affordable pricing? Maybe you’re looking for an application that will grow along with your business?

Whatever you’re looking for, chances are at least one of the above applications will offer it. When looking for a Xero alternative, take a closer look at the following features.

1. Invoicing

As a small business owner, invoicing your customers is one of the most important things you’ll do. Is it important that you're able to customize an invoice with your software?

Do you want to include payment links in your invoices? Do you want to add late charges to past due invoices? Deciding what invoicing features are important to you will make your software search a lot easier.

2. Reporting

Sole proprietors and freelancers can usually get by with limited reporting options, but if extensive reporting choices are important to you, be sure to check out the reporting capability in any software application you’re considering.

The easiest way to do this is to test-drive a demo of the application and spend a few minutes looking at the reporting options that are available to ensure it has what you’re looking for.

3. Support

If you need a lot of help when trying out a new software application, Xero may not be for you. It provides email support, but no telephone support, which can cause problems for those who prefer speaking to someone.

While it may not be at the top of your most wanted features list, reviewing the support options available for any software application you’re interested in will help you avoid surprises later.

Our top 10 picks for Xero alternatives

While millions of business owners around the world use Xero, there are plenty of alternatives to choose from. If Xero’s not right for you, check out our top 10 list of Xero alternatives to find the ideal solution for your business today.

1. QuickBooks Online

QuickBooks Online was originally designed for very small businesses, but changes over the years have made this application a popular choice for larger business owners.

QuickBooks Online offers many of the features you’re looking for, including easy system setup, bank connectivity, and good invoicing and expense management. QuickBooks Online also offers a bank reconciliation feature, making month-end reconciliation a breeze.

Reporting options are decent in QuickBooks Online, and you can integrate with plenty of third-party apps if you’re looking for a feature not offered in the software. Feature availability expands with each version, so you may have to opt for a more expensive plan to get the features you want.

QuickBooks Online makes it easy to properly account for your business expenses. Image source: Author

QuickBooks Online currently offers four plans: Simple Start, which supports a single user and runs $12/month; Essentials, which supports three users and is $20/month; Plus, which supports up to five users and runs $35/month, and Advanced, which supports up to 25 users and runs $75/month, with pricing for all plans increasing after the first three months.

Read The Ascent’s full QuickBooks Online review

2. Sage Business Cloud Accounting

Sage Business Cloud Accounting is best suited to freelancers, sole proprietors, and very small businesses. Available in two plans, Sage Business Cloud Accounting offers sales invoicing, payment tracking, and bank connectivity in both plans.

The sales feature in Sage Business Cloud Accounting lets you create quotes and estimates for your customers and later convert them to an invoice. The application also includes excellent invoice customization capabilities, or you can just use the invoice templates included in the application.

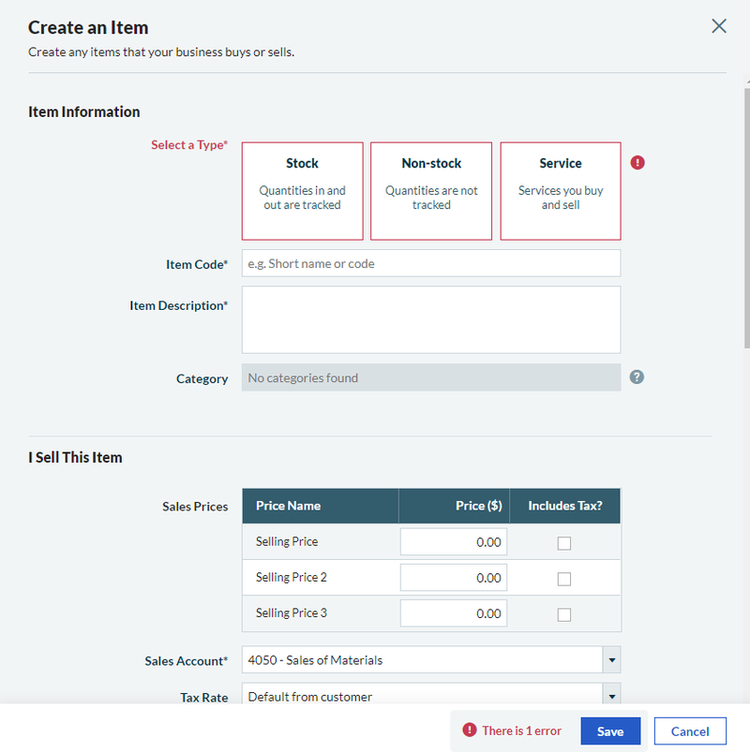

Sage Business Cloud Accounting lets you manage both products and services. Image source: Author

Once you create an invoice, you can easily track it in Sage Business Cloud Accounting, and you can also manage stock, non-stock, and service items in the application. In addition, you can accept online payments from customers and pay vendors using ACH transfers.

For an entry-level accounting application, Sage Business Cloud Accounting includes excellent reporting options, though report customization is limited, and reports are not available in the low-cost plan.

Sage Business Cloud Accounting offers two plans; Accounting Start, which offers basic features, for $10/month and Accounting, which includes bill processing, quotes and estimates, and reporting options and runs $25/month.

Read The Ascent’s full Sage Business Cloud Accounting review

3. Zoho Books

Zoho Books is an interesting application that's particularly well suited for smaller businesses. Zoho Books offers a long list of features, including solid inventory management capability and time tracking, making it a great option if you’re selling products and services.

Zoho Books can be particularly beneficial to new business owners who don't have any accounting or bookkeeping knowledge.

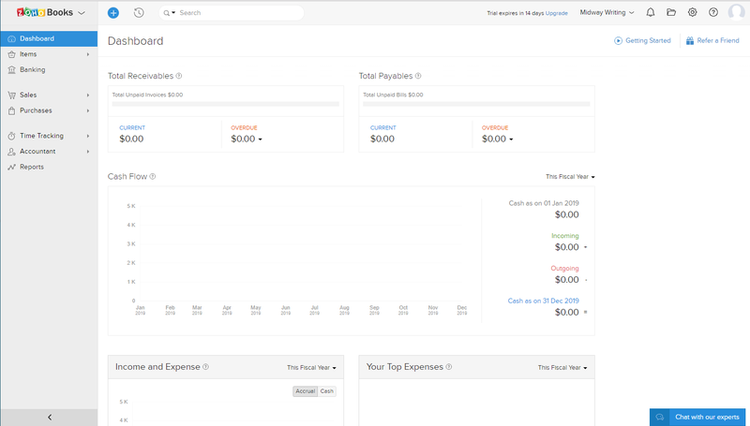

Zoho Books lets you track total receivables and total payables from the Dashboard. Image source: Author

Zoho Books offers a client portal for easy invoice delivery, and the application offers customer and vendor management capabilities, as well as estimates, sales orders, and recurring invoices and expenses.

It also integrates with numerous payment platforms, making it easy for your customers to pay you online. In addition, a mobile app is available for both iOS and Android devices.

Zoho Books offers many reports, all fully customizable and easily exported to Microsoft Excel.

Zoho Books offers three plans that are all affordably priced including Basic, which supports up to two users and is $9/month, Standard, which supports up to three users and is $19/month, and Professional, which supports up to 10 users and is $29/month.

Read The Ascent’s full Zoho Books review

4. OneUp

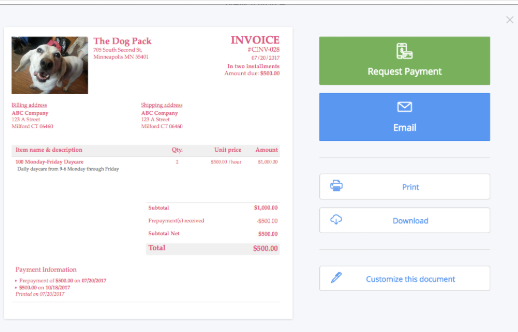

OneUp may be the best accounting software application you’ve never heard of. A good fit for sole proprietors, freelancers, and small businesses, OneUp offers great custom invoicing, can handle customer quotes, and lets you include a payment link with your invoices.

OneUp also has an Opportunities feature, ideal for service businesses to keep track of their customers, and the inventory management module lets you track inventory in multiple locations.

OneUp also includes good reporting capability, with a variety of reports available including purchase order and project reports, as well as all financial statements.

You can request payment right from your invoice in OneUp Image source: Author

. Source: OneUp software.

OneUp offers five plans:

- Self plan, which supports a single user: $9/month

- Pro plan, which supports two users: $19/month

- Plus plan, which supports three users: $29/month

- Team plan, which supports seven users: $69/month

- Unlimited plan, which supports unlimited users: $169/month

One of the biggest benefits of using OneUp is that you have immediate access to all features, no matter which plan you choose.

Read The Ascent’s full OneUp review

5. FreshBooks

Ideal for the self-employed and very small businesses, FreshBooks continues to add new features on a regular basis. Features found in FreshBooks include a retainer option, ideal for attorneys, accountants, and consultants who bill clients on a recurring basis.

Other features in FreshBooks include the ability to accept online credit card payments as well as ACH payments from customers.

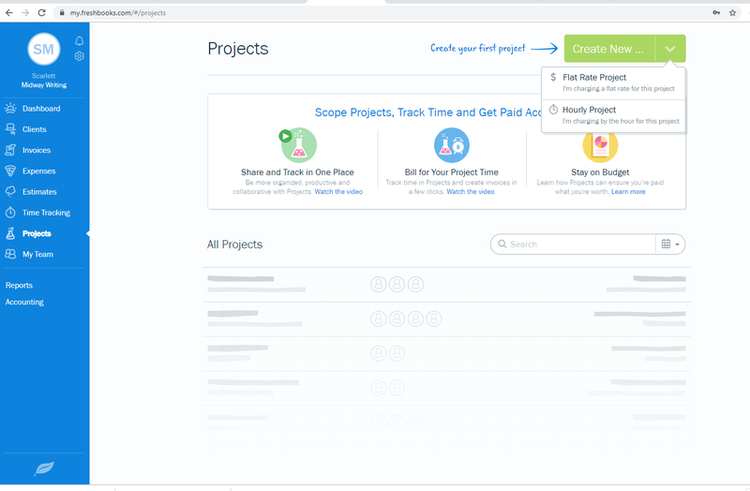

Sole proprietors and consultants will appreciate the Projects feature in FreshBooks. Image source: Author

FreshBooks offers good client invoicing, the ability to track and record expenses, and easy payment posting. In addition, FreshBooks includes time tracking, project management, and client estimate features plus the ability to create a client proposal.

For those working with a team, FreshBooks lets you add team members to your plan, whether they’re employees, associates, or consultants.

Reporting options in FreshBooks are decent, with reports such as recurring revenue and retainer summary particularly helpful for consultants.

FreshBooks offers four plans; Lite, which is best for sole proprietors and runs $15/month; Plus, which runs $25/month; Premium, which is $50/month; and Select, with pricing customized for each user. FreshBooks frequently runs software specials, so be sure to check the website for current pricing.

Read The Ascent’s full FreshBooks review

6. QuickBooks Desktop

There’s a reason QuickBooks Desktop remains the favored small business accounting application for businesses worldwide.

It offers everything a small business owner needs to manage their business, including solid invoicing, good inventory management, vendor management and bill payment capability. QuickBooks Desktop is also scalable, supporting up to 25 system users, making it suitable for small and growing businesses.

QuickBooks Desktop offers excellent reporting options. Image source: Author

Perhaps one of the most beneficial features of QuickBooks Desktop is the availability of industry-specific versions of the application, designed for small manufacturers, nonprofits, and retail businesses.

Another benefit is the unparalleled reporting options in QuickBooks Desktop, which offers more than 100 standard reports as well as industry-specific reports when using a specialty version of the application.

In addition, QuickBooks Desktop includes forecasting capability in both the Premier and Enterprise editions, a rare find in a small business accounting software application.

QuickBooks Desktop offers three plans: Pro, which supports up to three users and is $299.95 annually; Premier, which supports up to five users and is $499.95 annually; and Enterprise, which supports up to 30 users and is $1,091.70 annually.

Read The Ascent’s full QuickBooks Desktop review

7. Sage 50cloud Accounting

A close competitor to QuickBooks Desktop in terms of features and functionality, Sage 50cloud Accounting offers the reliability of a desktop application along with easy online access using Microsoft 365.

Sage 50cloud Accounting offers a long list of features that include customer management, invoicing and payment acceptance, automated bank feed, purchase orders, and sales tracking. Bank reconciliation capability is also included in the application.

Sage 50cloud Accounting offers excellent purchase and vendor management. Image source: Author

Ideal for small and growing businesses, Sage 50cloud Accounting also includes good inventory management and solid reporting options, with more than 100 reports available. In addition, the optional Intelligence Reporting add-on provides additional reporting choices that focus on analytics.

The top two plans in Sage 50cloud Accounting also include advanced budgeting and job costing capability. Sage 50cloud Accounting is a scalable application, making it ideal for growing businesses.

You’ll have three plans to choose from: Pro, which is a one-user system and is available for $199.95/year; Premium, which supports 1-5 users and is $299.95/year; and Quantum, which can support up to 40 users, with custom pricing available directly from Sage.

Read The Ascent’s full Sage 50cloud Accounting review

8. AccountEdge Pro

If your business is in a growth phase, you need an application that works for you today, but can also grow with your business. If you’re facing that challenge, check out AccountEdge, which is ideal for sole proprietors, freelancers, and consultants, but also offers the scalability your business requires long term.

AccountEdge Pro offers both sales order processing and invoicing capability. Image source: Author

Packed full of features such as sales, time and billing, purchasing, inventory management, and banking, AccountEdge Pro includes a customer portal for quick invoice delivery and a web pay option for easy invoice payment.

The application also includes a Contacts feature that can be used to manage customers, vendors, and employees from one central location.

Reporting options are good in AccountEdge Pro, with numerous reports available in a variety of categories. All reports can be customized or exported to Excel if desired.

AccountEdge offers two on-premise plans: Basic, with a one-time fee of $149, and Pro, with a one-time fee of $399 with an option to have the plan hosted remotely.

In addition, there are two cloud plans available: Priority Zoom, which runs $50/month, and Priority ERP, with pricing available directly from AccountEdge.

Read The Ascent’s full AccountEdge Pro review

9. Kashoo

Designed for sole proprietors, consultants, freelancers, and very small businesses, Kashoo offers standard invoicing capability, with an option to create a recurring invoice for customers that are billed monthly, a handy feature for consultants.

When the invoice is paid, you can enter payment information from the same screen. Kashoo also includes good bill payment capability, with an option to run checks to pay vendors, something many of its competitors fail to offer.

Kashoo also includes both vendor and customer management in the form of lists, allowing you to manage products as well, though inventory management is limited to tracking SKUs for products.

Reporting options are limited in Kashoo, with only eight reports available, so if reports are important, you may want to look at other applications. One of Kashoo’s biggest benefits is how easy it is to enter income and expenses, particularly important if you prefer not to connect your bank account to Kashoo.

Kashoo includes tax management capability for those who need to manage sales tax. Image source: Author

Kashoo is an all-in-one application, offering a single plan that runs $199 annually and supports an unlimited number of users.

Read The Ascent’s full Kashoo review

10. Wave Accounting

Best suited for sole proprietors, consultants, and freelancers, Wave Accounting is completely free. It remains free no matter how many users you may have.

Wave Accounting makes it easy for new users to navigate the application. Image source: Author

Being completely free has not limited the number of features available in Wave, with estimating, sales, custom invoicing, bank connectivity, purchases, and bank reconciliation capability all rolled into the application.

In addition, Wave lets you upload expense receipts from your smartphone directly into the application, making it easy to keep track of business expenses.

Reporting options are limited in Wave, with only 12 reports available. Reports offer limited customization, though they can be exported as a CSV file for customizing if desired. You can also save any report as a PDF, so they’re easy to share if necessary.

Wave Accounting is completely free, with fees only charged if you choose to use Wave Payments or Wave Payroll. Wave Payments currently charges a fee of 2.9% plus $.30 per transaction, with a 1% fee for ACH payments.

Wave Payroll charges a $35 base fee plus a $4 per active employee fee for full-service payroll, with self-service running $20/month.

Read The Ascent’s full Wave Accounting review

Which application is right for you?

Xero is one of the most widely used accounting software applications on the market, but that doesn’t mean it’s the right product for your business.

If you’re still not sure which application is right for you, check out the full reviews of these Xero competitors, download the demos, and find the application that offers everything you need for your small business to thrive.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles