Have you read our accounting software reviews but still aren't sure which product is right for you? To make things a bit easier, we're taking a look at both Wave and QuickBooks Online, providing you with a side-by-side comparison of the two applications.

Top Alternatives to Consider

Consider these additional accounting software options that offer a lot of value and sought-after features for many small businesses.

Wave vs. QuickBooks Online: An overview

Who is Wave for?

Designed for micro-businesses and sole proprietors, Wave makes it easy to keep track of your finances. While the $0 price tag is particularly appealing to those just starting out, Wave also offers solid accounting capability, and if you want to accept online payments, you’ll only have to pay the normal transaction fees you would pay using any other application.

For those who see themselves working solo for the foreseeable future, Wave offers all kinds of perks. However, if you envision your business growing and expanding, you may want to consider a product that can grow along with you.

Who is QuickBooks Online for?

Since its beginning, QuickBooks products have been designed with the small business owner in mind, and QuickBooks Online is no different. QuickBooks Online works for small businesses, sole proprietors, and growing businesses, offering a single-user plan, but it can also scale up to a plan suitable for up to 25 users -- perfect for growing businesses.

Wave vs. QuickBooks Online: Features

Wave offers a lot of features including accounting, invoicing, payments, payroll, and receipts, with QuickBooks Online offering much of the same, with a few additional ones thrown in, such as easy bill payment and full-service payroll. However, if you have a lot of bills to pay, the lack of bill payment capability in Wave may be an issue.

What Wave offers

One of Wave’s best features is its invoicing capability, particularly its custom invoices.

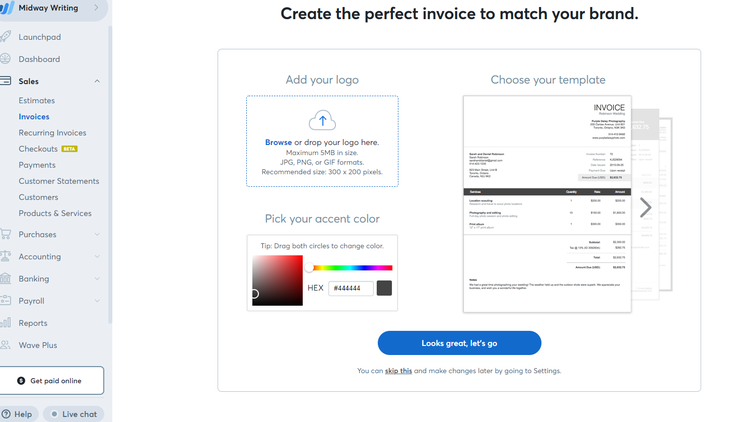

Users can customize their invoicing experience with Wave's intuitive design features. Image source: Author

Wave includes complete invoice customization capability, as seen above, so you can add your logo as well as your company’s accent color to any invoice you create. Wave also includes a variety of templates you can use, or take a few minutes to create a new, custom template. Get paid faster by setting up an online payment option for your customers, including the link when you email the invoice.

You can also make an invoice recurring, handy for those who bill clients a flat fee each month.

You can connect your financial institutions to Wave for automatic transaction import, or use the Add Manual Transactions feature to record banking transactions manually. There’s also an optional payroll feature available in Wave if you have any employees you need to pay.

You can create estimates for your customers and upload receipt images to track expenses. A new feature, Checkouts, lets your customers pay for goods or services directly from your website, eliminating the need to invoice.

There is an option to record bills in Wave, but any payment made will need to be entered manually, as there is no option to run checks to pay vendors, and while customer and vendor management is available, you can only track minimal information.

What QuickBooks Online offers

Like Wave, QuickBooks Online can track and manage your income and expenses, import receipt images, accept online payments, and connect your banking information. You can pay your vendors with a check in QuickBooks Online, something you can’t do in Wave.

The Sales feature in QuickBooks Online also offers some nice functions, including solid customer management capability and good invoice creation and management capability.

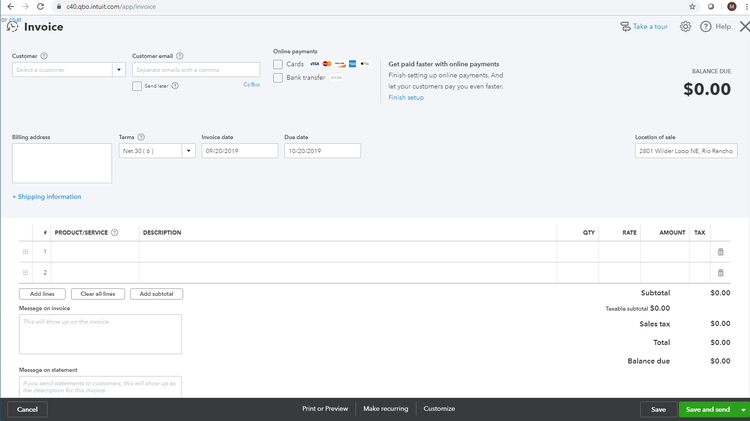

The Invoice screen in QuickBooks Online provides you with an overview of the status of all invoices in the software, so you can send a reminder to your customers via email, or follow up with a phone call for those seriously past due. You can also create a custom invoice in QuickBooks Online and provide an online payment link when the invoice is emailed.

QuickBooks allows users to pay vendors with checks. Image source: Author

One of the handier options available in QuickBooks Online is the ability to add a credit card number or bank account number directly to the invoice (see above) for immediate payment. Another convenient feature is the choice to have online payments automatically applied to an outstanding invoice, or handle the process manually, in order to ensure proper application of the payment.

Like Wave, QuickBooks Online also lets you enter all transactions manually, a nice option for those who don’t want to connect their banking institutions to the software.

Results

QuickBooks wins out here. While Wave offers many of the same features, more comprehensive versions of those same features are typically found in QuickBooks Online, such as bill payment capability and better customer and vendor management capability.

Wave vs. QuickBooks Online: Support

The accounting applications on the market today are designed to be easy, requiring little in the way of training or support. However, just because they’re easier to use doesn’t mean product support is unimportant. Both Wave and QuickBooks Online offer a good selection of tools and resources designed to make it easy to navigate through either application, and robust user communities mean you have access to knowledgeable users at your fingertips.

However, that’s no substitute for live product support. Stuff happens, and when it does, you’ll be thankful for having that number to call.

What Wave offers

Wave users can submit a support request from Wave’s website. In addition, new users will have access to chat support for the first 60 days of their contract. When that 60 days is up, you’ll only have chat access if you subscribe to Wave Payments or Wave Payroll. In addition, Wave offers the following:

- Featured articles

- In-product help

- Wave guides

- User community

- Searchable knowledge base

What QuickBooks Online offers

QuickBooks Online offers numerous support options for its users, including the following:

- User community

- In-product help

- Searchable knowledge knowledge base

- Featured articles

- Product training options

- Connect with a support agent through email

- Connect with a support agent through messaging

- Connect with a support agent by telephone

QuickBooks Online, like Wave, is designed to help users find answers to questions using a variety of resources, and it encourages users to access live support as a last resort. Nevertheless, it’s available.

Results

The winner in this category is QuickBooks Online. While the amount of help and support resources Wave provides, particularly for a free application, is admirable, having live support is always better than not.

Wave vs. QuickBooks Online: Ease of use

Nobody wants a product that’s difficult to navigate. Fortunately, both Wave and QuickBooks Online offer easy setup and system navigation, and both offer a mobile app for iOS and Android smartphones.

What Wave offers

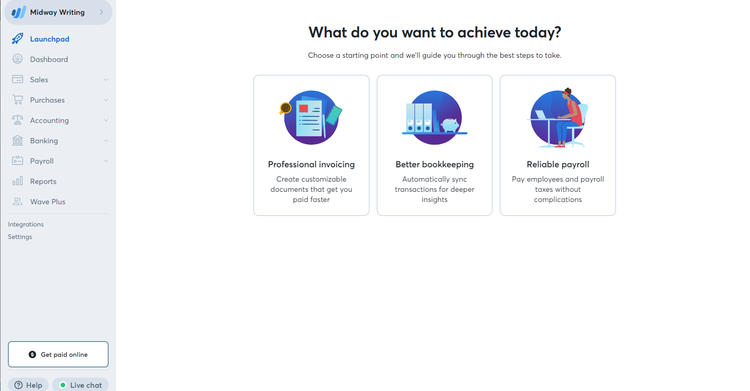

The Wave Launchpad (pictured below) is a great place for new users to start. Simply choose one of the options displayed on the screen, and you’re immediately guided through the entire setup process.

Wave Launchpad gives users a great place to start when first using the software. Image source: Author

You’ll only have to enter the information absolutely necessary in order to get started, and you can add the rest when the time comes. You can also import customers and other information into Wave from other applications using a CSV file. All product features can be accessed from the vertical menu bar to the left of the main screen, and help can be accessed from any screen in the application.

What QuickBooks Online offers

Like Wave, QuickBooks Online allows you to enter the bare minimum during the setup process and add the rest as you go. And like Wave, QuickBooks Online uses a vertical menu bar to the left of the screen that offers access to all system functions.

One of the major differences in QuickBooks Online is that clicking on a category will take you to a main page for that category rather than to the feature itself.

You can also import data from other applications using the Import Data option in QuickBooks Online and a CSV file or a Microsoft Excel file, and if you get stuck, you can access help from any screen.

Results

This one is a dead heat. Both applications make it easy to get started and find your way around without any issues.

Wave vs. QuickBooks Online: Pricing

Wave is a free application, with all accounting features free. QuickBooks Online offers a more scalable product, with a single user able to scale up to a more powerful version at any time without losing data or having to start from scratch with a different application altogether.

What Wave offers

Wave’s accounting features are completely free, but if you want to use Wave Payments (or another payment system) to get paid online, you’ll have to pay 2.9% plus $0.30 for each transaction. Wave charges a 1% fee per transaction for ACH transfers.

What QuickBooks Online offers

QuickBooks Online has four plan options, with the closest one to Wave’s free account being its Simple Start plan, which costs $12.50/month for the first three months and supports a single user. QuickBooks Online offers the following plans:

- Simple Start -- $12.50/month for three months, then $25 per month. The Simple Start plan supports a single user.

- Essentials -- $20/month for the first three months, then $40 per month. The Essentials plan supports up to three users.

- Plus -- $35/month for the first three months, then $70 per month. The Plus plan supports up to five users.

- Advanced -- $75 per month for the first three months, then $150 per month. The Advanced plan supports up to 25 users.

The Simple Start plan tracks both income and expenses, and it can also create invoices, run basic reports, track sales tax, and manage receipts. Additional features including vendor payment and time tracking are available in the more robust plans.

Like Wave, if you accept online payments with QuickBooks Online, you’ll incur a transaction fee of 2.9%, plus $0.25 per transaction. A 1% transaction fee is charged for ACH transfers, although QuickBooks Online caps its fee at $10.

Results

Wave wins. It’s difficult to argue with free, and even tacking on the transaction fees, which you will pay in QuickBooks Online (or any comparable product), too, Wave still wins.

Wave vs. QuickBooks Online: Integration with other software

Both Wave and QuickBooks Online offer good integration with other software apps.

What Wave offers

Wave offers integration with PayPal, Etsy, Stripe, and Shopify, along with numerous CRM and email marketing apps. There are also more than 1,000 apps you can integrate with Wave through Zapier, which works to connect web apps automatically.

What QuickBooks Online offers

QuickBooks Online offers integration with hundreds of apps, including Stripe and PayPal, expense-tracking apps like Expensify and Concur, as well as invoicing, time tracking, HR, CRM, and e-commerce apps. There’s also an Apps category on the navigation bar that lets you immediately connect QuickBooks Online to any available apps.

Results

QuickBooks Online gets the nod, here. Wave offers more apps for potential integration, but app integration in QuickBooks Online requires one less step than app integration using Wave. It’s nice to be able to connect the app from within the software application, which you can do in QuickBooks Online.

Wave vs. QuickBooks Online: Reporting

Reports can play a big role in the management of your business, and Wave and QuickBooks Online both offer reporting options, though those options vary widely between the two applications.

What Wave offers

Currently, Wave only offers 12 reports; though they are useful reports, with limited capability to customize the report. You can export any report to a CSV file for customizing, or save any report as a PDF.

What QuickBooks Online offers

QuickBooks Online offers more than 50 standard reports that can be customized within the application, exported to Microsoft Excel for further customization, or saved as a PDF.

How They Compare: Wave vs. QuickBooks

| Wave | QuickBooks Online | |

|---|---|---|

| Bill Payment |

|

|

| Free Version Available |

|

|

| Invoice Customization |

|

|

| Live Support |

|

|

| Mobile Apps |

|

|

| Multiple Plans Available |

|

|

| Reporting |

|

|

Results

QuickBooks wins this one, hands down. While Wave's reports are adequate, you have much more data at your fingertips with QuickBooks Online's reporting capabilities.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.