How to Complete and File Your 1099-NEC Forms

Though it's tempting to try, you probably can't handle every aspect of running your business in-house. Just because you can make the best pancake bun pineapple burgers in the Midwest doesn't mean you can make a good website or keep up with day-to-day bookkeeping.

These tasks need to be done, though, and while your business is growing, you may not have room in the budget for a full-time employee, so you might hire an independent contractor. At the end of the year, you'll need to fill out a 1099-NEC form to send to those contractors and the IRS.

Read on to learn about the difference between a contractor and an employee, how to complete the form, and where to send it when it’s done.

Overview: What is a 1099-NEC form?

The 1099-NEC form is the independent contractor tax form. Use it to report to your contractors, and to the IRS, how much they were paid over the course of the tax year. You only need to file 1099s for contractors who earned more than $600.

The 1099-NEC form was reincarnated in 2020 (it had originally been abandoned in 1982) to report payments made to individuals. Prior to 2020, those payments were reported on the 1099-NEC.

Who is responsible for preparing a 1099-NEC?

The payer is responsible for completing the 1099 tax form and sending it to the IRS and the contractor. If your business hires contractors to perform tasks, you will need to complete the form at the end of the tax year.

If you are paid as a contractor by one or more of your clients, you will receive the 1099-NEC, but you do not need to send it to the IRS. However, you do need to report the income on your small business taxes.

If you do not receive a Form 1099 from a client, the income still should’ve been booked to revenue when it was earned.

How to file a 1099 form

Here are the steps to completing and submitting the 1099-NEC form.

Step 1: Determine who is a contractor

The first step is determining which of the people you work with are contractors and which are employees. This amounts to a 1099 vs. W2 tax form decision, since independent contractors receive 1099s, and employees receive W-2s.

Independent contractors generally work for a business but exist separately from it. They prepare their own financial statements, pay their own FICA taxes, set their own work hours, and work on specific projects. Employees, on the other hand, are fully integrated into a business’ operations.

It may be tempting to consider employees contractors to avoid paying the employer portion of FICA taxes. The IRS is aware of this temptation and closely tracks contractor payments. It will be one of the first things the IRS looks at in an audit, and you could be on the hook for thousands in back payments and penalties if you break the rule here.

If you’re not sure, complete the IRS Form SS-8. In it, you will describe the work relationship, and the IRS will determine whether to classify the person as a contractor or an employee. It could take up to six months for the form to be returned, so it's best used in situations where there will be a long-term work relationship.

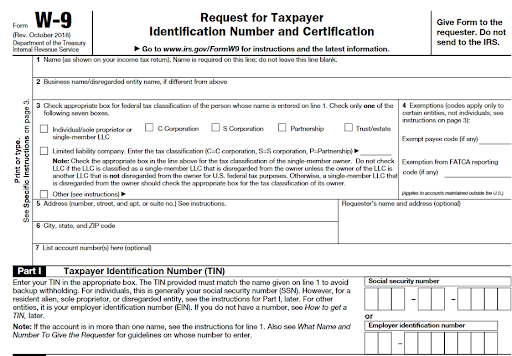

The best way to avoid stressful, last-minute decisions is to determine how to classify new people when they are hired. Send an IRS form W-9 to people who will be independent contractors. It asks for the info you need for the 1099.

Step 2: Order forms

You will need to order the IRS form 1099s and then print out the information on them. You can either order the forms from the IRS or from your tax software, which will also be helpful in completing the forms.

Step 3: Complete forms

We’ll go over the general 1099 requirements here. For more unique cases, reference the IRS 1099-NEC instructions.

Let’s start with the information on the W-9.

The W-9 will let you know the contractor’s legal name, EIN and address. Image source: Author

The W-9 is where you will find the legal name, address, entity type, and contractor EIN. If they are registered as an S corporation or C corporation, no 1099 is required. Enter this information into your accounting software and you can export it onto the 1099.

Onto the 1099-NEC.

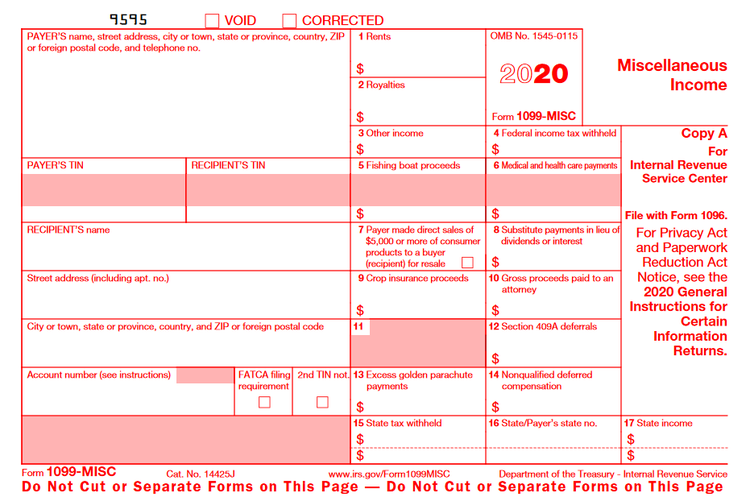

Copy A of the 1099-NEC is sent to the IRS. Image source: Author

You should receive four versions of the above form to be printed out for each contractor. One is for the IRS, two are for the contractor (one for their file and one they may need to submit to their state government), and one is for your file. Each version is completed with the same information. The IRS version is printed in red.

Start with the income amount in Box 1. Remember you only need to complete the form if you paid more than $600 to the contractor during the year. Check Box 2 if you purchased more than $5,000 in consumer products (e.g., t-shirts, cell phone cases, books, etc.) for resale from this contractor. Make sure to report the sales amount on your business’s income tax return.

Tax withholding, reported in square 4, is only required in rare situations, like for migrant agricultural workers who do not have a taxpayer identification number (TIN). See the instructions above if you think you may have to withhold taxes.

Finally, complete Form 1096, which is a summary of all 1099s. Your tax or accounting software should generate this form automatically.

Step 4: Mail forms

The forms can either be submitted electronically or mailed. To file Copy A electronically, first submit Form 4419 to get a Transmitter Control Code (TCC). The TCC can then be used to create an account with the IRS Filing Information Returns Electronically (FIRE) system.

The address for mailing Copy A along with the 1096 summary form varies by state.

Send the recipient copies of the form to contractors for their reporting.

Step 5: File forms

Scan the 1096 with all of the 1099s, and save the electronic file for future reference. It is a good practice to keep the saved form for three to five years. If you receive a 1099 from your clients, this should also be saved for three to five years.

When are 1099s due?

The IRS 1099 rules dictate that 1099s must be filed with the IRS and mailed to contractors by January 31. Your contractors need time to process their 1099s to file their own business tax return.

If you are coming up on the deadline and won’t be able to meet it, you can request an extension from the IRS directly. You won’t get much additional time, probably only 30 days, and the extension will be declined if you file it after the due date.

If you do not file on time, you will be fined per return and the penalty increases with each month that you do not file.

You would also need to request an extension for the recipient copy. Send a letter to the IRS at the following address:

Internal Revenue Service

Attn: Extension of Time Coordinator

240 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

Per the IRS general instructions, the following information must be in the letter, “(a) payer name, (b) payer TIN, (c) payer address, (d) type of return, (e) a statement that extension request is for providing statements to recipients, (f) reason for delay, and (g) the signature of the payer or authorized agent.”

Do your 1099s the easy way

Completing and sending 1099s is an important part of the business tax cycle -- the IRS and your contractors will not be happy with late or inaccurate information. If you only have a few contractors, it is easy enough to complete the forms manually.

If you use a lot of contractors, just keep your accounting up to date throughout the year, and let your software do the work in January.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles