3 Tips to Get W-9s From Vendors

Want to know what impresses accountants? Vendors who send their Forms W-9 before they’re asked. Also, calculators with color screens.

What are W-9s and why do I need them?

Form W-9 gathers the necessary information about a vendor for a business to prepare contractor tax forms at the beginning of each year.

When your business hires an independent contractor or another company to provide a service, it’s best practice to have them fill out a Form W-9. It collects the vendor’s name, address, business type, and taxpayer identification number (TIN), and it certifies an individual’s or entity’s legal eligibility to work.

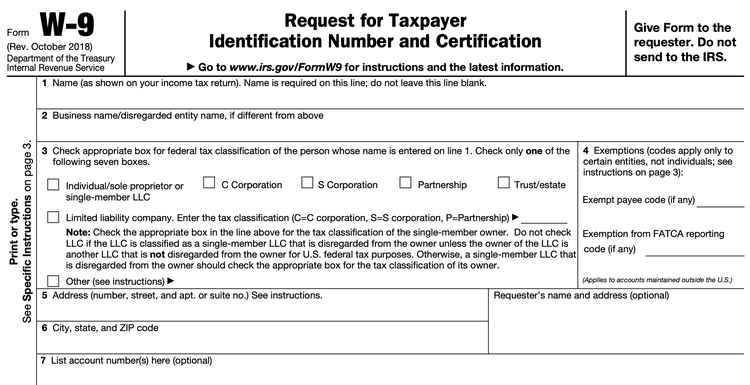

Form W-9 provides you with a vendor’s name, address, tax ID number, and taxation status. Image source: Author

At the beginning of every year, businesses issue 1099 tax forms to third parties who were paid $600 or more for rendering services in the previous year. In some cases, the threshold is even less. You need the information from a vendor’s W-9 to fill out their 1099.

If you hire a painter to design a mural in your office, you’ll ask them to fill out a Form W-9 before starting the job. The following January, you’ll send the painter, their state tax authority, and the IRS a Form 1099-NEC reflecting the payment. The painter will then use the 1099 when filing their independent contractor taxes.

Form W-9 also reveals a vendor’s run-ins with the IRS that would require you to withhold a portion of the payment for taxes. Unless you’re told otherwise through a W-9 or an IRS letter, non-employee workers are fully responsible for paying their taxes.

If your contractor strikes out the second item on Form W-9, backup withholding is required. Image source: Author

When do I need to ask for a W-9?

Before you start contracting with a person or company to provide services to your business, ask them for a Form W-9. The information on a completed W-9 reveals whether paying them triggers a 1099 filing.

The most common reason to file a 1099 is for payments to independent contractors and businesses that provide services, including freelancers, consultants, attorneys, and accountants. Other fees, like rent paid to non-corporate landlords and royalty payments, also require a 1099. Check out this IRS page for a complete list.

There are several types of 1099 forms, most prominently 1099-NEC and 1099-MISC. 1099-NEC is for non-employee compensation, like payments to contractors. Rental and royalty payments warrant the 1099-MISC.

It’s best practice to start every vendor relationship by asking for a W-9, even if you don’t expect to pay that person or company $600 or more during the year. You don’t want to find yourself in January without all the documentation you need to complete and file your 1099s.

When don’t I need to ask for a W-9?

Your reflex should be to ask for a W-9 from any non-employee whom you’re paying for services. However, you don’t need to collect a W-9 from companies when there’s no chance you’ll need to file a 1099.

For example, you don’t need to file 1099s for payments to businesses taxed as C corporations or S corporations, except for attorney payments and a few other circumstances. Since LLCs may be taxed in one of several ways, you need to pay close attention to how they’re taxed when filing 1099s. Payments to tax-exempt organizations and banks don’t warrant 1099s either.

By this logic, you don’t need to ask for a W-9 from a publicly-traded company since they’re all corporations, with public EINs to boot.

You also don't need a W-9 before buying merchandise in most cases. However, you need a W-9 before spending $5,000 or more for consumer products that you plan to resell outside of a “permanent retail establishment,” like from your home. It’s best to consult with an accountant if you suspect your business activity roughly fits this description.

W-9s aren’t required when paying for:

- Reimbursements to employees

- Telephone services

- Freight

- Storage

Tips for getting W-9s from vendors

Some vendors might be reticent to fill out a W-9. Here’s what to do when you need a W-9 from a new contractor or business.

1. Send a copy of Form W-9 to the vendor

Make it easy to fill out and return the Form W-9 by sending your vendor a copy to their email or physical inbox.

You can download Form W-9 from the IRS website. The agency occasionally updates the form, so make sure you have the most recent version. If you’re sending a W-9 digitally, encrypt the document so only the rightful users can view it.

2. Explain why you’re asking for a W-9

It’s reasonable for a contractor to be tentative about sending a W-9 to you if you’re a stranger. You’re asking for sensitive information, such as a Social Security number (SSN), so it helps to share with them why you need it and how you will store and use it.

Be transparent when asking for a completed W-9. Explain that you suspect a business relationship with the vendor might result in a required Form 1099 filing, at which point you’ll need the information on the W-9. Mention your secure document management system that allows only key employees access to personnel files.

3. Refuse to sign contracts without a W-9

If a potential vendor refuses to send you a W-9, it’s within your rights not to work with that vendor. I’d recommend avoiding any person or entity who can’t furnish a W-9 when you have reasonable grounds to ask for one.

Many companies have instituted policies that require a completed Form W-9 from every third party before starting work.

FAQs

-

A reluctance to provide a W-9 signals that you’re dealing with an illegal business or someone trying to evade taxes. You should avoid working with vendors who refuse to fill out a W-9 form after clearly explaining to them why you need it.

If you decide to work with a vendor who won’t furnish a W-9, backup withholding is required. Instead of paying the vendor the entire fee, you send 24% of it to the IRS, along with Form 945. You can stop backup withholding when you receive a completed W-9.

-

Hold onto Forms W-9 for active contractors and inactive contractors for whom you’ve filed a 1099 in the past three years. If they’re paper forms, make sure to keep them in a locked filing cabinet.

These days, most businesses manage W-9s digitally. Since the form contains sensitive information, encrypt them with a password.

-

No, you don’t have to file Form W-9. The document is a formal way to request information from a vendor and isn’t meant to be shared with the IRS or other tax authorities.

Let’s get in form-ation

Making Form W-9 part of your contractor onboarding prevents a frenzy in January to track down people you engaged for services last year.

Once you receive a completed W-9, store it in your accounting software under the vendor’s profile.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles