How Do I Report Excise Taxes? A Guide to Filling out Form 720

The IRS did a great job making Form 720. It embodies the purpose of excise taxes: to curb the use of deleterious goods and services. Form 720 is a long, complicated tax return that makes you second-guess whether you need these goods and services.

We’ll get through it together.

Overview: What is Form 720?

Businesses file Form 720 quarterly to report excise taxes paid on specific goods and activities.

All levels of government levy excise taxes to influence behavior and raise revenue. Although the most visible excise taxes are on “sinful” goods and services -- alcohol, tobacco, and gambling -- you can find excise taxes on goods in virtually every industry. From fuel to sport fishing equipment, excise taxes run the gamut.

Excise taxes increase specific goods’ selling prices, theoretically making them less attractive to consumers. The U.S. Surgeon General suggests the tobacco excise tax has effectively curbed cigarette smoking in the U.S.

Excise taxes are payable to your local tax authority, the IRS, or the Alcohol and Tobacco Trade Bureau (TTB), depending on the good or activity. Only file Form 720 for IRS-collected excise taxes.

Excise tax vs. sales tax: What's the difference?

Excise and sales taxes are more similar than different. The starkest difference: Sales taxes apply to most goods while excise taxes target only a handful.

Sales taxes are calculated as a percentage of an item’s cost. For example, Washington, D.C.’s standard sales tax rate is 6%. You can expect to see a 6% sales tax on nearly all non-grocery purchases while you’re in the nation’s capital.

While some excise taxes are calculated as a percentage of sales -- called “ad valorem” -- many are a flat rate. A pack of cigarettes is subject to a $4.50 excise tax in D.C., for instance.

Who files Form 720 to pay excise tax?

Form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form.

In general, Form 720 is for businesses that owe excise taxes on:

- Fuel

- Ozone-depleting chemicals

- Sport fishing equipment

- Trucks, trailers, tractors, and semi-trailer chassis and bodies

- Water transportation services

- Foreign insurance

- Coal, tires, gas guzzlers, and vaccines

- Archery supplies

- Indoor tanning services

There are plenty of other excise taxes that don’t fall under Form 720’s purview. For example, convenience stores that sell tobacco and alcohol wouldn’t file Form 720; they’d file TTB Form 5000.24. Wagering excise taxes are reported on Form 730.

Businesses that simply buy excise goods don’t file Form 720. A company that buys gasoline at the gas station pump doesn’t need to worry about yet another tax filing.

However, landscaping, manufacturing, farming, and construction businesses may score a fuel tax credit for federal fuel excise taxes passed onto them. Check out the FAQ for more details.

How to fill out Form 720

You’ll want your accounting software, tax software, and favorite pain reliever at your side while you complete Form 720. It isn’t known for its brevity or simplicity, so you might want to have a tax professional take the lead the first few times you file Form 720.

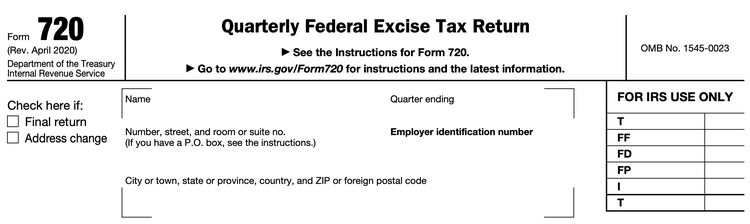

1. Enter your business’s information

Let’s start slowly with your business’s information. Enter your business’s address and employer identification number (EIN). Enter the last day of the quarter for which you’re filing the return: March 31 for Q1, June 30 for Q2, Sept. 30 for Q3, or Dec. 31 for Q4.

The top section is my favorite part of Form 720. Image source: Author

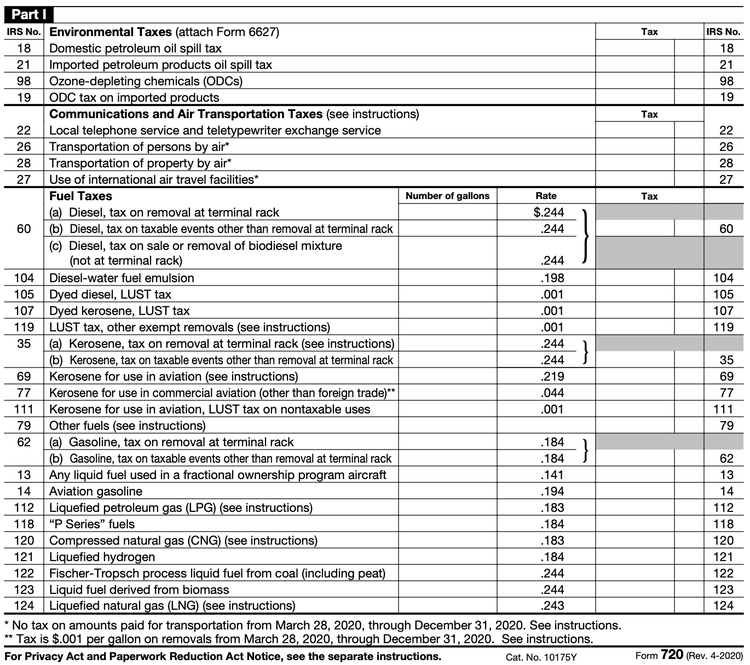

2. Fill in part one

By the time you get to Form 720 part one, you likely know which excise taxes you’re reporting on Form 720. Fill out part one only if your business owes any of the following excise taxes:

- Environmental taxes for oil spills and ozone-depleting chemicals

- Communications and air transportation taxes

- Fuel taxes

- Retail taxes for trucks, trailers, tractors, and semi-trailer chassis and bodies

- Ship passenger taxes for water transportation

- Foreign insurance taxes

- Manufacturer's taxes for coal, tires, gas guzzlers, and vaccines

One note about fuel taxes: Due to the COVID-19 pandemic, legislators introduced an excise tax “holiday” on IRS no. 77, kerosene used in commercial aviation. Designed as a reprieve for airlines, businesses can ignore this specific excise tax from March 28, 2020, to December 31, 2020.

If none of the excise taxes you’re reporting go in part one, skip to step four of this guide to work on Form 720 part two.

Only fill out Schedule A when your business reports excise taxes in part one on Form 720. Image source: Author

Use the IRS instructions, tax software, or a tax professional to calculate each excise tax amount. The amount you enter in the “tax” column reflects the excise taxes your business incurred during the quarter, whether or not you already paid it.

For example, say I own a car dealership that incurred $10,000 in gas guzzler taxes last quarter, but I’ve only paid $5,000 before filing Form 720. I’d fill in $10,000 on the gas guzzler tax line in part one.

The fuel taxes section has you enter the number of gallons subject to the excise tax. You’ll multiply that number by the tax rate to arrive at the tax liability.

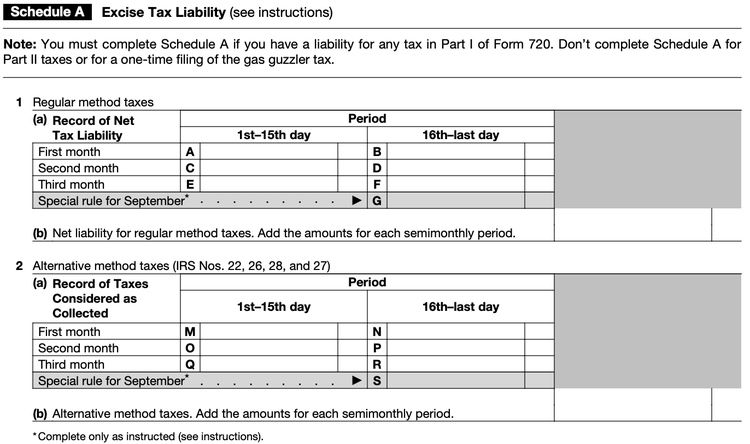

3. Fill out Schedule A

If you reported tax liabilities in part one, jump down a couple of pages on Form 720 to Schedule A. You have to break down your part one excise tax liability semi-monthly for the entire quarter.

You’re exempted from filling out Schedule A if the only liability reported in part one is a one-time gas guzzler filing. You can learn more about one-time gas guzzler filings in the Form 6197 instructions.

Only businesses that owe fuel taxes should fill in the alternative method table in Schedule A. Image source: Author

Schedule A is only concerned with the excise taxes reported in part one; don’t include part two excise tax liabilities. Allocate the total excise tax liability reported in part one over each half-month in the quarter.

There are separate tables for regular and alternative tax methods, each with sections that read, “Special rule for September.” Unless you work in aviation, focus on the regular table.

The special rule for September is just one of those tax rules that makes you want to shake your fist in the air in frustration. Excise taxes incurred between September 16 and September 27 are due on September 29, when they’d ordinarily be due in mid-October. Ignore this rule unless you’re filing for Form 720 in the third quarter.

Having impeccable bookkeeping practices can help you sail through Schedule A.

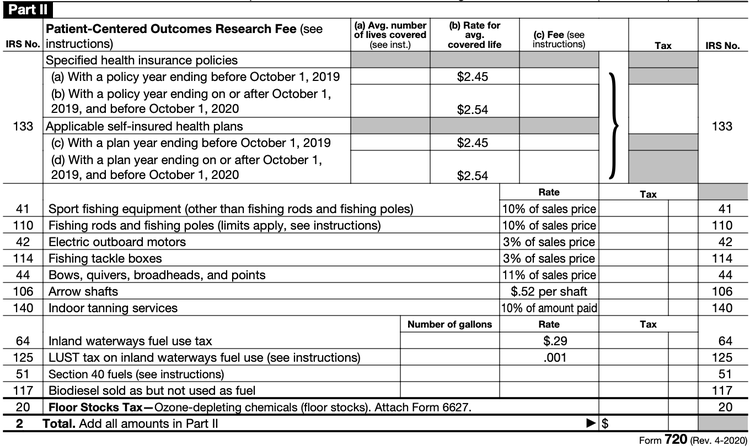

4. Fill out part two

Now we’re back to reporting more excise taxes. Part two covers excise taxes on:

- Patient-centered outcomes research fees

- Sport fishing equipment, including fishing rods, poles, and tackle boxes

- Electric outboard motors, used in boats

- Archery supplies, including bows, quivers, broadheads, points, and arrow shafts

- Indoor tanning services

- Some fuel use

- Floor stocks tax for ozone-depleting chemicals

Part two covers excise taxes for sport fishing equipment and indoor tanning services. Image source: Author

The IRS lists most excise tax rates inline. Refer to the IRS instructions or your tax software for help with specific calculations.

5. Fill out Schedule T and Schedule C

If you reported fuel excise taxes in parts one or two, fill out Schedules T and C. I’d recommend bringing in a tax accountant for Schedule C in particular. We’re not talking about Form 1040 Schedule C; this Schedule C is within Form 720.

Schedule T asks about two-party exchanges, a non-sale transaction where one business picks up fuel from another at an intermediary step in the fuel supply chain. Schedule C gives taxpayers the chance to claim credits against their fuel excise taxes, potentially lowering their tax liabilities.

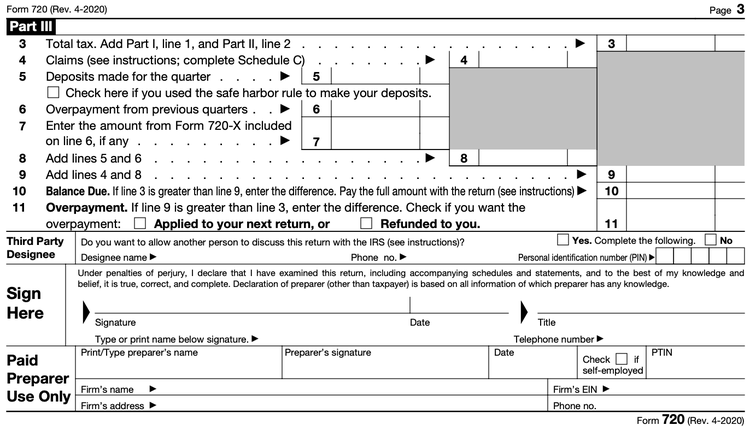

6. Fill out part three

We’ve finally made it to the end of Form 720. Here’s where you figure out your business’s current excise tax liability.

Start by adding up the total excise taxes for the quarter on line 3. Then, subtract claims from Schedule C and deposits your business made ahead of filing. Eventually, you’ll make your way down to lines 10 and 11, where you figure out whether you are due a refund or owe more in excise taxes. You can make a tax payment when you file Form 720.

Sign and date the form to make it official.

Calculate your business’s excise tax balance in part three. Image source: Author

7. File Form 720

You can e-file Form 720 through the IRS website or your tax software. You can also make an additional excise tax payment through the government’s Electronic Federal Tax Payment System (EFTPS).

FAQs

-

Though you file Form 720 quarterly, you’re required to pay excise taxes twice monthly.

You remit excise taxes 15 days after they’re incurred. For example, say you own a tanning salon, where most tanning bed services are subject to a 10% federal excise tax. All excise taxes collected for tanning sessions between January 1 and January 15 are due on January 29.

You can find the Form 720 excise tax deposit calendar in IRS Publication No. 509.

-

You can get around paying the federal fuel excise tax when the fuel is used for a specific purpose, such as farming. If you reported a fuel tax in part one or two on Form 720, you might be able to claim a neutralizing fuel tax credit on Form 720’s Schedule C.

Businesses that don’t need to file Form 720 otherwise can claim fuel tax credits on Form 4136. Manufacturing, construction, and farming businesses should take advantage of this little-known small business tax tip.

Say you’re a small landscaping business that buys gasoline at the local gas station. You don’t have to file Form 720 because federal excise taxes are included in the purchase price. However, you can file Form 4136 to claim a tax credit for federal taxes paid on fuel used for “off-highway” purposes, such as lawnmowers and other gasoline-powered equipment.

Fuel tax credits operate like any other tax credit, giving you a dollar-for-dollar reduction in your small business tax bill. If your business incurred a $100 excise tax on fuel, a $60 fuel tax credit brings down your liability to $40 ($100 excise tax - $60 tax credit).

-

Form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. For example, your first-quarter Form 720 return is due on April 30.

| Quarter | Due date |

|---|---|

| January, February, March | April 30 |

| April, May, June | July 31 |

| July, August, September | Oct. 31 |

| October, November, December | Jan. 31 |

They’re not all like this

Don’t let Form 720 sour your impression of filing your taxes. The most common business tax documents are less painful, especially when you have tax software at the ready.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles