7 Smart Tips for Conducting Grant Research

Wouldn’t it be nice to hope for funding and have it magically appear in your business bank account a few days later? Unfortunately, that’s not how these things tend to work. Instead, you have to go out and search for what’s available for your small business needs. Often, this comes in the form of a loan. Another option is a grant.

Grants come in all types and sizes, from quick microloans of a few thousand dollars to significant government sums. While grants often have specific rules for how the funds are spent and involve serious paperwork, it can be another place to get some of the funds you need to help your business grow.

A crucial part of seeing success with grants is knowing where to look for the opportunities available. The good news is you don’t need to be an expert grant researcher to get started. What you do need is a plan, and that’s why you’ll want to keep reading.

Overview: What is grant research?

In general, the concept of grant research is pretty simple. It’s the process organizations go through to find the grants they qualify for before starting the application process.

You might not realize this can often be one of the most important parts of the entire process. While typing a few keywords into your favorite search engine is a way to start finding funders, the full research phase is more extensive.

With good research, you’ll streamline the process and focus only on the grants you want and have a good chance of meeting all the requirements.

How to conduct grant research

When you have a plan and know what kind of grants you’re looking for before you start the process, you’ll often have a much easier time getting going.

1. Understand what you’re looking for

Before you even begin the grant researching process, you have to look at your organization and determine what you need. While you don’t have to pay any funds back with grants, the majority of funders want you to tell them exactly how you plan to use their money and the specific ways you plan to spend it. As you get into fleshing out your research process, you’ll need to know the answer to that question.

Knowing what you need also helps you narrow down your list. Applying for grants can be a long and sometimes tedious process. It might be appealing to have dozens of grants to apply to, but in reality, you want to have a shortlist of just a handful where you think you have a good chance of getting funding.

2. Build out your list of search criteria

Now that you know what you need in terms of funding, it’s time to think about the rest of your search criteria too. All of this can vary greatly depending on the type of business you run. However, you ideally want to create some sort of checklist of your criteria that you can use as a simple guidepost to help you narrow down potential opportunities.

3. Begin your search

Now you can start your search in earnest. With your funding needs and criteria set, you’ll have a much easier time determining which grants should be added to your list or ignored.

Keep in mind, this part of the process can take a while, so plan for it. You might even set up a calendar on a biannual or quarterly basis, so you don’t miss any new grants throughout the year.

4. Pay attention

One last thing to remember: Most grants have all sorts of qualifications and requirements, both for applying and for spending the funds. These aren’t merely suggestions but an essential part of the grant process. If you miss any of these, you may need to resubmit your proposal or be disqualified entirely.

So, keep track of any particular requirements or qualifications that stand out or are unique for specific grants. If you have questions, never hesitate to call up the funding organization and ask for clarification. They are often happy to help.

Grant research tools and resources

Since thousands of businesses apply for grants each year, there are some tools of the trade that can make your life a lot easier. That doesn’t mean you don’t want to do your investigative work, but these tools can help soothe some of the concerns you might have around how to find grants.

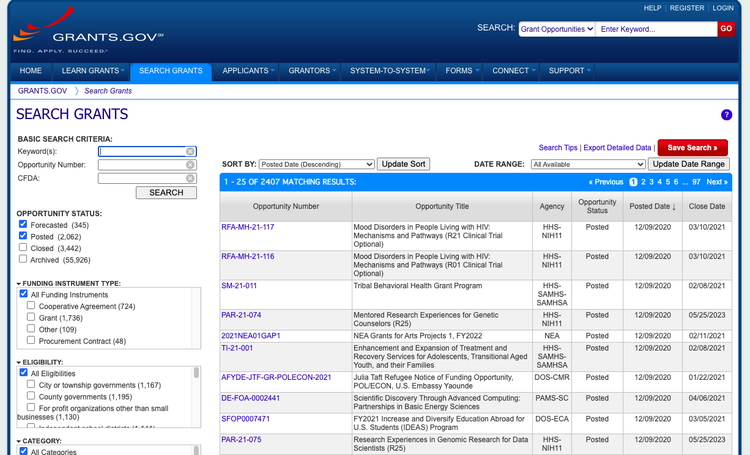

Grants.gov

If you want to explore all the grant opportunities offered by the government, look no further than grants.gov. It’s a massive database featuring thousands of grants. You can also find a comprehensive list of grant-making agencies, covering more than two dozen federal agencies, on the site.

You can search through thousands of funding opportunities from the government. Image source: Author

Online directories

Online directories can be another useful tool for a lot of business owners. Some of these share some free information, but most have a yearly or monthly fee for access. A few of the more popular directories include:

- The Foundation Center: This nonprofit organization has a massive database called the Foundation Directory Online, which you can buy access to.

- GrantStation: GrantStation has a variety of searchable directories, including a sizable nonprofit grant database.

- Grant Gopher: Grant Gopher is a grant aggregator of sorts, showing grant opportunities while they are available.

A few examples of grant opportunities. Image source: Author

Small Business Development Centers

The Small Business Administration (SBA) also runs Small Business Development Centers (SBDC) across the country. In these offices, you can work with people who can help you find funding opportunities in your area.

Nonprofit and corporate foundations

There are plenty of foundations that give out grants to small business owners each year too. Search for nonprofit and corporate foundations, which often have dedicated websites highlighting the grants they offer. Don’t forget to look at small family foundations also; these can often get neglected in searches.

Your local library

Many local libraries across the country have subscriptions to journals and other resources where you can search for grant information and opportunities. If you’re a college graduate, check your alumni program, you might get access to the university library too.

7 best practices when researching grants

There’s no right or wrong way to start researching grants, but there are some tips and tricks the pros use to make the process much more efficient.

1. Keep track of everything

As soon as you start digging into the grant funding process, you’ll quickly learn there are lots of dates, not to mention the paperwork, to keep your eye on. So, your best bet is to develop a system that allows you to keep track of important deadlines. Determine what will work best for you -- spreadsheet, calendar, or project management tool -- and get everything you need on it.

2. Create your grant library

You’ve spent a lot of time learning how to research grants, don’t let all of your newfound expertise go to waste. Compile all the information you’ve gathered, from contact information to regulatory guidelines, and file it away for later use. Get all your essential documents including, short- and long-term financial estimates, sales and marketing business development goals, and business proposal information in one place.

3. Build a template

If there’s one no-no you want to avoid, it’s copying and pasting your entire grant proposal and submitting the same thing to all your prospective funders. However, that doesn’t mean there won’t be elements or sections you can essentially reuse, with a bit of tweaking. Create a template grant proposal document that you can build off of when you apply.

4. Establish a network

If your business is looking at local or community grants, check in with past winners and applicants and ask about their experience applying for grants. You’ll likely learn a variety of tips and tricks you might not have otherwise considered that can help strengthen your application.

5. Know your needs

One of the primary things you want to do as you dig into the grant research process is to look at your organization first. Know how much funding you need, what you need it for, and how you plan to spend it. That can help you immediately start your research with a much more targeted list of granting organizations.

6. Explore underrepresented funding opportunities

Often, businesses owned by women, people of color, and veterans can struggle to get traditional financing. Many organizations create grants specifically dedicated to underrepresented groups. There are a variety of SBA grants and mentorship programs for these groups.

7. Make room in your budget

Researching grants takes time and money, so don’t sell yourself short. While some businesses have the budget to outsource the research portion, you might not. What you can do, however, is set aside some funds for the tools you’ll need that can help make the process easier, such as grant research databases or funding opportunity books.

With excellent researching skills comes more opportunities

With a research plan in place and a grant management system ready to go, you can make the actual application process much more efficient, enabling you to apply for more grants down the road. The key is putting a system in place that’s going to work for your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles