How to Calculate Payroll Taxes for Your Small Business

Of all the taxes business owners must pay, payroll taxes can be the most vexing. If you think paying your employees is confusing, just wait until you have to calculate payroll taxes.

While you can find plenty of payroll services eager to take this task off your hands, even if you do turn payroll over to payroll software or a service provider, you should still know how to calculate payroll taxes.

Overview: What are payroll taxes?

If you have an employee -- even just one -- you need to pay payroll tax. Payroll tax is divided into two types: those that you are solely responsible for, and others that you collect from your employees to remit to the correct government entity.

In this guide, we explain what payroll taxes are, what forms you need in order to calculate taxes properly, and finally, a step-by-step guide to calculating payroll taxes for your employees.

How to calculate payroll taxes for your small business

Before we explain the steps you need to take to calculate and pay taxes, let’s talk about the types of taxes you need to pay.

Taxes paid by you:

- FICA (employer portion): Federal Insurance Contributions Act (FICA) is a combined tax that covers both Medicare and Social Security. The employer and employee tax rate for FICA are the same, which is 12.4% of gross pay for Social Security and 2.9% for Medicare. You will each pay 6.2% for Social Security and 1.45% for Medicare.

- FUTA: The Federal Unemployment Tax Act (FUTA) is an employer tax that is used to fund state unemployment systems.

- SUTA: State Unemployment Tax Act (SUTA), like FUTA, is your responsibility as an employer, and it's paid to your state government.

Taxes paid by your employees that you collect and remit on their behalf:

- Federal income tax: Based on information provided by your employee on a Form W-4, you can calculate federal taxes to withhold from your employee. We’ll explain how to do this later in this article.

- FICA (employee portion): Stated earlier, your employee is also responsible for paying 6.2% for Social Security and 1.45% for Medicare.

- State and local taxes: Along with federal withholding, you’ll also have to withhold state and local taxes from your employee’s paycheck.

Now that you know what taxes you’re responsible for, let’s calculate them.

Step 1: Calculate employee gross pay

Before you can calculate taxes, you’ll need to calculate employee payroll.

In our example, let’s say that Aaron currently works in New Mexico. He’s a salaried employee, earns $60,000, and is paid semi-monthly, which means he’s paid 24 times a year. Aaron’s gross pay each pay period is the same, $2,500, which is calculated by dividing his annual salary by 24:

$60,000 ÷ 24 = $$2,500

Now that we know Aaron’s gross pay for the period, we can calculate his payroll taxes.

Step 2: Calculate federal withholding

In order to calculate federal withholding, we’ll need to know what Aaron claimed on his IRS Form W-4, which is a withholding certificate that needs to be completed by every employee.

The form has been redesigned for 2020, with withholding calculated differently. Any W-4 forms completed prior to 2020 can use the old calculation.

The information on the W-4 tells you how much income tax needs to be withheld from Aaron’s check each pay period. On his W-4, Aaron claimed married status with one allowance. You’ll need to know this in order to calculate his federal, FICA, and state taxes.

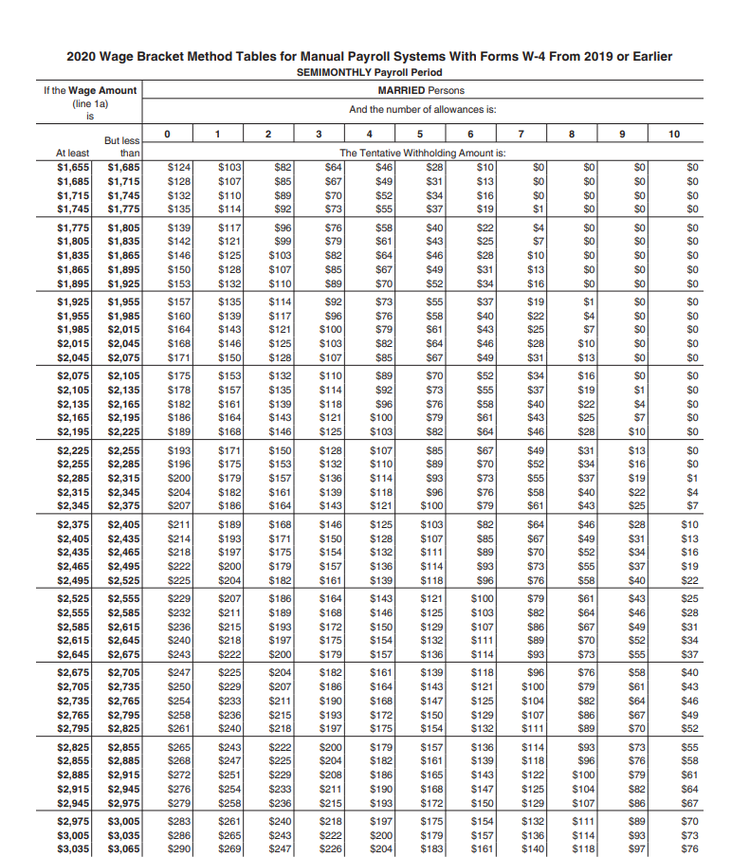

Since Aaron completed his W-4 in 2019, we’ll use the following IRS tax tables to calculate his withholding. According to this form, the federal tax you should withhold from his check is $204.

2020 IRS Wage Bracket Method Tables can be used to calculate federal withholding. Image source: Author

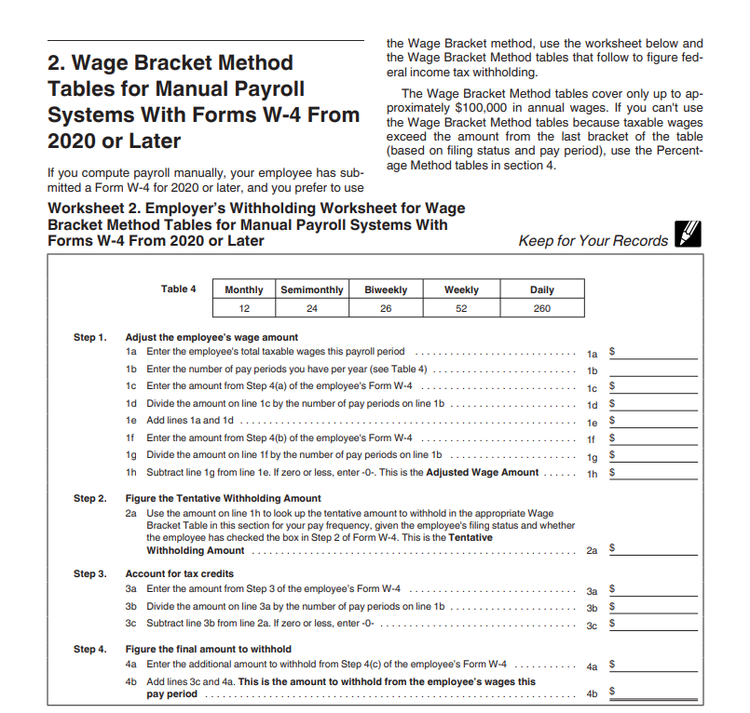

If Aaron’s W-4 form had been from 2020, you would use the updated tax tables found in Publication 15-T, Federal Income Tax Withholding Methods.

The IRS created a new Wage Bracket Table to calculate withholding for those with W-4 forms filled out in 2020 or later. Image source: Author

Step 3: Calculate FICA

Both you and your employee contribute 7.65% to FICA; 6.2% for Social Security and 1.45% for Medicare. The first $137,700 of wages are subject to the Social Security tax, while employees earning more than $200,000 are subjected to an additional Medicare tax.

Let’s calculate Aaron’s portion of FICA:

$2,500 x 6.2% = $155 Social Security

$2,500 x 1.45% = $36.25 Medicare

Aaron’s total FICA withholding is $155 + $36.25 = $191.25

As Aaron’s employer, you are also responsible for the same amount of FICA taxes.

Step 4: Calculate state and local tax

You next calculate any state taxes Aaron may be responsible for. Since Aaron lives and works in New Mexico, he must pay state tax. However, if Aaron lived in Alaska, Florida, Nevada, South Dakota, Texas, Washington State, or Wyoming, there would be no state income tax deducted from his check.

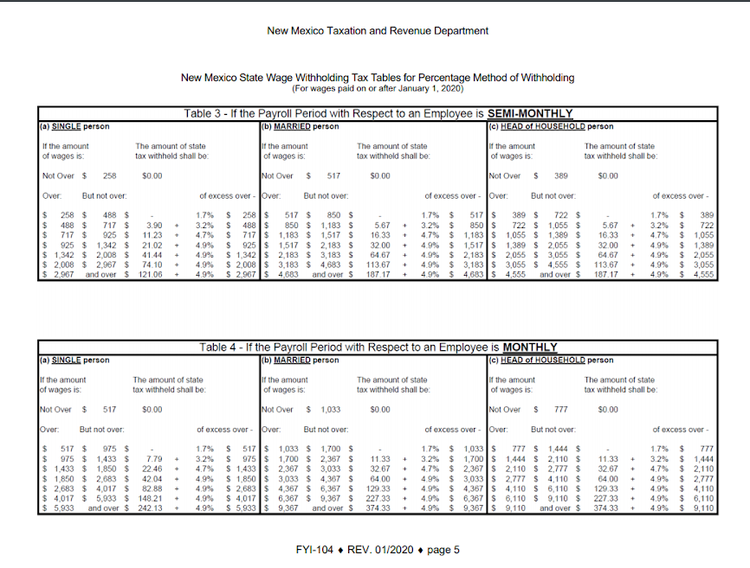

New Mexico’s Wage Withholding table lets you know how much tax to withhold. Image source: Author

The New Mexico Wage Withholding table shows that you’ll need to deduct $64.67 plus an additional 4.9% of the additional amount over $2,183, which you can calculate as follows:

$2,500 - $2,183 = $317

$317 x 4.9% = $15.53

$64.67 + $15.53 = $80.20

The amount you'll need to deduct from Aaron’s paycheck is $80.20 for New Mexico state income tax.

Step 5. Subtract any payroll deductions

If any other deductions need to come out of Aaron’s check, you’ll need to deduct them. For the purposes of this example, we’ll say there are no additional deductions.

Step 6: Add any reimbursements

If you were reimbursing Aaron for expenses, you would add it back to his gross pay. For this example, Aaron did not receive any reimbursements.

Step 7: Calculate paycheck

Aaron’s paycheck is ready to be calculated:

| Gross Pay | $2,500.00 |

| Federal Withholding | -204.00 |

| Social Security | -155.00 |

| Medicare | -36.25 |

| New Mexico Tax | -80.20 |

| Net Pay | $2,024.55 |

Aaron’s net pay is $2,024.55

Step 8: Calculate FUTA

Now that all withholding taxes have been calculated, you’ll need to calculate FUTA tax for the period. FUTA tax is calculated on the first $7,000 of wages paid to each of your employees. The FUTA tax rate is 6%, but most employers receive a credit of up to 5.4% when Form 940 is filed.

If Aaron is your only employee, you would owe FUTA tax in the amount of $150. Though Form 940 is filed at the end of the year, you would need to make quarterly payments in any quarter that you owe more than $500.

Step 9: Calculate SUTA

The next tax you’ll need to calculate is SUTA, which is state unemployment tax. The New Mexico state unemployment tax rate ranges from 0.33% to 5.4%, depending on how many former employees have filed for unemployment benefits.

We’ll say that since no one in your business has filed for unemployment, the state has set your payroll tax rate at 1% of taxable payroll, which is $2,500.

$2,500 x 1% = $25

The state always sets your rate and will notify you of any changes.

Step 10: Total tax payments required

Based on the above calculations, your total tax payment for Aaron is:

- $204.00 Federal withholding

- $155.00 Social Security, employee portion

- $ 36.25 Medicare, employee portion

- $155.00 Social Security, employer portion

- $ 36.25 Medicare, employer portion

- $ 80.20 New Mexico state income tax

- $150.00 FUTA

- $ 25.00 SUTA

- And it totals a $841.70 total tax liability

Your total tax liability for the period would be $841.70, with $475.45 of the total paid by your employee through withholding.

FAQs

-

Some of the taxes you need to pay come out of your own pocket, but others are paid by your employee. Either way, you’re responsible for collecting and paying the following taxes:

- Federal income tax: Paid by employee

- State income tax: Paid by employee

- FICA: Paid by both employer and employee

- FUTA: Federal unemployment tax paid by employer

- SUTA: Paid by employer

-

All of your employees need to fill out IRS Form W-4. This form determines how much money you need to withhold from your employee’s paychecks. If you’re calculating payroll taxes manually, you can use the withholding tables provided by the IRS. If you’re using payroll software, your payroll service will calculate this amount, and all other payroll taxes, for you.

-

It’s not easy to keep track of all of the filing dates and requirements the IRS has regarding payroll taxes. Form filing dates vary from deposit dates, and as an employer, it’s your responsibility to keep track of all of it.

The best place to start is the Employment Taxes page on the IRS website, which provides a list of filing requirements, including due dates and electronic filing information.

Payroll taxes don’t have to be difficult

If you have an employee, you have to file payroll taxes. Sounds simple, but the reality can be challenging. The best option for calculating and paying payroll taxes is to use a payroll software or service.

If you’re still filing manually, be sure to check out the resources provided by the IRS, which include information on federal payroll tax rates as well as guidance for whether you need to be estimating payroll taxes for your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles