How to Deduct Home Office Expenses With Form 8829

Which is better -- being able to go from home to work without stepping outside and still wearing pajamas, or being able to get a tax break for it?

The COVID-19 pandemic has relegated many of us to working at home for the first time. Whether you’re a seasoned work-from-home business owner, or you installed a home office in 2020, you can claim a deduction for making part of your home into an office space.

Overview: What is IRS Form 8829?

Self-employed people with dedicated home offices can fill out Form 8829 to claim a tax deduction for the business use of their home.

The deduction amount depends on the method you use. The simplified method, discussed in more detail below, doesn’t require you to file Form 8829 and instead goes directly on Schedule C, the sole proprietor profit or loss tax form.

The other option is the actual expense method, which necessitates Form 8829. You can get a deduction for your direct home office expenses -- like buying office furniture -- and get a portion of your total home expenses. The form walks you through calculating the percentage of your home that can be claimed for business use.

The actual expense method produces a higher deduction in most cases, albeit more legwork and record-keeping during the year.

Eligibility requirements for Form 8829

Setting up a foldable table in your living room isn’t going to qualify you for a home office deduction. Here’s what it takes to write off your home office expenses.

You’re filing Schedule C

Form 8829 is only for taxpayers filing Form 1040 Schedule C. Sole proprietors and most single-member limited liability company (LLC) owners file Schedule C and are therefore eligible to calculate a home office deduction using Form 8829.

Partners in partnerships, members of LLCs, and shareholders of S corps and C corps need to request reimbursement from their companies for home office expenses. Your business can pay you back for the business use of your home and claim the deduction on their business tax return. The result is the same, but the road to get there is more circuitous.

Employees who receive a Form W-2 each January can’t get a tax write-off for the business use of their home, even if they’re forced to work from home due to the COVID-19 pandemic. However, if you have a work-from-home side gig that gives you a Form 1099, you can claim a home office deduction if the space is only used for the side gig.

You don’t use the space for anything else

To qualify for a home office tax deduction, the IRS says you must dedicate a portion of your home to be used “exclusively and regularly” for your business. Ideally, the space is a spare room or basement that is clearly separate from the rest of your home.

In the event of an IRS audit, you’d need to prove that your home office space doesn’t have a non-business purpose. For example, your dining room doesn’t suddenly become a home office space when you still use it for family dinners.

Like in many aspects of life, creating boundaries can make this work. Put a sign on your home office door, or lay a piece of tastefully designed tape on the floor to designate your home office space. Tell your children the floor in your home office is lava.

But, for every rule, there’s always an exception or two. If you run a daycare out of your home, you may count areas of your home that are also used for non-businesses purposes, such as a playroom that your children also use when daycare isn’t in session. We’ll get into the specific calculation in the next section.

Second exception: If your home office is the business’s only location, you can count inventory storage areas, and they, too, can be shared with the personal use of your home. So, if you keep inventory and samples in your garage, you don’t need to move your skis from the adjacent wall.

It’s worth noting that Form 8829 isn’t for you if all your home office expenses relate to storing inventory and samples. You can deal with those expenses on Schedule C Part III, cost of goods sold.

If either of the exceptions applies to your business, you should get a tax accountant involved the first year you fill out Form 8829.

It’s your principal place of business

Your home office needs to be the main place that you get management and administrative tasks done. You can do work elsewhere, but your home office needs to be your home base.

The IRS says that a home office is your principal place of business when it’s the only place where you:

- Bill customers, clients, or patients

- Keep books and records

- Order supplies

- Set up appointments

- Forward orders or write reports

Say you’re a self-employed consultant who often meets clients at their offices. Although you spend much of your time outside your home office, you have a set-aside space in your home to bill clients and do your bookkeeping.

One exception: A separate free-standing structure on your lot, like an unattached garage, also counts as a home office when used only and often for your business. It doesn’t need to be a principal place of business by the standard definition.

IRS Publication 587 gives the example of a flower shop owner who grows plants in a greenhouse behind his home. He can deduct the expenses for the use of his greenhouse since he uses it exclusively and regularly.

You don’t want to use the simplified method

You can avoid filling out Form 8829 if you elect the simplified method for the home office deduction, which gives you a $5 deduction for every square foot of office space, up to 300 square feet.

If you started running your business from home during the year, you’d need to reduce the simplified method deduction amount to reflect the months your home office existed.

There’s a designated line on Schedule C for the home office deduction. If your home office space is 300 square feet or less, or if you have shoddy home expense records, you’ll want to go with the simplified method.

However, you’re more likely to receive a larger deduction when you elect the actual expense method, which Form 8829 is made for.

How to fill out Form 8829: Step-by-step instructions

Form 8829 is only one page long, but it asks many long-winded questions.

1. Calculate the business area of your home

You might need a tape measure for this one. The first section of Form 8829 asks you to enter the square footage of your home and your home office.

You probably have some floor plans from when you bought or moved into your home that list room dimensions. I wouldn’t trust a website like Zillow to tell you since it can often be inaccurate.

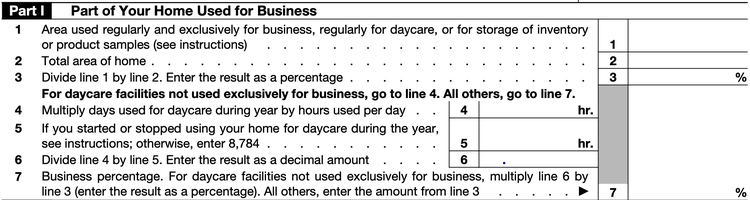

Part I determines the percentage of your home used for business. Image source: Author

If you run a daycare, here’s where you have some extra work to do. Calculate the portion of the home used as a daycare facility by multiplying the number of days your house was used by the number of hours used each day.

The quotient of your home office area and your total home gives your business percentage, which guides the amount of your deduction.

Home Office Area ÷ Total Home Area = Business Percentage

2. Calculate the allowable deduction

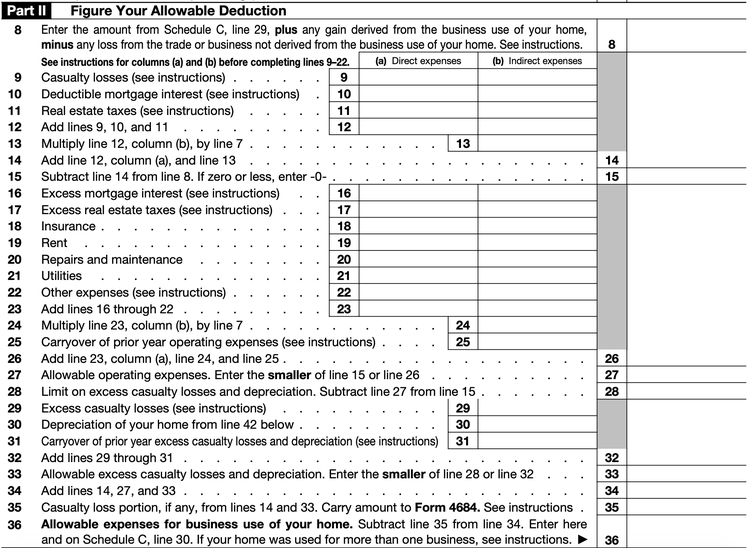

Part II is asking you to list all the deductible expenses associated with your entire home. Every few lines, Form 8829 has you subtotal the expenses and multiply that number by the business percentage listed on line seven.

Don’t fill out lines 10 and 11 if you’re taking the standard deduction. Image source: Author

To fill out Part II, you’ll need records for the following expenses incurred while you had a home office. If you opened your home office in March, don’t include expenses from January and February.

- Casualty losses

- Mortgage interest

- Real estate taxes

- Home insurance

- Rent

- Repairs and maintenance

- Utilities

Line eight. Those who run their business entirely from home should be able to just plop in their business profit or loss from line 29 on Schedule C. You’ll have some more work to do if you have another business location or sold a non-inventory business asset during the year.

Parts A and B. For the next few lines, you’re required to categorize expenses as either direct or indirect. Direct costs can be easily traced to your home office, like the purchase of a desk. Indirect expenses are for shared resources, like an electricity bill for the whole house. However, if your home office receives a separate electricity bill, you’d consider it a direct expense. Make sure not to double-count any expenses on both Schedule C and Form 8829.

Line nine. Casualty losses refer to the loss or destruction of property due to an unexpected event, like a hurricane. If you’re dealing with a casualty loss, you’ll want to bring in a tax professional to help you fill out Form 8829 and Schedule A.

Lines 10 through 26. Here’s where you enter the majority of your home office expenses and bring back expenses that you couldn’t claim in a prior year. If you’re taking the standard deduction -- meaning you’re not itemizing deductions on Schedule A -- and you suffered no casualty losses, start on line 16.

Those who itemize deductions will have a few more hoops to jump through. Make sure you’ve already filled out Schedule A before finishing Form 8829.

Line 27. Form 8829 says allowable operating expenses for the year is the lesser of the sum on lines 15 or 26. If line 26 is greater than line 15, you can carry that excess amount forward for next year’s business taxes.

Lines 28 through 36. You’ll have to return to many of these lines after you complete Part III, depreciation. Line 36 marks the amount that you’ll report on Schedule C for the home office deduction.

If this sounds stressful, remember that tax software can help you complete the calculations.

Remember, any small business tax deduction you claim must be supported by documentation. If you don’t have a record to show how much you spent on a home repair, you can’t include it.

3. Calculate home depreciation

In business, all fixed assets are subject to depreciation, which reduces taxable income. Since your home is now a part of your business, you can take a depreciation deduction for the business portion of your home.

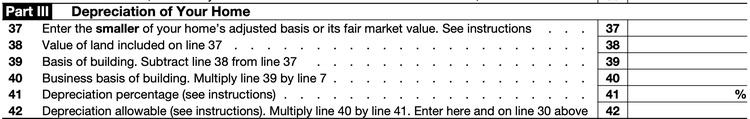

The depreciation of your home is limited to its use in your business. Image source: Author

Lines 37 through 40. These lines ask you for the lesser of your home’s market value or adjusted basis, broken down by land and building.

Your home’s adjusted basis is its purchase price plus major improvements and fewer casualty losses. Fair market value is how much you could get for it if you put it on the market. These amounts are as of the first day you used your home for business.

Line 41. Take a look at the Form 8829 instructions for your depreciation percentage.

Line 42. Multiply the depreciable basis of your home by its depreciation percentage and return to Part II to fill out what you missed.

4. Carryover unallowed expenses

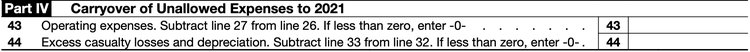

We talked about excess expenses on line 27. Here’s where you enter how much you’ll carry into the next tax year, which is when you get another chance to deduct your home office expenses.

You can carry forward some unallowed expenses from this tax year into a future tax year. Image source: Author

Live, laugh, lots of deductions

The home office deduction might help you justify turning what could be a lovely living space into an office space. Make sure not to miss any of the other self-employed tax deductions out there.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles