Create a Quarterly Business Plan in 9 Simple Steps

If you’re a small business, you may ask why you need a business plan at all -- especially if things seem to be going just fine. The reality is that whether your business is lagging, maintaining, or booming, a strategic plan will help you stay focused and on track to meet your goals.

Why you should create a quarterly business plan

Think of your small business plan like a GPS. When you start your drive, you set the GPS to your destination. If you get off track, the GPS will let you know and help you find your way back. When you reach your destination, it will proclaim you’ve arrived. Your quarter plans and annual plans for your business can do the same.

- Setting goals and tracking performance will help you see the big picture.

- Reaching milestones gives you confidence you’re meeting your goals.

- If you fall short, it's a roadmap for where you need to adjust.

- If you need a business loan, lenders or investors will want to know there’s a plan in place.

If you’ve created an annual business action plan, your quarterly plan will be a review to assess your performance against the plan and what you need to revise moving forward. If you haven’t done an annual plan, this is the perfect time to get started by creating a quarterly small business plan.

1. Conduct a quarterly financial analysis

At the end of each quarter, businesses of all sizes should be doing a financial analysis to determine the health and trajectory of their business. While there’s no end to what you can track, most businesses focus on the fundamentals:

- Income statement: revenue, cost of goods, operating expenses, net profit

- Balance sheet: assets (capital and liabilities), equity, retained earnings

- Cash flow: operational, investing, financing activities

What’s important is to measure performance against your expectations. This information will help you with your gap analysis.

2. Do a gap analysis

A gap analysis considers shortfalls to understand why you didn’t meet your financial goals. This will help you pinpoint where to focus efforts in the future. These typically take the shape of one or all of these types of analyses:

- Measuring performance against budget goals

- Analyzing market trends to surface opportunities

- Evaluating staffing and resources

- Analyzing gaps in profitability

Where shortfalls exist, determine their importance to your overall operations, and use them as a framework for writing your goals for the next quarter.

3. Update your business impact analysis

With the disruption we saw with COVID-19, every business should also do a business impact analysis. It's important to Identify potential disruptions to your business operations and the financial impact that can result.

While you couldn’t have predicted the massive disruption to supply chains caused by the coronavirus or the enormous shift to remote working environments, you can measure the impact of other disruptions. For example, what happens if your point-of-sale (POS) system goes down for more than a few hours?

With our increasing reliance on technology and the data volume generated, pay particular attention to your operations analytics.

You may find things you need to implement in your quarterly plan to mitigate financial risks moving forward.

4. Analyze previous quarter’s KPIs

Hopefully, you created goals and key performance indicators (KPIs) for the last quarter. If so, you need to pull them out and see how you did. Were they completed? If so, celebrate. If not, do they need to be adjusted for the next quarter?

Pay special attention to your sales analytics. Revenue is what keeps you in business, so many of your KPIs will likely revolve around it: how well you’re generating it and the efforts you’re undertaking to do so.

5. Benchmark against peers

If possible, benchmark your performance in key areas against peers and competitors in your industry. It’s easier if a company is publicly traded, and you can examine their revenue figures and public filings. For smaller businesses, check with your trade association or do an online search for benchmarking data.

For example, if you’re in the plumbing business, a Google search can show you these industry averages for an assortment of financial benchmarks to use for comparison.

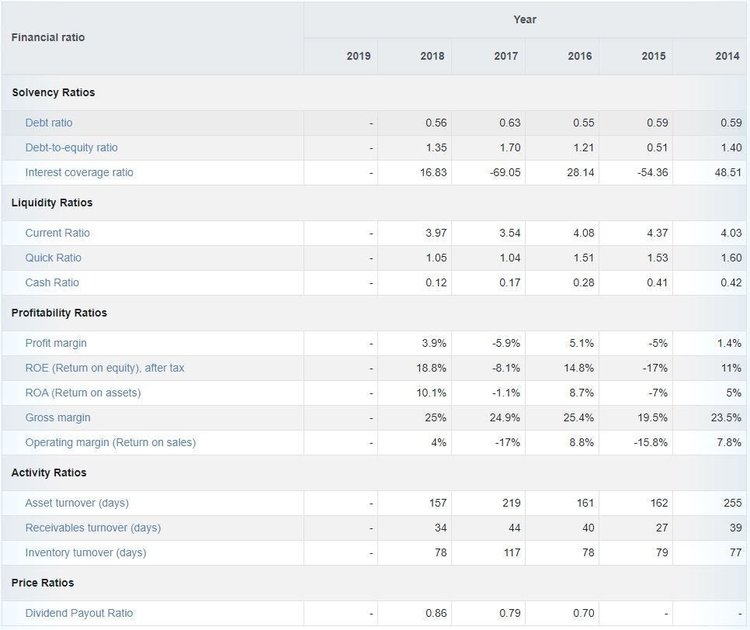

ReadyRatios provides financial benchmarks for many industries. Image source: Author

6. Adjust KPIs for the upcoming quarter

With the first few steps out of the way, you should have some idea where you need to improve or grow. To do that, set the KPIs you use to measure success. The clearer your goals are, the easier they will be to measure.

For example, let’s say your goal is to increase your quarterly profit margin by 2%. To do that, you'd need to track revenue, expenses, and margins. In the next step, your action plan will itemize the steps you need to take to accomplish your KPIs.

7. Create a quarterly action plan

It’s time to itemize the ways to improve work performance to accomplish your goals and meet your KPIs.

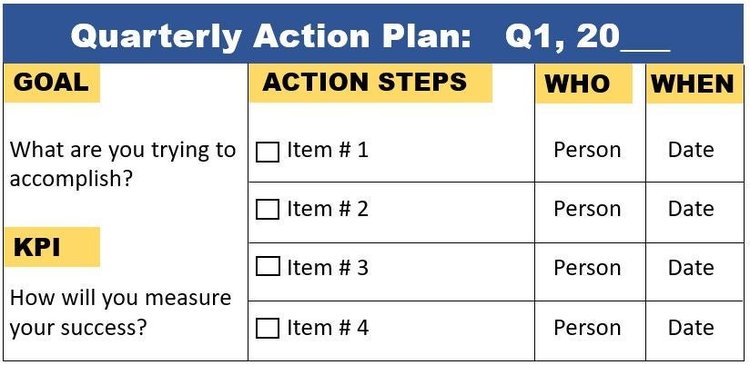

When creating your plan, it’s helpful to use a quarterly action plan template or create a one-page action plan. It can be tempting to create a long list of items to accomplish. Don’t do it. If you put too many quarterly planning goals on the list, it can be overwhelming, and you may lose focus. Find the one, two, or three most important goals and put them on your checklist. If you can mark them as complete, you can add more if you wish.

8. Action plan example for business

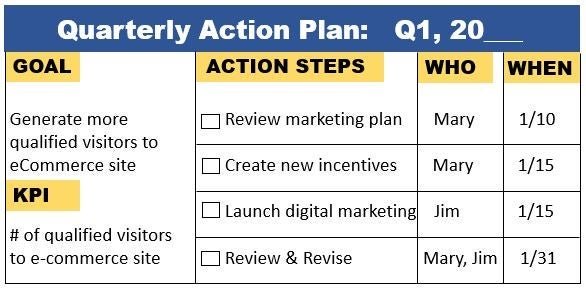

Once you’ve narrowed your list of priorities, break each goal into smaller action steps. Identify who's responsible for accomplishing each step and a due date. You can sketch it out on paper, use sticky notes, or use a spreadsheet. Here’s an example.

Quarterly action plan template. Image source: Author

Here’s a simplified example of how you might fill it out. Of course, yours will look different, depending on your goals and action steps.

Quarterly action plan template with examples. Image source: Author

Of course, an even better way to set your goals and action steps would be to quantify everything you can. For example, instead of generating more qualified visitors to your e-commerce site, you might say increase visitors by 15%.

9. Assess your resources

Once you have your KPIs in place and an idea about your overall goals, examine your resources. In our example, you’re going to be spending marketing dollars to attract more qualified shoppers to your e-commerce site. You’ll need to have budget allocated to do it. Besides marketing expenses, you’ll need to make sure you have enough inventory on hand and the additional budget for any additional holding costs.

You’ll also need to factor human resource planning into the equation. Do you have the personnel or resources to launch and manage your marketing campaign? If it’s successful, can you handle the increased volume?

Your strategic to-do list

For many small businesses, the idea of a formal business plan can be daunting. It doesn’t have to be. Approach it like a strategic to-do list to hold yourself and your team accountable. If possible, narrow down your objectives, break them down into measurable goals, and keep them to one page. Put it in a place you can review regularly to make sure it remains top of mind.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles