2024 Small Business Ownership Statistics

How many small businesses are there in the United States? What’s the average age of small business owners? How do things further break down along gender or racial lines?

This guide aims to answer those questions and more about small businesses, diving deep into the statistics and where the trend lines are headed.

Key findings:

- Small businesses make up 99.9% of all U.S. businesses but a minority of the workforce.

- Women- and minority-owned businesses still lag far behind firms owned by white men.

- Women-owned businesses have skyrocketed by 114% over the past 20 years; however, the revenue share of women-owned businesses has fallen .02% in that same period.

- The majority of entrepreneurs did not possess a college degree.

- Minority-owned businesses were less likely to attract outside funding.

Average size of small businesses

The U.S. has a lot of small businesses -- more than 30 million, in fact. But despite there being so many, a small minority of large firms swallow up the majority of wealth.

And while 99.9% of all businesses in the U.S. are classified as small businesses, they employ less than half of the workforce -- 47.3%, or 59.9 million people, according to 2019 U.S. Small Business Administration statistics.

The average small business employed about 11 individuals, but those numbers fluctuate widely based on race and gender. The average woman-owned business employed about eight employees compared to 12 for businesses run by men.

The breakdown was similar for minority-owned businesses compared to non-minority-owned ones, with the former employing eight workers and about 11.5 for the latter, according to SBA statistics.

SMB ownership by age

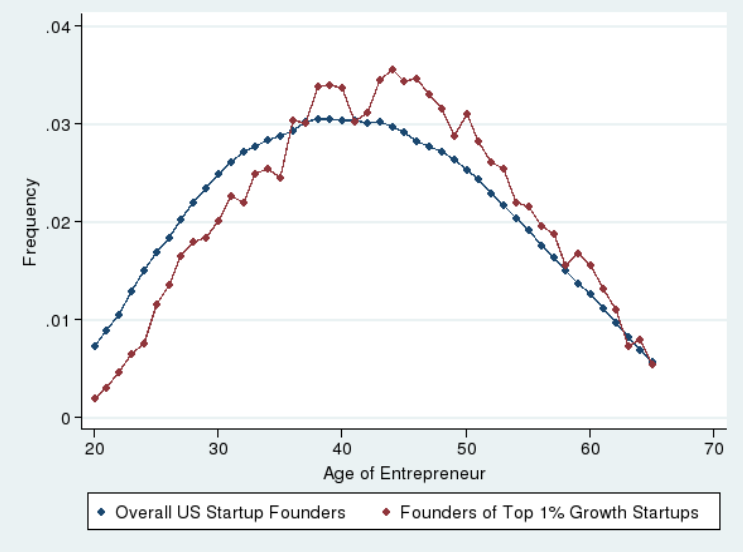

Although you can find stories everywhere you look of 20-something entrepreneurs striking it big, the truth is that startup founders tend to be in their 40s most often, according to a National Bureau of Economic Research paper.

A graph featured in the paper (embedded below) shows that startup founders are rarely in their early 20s, with most not starting to achieve success until their mid-30s and up to age 50, when the likelihood starts to decline. It’s an indication that most entrepreneurs aren’t overnight successes -- instead, they likely endured many years of failure and gradual growth before finding a business model that worked.

Most startup founders tend to be in their 40s, according to this graph. Image source: Author

SMB ownership by gender

The U.S. business world continues to be male-dominated, and the trend lines have not been very positive in recent years. While women-owned businesses have made significant strides in some areas, they struggle to gain forward momentum in others.

An estimated 11.6 million U.S. businesses were at least 51% owned, operated, and controlled by one or more women in 2017, and they employed nearly 9 million people and generated $1.7 trillion in revenue, according to an American Express report.

That represents a growth of 114% in total women-owned businesses over the past 20 years, compared to an overall national growth rate of just 44% for all businesses, indicating that women are certainly joining the business world at a significantly higher rate compared to previous years.

However, these businesses have seen very little change in total employment and revenue in the past two decades. Women-owned businesses make up just 39% of all U.S. firms today, and they employ a scant 8% of the total private-sector workforce and collect just 4.2% of total business revenues.

Also, while the number of women-owned businesses has surged over the past 20 years, their revenue share has actually declined slightly over that period, from 4.4% to 4.2%, according to the report.

SMB ownership by race

The business world remains white-dominated as well. A 2018 U.S. Census report found that just 5% of Black individuals in the U.S. were self-employed, compared to 9.6% for the overall population.

Additionally, minorities across the board were less likely to attract outside investment. Just 64.5% of white-owned firms relied on personal and family savings as a source of startup capital, compared to 70.6% for Black Americans, 71.9% for Hispanic immigrants, 72.3% for Hispanic non-immigrants, 70.8% for Asian immigrants, and 73.2% for Asian non-immigrants.

| Race | % Relying on Personal or Family Savings for Startup Capital |

|---|---|

| White | 64.5 |

| Black | 70.6 |

| Asian (Immigrant) | 70.8 |

| Hispanic (Immigrant) | 71.9 |

| Hispanic (Non-Immigrant) | 72.3 |

| Asian (Non-Immigrant) | 73.2 |

White small business owners rely less on personal or family savings for startup capital compared to minority small business owners. Source: Congressional Black Caucus Foundation.

Black Americans had to tap into personal credit cards to fund their businesses 17.6% of the time, compared to just 10.3% for white Americans.

Overall, white small business owners represented a 3.8% share of the U.S.-born labor force, compared to just 2.5% for Asians, 1.6% for Hispanics, and 1.1% for Black Americans, according to the Census report.

SMB ownership by education attained

A surprising number of entrepreneurs never received a college degree -- in fact, they represent the majority. A 2017 CNBC/SurveyMonkey survey found that just 44% of independent business owners received at least a bachelor's degree.

Another 31% achieved an associate degree or took some college courses but did not graduate. Another 20% graduated from high school or earned a General Educational Development certificate (GED), and the remaining 5% did not complete high school.

| Education Attained | % of SMB Business Owners |

|---|---|

| Did not receive GED | 5.0 |

| High School | 20.0 |

| Associate Degree | 14.0 |

| Some College | 17.0 |

| Bachelor’s Degree | 26.0 |

| Post-Graduate | 18.0 |

A breakdown of small business owners by education level. Source: CNBC.

These survey results are perhaps no surprise, given all of the success stories of those who didn't complete college. Successful business titans such as Bill Gates, Mark Zuckerberg, and Steve Jobs famously dropped out of college to pursue their entrepreneurial careers.

However, that doesn't mean dropping out of college and marketing your business is a great idea. Most who do this have the advantage of family wealth to tap into. A 2013 National Bureau of Economic Research study found that successful entrepreneurs were more likely to be male, white, better-educated, and come from high-earning, two-parent families.

SMB legal structures

Limited liability companies and sole proprietorships are two of the most common forms of small business legal setups, but they aren’t the majority. A 2018 report from the National Small Business Association found that 35% of small businesses were LLCs, and 12% were sole proprietorships in 2017. The rest were S corporations (33%), corporations (19%), and partnerships (2%).

| SMB Legal Structure | % of SMBs With This Structure |

|---|---|

| LLC | 35% |

| Sole proprietorship | 12% |

| S corporation | 33% |

| Corporations | 19% |

| Partnerships | 2% |

LLCs and S corporations comprise the majority of small business legal setups. Source: National Small Business Association.

SMBs still face an uphill battle

The takeaway from these statistics is that while small and medium businesses in the U.S. are extremely important and support nearly half of America’s workforce, they have a long way to go in a couple of areas.

First, while they make up nearly all businesses -- 99.9% -- they employ just less than half of the overall workforce simply because larger firms dominate in overall revenue and market share.

Second, SMBs continue to struggle in terms of gender and racial diversity. While these firms have gained ground in some areas, female- and minority-owned firms still lag far behind when it comes to revenue.

Also, most firms were founded by people who had graduated from college, indicating that those who did not attend college, or left before graduating, may struggle to attain success despite anecdotal examples of college dropouts striking it rich as entrepreneurs.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles