How to Get Your EIN With an IRS Form SS-4

Before you can register for a business license, get a loan from a bank, make big purchases from suppliers, or even pay taxes, you need to submit an EIN application for a tax ID number.

In this article, we will go over what form to use to apply for an EIN number and how to complete and submit the form.

Overview: What is the IRS Form SS-4?

The IRS form SS-4 is used to apply for an EIN. You will need an EIN to file taxes or apply for a business loan.

If you’ve already completed your business plan and know what type of legal entity your business will be, the SS-4 application will be easy to complete.

What is an EIN, and why should you apply for it?

The EIN number, or Employer Identification Number, is the business form of a Social Security number.

If you believe you may have an IRS EIN already, there are a few places where you can look it up.

How to complete Form SS-4 to apply for an EIN

Follow the steps below to complete your Form SS-4 and get one step closer to starting your business.

Step 1: Determine legal entity type

The first step is deciding which legal entity type your business will be. This will determine how you will file your business taxes and how to allocate ownership in your business.

You will also decide whether your business will be a Limited Liability Corporation (LLC). LLCs shield the owners from legal liability for the corporation. Almost all new businesses should be LLCs.

Here are the four main legal entity types:

- Sole proprietor: Sole props are most useful for side hustle type of businesses. If you’re working as a consultant on the side or running a dog walking business, use a sole proprietorship. You report taxes on your personal tax return.

- Partnership: Partnership is identical to a sole proprietor, but there are multiple owners. The income of the business passes through to your personal return.

- S corporation: S-corporations can have one owner or multiple owners and make it easier to issue shares and sell parts of the company to other owners. There is a limit to the number of shareholders. The income of the business passes through to your personal return.

- C corporation: Most big businesses that you deal with are likely C corporations. It is the easiest entity type from which to issue shares. C-corporations pay their own taxes, and owners then pay tax on the dividends they receive from the business.

Step 2: Register with your state

Your secretary of state’s website is where you register the legal name of your business and set up accounts for all sorts of fun stuff such as unemployment taxes, tax withholding, and a business license.

Your best bet is to Google “register a business in (your state).” Click on the first link that has the extension .gov. For example, in my state the website is corporations.utah.gov.

Most states will take you through several pages of registration and, at some point, will tell you to register for an EIN and return with the number to complete the process.

Step 3: Complete Form SS-4

Let’s go through the form in three steps.

The first third of the Form SS-4 asks for mainly administrative details such as name and address. Image source: Author

The first third of the form is straightforward. You should be able to answer lines 1 through 7 on your own with the information you entered into the state website. Line 3 is for trusts only. For 7a, put the owner’s name.

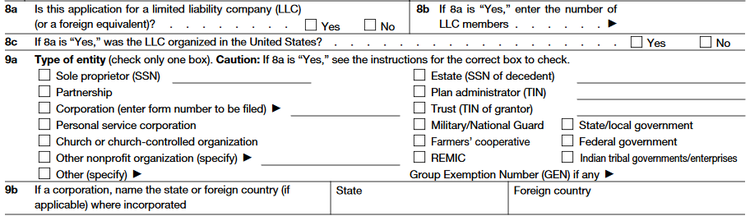

The second section of Form SS-4 asks about entity type. Image source: Author

If you are registered as an LLC, check yes on line 8a, enter the number of owners on line 8b, and check whether the LLC was organized in the U.S. on line 8c.

Line 9a asks about the type of entity that you chose in step 1. If you chose one of the four types discussed, you would check one of the first three boxes.

The final section of IRS Form SS-4 asks for administrative details about your business. Image source: Author

We’ll go through this final section of the form line by line.

- Line 10: It is likely that you started a new business, but if one of the other reasons applies, check it instead.

- Line 11: Enter the date that you completed your Articles of Organization on the state website.

- Line 12: Most businesses close accounting in December. If you have a seasonal business, you may close in a different month.

- Line 13: Enter the number of employees that you expect to hire this year.

- Line 14: If you will be paying employees other than yourself less than $5,000 total in the first year, check this box so that you can file an abbreviated employment tax form.

- Line 15: If you don’t have employees yet, skip this line.

- Line 16: Choose your industry type.

- Line 17: Enter your business type.

- Line 18: Enter whether your business has had an EIN before.

That’s it. The next step is to submit the form to the IRS.

Step 4: Submit Form SS-4

Applying online is the easiest way to submit your form SS-4. The IRS website will take you through the same steps on the form and then confirm your number so you can get back to the state website.

Alternatively, you can complete and print the form and mail or fax it to the IRS for approval. This will take longer, especially during the COVID-19 pandemic. Here is the address and fax number to submit the form:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Step 5: Profit

Once you have an EIN, you can return to your state website and complete the rest of the application process. Finish your new business presentation, wrap up your product details, and purchase tax software to complete setup.

Can you get a copy of the IRS Form SS-4 notice?

You will receive a notification letter from the IRS that shows your official EIN. File this in a safe place for future use. If you lose it, you can request a new one by calling the IRS at 1-800-829-4933 and requesting a new one for your file.

Sending out an SS-4

It can be demoralizing to churn through so much paperwork when you’re starting your business. Luckily, the IRS Form SS-4 is relatively easy. Now you can roll through it, get your tax ID number, and move on to other business activities such as sales and inventory management.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles