How Do You Value a Startup?

Valuing your business is important for many reasons. Foremost among those is usually to get a good price in a sale. For that occasion, it makes sense to engage a valuation company which will employ some finance experts to put together the value and then charge you several thousands of dollars.

If you run a fast-growing startup and are seeking investment from a venture capital (VC) fund, you may need to produce a valuation of your own to bring to the negotiating table. Unfortunately, there is no easy formula to calculate business value.

Finding the valuation of a company is more of an art than a science, and it will likely go through several iterations as you negotiate.

The 5 business valuation methods

The market value of a business is whatever someone will pay for it. In our case, it is whatever a venture capital fund is willing to agree to as the basis for its investment. Let’s go through several methods to estimate a value for your business.

1. Pre- and post-money

Before we get started on the more in-depth valuation techniques, we need to discuss pre-money valuation and post-money valuation. The number you come up with when using any of the methods in this article is considered the pre-money valuation. You and the VC come to the table with valuation estimates and negotiate the value.

Post-money valuation adds the new cash from the investment to the pre-money valuation. Typically, you would pitch an investment into your company using the post-money value. During the presentation, add your valuation calculation and then make the request as X dollars for Y% of the company.

If the VC decides to invest, you’ll receive a term sheet with their valuation proposal and other terms of the investment, and you’ll go from there. It is more about what value you have the leverage to get than what number you end up calculating on a spreadsheet.

2. Revenue multiple

The most common way to determine the value of a startup is by comparing it to similar companies. These are usually competitors, but similar-sized startups with similar business models may be used even if they are not direct competitors.

Think one software-as-a-service (SaaS) startup selling scheduling software to railroads and another selling accounting software to grocery stores. They may be similar enough to compare but likely would not compete with each other.

You can compare the multiple that similar companies are trading at in the stock market, that they have been acquired for recently, or that other VCs paid in a recent funding round.

Stock market comparisons are not ideal, though, because public companies have different cost structures by nature of their required reporting to the SEC, and public companies are rarely the small, fast-growing businesses that would be targeted by venture capitalists.

Recent investments by other VCs would be ideal, but these numbers are often kept secret and are tough to find as a business owner unless you have contacts at the fund.

Recent acquisitions or precedent transactions are what you should look for. There still isn’t a public database for these transactions (nothing is easy), so the best bet is to look through venture websites and do Google searches for M&A (mergers and acquisitions) deals in your industry.

Once you find some good precedent transactions, calculate what multiple of revenue was paid, take an average, and apply it to your company. Voilà, you have a value. This may not seem like a very technical valuation, but the simpler your argument the easier it is to defend it. Sometimes valuation is more of a Sherlock Holmes game than a Vulcan one.

3. Cash flow

Once you have a more mature company with developed controls and cost structure, it makes more sense to look at cash flow instead of revenue. We usually use revenue to compare startups, because so many have not yet made a profit.

Cash flow can be calculated in innumerable ways. The most common is EBITDA, or earnings before interest, taxes, and depreciation. EBITDA is a way to compare net income between businesses without it being affected by capital structure (interest), tax rates, or capital purchases (depreciation).

There are also common industry cash flow calculations based on normal business metrics for the industry, such as the funds from operations numbers used by real estate investment trusts.

Once you nail down the cash flow calculation you want to use, build out a few years of financial projections. The two main ways to value a company based on cash flow are multiple analysis and discount cash flow analysis.

- The multiple method is widely used, and you can either apply an average multiple to the current year’s cash flow or apply it to a future year based on your projections and calculate what the return is from today’s valuation.

- Discounted cash flows (DCFs) are more widely used among mature businesses. In a discounted cash flow model, you project out cash flow for a number of years and then discount it back to the present at whatever return is required by the investor. That way, you can determine what amount to pay today to earn the required return.

Startup financial projections are notoriously unreliable. I once read an interview with a well-established fund manager who compared DCFs to the Hubble Telescope -- move it an inch and you’re in a totally different universe. With startups, you could see revenue growth deviation of 50% or more from projected to actual. Not to mention that the required returns for venture capital funds are immense.

It doesn’t hurt to do a DCF; just don’t weigh the result as heavily as you would the others.

4. Combo

The true answer for the best valuation method is the semi-cop-out answer. You need to do a combination. Since the value of the company is whatever you can best defend in negotiations, you need to run through different analyses and figure out how to defend the highest number you can.

5. Assets

You don’t want to do an asset valuation. Either your business is not capital intensive, which is good because you earn higher returns, and you don’t have many assets to value, or your business is asset-intensive, which is bad, because it’s harder to grow without constantly giving up part of your company.

In any event, asset valuations, or liquidation analysis, is usually reserved for companies when the vultures are circling. It is used to figure out what can be gotten out of the company in a flash sale -- not for what potential the company has for a VC investment.

The valuation football field

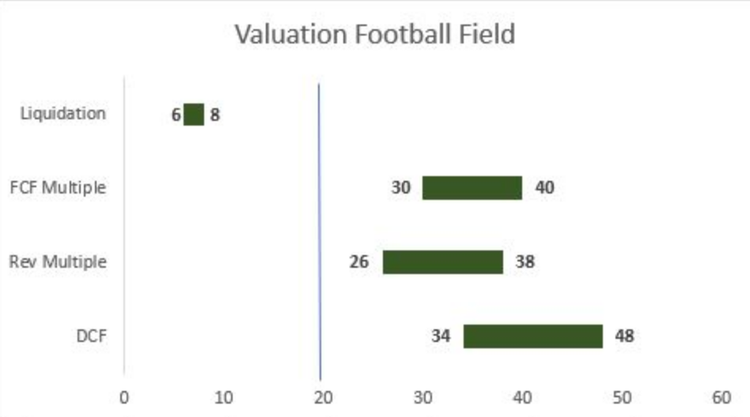

If you could sneak a peek at the investment write-up some poor analyst did for your company at the VC fund, you would inevitably find a “valuation football field.” As we talked about above, VCs prefer to settle on a range of potential values, and the football field is an easy way to capture those. We don’t have space in this article to go over how to create your own, but I’ll share a graphic and then quickly explain what it shows.

Non-liquidation value ranges from $26/share to $48/share. Image source: Author

In elaborate write-ups, the football field can grow much larger than this, showing several different precedent transaction scenarios and projected years. On the chart above, the minimum value of the different methods is the number to the left and the maximum is the number to the right. The liquidation value is included for illustration purposes and the line at $20/share shows the average price of the last round for comparison.

Valuation celebration

A key in any important negotiation is understanding the terms and how your counterpart came up with them. If you go into a VC negotiation without ever having heard of a DCF or pre-money versus post-money valuation, you’re at a massive disadvantage. If you learn how to use the methods and have already applied them to your own company, you have a lot more ammo to come back with.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles