What Tax Nexus Means for Your Small Business

One of the more frustrating aspects of starting a business is determining what taxes you’re responsible for. This can be particularly confusing with sales tax. Where do you need to collect it? Do you only need to collect sales tax in the state where your business is? What about online sales? If your business is in Nevada, do you need to collect state sales tax from a customer in Illinois?

That’s where tax nexus comes in. The definition of nexus is "a connection or series of connections linking two or more things." Keeping that definition in mind, tax nexus is the relationship or connection a business has with a tax authority. If you don’t sell out of state, your tax nexus would be only with your home state tax authority.

Simple enough, right? But as online sales grew, tax nexus became murkier, with many online sellers continuing to collect only taxes from their home state. And as more residents shopped online, more states became concerned with the resulting drop in sales tax revenue and began to lobby for a more inclusive sales tax collection process.

Their concerns were addressed with the 2018 Supreme Court case South Dakota v. Wayfair, which established an economic nexus for companies selling online. Because of this ruling, both physical presence and economic presence are now used to create sales tax nexus. A business can have a physical presence and/or an economic presence in a state to establish tax nexus.

Overview: What is a tax nexus?

A tax nexus is simply an established connection between your business and a tax authority. For example, you open a small retail store in Chicago. Your sales are limited to in-state transactions, as you don’t have an online presence. Your sales tax nexus is the state of Illinois, and possibly the city of Chicago. You could also have a tax nexus with any Illinois county that may impose taxes.

If you sell your products out of state, you will then establish a tax nexus with those states where you’ve sold products.

It’s fairly easy to maintain tax nexus properly if you’re only selling locally, but things become more complicated when online sales are introduced. When more than one tax nexus is introduced, many business owners turn to sales tax software, which can simplify the entire sales nexus by examining state nexus laws and other potential nexus issues.

How does this type of tax work?

Tax nexus is not a type of tax, but it determines whether there is a relationship between a business and a tax authority. Each state defines tax nexus, with the specifics of the relationship constantly changing. Unless a tax nexus is established between your business and a particular state, you don't have to collect and remit sales tax to that tax authority.

3 types of tax nexus

There are three main tax nexus that small business owners should be concerned with.

1. Sales tax nexus

Sales tax nexus is the easiest to establish, with a variety of circumstances able to establish nexus including:

- A physical presence in the state

- Employment of state residents in the business

- Property is owned in the state

- Inventory is maintained in the state

- Business is conducted in the state regularly

For example, Kate owns an interior design firm in New Mexico. Though her firm is in New Mexico, her salespeople regularly solicit business from Colorado residents, establishing a nexus with the state. Because of that nexus, if Kate accepts a commission in Colorado, her customers will have to pay Colorado sales tax.

Workers, property, warehouses, and inventory are all items that can create economic or income tax nexus with a state. Image source: Author

2. Online or economic nexus

When e-commerce sales began, companies collected sales tax only from residents of the state where their business was established. But because of South Dakota v. Wayfair, referenced earlier, businesses are now required to establish an economic nexus with any state where they conduct business, whether they have a physical presence in the state or not.

And because most states have different nexus requirements, each state will need to be handled separately.

3. Corporate income tax nexus

Corporate income tax nexus is muddier than the other two. In Kate’s case, her proximity to Colorado will likely result in a nexus for income tax purposes. Income tax nexus can occur if you derive income from within the state. And because Kate has a lot of customers that reside in Colorado, chances are her income from Colorado residents will establish an income tax nexus with the state that will need to be addressed on her tax return.

Of course, because her business is in New Mexico, Kate also has an income tax nexus there, which will need to be filed with her personal or corporate income tax return.

How a tax nexus can affect online sales

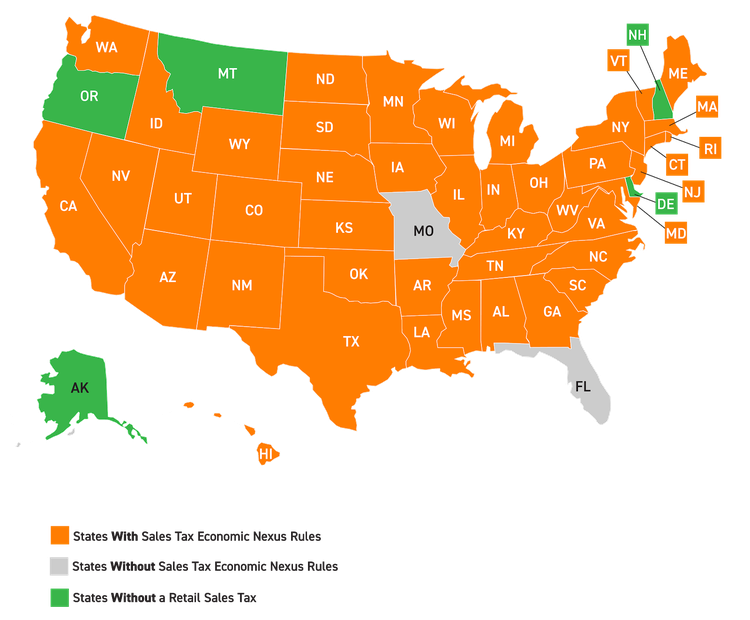

Before the establishment of economic nexus, retailers were only required to collect sales tax from in-state customers. Today, except for four states: Delaware, Montana, New Hampshire, and Oregon, all states have established economic nexus, with Florida and Missouri legislation pending.

Except for a few states, most states have economic nexus at some level. Image source: Author

While the establishment of online sales nexus doesn't impact sales, it does affect your business. If you’re dealing with economic nexus for the first time, these tips can make your life easier.

1. Identify states where you may have economic nexus

In any state where you have sales, you can have economic nexus. Since every state is different, you will need to determine the states where you’re selling and then research the sales threshold established in that state.

For example, Colorado has a sales threshold of $100,000 or 200 transactions. So if you have more than $100,000 in sales in Colorado or more than 200 sales transactions, you will need to begin collecting sales tax from your customers. Keep in mind the threshold in most states includes the current and the previous year’s totals.

2. Make sure you’re collecting the appropriate amount of sales tax

Since sales tax is paid by the consumer, it’s up to you to collect the appropriate sales tax from your customers, keeping in mind that if you don’t collect the proper amount, your business will be responsible for the balance owed. For example, ABC Sports has collected 5% sales tax from their customers, but the actual sales tax rate is 5.75%. Because they did not collect enough from their customers, ABC must make up the difference.

3. Use sales tax software

If this is giving you a migraine, you’re not alone. That’s why more businesses turn to sales and use tax software to simplify the entire sales tax nexus process. Different from income tax preparation software, sales tax software can help identify nexus, while also ensuring you collect the correct tax from your customers.

If you need to collect and remit sales tax for more than one state, sales tax software can be a lifesaver. Sales tax software can also help maneuver potential issues such as tax holidays and local tax nexus.

A few final thoughts on tax nexus

To remain compliant, you must understand tax nexus. Tax nexus simply means you have a relationship with a taxing authority. It’s up to you to manage that relationship appropriately by knowing the requirements of each of the taxing authorities. The easiest way to do this is to use sales tax software, which helps you establish nexus, collect the correct sales tax, and remit the tax owed to the proper tax authority.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles