What Do I Need to Open a Business Bank Account?

Each stage of building a business presents unique challenges. Once you finally have money coming in, you need to decide where you're going to keep it. For most companies from large corporations down to sole proprietorships, a business bank account is essential. But there are a few things you need to know before you can open one.

Below, we'll explore why you should open a business bank account, what documents you need, and how to decide which account is right for your company.

Overview: Why should you open a business bank account?

Having a business bank account can make your life a lot simpler. Here are five reasons why.

1. Protect your personal funds

If you use a single account for your personal and business finances, your personal savings could be at risk in a lawsuit. That means if someone sues your business and the court awards them compensation, your personal money could be fair game, even if the way you earned it had nothing to do with your business at all. A separate small business banking account protects your personal savings in these situations.

2. Avoid tax issues

Maintaining a separate business bank account makes it easier to track business earnings and expenditures. This can save you a lot of headaches when you go to file your taxes and it can help you avoid problems with the IRS. Separating your personal and business finances indicates to the IRS that you're running a legitimate business and not a hobby business, which is not permitted business tax deductions.

3. Accept credit cards

You cannot accept debit or credit card transactions through a personal bank account. If you have customers that habitually pay with cards, you need a business bank account to process them. Otherwise, you must limit your customers to paying with cash or a check, and that could deter some from working with you.

4. Give others access to company funds

When you're running a partnership or corporation, you probably won't be the only person who needs to make a business purchase or access the company's funds. You don't want your business associates using your personal bank accounts, so a business bank account for an LLC or corporation is a better arrangement.

5. Maintain a professional appearance

Your company will appear more professional if you can write your vendor checks from an LLC bank account rather than from a personal account. Customers may also feel more secure writing checks to a business name than to you as an individual.

What do I need to open a business bank account?

These are some of the most common requirements to open a business bank account.

1. Employer Identification Number (EIN) or Social Security Number (SSN)

Most banks require business customers to provide their employer identification number (EIN) in order to open a business checking account or savings account, though some may permit sole proprietors to open a small business account with just their Social Security Number.

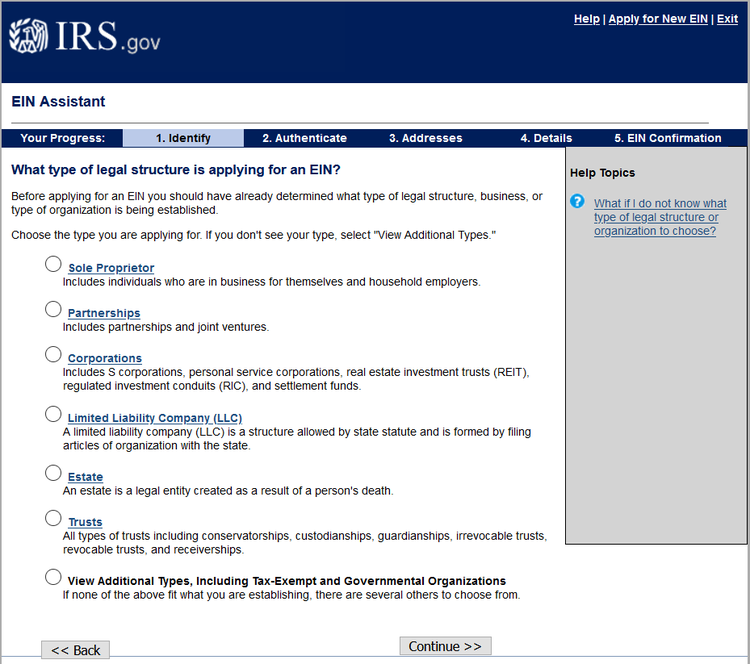

You can obtain an employer identification number (EIN) for various types of businesses by filling out a simple form on the IRS website. Image source: Author

If you don't have an EIN, you can obtain one for free by filling out the application on the IRS's website as long as you have a valid Social Security Number and your business is operating in the United States or its territories.

2. Personal identification

Just as when you open a personal bank account, your bank will want to see a driver's license, passport, or another form of state-issued identification to prove you are who you say you are.

3. Business formation documents

Your bank will need a copy of your formation documents. For limited liability companies (LLCs), this means the articles of organization; for a corporation, it's the articles of incorporation. These documents list some basic information about your company, including its management structure, who is responsible for managing the finances, and how your business will operate.

4. Ownership agreements

If you're running a partnership or a corporation, you and the other owners will need to create a partnership or operating agreement. This will outline each owner's rights and responsibilities as well as how the business will operate.

5. Business license

Your bank needs proof that your business has the appropriate licenses before it will enable you to open a business bank account. The requirements to obtain a business license vary depending on where you live, so do some research to find out what's required in your area.

6. Certificate of assumed name

If the name you use to advertise your business to your customers is different from the company's legal name, you will need a certificate of assumed name, also known as a doing-business-as (DBA) name. Your bank will need a copy of this as well when you open your account.

7. Monthly credit card revenue

Businesses interested in opening a merchant services account to process debit and credit card transactions should provide their bank with details of their average monthly credit card revenue. Startups may not have any prior credit card revenue but they should have an estimate of how much they expect.

How to open a business bank account

When you're ready to open a business bank account, here's what you need to do.

1. Decide which accounts you need

There are several types of business bank accounts and your company may need more than one. The most common are:

- Business checking account: Similar to a personal checking account, business checking accounts are designed for receiving payments and spending. This is where you keep your working capital. It's possible to earn interest on these funds, but interest-bearing business checking accounts are rare.

- Business savings account: This is where you put money your company doesn't intend to spend in the near future. Savings account funds earn interest over time, but they have more limitations on how you can access your funds.

- Merchant services account: A merchant services account is necessary if you plan to accept credit and debit card transactions.

2. Select a bank

Once you know which types of accounts you need, you need to find the right bank. Keep the following things in mind:

- Account variety: Obviously, you need a bank that can provide you the basic business bank accounts you need right now, but you should also try to anticipate your future needs. If you think you may want a business credit card or business loan in the future, make sure your bank offers these as well.

- Fees: Business bank accounts may have monthly fees as well as per-transaction fees if you exceed a certain number of transactions in a month. Other fees to watch for include cash deposit fees, ATM fees, and wire transfer fees. Think about which of these services your bank uses and how these fees could affect your profits.

- Interest rates: Interest rates matter most on business savings accounts, but some business checking accounts offer interest as well. A higher rate is better, but you have to weigh this alongside the other factors listed here.

- Branch and ATM network: Whether you choose an online or brick-and-mortar bank, make sure it has a large ATM network with fee-free ATMs in your area if you believe you'll need to access cash. Brick-and-mortar banks are a better fit for those who value personalized customer service, though they often have higher fees than online banks.

- Account management tools: A good business bank account should enable you to view your balance, pay bills, and move funds around through an online account or a user-friendly mobile app. This also makes bank reconciliation much easier.

3. Gather the required documents

Now that you know which business bank accounts you need and which bank you'd like to work with, you should gather all the important documents discussed above so you're ready to apply. If you have any questions about anything else you might need in order to apply, reach out to the bank to ask.

4. Apply for the account

Many banks enable you to apply for a business bank account online, though a few may require you to visit a branch in person to do so. Applying shouldn't take too long as long as you have all your paperwork in order.

If you run into any problems when applying online or you have any questions about the application process, don't hesitate to reach out to the bank. You want to make sure everything's done correctly so you don't run into issues with your bank or the IRS later.

5. Deposit funds and start using your account

Once your account is set up, you can deposit funds and begin using it just like you would any other bank account. Your bank may require you to make a certain minimum deposit when you set up your account. This can be cash or money you transfer from another bank account via electronic or wire transfer. You could also write a check.

3 tips when setting up a business bank account

Keep the following tips in mind when opening a business banking account.

1. Compare accounts at several banks

It's tempting to open a business bank account with the bank where you have your personal accounts because then you can manage your money all in one place, but this isn't always your best option. Compare bank accounts and fees from several banks and make your choice based on which account is best for your business, even if that's an account at a separate bank. You can always transfer funds from one bank to the other as needed.

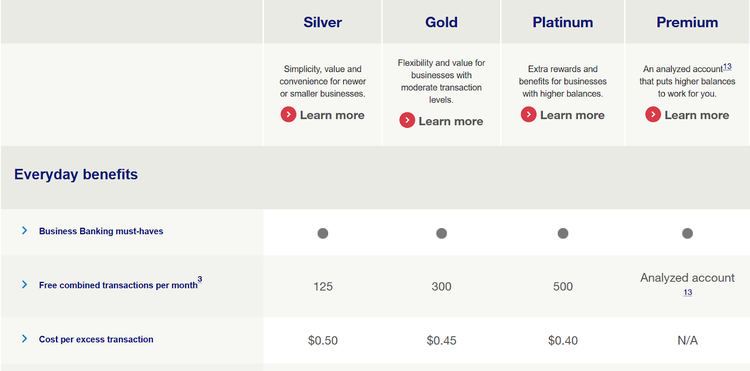

Consider choosing U.S. Bank or a similar financial institution that offers several tiers of business bank accounts so you can upgrade as your business grows. Image source: Author

2. Make sure your business bank account leaves you room to grow

Some business bank accounts impose transaction limits and charge you extra fees for exceeding them. This can prove costly if you're constantly bumping up against this limit. Review your business budget and anticipate how your company's future growth could affect how much you pay in fees every month.

If you think your current business bank account could become restrictive, check to see if the bank has another account that would provide you with the additional free transactions or other services you need.

3. Save time with accounting software integration

Some business bank accounts integrate with popular accounting software. This can save you time when it comes to managing your business finances and creating expense reports and balance sheets because you won't have to manually look up information in your business bank account and enter this into your accounting software.

The bottom line

A business bank account is a must if you're serious about growing your product or service into a profitable company. There's a lot to think about when comparing the options available to you, but if you follow the steps above, you should be able to find the perfect fit for your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles