A few years ago, Chicago made headlines for issuing tickets for missing sign permits. One popular pizza shop was fined more than $1,000, receiving a separate ticket for each window panel.

Your location, the nature of your work, and even your signage can affect the licenses and permits you need to legally operate your small business. To find out which licenses apply to your particular situation requires some homework.

These six steps will help you drill down to the relevant licenses and apply for the ones you need. Depending on your business, you may be able to check some of the steps off your list without any work at all.

Here are our 6 steps to obtain a business license:

- Register your name

- Form your legal entity

- Acquire general business licenses

- Complete tax registrations

- Apply for professional licenses

- Obtain licenses for regulated activities

Types of small business licenses

Business licenses fall into these general categories:

1. Secretary of state registrations

Legal business entities such as LLCs and corporations must register to do business with the secretary of state. Sole proprietorships and partnerships operating under their owners' names generally don't have to meet business registration requirements.

2. General business licenses

Many states, counties, and cities issue general business licenses. Each jurisdiction sets up its own rules for the types of businesses that must be licensed. Sole proprietorships are often exempt from these requirements.

3. Tax registrations

Federal, state, county, and local governments require many businesses to register for income taxes, payroll taxes, and sales taxes.

4. Building and occupancy permits

Many cities and counties require businesses to obtain building permits or home occupancy permits. They may also require sign, alarm, and elevator permits.

5. Permits for regulated activities

Certain business activities require special permits at the federal, state, county, or local levels. Examples include gambling and games of chance, public events, sales of alcohol, tobacco, and firearms, food service, and daycare operations.

6. Professional licenses

If you're a member of a licensed profession such as architecture, engineering, construction, or real estate, you may need a state business license in addition to your individual professional license.

7. Industry licensing

Certain highly regulated industries such as banking, insurance, pharmaceuticals, transportation, energy, and agriculture require federal licenses. They may also require industry-specific state and local permits.

How you can get a business license

To license your business, you need to identify requirements that apply to your business in all the relevant jurisdictions, gather the required information, and submit your applications. These steps will walk you through the process.

Step 1: Register your name

If you're a sole proprietor operating under your own name, you generally do not need to register your name. If you're operating under a business name, you will need to register it with the secretary of state.

Step 2: Form your legal entity

If you want to operate as an LLC or corporation, you will need to form your business entity. This requires filing an application and paying a fee to the secretary of state. Most businesses form in the states where they're located, although you may choose to form in another.

Consult your tax and legal advisors if you are considering forming in a different state.

Step 3: Search licensing requirements

For the next steps, you will need to search the specific licensing requirements that apply to your business. I recommend starting at the local level and moving out from there.

If you live in a big city, your city's website will probably include a small business license portal. Here's the portal for Los Angeles (LA):

Most states and large cities provide a helpful portal for licensing. LA's takes the cake. Image source: Author

I have to say, LA really knocked it out of the park with this portal. Click "Try the Startup Guide," answer six quick yes or no questions, and you get a custom guide covering the whole deal.

I mean everything, from local tax registration to registering with the state and publishing your name, complete with links to the forms you need. You can print the guide, email it, or just work through it online.

A regulatory work of art: Check out LA's custom checklist for business licensing. Image source: Author

If you're from a smaller town, you will probably find something like this printable guide from Suwanee, Georgia. It includes a brief checklist and a paper application for tax registration, the sole business license required of all Suwanee businesses.

Many towns provide links to paper applications for licenses and registrations. Image source: Author

Be sure to look for any occupancy permits in addition to general business licenses required at the local level, including home occupancy, signage, and alarm permits.

Once you've researched the local licensing requirements, go to your state's website. Most states will have a licensing portal similar to LA's to walk you through the application process.

In many cases, you can apply for the licenses you need directly online, or download them to print and mail in. License applications require information such as your business name and address, business type, ownership, and tax identification numbers.

You will also generally need to submit a fee along with your applications.

Step 4: Complete tax registrations

If you're a sole proprietor, you may find the only registrations required for your business are tax registrations. For example, in both Los Angeles and Suwanee, tax registrations were the only license required for sole proprietors.

You can typically register online for your tax accounts or download the application to print and mail to the tax authority.

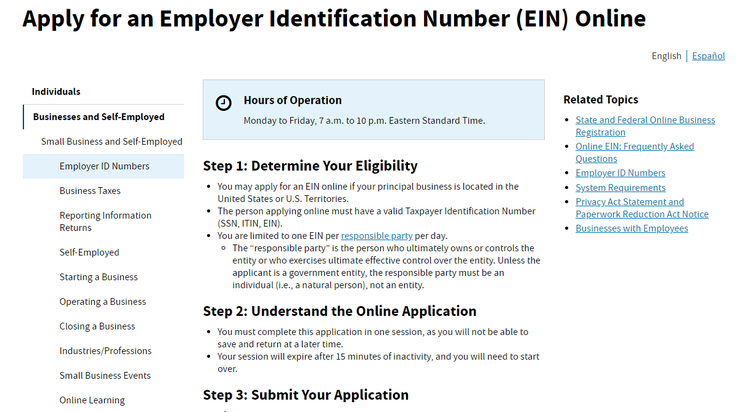

In addition to state and local income tax registrations, you may want to apply for a federal Employer Identification Number (EIN) for tax purposes. It's free and takes just minutes to complete, and you get your number immediately.

Be sure to use the genuine IRS portal to get an EIN. There's no need to pay a fee for an EIN. Image source: Author

Employers need an EIN to administer payroll taxes, but even if you're a sole proprietor with no employees, it's good to apply for one so you don't have to use your Social Security number for business identification purposes.

If you sell taxable goods, you may also need to register for sales tax at the local and state levels. If you sell taxable goods online, you may need to register in multiple states.

Tax software can help you manage all of your small business taxes more easily and accurately.

Step 5: Apply for professional licenses

If your line of work requires a professional license, you may need to apply for a company license through your state's professional licensing bureau. Check your licensing bureau's website for company licensing requirements.

Professional licensing boards in each state issue licenses to individual professionals and professional firms. Image source: Author

State license applications for professional firms often require detailed information on ownership, professionals in charge of the firm's services, and finances. Sole proprietors are usually exempt from these requirements.

Step 6: Obtain licenses for special activities

If your business will be engaged in regulated activities such as food service or childcare, be sure to look for special licenses or permits required at the local and state levels.

What does it cost to get a business license?

Some business licenses are free, but most charge a fee in the $20 to $50 range, and some run into the hundreds. Many licenses must be renewed annually or biennially, with renewal fees.

One thing you can count on: The license fee is a lot cheaper than the fines you'll get if you overlook a requirement.

Where can I find more information about business licenses within my specific state?

The National Association of Secretaries of State (NASS) features a directory of corporate registration bureaus. Simply go there and choose your state from the drop-down menu. You can also visit the main page of your state's website. Most include prominent links for business licensing.

Your local Small Business Administration (SBA) District Office is another excellent source of information and help with all aspects of starting and running your business.

Open for business

Even if you're starting out small, you want to set your business up correctly for future growth and success. Licensing and registering your business takes some homework, but if you approach it methodically, you can give your business a solid legal foundation to grow on.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.