Advantages and Disadvantages of S Corporations

Is an S corporation better than a limited liability company (LLC) or traditional corporation? What are the advantages of each structure, and which is best for your small business?

I recently sat down with attorney Dan Desmond, partner with Barley Snyder LLP in Lancaster, Pennsylvania, for an expert take on the pros and cons of S-corp status for small businesses. Desmond specializes in corporate, finance, and municipal law, and has set up S corporations for many of the firm's clients.

Overview: What is an S corporation?

S corporations are often thought of as business structures, like corporations or LLCs, but they're not. "An S corp is a tax election that your business files," Desmond explained.

"If you're a business entity, usually either a corporation or an LLC, you can file a Subchapter S tax election, which means that you will be taxed as an S corp. That doesn't change the type of legal entity that you are. You're still an LLC or a business corporation as far as your state of formation is concerned. It just refers to how you're taxed."

A sole proprietorship or qualified joint venture would have to form a legal business entity such as a corporation or LLC in order to elect S-corporation status. This significantly increases the document management requirements for your company.

S corp vs. C corp vs. LLC: What are the differences?

Once an LLC or a traditional C corp elects to be taxed as an S corp, how do the three compare?

"All three types of businesses provide the same limited liability protection," Desmond said. "The main difference is that S corporations don't have to pay self-employment taxes on ownership distributions, which can mean significant tax savings."

The tax differences break down as follows:

Corporations: Profits from traditional corporations who do not elect S-corp status are, by default, taxed as a C corporation. This means that they are taxed twice, once at the corporate level and again as the owners pay personal income tax on distributions.

LLCs: LLCs are taxed as pass-through entities, which means profits pass through to the owners' personal income. This eliminates the double taxation of corporations, but it means the owners must pay self-employment taxes on all distributions.

S corps: S corps enjoy the benefit of pass-through taxation like LLCs, saving the corporate double-tax hit. Then they offer a further tax benefit by allowing owners to take a reasonable salary and draw additional profits as distributions, which are not subject to self-employment taxes.

According to Desmond, those tax breaks can add up fast. "Imagine you're a business and your income for the year is $100,000. If you did not elect S-corp status, you would pay self-employment taxes on all of that $100,000. If you were an S corp, you would pay yourself a salary, let's say it's $50,000.

The remaining $50,000, you take as an ownership distribution, which isn't subject to self-employment tax. That is the primary driver of electing S-corp status."

In fact, you might want to look into an S corp sooner rather than later. "I took on a client once who had been operating his company for 30 years," Desmond said.

"I filed an S-corp election for him. Once he saw what he was saving, the accountant told me he started crying. He was happy about what he was going to save, but also sad about all the extra money he'd been paying the IRS over the years. So it's definitely something worth looking into for small businesses."

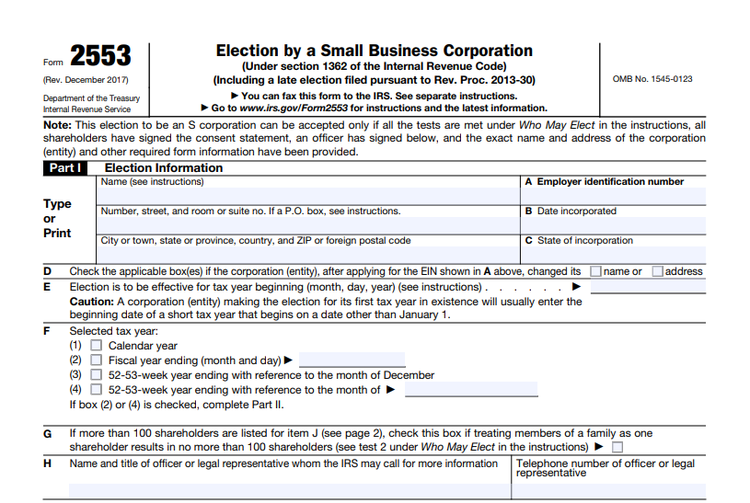

LLCs and C corps elect S-corp status by filing IRS Form 2553. Image source: Author

Yet those savings come with a lot of strings attached, strings that can trip up a business owner who jumps into S-corp status without understanding the requirements. Let's take a look at the benefits and limitations of S corps for small businesses.

What are the eligibility requirements for forming an S corporation?

Internal Revenue Service (IRS) rules set forth strict S-corp requirements. To qualify, a business must:

- Be a domestic corporation

- Be owned exclusively by U.S. citizens or certain trusts and estates

- Have no more than 100 shareholders

- Have only one class of stock

In addition, certain types of corporations such as financial institutions and insurance companies are ineligible.

What do the rules mean for businesses electing S-corp status? "One implication of this that trips people up is that, in an S corp, your profit distributions have to be proportional to your ownership interests," Desmond said.

"For example, if you have an S corp with someone else, and you each own 50% of the entity, you have to distribute profits 50/50. You can pay one owner more in the salary component, but you can't pay someone more as a profit distribution than their ownership percentage."

Another potential pitfall is the single class of stock, Desmond said.

"Some corporations issue a preferred class of stock that gets paid certain dividends before the second class, or sometimes they'll have different rights. With an S corp, you can't do that. The only exception is that you can make one class voting and one nonvoting. But you can't have a preferred class that's getting paid on a different schedule."

A further catch Desmond noted is that owners must pay themselves a reasonable salary. "You can't just pay yourself a nominal salary and then take the rest in ownership distributions. Your salary has to be on par with what the average practitioner in your field would make.

You can't get too aggressive with that, or you'll raise a red flag with the IRS." Desmond always recommends to his clients that they discuss with their accountants what constitutes a “reasonable salary.”

This requirement can pose challenges for startups. "You should have an idea of what you're going to make in order to determine a reasonable salary level," Desmond said.

"If you're just starting out, and you don't know if you're going to make $100,000 or $10,000 or $500,000, it's going to be difficult to discuss with your accountant what a reasonable salary would be. I generally advise entrepreneurs that they might want to wait a year to see what the income stream is going to be like, unless they have a really solid idea of what they're going to be making that year."

So there are limits on an S corp's flexibility. "I wouldn't call them drawbacks," Desmond said, "but they are rules that businesses need to strictly follow."

M-Files can help you manage the added paperwork that comes with S-corp status. Image source: Author

One other important consideration is the added complexity and documentation an S corp brings. An electronic document management software solution can help you streamline and automate much of the paperwork.

3 benefits of forming an S corporation

So what are the benefits of S-corp status?

1. Major potential tax savings

S-corp self-employment tax savings can be substantial -- even tear-worthy -- depending on your business's finances.

2. Same legal entity

Because S corporation is a tax status, it doesn't affect the legal operation of your business entity. As far as your home state is concerned, you're the same LLC or corporation you were before. This provides continuity and simplicity in maintaining your business entity.

3. Salary options

While you do give up some flexibility in distributing profits, you can reclaim some of that through the ability to pay reasonable salaries to shareholders.

3 disadvantages of forming an S corporation

S corps aren't for every business. Here are some limitations.

1. Complexity

Electing S-corp status is more complex than filing an IRS form. "An S corp changes the way you're taxed," Desmond said. "It changes the tax forms you need to file and the way you're paid. These are issues you should discuss with your accountant."

2. Expense

Because S-corp tax returns are more complex, you can expect to spend more time and money on tax preparation and advice as well as other business documentation.

3. Lack of flexibility

Electing S-corp status limits your options in ownership and distribution of profits among shareholders, as outlined above.

Is forming an S corporation right for you?

Desmond has filed S-corp elections for many single-owner LLCs and corporations, so it is an option for very small corporations. But is S corp the best choice for every small business? Here's the bottom line.

When an S corporation makes sense

An S corp makes the most sense for businesses with:

- Eligible stockholders: The IRS rules are inflexible; step one is making sure your company meets all the requirements.

- Predictable income: You need to be able to come up with a justifiable basis for paying yourself a salary, preferably based on at least a year of past performance.

- Straightforward ownership: Since you need to distribute profits evenly among shareholders, businesses with relatively simple ownership arrangements are best suited for S-corp status.

When you should seek other options

S-corp status may not work for:

- Startups: If your business is just starting out, you don't have a track record to rely on for projecting salaries and distributions, making the potential savings on S corporation taxes uncertain.

- Shoestring budgets: If you're doing most of your bookkeeping, tax filing, and regulatory work for yourself to keep expenses to a minimum, S-corp status may not be a good choice.

- Large, complex companies: Because of the shareholder limitations, S corps aren't a fit for many larger businesses with complex ownership.

- Foreign companies: If your company has owners or affiliates outside the U.S., you may not qualify for S-corporation status.

Worth a look

We all shed enough tears over our tax bills every year, so there's no need to pay more than your fair share. If you're wondering what an S corp would mean for your business, talk to an expert.

"For the right business, electing S-corp status can be a powerful tool to experience tax savings," Desmond said.

"Many businesses are prime candidates for these savings, but just do not realize it or are wary of paying attorney or accountant fees. However, consulting with experienced tax and legal advisors can be well worth the up-front cost when they realize how much they might be able to save."

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles