E-commerce makes many aspects of starting a business simpler, but sales tax isn't one of them. Your online store is basically open for business in 50 states, each with a unique set of sales tax laws.

So, how can you be sure you're playing by the rules? This article explains what every e-commerce entrepreneur needs to know to manage sales taxes with confidence.

Overview: What is sales tax?

Sales tax is a tax levied on the sale of certain goods and services. Sales taxes are charged by 45 states and many local governments, and they’re generally collected and remitted by the seller.

When sales taxes aren't collected by the seller, which has often been the case with interstate sales, state and local governments generally require their residents to pay use taxes on the purchases. Use taxes are simply sales taxes remitted directly by the consumer instead of the retailer.

For example, say you live in Philadelphia, where sales are subject to a 6% state tax plus a 2% county tax. You go online and buy $10,000 of furniture from an online store in Oregon. At checkout, you realize that Oregon has no sales tax. You might be excited, thinking you just saved yourself 8%.

But you know what they say about death and taxes. The state of Pennsylvania and Delaware County are going to expect you to pay that 8% back in use taxes.

Businesses are expected to pay use taxes on their untaxed purchases when filing sales and use tax returns. Consumers are also expected to report untaxed sales and pay use taxes on them through their annual state tax returns.

Do e-commerce businesses need to charge sales tax?

Businesses have to collect sales taxes in states where they have economic nexus. Tax nexus refers to the level of connection between a business and a state that triggers tax obligations.

In the past, retailers with a physical presence in a state, such as offices or warehouses, had sales tax nexus. Under that definition, online sellers could simply collect sales taxes in the states where they had facilities and ignore the rest.

That changed with the 2018 Supreme Court decision in South Dakota v. Wayfair, which allowed states to define sales tax nexus more broadly to include e-commerce businesses with no physical presence within their borders.

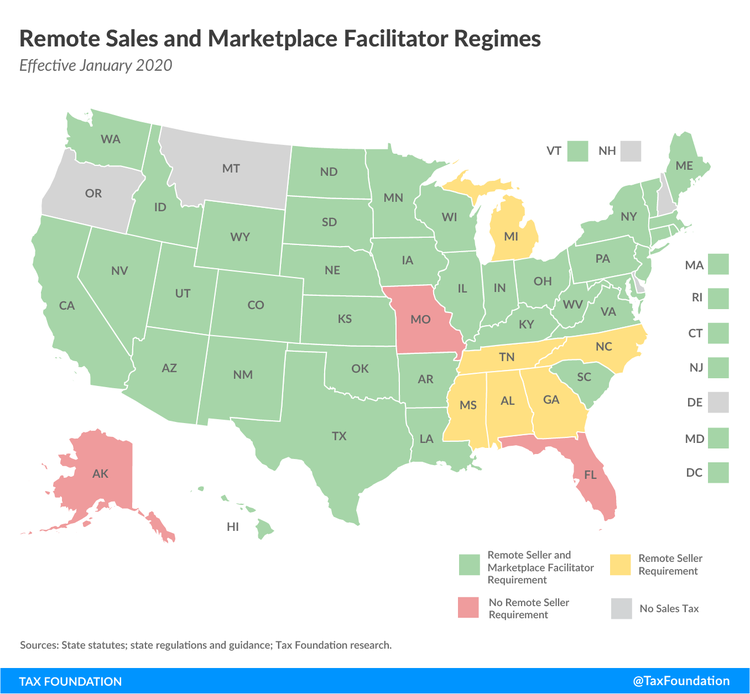

This map from the Tax Foundation illustrates state sales tax laws for remote sellers. As of this writing, Alaska is rolling out a remote seller requirement for local sales tax. Image source: Author

In the wake of that decision, many states have enacted remote seller laws requiring online retailers to collect and remit sales tax. Some have also passed laws requiring marketplace facilitators such as Amazon and Etsy to collect taxes at the point of sale.

These developing laws complicate the tax picture for your small business immensely.

How to comply with e-commerce sales tax laws for your business

The following steps will help you stay on top of developing requirements and manage sales taxes for your online store accurately.

Step 1: Determine where you have sales tax nexus

The first job for online sellers is to understand U.S. sales tax laws and how they apply to your business.

As I mentioned above, 45 states impose sales taxes. The states without sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon. Among states with sales tax, all but two, Florida and Missouri, currently require remote sellers to collect and remit sales tax.

Alaska is a nuanced case. While the state has no sales tax, many local jurisdictions in Alaska impose sales taxes, and the state recently passed a uniform code requiring remote sellers to begin collecting them in 2020.

Since states are still adapting to the changes caused by the Wayfair decision, you'll have to examine current requirements for remote sellers in each state where you have sales to ensure compliance.

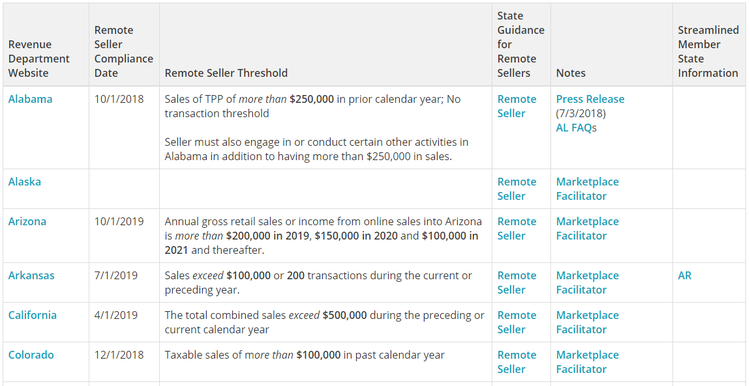

SSTGB provides resources to help you sort through state requirements for remote sellers. Image source: Author

To understand your sales tax nexus nationwide, consider the following:

- Check thresholds. Most states have substantial sales thresholds for sales tax nexus. The most common is $100,000 in sales or 200 transactions, so you may find that you’re exempt from requirements in many states. Exceptions include Oklahoma, with a threshold of $10,000, and Kansas, which requires sales tax collection from the first sale.

- Look at your sales footprint. Track your sales carefully to get a clear picture of where you're selling and what your volume is state by state.

- Research state requirements. Research state laws on sales tax nexus and collection by remote sellers. The Streamlined Sales Tax Governing Board (SSTGB), National Conference of State Legislatures, and the Tax Foundation have helpful charts and maps to help you sort through the requirements.

- Include local sales taxes: Wherever you have sales tax nexus, you are responsible for collecting local as well as state sales taxes.

Step 2: Check affiliate policies

If you sell through a marketplace facilitator such as Amazon or Etsy, they may handle the bulk of sales tax collection and remittance for you. When working with any third party, consider the following tips:

- Know the law: Even if you're working with an established third-party marketplace, it pays to be familiar with marketplace facilitator laws in states where you sell.

- Ask questions: Ask facilitators to clarify their policies and compliance efforts. Don't assume they’re handling everything for you.

- Verify accuracy: Audit your transactions periodically to confirm that your sales are being taxed accurately.

Step 3: Obtain seller's permits

Once you've determined where you need to collect sales tax, you’ll need to register your business with the revenue department to begin collecting taxes. You may need to obtain a seller's permit or sales tax permit in some states.

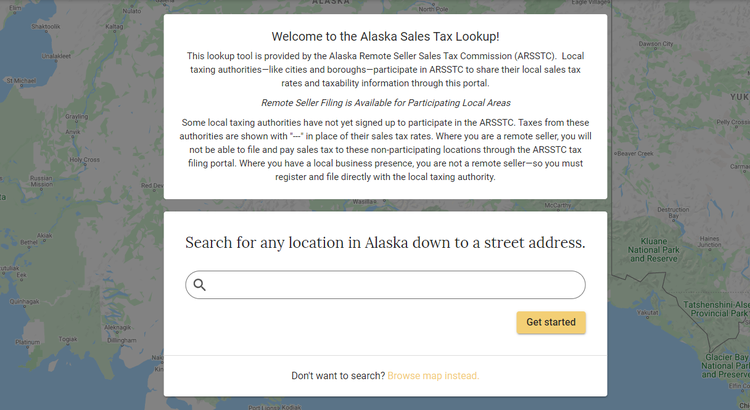

Alaska’s sales tax lookup tool. Image source: Author

Registration is usually managed by the department of revenue and can often be completed online.

- Check state websites: Even if you're exempt from collecting taxes, you may be required to register or complete other paperwork. Check the state department of revenue website in each state where you're selling to ensure compliance.

- Use state tools: Many states are providing software to help businesses navigate state and local sales taxes successfully. Alaska, for example, has developed an online sales tax lookup tool for remote sellers to facilitate compliance.

- Check out streamlined registration: If you need to collect taxes in many states, SSTGB provides a streamlined application covering more than 20 participating states.

Step 4: Collect and remit sales taxes

Each state has its own process for remitting sales taxes. Taxes are commonly submitted monthly, although some states may allow quarterly filing. In states where you collect sales tax, consider the following:

- Use software: Look for an e-commerce CMS and small business tax software built to simplify sales tax collection, reporting, and remittance. Features for looking up applicable rates and calculating sales tax automatically are essential.

- Train employees: Make sure your employees understand how to handle sales tax for remote sales. Many states provide resources to help such as this sales tax training page from Colorado, which includes videos and webinars.

Step 5: Monitor compliance

Since remote seller laws are still developing, it's important to conduct periodic audits to ensure compliance. The following tips will help you stay on top of changing requirements:

- Connect with states: Most revenue departments have email newsletters to keep you apprised of changes in the law, so sign up for their lists. You may also be able to stay on top of the news by connecting with state authorities on social media.

- Monitor sales: If you're close to a sales tax threshold in a certain state, be sure to monitor your sales or set up an automated notification to ensure that you register promptly if your sales exceed that level.

- Consult with advisors: Include sales tax compliance in discussions with your small business tax advisor.

Grow your e-commerce business with confidence

E-commerce is growing fast, and states have adapted quickly in the wake of the Wayfair decision to capture their share of revenue from online sales. You can expect the laws to continue to change and compliance efforts to become more stringent as e-commerce sales continue to climb.

By familiarizing yourself with the laws and adopting tools and processes for complying, you can stay ahead of the curve and grow your online sales with confidence.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.