The 5 Top Expensify Alternatives

If you’ve read our Expensify review, you know Expensify is a solid expense management application that offers scalability and a variety of plans, making it suitable for the freelancer and growing business alike.

But if Expensify doesn’t provide exactly what you’re looking for, you’ll find awesome alternatives on the market today. One or more will have what you’re looking for in an expense management application.

We’ve identified these top alternatives to Expensify as an expense management software:

- Certify

- Abacus

- ExpensePoint

- Zoho Expense

- Rydoo

What to look for in a great Expensify alternative

The best way to determine a superior Expensify alternative for your business is to identify the features important to you. Are you looking to automate the entire expense reporting process? Do you want to eliminate expense reports altogether? Are you looking for a better way to manage receipts? Decide which features are the most important and start your search there.

While checking out Expensify alternatives, keep an eye out for these important features.

1. Expense reporting (or not)

Are you looking for an application that can automatically create an expense report? Or are you looking beyond expense reporting? Because you do have a choice. While the majority of applications include easy expense report creation, some applications on the market do away with the expense report altogether.

It’s up to you to decide which approach is better suited for your business and then look for an application that offers what you’re looking for.

2. Optical character recognition (OCR)

To make your life easier, look for OCR technology in any expense management application you purchase. Why? Because OCR technology reads your receipts, takes that information, and plugs it into a complete transaction that can be submitted on an expense report. Ditch the data entry, and let OCR technology do the work for you.

3. A robust mobile app

While all expense management applications offer a mobile app, they’re not all created equal. Do you want a mobile app to snap a photo of a receipt, or do you want it to do everything the software does as well? There are major differences, so look for the app and software that can do what you’re looking for.

Our top 5 picks for Expensify alternatives

If Expensify leaves you uninspired, check out our top 5 Expensify competitors to find the application that’s right for you.

1. Certify

Top rated for a reason, Certify offers all the features small businesses could ask for in an expense management application. Easy to implement, easy to use, and affordably priced, Certify can easily find a home with a freelancer, small business owner, or growing business. And if you travel, consider Certify Travel to manage everything from airfare to hotel bookings.

Some of Certify’s standout features include:

- ReceiptParse™ OCR: ReceiptParse OCR takes OCR technology one step further by scanning and extracting data from scanned images for up to 15 fields.

- Automatic expense report creation: No longer do your employees need to manually create an expense report. Once a business expense is uploaded, an expense report is automatically generated, with additional expenses added to the report until it’s ready to be submitted for approval.

- Mobile app: Certify’s mobile app lets you capture receipt images in seconds, but it also allows you to create expense reports, add additional expenses, and access other Certify tools from the app.

- Analytics: Capturing expenses is only part of what expense management applications should do. With Certify’s Analytics feature, you can generate reports that show who’s spending the most and the most common policy violations.

Certify also supports multiple languages and multiple currencies and tracks mileage, all while guaranteeing 99% uptime.

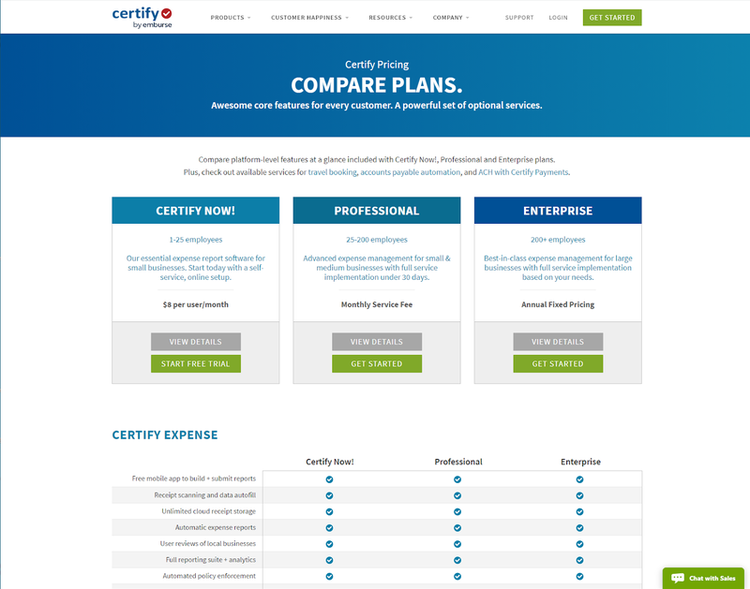

Certify offers three expense management plans:

- Certify Now!

- Professional

- Enterprise

Certify Now! is designed for small businesses with 1-25 employees, with pricing a very reasonable $8/month, per user. The Professional plan serves businesses with 25-200 employees, while the Enterprise plan serves businesses with more than 200 employees.

Certify offers three expense plans suitable for the one-person office to 200 + employees. Image source: Author

Professional plan pricing is based on a monthly service fee while the Enterprise plan is an annual fixed price. If you’re interested in either plan, you can request a custom quote directly from Certify.

Both you and your employees can benefit from Certify’s automatic expense report creation process, and I would guess no one will miss matching receipts to expenses, a task that Certify does with ease.

Read The Ascent’s full Certify review

2. Abacus

If you need to manage expenses for multiple employees, Abacus may be the way to go. Abacus expedites the entire expense management process, eliminating expense reports for an immediate expense submission process, where employees can immediately submit an expense, which is then approved and reimbursement processed immediately. Other notable features in Abacus include:

- Automatic reimbursement: A great feature if you’re constantly approving and processing employee expense reimbursements, once an expense has been approved, it’s automatically submitted for reimbursement via ACH transfer, which expedites the entire process and will make your employees very happy.

- Easy expense policy: An expense management application is only as good as its policy rules. Abacus makes it easy to create policies by using only two types of rules: warning rules and blocking rules. One serves as a reminder, while the other blocks submission.

- GPS tracking: Abacus includes a mileage calculator that makes it easy for employees to accurately track mileage, allowing you to better manage their reimbursement.

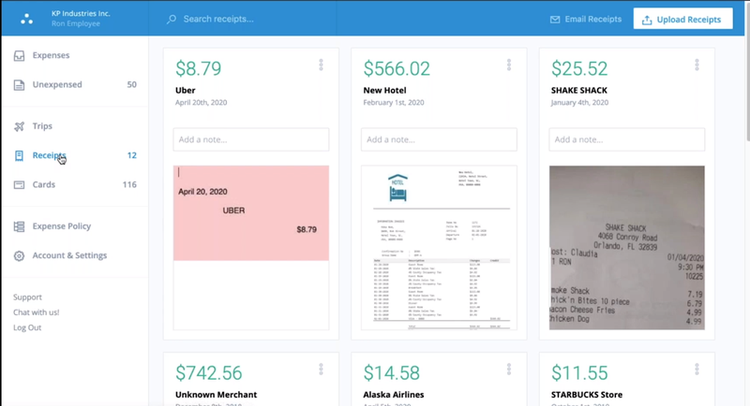

- Receipts folder: Receipts can be submitted at any time and stored in the handy receipts folder until your employees are ready to submit them.

The receipts folder displays all receipts stored in the folder. Image source: Author

Abacus offers a mobile app, but the app’s features are limited to snapping and submitting receipt images.

Abacus’s pricing starts at $9/month, per user, for the Starter plan, which has a two-user minimum. The Professional plan was priced at $12/month, per user, but has now gone to custom pricing. In addition to the features found in the Starter plan, the Professional plan includes accrual accounting sync, credit card integration, and a complete implementation package.

But because the Professional plan is billed annually, you’ll need to pay upfront based on the estimated number of plan users you expect for the year. Abacus also offers an Enterprise plan designed for larger organizations that offers integration with Salesforce and complete API access.

With Abacus, you can eliminate the entire expense report process while better managing your business expenses and expense categories.

Read The Ascent’s full Abacus review

3. ExpensePoint

A good choice for any size business looking for an expense management application, ExpensePoint is an even better choice for smaller businesses with limited budgets. Small business owners, with limited staff, will also appreciate the free product setup option offered by ExpensePoint, with some free training thrown in as well.

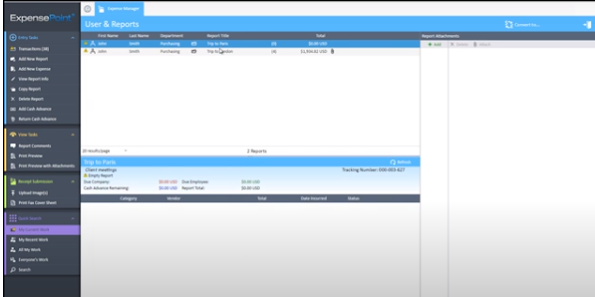

While Abacus eliminates the expense report process, ExpensePoint has focused on expense report creation, giving you the ability to create multiple reports, add additional lines to any report, and even comment on line item submissions. Other features in ExpensePoint include:

- Receipt Wallet: Receipt Wallet serves as a repository for all of your uploaded and emailed receipts. You can add a handy description to any receipt that will later help you identify it when creating your expense report.

- Receipt Reader: One of ExpensePoint’s newer features, the Receipt Reader offers OCR technology, reading information on uploaded receipts including date, vendor, tax, and total amount, and populating your automatically generated expense report with details.

- ACH Reimbursement: ExpensePoint includes a built-in ACH reimbursement feature that will automatically process reimbursements on any approved expenses.

- Automatic expense reports: The two previous features, Receipt Wallet and Receipt Reader, work in tandem to create automatic expense reports populated with information obtained from receipts. Employees can create as many expense reports as desired, and you can even create an expense report for an employee if necessary.

The User and Reports screen provides access to all expense reports as well as any related expenses. Image source: Author

Good workflow capability makes it easy to route reports to the correct approvers and offers auto-sync technology, making it easy to enter data, even when offline.

ExpensePoint’s pricing is simple and straightforward, with no plans to choose from, no additional modules to subscribe to, and no hidden costs. With pricing coming in at $7.50/month, per user, ExpensePoint is an attractive option for smaller businesses operating on a tight budget.

One of the major benefits of using ExpensePoint is that ExpensePoint support personnel handle the initial product setup, so you can be up and running quickly. Another benefit is the simple pricing structure that eliminates the need to purchase more expensive plans to have access to product features.

Read The Ascent’s full ExpensePoint review

4. Zoho Expense

If you’re looking for an expense management application that contains every feature you want and is easy to use, look no further than Zoho Expense. Better suited for small to mid-size businesses, including freelancers and sole proprietors, Zoho Expense streamlines the entire expense management process. It provides the same features and functions on all devices. What makes Zoho Expense stand out?

- Outstanding receipt processing: You can upload receipts from your computer or mobile device, drag and drop receipts directly into the receipt inbox, and email or upload receipts from online storage applications. You can even use the Google Chrome extension to upload a receipt.

- Mobile app: Zoho Expense’s mobile app includes a dashboard that summarizes unreported expenses and unsubmitted and submitted reports. It also displays a spending overview and can track mileage, all while syncing with the online application.

- Free plan: Zoho Expense offers a free alternative to Expensify, with its Free plan suitable for up to three users. This is a great way to get started with Zoho Expense, allowing you to easily scale up to a paid plan as your business grows.

- Expense policy rules: Zoho Expense makes it easy to create custom expense rules for your business. You can set spending limits by day, month, or year, block expense submissions that violate policy rules, and even set rules by department, group, or individual employee.

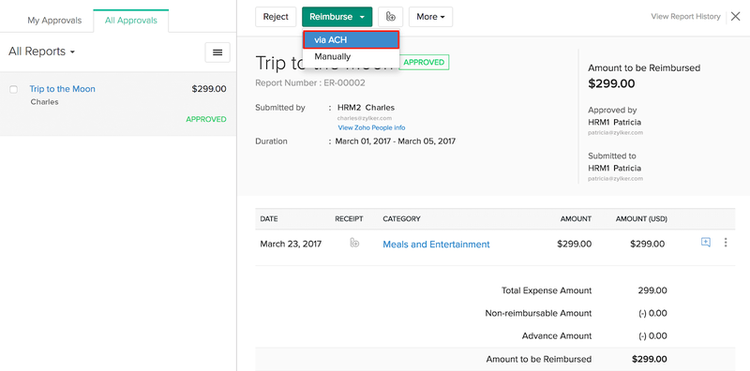

Zoho Expense also includes an online reimbursement option that allows you to process reimbursements via ACH immediately.

Zoho Expense makes it easy to reimburse expenses manually or via ACH transfer. Image source: Author

Zoho Expense is affordably priced, and with a free plan, it makes it easy for freelancers and sole proprietors to use Zoho Expense, with the option to move to a more robust plan if necessary.

- Free: Zoho’s Free plan supports up to three users.

- Premium: The Premium plan runs $5/month, per user, billed annually or $8/month, per user, billed monthly.

- Enterprise: The Enterprise plan is $8/month, per user, billed annually or $12/month, per user, billed monthly.

One of Zoho Expense’s biggest benefits is affordability, with even the top plan affordable for small businesses. Another benefit is its ease of use, with little time needed for setup or training.

Read The Ascent’s full Zoho Expense review

5. Rydoo

Rydoo, previously known as Xpenditure, results from a merger with two other expense management applications, iAlbatros and Sodexo. With features similar to those in competing applications, Rydoo stands out for a couple of reasons: the elimination of the expense report process, and its unique ability to serve as a global expense management solution.

While good for small to mid-size businesses, Rydoo has a 5-user minimum for all its plans, so freelancers and sole proprietors would be better served with another application. Rydoo also includes other features that small business owners may appreciate.

- Excellent integration: Rydoo stands out among its competitors by offering seamless integration with many third-party applications, including QuickBooks Online, Xero, Exact Online, Slack, Dropbox, Uber, and Lyft, along with ERP systems such as NetSuite, Microsoft Dynamics, Oracle, SAP, and VAT Cloud.

- Real-time expense reporting: You can ditch the expense report in Rydoo and simply submit expenses as they occur.

- Receipt management: Rydoo lets you scan a copy of your receipts, upload a receipt directly into the application, drag and drop a receipt into the expense folder, or email a copy of a receipt. You can also add expenses manually in Rydoo if needed.

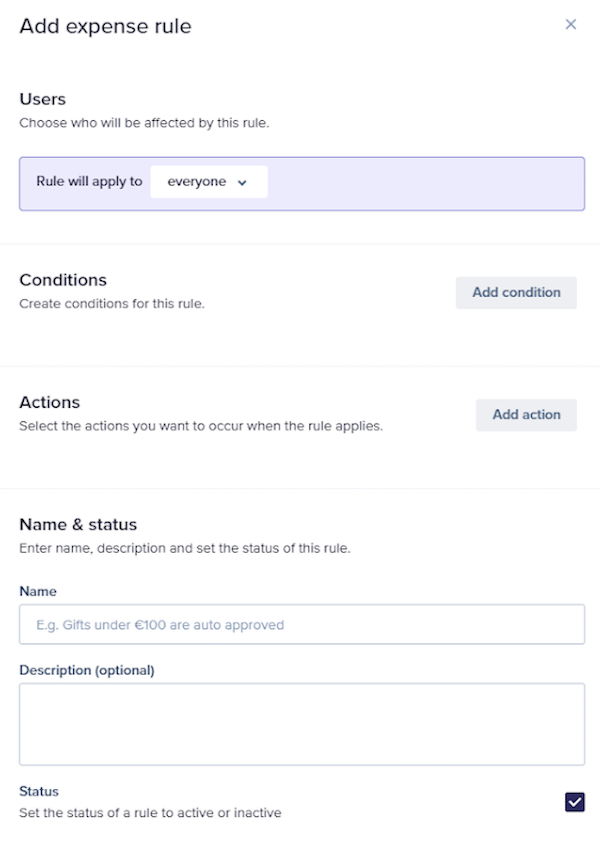

- 4-step expense rule creation: Rydoo recently rewrote their entire expense rules, making it easier to add more advanced rules while also better defining each rule created.

Rydoo allows you to add as many rules as you like, including how they’re enforced. Image source: Author

Rydoo also includes multicurrency and multi-language capability, making it a great fit if you do business globally.

Rydoo offers three competitively priced plans, with the Starter plan designed for up to 50 active users, running $7/month, per user, when billed annually. The biggest drawback to the starter plan is that a minimum of five active users is required, putting this product out of reach for very small businesses, freelancers, and sole proprietors.

Next up is the Growth plan, recommended for companies with more than 50 active users. It comes in at $9/month, per user, billed annually, or $11/month, per user, when billed monthly. Rydoo also offers an Enterprise plan for very large businesses with more than 500 active users, with pricing available upon request.

One of the biggest benefits of using Rydoo is its ability to adapt to geographic locations, making it tremendously valuable for businesses that deal with multiple currencies regularly.

Read The Ascent’s full Rydoo review

Which application is best for your small business?

Only you can decide which of these expense management and reporting applications would work best for your business. The number of employees who will be using the application, and what you want it to do (produce expense reports, eliminate expense reports, etc.) will play a big role in your decision.

Every application offers a free demo for you to test drive before deciding, so take a few minutes, check out our complete reviews, and set up your trial accounts today.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles