If you want to attract top employees and keep them happy, you need an enticing benefits package. You also need to manage benefit costs to ensure they're driving the results you're looking for in your hiring and talent management efforts.

Since some job benefits are required by law, making sure your benefits meet applicable requirements and are properly managed is another key human resource (HR) task for small businesses.

This article highlights benefits required nationwide and provides costs for benchmarking your performance. Generally, requirements apply to full-time employees and not part-time workers or those in other types of employment arrangements.

Mandatory benefits small businesses must offer employees

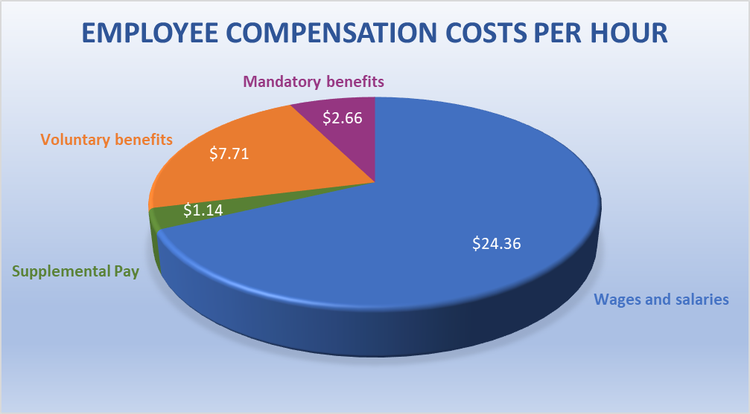

The U.S. Bureau of Labor Statistics (BLS) reports that on average, employee compensation and benefits cost employers $34.73 per hour worked, with wages of $24.36 and benefit costs of $10.37.

Legally required benefits make up just $2.66 per hour, or 7.7% of those costs. Supplemental pay such as bonuses and overtime cost an additional $1.14 per hour.

The following employee benefits are required for all employers, no matter their size.

1. Social Security and Medicare

For every employee, businesses must withhold Federal Insurance Contributions Act (FICA) taxes of 1.45% for Medicare and 6.2% on the first $137,700 of earnings for Social Security. Employers must also contribute an equal share into the funds.

On average, these taxes cost employers $2.05 per hour worked, or 5.9% of compensation.

2. Unemployment insurance (UI)

Employers must also pay Federal Unemployment Tax Act (FUTA) taxes and state unemployment taxes. In Alaska, New Jersey, and Pennsylvania, employers must also withhold employee taxes for UI. All told, UI taxes cost employers $0.17 per employee hour.

3. Workers' compensation

While generally not required by federal law, every state has a workers' compensation fund to provide care for workers injured on the job. The funds are administered by state labor departments. On average, workers' compensation costs businesses $0.45 per hour, or 1.3% of compensation.

4. Overtime pay

Under the FLSA, you must provide employees who earn less than $684 per week or $35,568 per year with overtime pay for hours worked beyond 40 in a work week. The minimum rate for overtime is one-and-a-half times the employee's usual hourly wage.

The FLSA does not require you to pay a premium for night or weekend work.

5. Jury duty leave

All employers must provide unpaid leave for employees called to jury duty. In some states, jury duty leave must be paid.

6. Coronavirus leave

At this writing, the Families First Coronavirus Response Act (FFCRA) requires certain employers to provide up to 80 hours of sick leave for employees who are stricken by COVID-19, under quarantine, caring for someone under quarantine, or caring for a child during a COVID-19-related school closure.

The law further provides up to 10 weeks of paid family and medical leave for childcare needs related to COVID-19.

Small businesses may request an exemption from provisions of the FFCRA if meeting them would pose a substantial threat to their operations.

Compensation costs total $34.73 per hour, according to the most recent BLS data. Image source: Author

Voluntary benefits small businesses can extend to employees

As you can see, federally required employee benefits are pretty basic, yet they still add up to almost 8% of wages. Adding voluntary benefits to those offerings makes your company a more attractive prospect for job seekers.

1. Paid leave

While not required at the federal level, paid holiday, vacation, personal, and sick leave are among the most valued employee perks. And giving employees a chance to recharge is good for business, too.

According to the most recent benefit survey from the BLS, the share of small businesses employees with access to paid leave breaks down as follows:

- Holiday: 70%

- Vacation: 69%

- Sick leave: 64%

- Jury duty: 42%

- Funeral leave: 39%

- Personal: 33%

- Family leave: 14%

Participating small businesses offer an average of 7 paid holidays and 10 vacation days, with additional vacation tied to tenure.

While there is no federal requirement for paid leave, many states and cities have enacted requirements of their own. For example, 11 states and at least 18 cities have paid sick leave laws, and 8 states have paid family and medical leave laws.

When managing leave, be sure to consult state and local laws in addition to federal requirements.

On average, paid leave adds up to $2.53 per hour worked, or 7.3% of compensation.

2. Unpaid leave

Interestingly, 80% of small business employees have access to unpaid family leave, even though it’s not required under the Family Medical Leave Act until a business reaches 50 employees. Allowing employees time off to care for a new baby or a sick family member is a high-impact, low-cost benefit.

3. Health insurance

Small businesses are not required to provide medical benefits or prescription drug coverage to employees, yet roughly half of small business employees receive them. Dental care is available to 29% of small business workers, and vision care is offered to 18%.

If you do offer healthcare insurance, the Affordable Care Act (ACA) requires that you offer it to all employees when they become eligible. You must also meet ACA employee notification requirements.

Costs of healthcare benefits average $2.61 per hour worked.

4. Life and disability insurance

Only 37% of employees at smaller companies receive life insurance benefits. Short- and long-term disability benefits are rarer yet, with access rates of 30% and 23%, respectively.

That might be a missed opportunity, as the hourly costs for these employee benefits are just $0.04 for life insurance, $0.07 for short-term disability, and $0.04 for long-term disability.

5. Retirement

Roughly half of small business employees receive retirement benefits, with the vast majority being defined contribution plans such as 401(k)s. These benefits cost roughly $1.22 per hour worked, or 3.5% of compensation.

This e-book from the National Federation of Independent Business (NFIB) is a great resource for constructing a benefit plan. Image source: Author

6. Fringe benefits

Fringe benefits are benefits you can offer on a low- or no-cost basis because employees bear the bulk of the costs. Examples include daycare, tuition assistance, employee discounts, and gym memberships.

7. Free benefits

Many employee benefits prized by workers are cost-neutral for you. Inviting work spaces, casual dress, remote work options, flexible schedules, and even pet-friendly policies can enrich your culture and help your small business stand out in the marketplace.

Your business needs will dictate the kinds of employee benefits that make sense for you, but getting creative with benefits can pay off in recruitment and employee engagement.

Legal considerations and responsibilities of small business benefit administration

Benefit administration involves a lot of moving parts, many of which are tied to federal and state laws. Following are some guidelines to keep in mind when managing benefits.

1. Timely, accurate payroll

Accurately managing taxes and payroll deductions is a critical HR function. Paying employees on time is also required by federal law.

HR software is a good way to ensure accuracy and promote compliance while substantially reducing the work of benefit administration.

2. Federal and state compliance

As mentioned above, many states and cities have enacted benefit laws that significantly expand requirements for your business. To ensure you're meeting all requirements, you need to check benefit laws at the federal, state, and local levels.

Your state labor department and local small business district office are good resources.

3. Benefit milestones

As your business grows, it becomes subject to new labor laws and benefit requirements. For example, provisions of the FMLA and ACA are triggered when you reach 50 employees. Make sure to review your benefit offerings periodically to ensure continuous compliance as your business grows.

4. Privacy

Maintaining your employees' privacy regarding benefits is an absolute must. This includes online data security, secure storage for paper files, and appropriate communication protocols to protect sensitive employee information.

Plenty to offer

You know your company has a lot to offer employees. Your benefit package is a big part of your offer and your culture, affecting everything from job performance to wellness and quality of life.

With careful consideration, you can put together a benefit package that hits all of the legal marks and, just as importantly, earns high marks from your employees.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.