A Guide to Voluntary Benefits for Your Small Business

Your benefits portfolio plays a major role in your ability to recruit and retain high-performing employees. Voluntary benefits provide a wider range of options for today's diverse, multigenerational workforce and enhance their physical and financial well-being.

Read on to learn how to revitalize your employer-paid benefits package with the most popular voluntary benefits.

Overview: What are voluntary benefits?

Voluntary benefits let employees choose and purchase their supplemental benefits through payroll deductions. Employees pay most or all of the costs, making them an affordable option for small businesses.

Employees benefit by taking advantage of employer-secured group rates and convenient payroll deduction payments. Voluntary benefits such as vision and dental insurance also encourage preventive medical care, promoting employee health.

What are the most common voluntary benefits?

The following are the most common employer-provided voluntary benefits:

1. Health insurance

While health insurance is a core offering of many benefit portfolios, it may also be provided as a voluntary benefit, with most or all costs borne by the employee.

The most recent employee benefits survey from the U.S. Bureau of Labor Statistics (BLS), shows 57% of employees in small firms (those with fewer than 100 employees) have access to group health insurance, and 56% have access to prescription drug plans.

Of those with access, 78% sign up. Many companies provide high-deductible plans that increase the employee's financial share of health care costs. Some companies offer supplemental medical plans to cover needs such as cancer treatment and hospitalization.

2. Retirement savings plans

The BLS reports half of small firm employees have access to retirement savings plans And when offered, roughly 70% of employees take advantage of them.

These defined contribution plans let employees save for retirement through payroll deductions, enhancing their long-term financial security. Employees and the business may also receive tax savings with these plans.

3. Dental insurance

Dental insurance is a highly coveted benefit. When offered, up to 78% of employees participate. Yet only 32% of employees at small firms have access to dental insurance.

Premiums are generally affordable, and a study by MetLife found employees ranked dental insurance as highly important for reducing financial stress.

Dental insurance contributes to employee wellness, as people without dental insurance are more likely to skip routine care, according to the U.S. Centers for Disease Control and Prevention (CDC).

5. Life insurance

Life insurance is available to 42% of employees at small firms with a take-up rate of 98%. In fact, MetLife found that after health insurance, employees cited life insurance as a top benefit for reducing financial stress.

Most employers who offer life insurance cover most or all of the cost, with additional coverage as a voluntary benefit.

4. Vision insurance

Only 19% of employees at small firms are offered vision insurance as part of their employer benefits packages, says the BLS. And yet employees want it, with a take-up rate of 81%. Like dental care, vision care saves employees money, promotes preventive care, and enhances well-being.

6. Accident and disability insurance

Only one-third of employees at small firms have access to short-term disability insurance, and one-quarter have access to long-term disability insurance.

Take-up rates of nearly 100% testify to their popularity. Disability insurance is affordable and safeguards financial security, making it a valuable voluntary benefit.

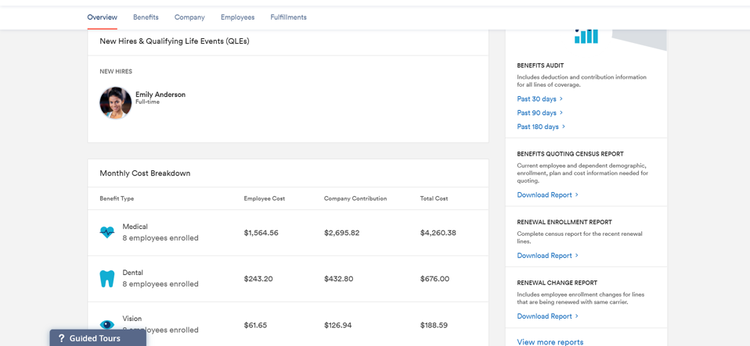

HR software such as Zenefits makes managing employee benefits easier. Image source: Author

How to implement voluntary benefits in your small businesses

Add voluntary benefits to your existing benefits package by incorporating them into your company's wider human resource (HR) strategy.

Step 1: Set strategic benefit goals

Your benefit package exists to build a high-performing, happy workforce so you can meet your company's goals. It's critical to tie your employee benefits closely to your company's strategic goals to ensure that they deliver measurable value.

- Set objectives: Set strategic goals for employee benefits that align with your company's HR goals. If a company-wide goal is to reduce employee turnover, set a benefit goal of improving employee retention.

- Establish metrics: Determine what HR metrics you will use to measure success. For example, if your goal is to improve employee satisfaction, measure results through employee survey data. If your goal is to improve retention, measure turnover rates.

- Put everything on the table: Compile a preliminary list of employee benefits that might contribute to your goals. Be inclusive at this early stage in your benefit planning.

Step 2: Assess needs and desires

A survey by Willis Towers Watson found employers who tailor their benefit plans to meet employees' needs are 1.6 times as likely to be satisfied with the results. It takes time to offer and administer new benefits, but you’ll find the return justifies the up-front investment.

First, find out what benefits are most important to your employees.

These steps will help you gauge need and interest levels for voluntary benefits:

- Assess employees' needs: Evaluate your employees' needs and desires for the benefits you identified in Step 1. Use a combination of employee surveys, focus groups, ad hoc committees, or group discussions to measure interest.

- Consider your workforce goals: It's important to consider your existing employees, but you should consider the needs of the workforce you want to attract too. Consider your hiring goals and research the benefits that are most popular with prospective recruits.

- Research benchmarks: Discover the most common benefits offered by businesses competing for the talent you're looking to hire.

- Rank desirability: Based on these activities, rank the benefits you listed in Step 1 according to employee interest, recruiting value, and competitive value.

Step 3: Analyze costs

You can provide many voluntary benefits at little or no cost to you. Employees will benefit from the group rates you secure. For example, an employee with a health condition might find life insurance out of reach financially, but you may be able to offer group coverage at a rate they can bear.

Consider the following to analyze costs:

- Research costs: Your providers are the best source of cost data. You can also use data from other sources to assess potential costs of each of the benefits you're considering.

- Consider tax savings: Some benefits provide tax savings that factor into your cost analysis, while others may be taxed as fringe benefits. Your tax advisor can help you weigh the tax impact of the items on your list.

- Analyze costs and benefits: Based on your research, do a cost benefit analysis of each voluntary benefit you're considering.

Step 4: Craft a package

You now have all the data you need to create a voluntary benefits plan to meet your goals cost effectively. When choosing your final offerings, consider the following:

- Focus on high-return benefits: Based on your findings, select the benefits that provide the best return and achieve your strategic goals.

- Consider flexible options: Giving employees a flexible voluntary benefits package to choose from will enhance their impact. On the other hand, it increases benefits administration complexity, which drives up costs.

- Set key performance indicators (KPIs): Set KPI targets for your new benefit portfolio.

Step 5: Administer benefits efficiently

Offering new benefits means additional legwork when onboarding and offboarding employees and managing open enrollment. The following steps will help you minimize the administrative burden on your HR operations.

- Use HR software: Automate as many aspects of employee benefits as you can through HR software.

- Enable self-enrollment: Software with employee portals puts employees in charge of their benefits and can further reduce the administrative burden of benefits administration.

Step 6: Measure results

As with all aspects of human resource management, benefit planning requires continual results measurement and adjustments.

- Gather data continually: HR software allows you to pull reports on benefit usage as well as other HR metrics for continual evaluation.

- Assess performance: At least every six months, you should evaluate your benefit package. Monitor its performance against your KPIs and strategic goals. Use surveys and other measures to test your assumptions about various benefits.

- Adjust strategy: Over time, your assessments will allow you to tailor a package tuned to meet the needs of your employees and potential recruits more closely.

FAQs

-

Voluntary benefits help small businesses with limited resources because they can be provided for little or no cost to the employer other than administrative overhead.

-

Voluntary benefits put financial products such as life insurance within reach for employees, thanks to their employer’s group purchasing power. Employees list voluntary benefits such as dental and vision insurance as major relievers of financial stress.

-

Most voluntary benefits providers will help with enrollment through employee meetings, training, and other resources. Because employees pay for voluntary benefits, providers are usually eager to help with communication and onboarding.

Get more out of your benefits package

You don't have to be Google or Facebook to offer an attractive voluntary benefits package. Since employees pay the bulk of the costs, voluntary benefits level the playing field between your business and larger firms with deeper pockets as you compete for top talent.

They also benefit your employees through greater financial security and well-being.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles