4 Inventory Costing Methods for Small Businesses

Running a profitable business depends on many factors, but one of them is the health of your supply chain.

A healthy supply chain depends on effective inventory management, and part of that process is implementing a solid inventory control and inventory costing plan. Inventory is critical to your success, and knowing how to assign costs to your items is essential to helping you make strategic business decisions.

In this article, we go through four inventory costing methods to help you decide which is best suited to your business.

The 4 inventory costing methods for effective stock valuation.

- The first in, first out method (FIFO)

- The last in, first out method (LIFO)

- The specific identification method

- The weighted average method

Overview: What is inventory costing?

Inventory costing, also known as inventory cost accounting and stock costing, is when businesses assign costs to the products they have in inventory. This process helps companies ensure that they hold the right amount of inventory.

The process also has important tax implications. Businesses calculate how much it costs to sell their products, and are able to deduct the cost from their taxes. Organizations must accurately assign costs to their stock to make sure they’re not paying too much or too little tax.

The 4 inventory costing methods your business can use

Alongside measurements such as inventory turnover ratio, your small business needs to employ the right method of determining the cost of inventory. Below, we explore four of the most common inventory costing methods that modern businesses employ to help you decide which is suitable for your business.

1. The first in, first out method (FIFO)

The concept of the FIFO method (also known as the first in, first out method) for inventory costing is simple: A business will sell its oldest inventory first, and not all inventory is created equal.

Businesses that sell perishable products or items that can become outdated (such as clothing) often use the FIFO inventory costing method. This method relies on the practice of selling older products before they perish or become obsolete.

However, this inventory costing method is popular among many other industries, too, because of its intuitiveness, accuracy, and simplicity. Generally, FIFO is calculated by multiplying the cost of your oldest inventory by the amount of that inventory sold.

The FIFO method is also popular because it’s likely to mean higher profit margins. Because of the inflation of material costs, businesses match the lower cost units of older inventory items with higher current-cost revenue.

If your business has international locations, the IRS stipulates that, for tax purposes, FIFO is the only inventory costing method that you are allowed to use.

Find out more about the FIFO method of inventory costing here

2. The last in, first out method (LIFO)

The mirror image of the FIFO method, the last in, first out method (LIFO), is based on the idea that a business will sell its newest inventory first.

The main advantage to using LIFO is that when it comes to accounting, using LIFO allows you to match your most recent costs against your revenue, increasing inventory valuation and lowering net income.

Most retailers would not choose to use LIFO in place of FIFO, because there’s rarely a good reason to use the most recent inventory over older, outdated inventory.

Plus, if your business operates internationally, this method is not permitted by the International Financial Reporting Standards (IFRS). You’ll also need to seek permission from the IRS to use the LIFO method.

Find out more about the LIFO method of inventory costing here

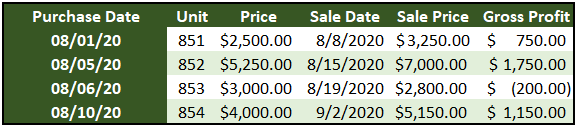

3. The specific identification method

The specific identification method involves tracking every single piece of inventory by assigning it a specific cost, and adjusting the balances when inventory is sold and purchased. This method is suited to small businesses since it can provide them with more accurate numbers.

For this reason, it’s also a good method for those with low-volume sales, and unfeasible for those with high-volume operations, as it’s impossible to track thousands of stock items individually.

With the specific identification method, each item is assigned a specific initial cost, plus any additional costs that are incurred until it is sold.

This method is a good option for businesses that sell heterogeneous items that can’t be grouped or counted together. However, you’ll need to make sure that you complete an ending inventory count to account for theft or spoilage.

The specific identification method assigns every item a specific cost. Image source: Author

Find out more about the specific identification method of inventory costing here

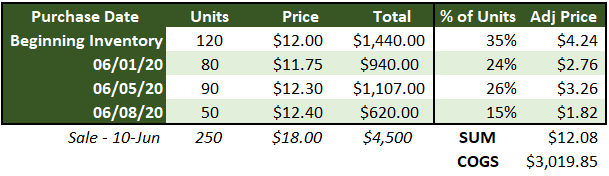

4. The weighted average cost method

The weighted average cost method uses a weighted cost that averages the price of all purchased inventory. Basically, this method calculates inventory value by dividing the cost of goods available for sale by the number of units available for sale; this yields the weighted-average cost per unit.

With this method, the inventory value of a particular unit is calculated at somewhere between the oldest and newest units of purchased stock.

This method is commonly used when inventory items are almost identical to each other, or when it’s impractical to assign specific costs to items. It’s also one of the easiest ways to track and cost inventory, given that only one formula or calculation is needed.

However, this method assumes that stock items are equal, so when inventory prices vary widely, businesses will have a hard time recovering the costs of the more expensive units. Plus, the stock valuations often bear little relationship to prices actually paid to suppliers.

Using the weighted average cost, each unit cost is the total cost for an item, divided by the total number of items or units available. Image source: Author

Find out more about the weighted average cost method of inventory costing here

Don’t underestimate the importance of inventory costing

Inventory valuations determine the cost of goods sold, gross profit, and net income of a business. Not only will choosing the right inventory costing method help you calculate the most accurate inventory cost to deduct from your taxable income, but it will give you the power to make more informed business decisions.

If you’re looking for a better way of valuing your stock than average inventory formulas, there are many options in inventory management software that can help you take control of inventory costing, with features like automatic calculations and inventory reporting.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles