Part of learning how to do payroll is choosing a cycle for running payroll. Common payroll cycles include:

- Weekly

- Biweekly

- Semimonthly

- Monthly

One of the most popular payroll cycles is biweekly pay, which means that you pay your employees every two weeks, with employees always paid on the same day. Though many businesses opt to pay their employees on Friday, as an employer, you can choose the day that your employees will get paid.

Overview: What is biweekly pay?

Biweekly pay, as explained above, means that you pay your employees once every two weeks on a specific day. In fact, according to the U.S. Bureau of Labor Statistics, biweekly pay is the most popular payroll cycle in the U.S., with almost 37% of businesses opting to pay their employees biweekly.

Biweekly is particularly good for businesses that have a lot of non-exempt employees that are paid hourly, as overtime calculations are much easier, and employees that are paid biweekly appreciate the consistency of being paid on the same day every pay period.

Between biweekly vs. semimonthly pay: What’s the difference?

There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Biweekly payroll offers consistent pay days every month, with the added bonus of two extra pay periods.

Semimonthly payroll is great for businesses that mostly have salaried employees, with pay dates usually the 15th and the last day of the month, although some businesses opt for the 1st and the 15th of each month.

While you’ll be processing less payroll, which is always nice, your employees may not appreciate the disparity in pay days from month to month, not to mention the effect that holidays and weekends can have on pay days.

How to choose between biweekly and semimonthly pay for your business?

Both biweekly and semimonthly payroll cycles have numerous advantages and disadvantages. When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried.

You’ll also want to decide if you want to have more or less payroll cycles, which can affect the amount you pay for payroll services, if your payroll service charges you based on the number of payroll cycles you process throughout the year.

Below are a few pros and cons for both biweekly and semimonthly payroll.

Biweekly pay pros

- Consistent pay days throughout the year

- Easier to calculate overtime

- Less time to process than weekly payroll

Biweekly pay cons

- Harder to calculate overtime for hourly employees

- Extra cost if charged per pay run

- Deductions can be harder to process

Semimonthly pay pros

- Easier to pay salaried employees

- Can save money if charged by pay run

- Easier to manage deductions

Semimonthly pay cons

- Inconsistent payroll days throughout the year

- More difficult to pay hourly employees

- Weekends and holidays can affect pay dates

Here are some specific things to take into consideration when making your decision as to which payroll cycle is best for your business.

Hourly vs. salaried employees

One of the biggest things to consider when making the decision whether to pay employees biweekly versus semimonthly is the number of hourly employees you currently need to pay.

It’s much easier to pay hourly employees biweekly, which runs on a 40 hour work week than it is to pay them semimonthly, particularly if your employees frequently work overtime.

If the majority of your employees are paid hourly, it might be best to opt for biweekly. If they’re salaried, semimonthly may be the way to go.

Benefits management

If you offer your employees benefits, you will also have to manage those benefits properly, including ensuring that deductions are processed properly each pay cycle.

While deductions are fairly straightforward with semimonthly payroll, remember that biweekly payroll has two months with three payroll dates instead of two, making the deduction process a little more complicated.

You have the choice to remove the deductions for the last payroll of the month during the three-payroll month, or calculate the deduction total based on 26 pay periods rather than 24. The choice is yours, but don’t forget to adjust it, otherwise you will be over-deducting from your employee paychecks, which will create additional work and a lot of unhappy employees.

Payroll cost

While many payroll software and services providers offer an unlimited number of payroll runs, there are some payroll service providers that charge for each payroll run. This can affect the final cost of the service depending on the payroll cycle that you choose.

How to calculate biweekly pay

If you’re not sure how to calculate biweekly payroll, check out our biweekly pay calculator, where we’ll provide you step-by-step instructions on how biweekly pay works.

For instance, Susan is an hourly worker who currently earns $25 per hour, and she regularly works 40 hours a week. For the last pay cycle, Susan worked a total of 81 hours. Here are the calculations you would need to make in order to properly calculate biweekly pay for Susan:

Step 1: You need to determine Susan’s gross pay. Here is the formula:

80 regular hours x $25 = $2,000

Step 2: Next, you will need to calculate overtime hours. This is done by taking the number of overtime hours and multiplying it by 1.5 in order to calculate the overtime total to be paid:

1 overtime hour x $25 x 1.5 = $37.50

Step 3: Next, add Susan’s regular pay to her overtime pay to get her gross pay:

$2,000 + $37.50 = $2,037.50

Step 4: Reduce the amount of gross pay by calculating taxes and any other deductions Susan may have. Let’s say that Susan’s deductions are $420 in taxes and another $50 for insurance. Calculating her net paycheck would be as follows:

$2,037 gross pay - $420 taxes - $50 insurance = $1,567 net pay

The best payroll software for your pay schedule

As a busy business owner, do you really have the time to manually calculate employee payroll? Maybe you're still not sure exactly how payroll works and could use a virtual hand.

There are numerous payroll service and software applications on the market today that automate the entire process from beginning to end. Here are just a few choices to consider.

1.OnPay

OnPay is designed for small businesses, with the ability to scale up to support mid-size businesses as well. OnPay is better suited for businesses with hourly employees, as no auto-pay option is available.

OnPay offers easy employee setup for all your employees. Image source: Author

OnPay also includes unlimited payroll runs, offers mobile access, and offers varying levels of system access. Employees can be paid by direct deposit, check, or debit card, and all the necessary payroll taxes are processed and remitted by OnPay.

The application also integrates with numerous accounting, time tracking and HR applications, reducing the amount of data entry.

OnPay is $36/month, with a $4/employee fee charged. Pricing is all-inclusive, so there’s no extra charges.

2. QuickBooks Payroll

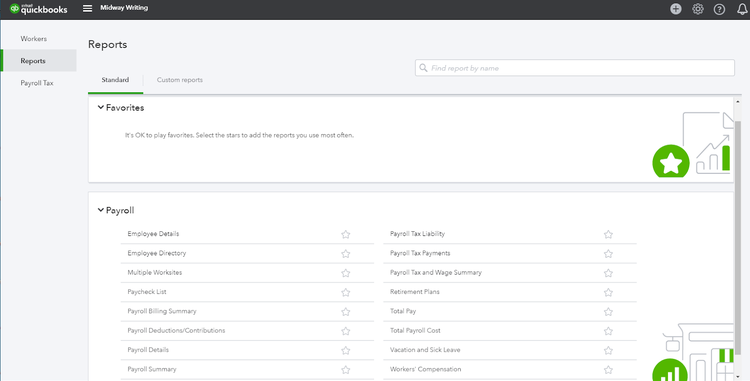

Designed to integrate with QuickBooks Online along with other third-party accounting software applications, QuickBooks Payroll offers unlimited payroll runs, complete tax filing and remittance, and an employee portal for easy, anytime employee access.

QuickBooks Payroll offers an excellent selection of payroll-related reports. Image source: Author

QuickBooks Payroll offers three plans. There is also a mobile app for iOS and Android devices, and the Auto Payroll option makes it easy to pay salaried employees.

QuickBooks Payroll includes good benefit management capability, making it easy to track all employee benefits including monthly deductions.

QuickBooks Payroll starts at $22.50/month, plus a $4/employee charge, with pricing good for the first three months.

3. Gusto Payroll

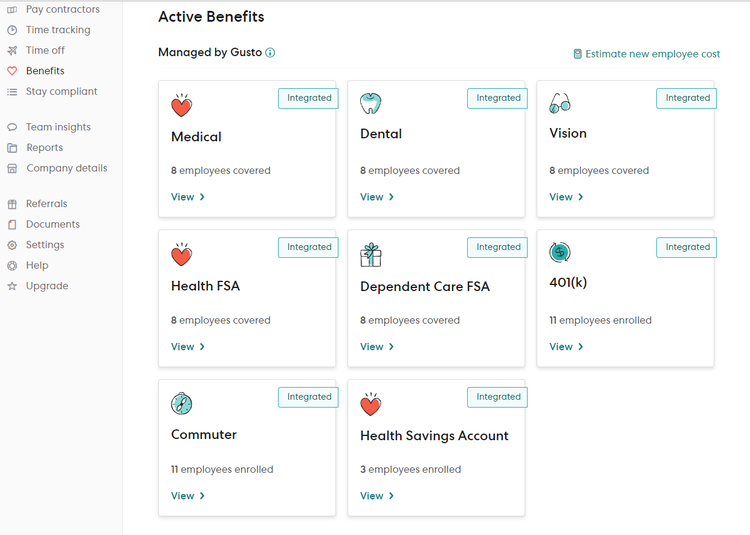

Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Gusto includes flexible payroll schedules, unlimited payroll runs, and multistate payroll capability.

The Active Benefits feature lets you set up and manage employee benefits. Image source: Author

Gusto offers complete employee onboarding, with employees able to access Gusto to complete employment forms and direct deposit information. AutoPilot payroll is available in Gusto, allowing you to run payroll automatically at any designated interval, making Gusto a good choice for those whose payroll information doesn’t change frequently, such as for salaried employees.

Gusto also handles all tax calculations and filing, including year-end tax forms.

Gusto pricing starts at $39/month, plus a $6/employee charge, making it a little more expensive than its competitors.

For more information on these and other payroll software and services, be sure to check out The Ascent’s Payroll reviews.

What payroll cycle is best for your business?

When setting up payroll for the first time, take a bit of time to determine which payroll cycle will work best for your business.

Remember that a biweekly pay period is a good choice for those with hourly employees to pay, but if the majority of your employees are salaried, you may be better off choosing semimonthly. Just keep in mind that changing your payroll cycle can negatively affect your employees, so choose wisely.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.