When you ask your employees to hop on a plane for work, they shouldn’t have to use their own money to get to the destination. Just as you’d pay for an employee’s plane ticket, you should reimburse employees when they use their personal car for business.

Employee mileage reimbursement is the simplest way to keep employees from shelling out their paychecks to cover business driving costs.

Overview: What is mileage reimbursement?

More common in the days of yore, businesses would issue company cars to salespeople and executives who often traveled by car for business meetings. The company provided the car and paid for related expenses such as gas, insurance, and maintenance.

It’s customary now for employees to use their personal vehicles for work. Businesses can offset an employee’s car expenses with mileage reimbursement: Employees receive a set amount for every mile they drive for work.

Businesses can also reimburse employees based on the actual costs incurred for business driving, but applying a mileage reimbursement rate is often simpler.

Usually, reimbursing your employees for using their personal cars is not a federal requirement. Still, it’s a common practice your business should adopt to keep your employees from opening their wallets to fund business expenses.

Mileage reimbursement also applies to self-employed people. You can take a deduction for the business use of your personal car on Schedule C of IRS Form 1040.

The IRS sets a standard mileage reimbursement rate. For 2020, the federal mileage rate is $0.575 cents per mile.

Reimbursements based on the federal mileage rate aren't considered income, making them nontaxable to your employees. Businesses can deduct those costs on their business taxes.

A best practice is to use the IRS mileage reimbursement rate, but you’re free to choose a higher or lower rate. When you reimburse employees at a higher rate, the extra amount is counted as gross wages and is subject to payroll taxes.

What qualifies for mileage reimbursement?

Your business can deduct mileage reimbursement costs for business trips that exclude an employee’s regular commute.

Qualified mileage reimbursement costs include:

- Business trips

- Off-site meetings with clients and prospective clients

- Running errands for business supplies

- Deliveries

The mileage rate helps cover costs like gas, oil changes, maintenance, and insurance. Tolls and parking expenses are not designed to be included in the mileage reimbursement rate, so employers should reimburse those expenses at their actual cost.

When you use the IRS mileage rate for these costs, they’re not taxable to your employees and are deductible for your business. If you choose a higher rate, both you and your employees pay payroll taxes on the extra amount.

You can reimburse your employees for commuting costs, but that’s a benefits administration decision because employer-paid commuter costs are considered a taxable fringe benefit.

How to calculate standard mileage reimbursement

Employers should create a mileage reimbursement policy that outlines:

- What trips are subject to reimbursement

- The reimbursement rate

- How to calculate the number of miles

- How to record the mileage reimbursement

- How reimbursements will be paid

Create an expense report that automatically calculates the standard mileage reimbursement based on your policy. You can use a Microsoft Excel template as a starting point.

Ask your employees to submit a record that supports their expense report. Methods of calculating mileage include:

- Taking photos of the car’s odometer before and after each business trip

- Using an online tool like Google Maps

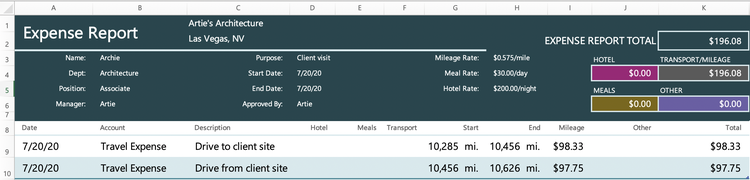

Let’s calculate a mileage reimbursement for Archie, an employee of Artie’s Architecture. Archie drove his personal car to visit a client site last week and is seeking reimbursement for the miles driven.

Artie’s policy states:

- Client sites qualify for mileage reimbursement

- The reimbursement rate is the IRS standard rate of $0.575 cents per mile

- Compare the car’s odometer reading before and after the trip to calculate miles driven

- Employees must fill out an expense report for mileage reimbursement within 10 business days of the trip

- Employees receive reimbursement by direct deposit within five business days after submission

Before and after each business trip, Archie takes a picture of his odometer to keep track of his mileage.

After the trip, Archie fills out an expense report using the employer-provided template that automatically calculates his reimbursement according to the 2020 IRS mileage rate.

Have your employees submit an expense report that tracks their mileage. Image source: Author

As an employer, always check expense report calculations to make sure the Excel formulas are working correctly.

The business owner, Artie, should find the difference between the odometer readings and multiply it by the standard mileage reimbursement rate.

The difference for the first trip is 171 miles (10,456 - 10,285). Multiplied by $0.575 cents, the result is $98.33, which matches the expense report output. Artie should repeat the process for the second trip. The total reimbursement amount comes out to $196.08.

Payroll software often has a feature that allows employers to send reimbursements with direct deposit.

Since standard mileage reimbursement isn’t taxable, treat these reimbursements separately from payroll processing. Don’t add the reimbursement to your employee’s next paycheck because you might accidentally subject the reimbursement to unnecessary payroll deductions.

If you reimburse mileage in employee paychecks, regularly reconcile your payroll to catch mistakes.

Do you have to pay employees for business driving expenses?

If you live in certain states or pay employees minimum wage, you might have to reimburse them for business driving expenses.

California and Massachusetts require mileage reimbursement. Check your state’s labor department website for the most up-to-date regulations.

You can’t expect employees earning at or near minimum wage to pay for their business driving expenses. The Fair Labor Standards Act (FLSA) kickback rule says if an employee’s driving expenses cause them to earn less than minimum wage, the employer must reimburse them.

When an employee earns at or near minimum wage, any unreimbursed expense triggers the FLSA kickback violation.

The FLSA kickback rule comes up commonly for food delivery drivers who use their own cars. Employers must track the travel of employees earning near minimum wage to ensure they’re not underpaid.

For example, say you own a pizza shop in Connecticut and pay your delivery drivers $12 per hour, the minimum wage. The drivers use their own cars to make deliveries.

If your employees have to pay for gas used for deliveries, they’re technically using their earnings to benefit the company. The FLSA says those costs cannot cause an employee’s hourly rate to fall below minimum wage.

Say a delivery person works for four hours, earning $48 in gross wages ($12 hourly rate x 4 hours).

| Gross wages (rate * hours) | Gas expense during shift | New gross wages (gross wages - gas) | Net hourly rate (new gross wages / hours) |

|---|---|---|---|

| $48 | $25 | $23 | $5.75 |

The driver’s new hourly rate is $5.75 after accounting for gas expenses. The employer must reimburse the employee for the $25 gas expense.

Miles and miles of reimbursement

While it’s not federally required, you should reimburse your employees for the business use of their personal vehicles. When you use the IRS mileage rate, the reimbursement is not taxable to your employees, and it’s a tax deduction for your small business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.