Do you remember your first job offer? Mine came from a musical instrument store while I was in high school.

The offer letter listed my start date and my hourly pay, also called a gross wage rate. Knowing I’d soon get paid $8.25 an hour -- then the New Jersey minimum wage -- felt like a windfall.

Then I learned about payroll taxes. That’s a story for another article.

Overview: What are gross wages?

Gross wages, also called gross pay, are the amount an employee receives during a pay period, before taxes and other payroll deductions. It’s calculated using the hourly rate or salary that appears on a job offer letter.

If you pay your employee Sam $50,000 per year, his gross salary is $50,000.

One exception: Sometimes, non-cash fringe benefits get added into gross income. Certain benefits, such as personal use of a business vehicle and employer-paid gym memberships, are considered imputed income. They’re taxed the same as cash paid to employees.

If Sam’s compensation package includes a gym membership valued at $2,000 per year, his gross pay goes up to $52,000.

The first step when you do payroll is to determine gross wages. From there, your payroll software steps in and calculates tax withholdings and contributions to retirement and health plans.

Gross wages get reported as an expense on your income statement, usually under an account called “wages expense” or “salaries expense.”

A miscalculation of employees’ gross wages affects not only your employees’ paychecks but also your employer-paid payroll taxes, such as federal unemployment taxes (FUTA).

Gross wages vs. federal wages

The number for federal wages is smaller than your gross wages because the federal wage number reflects deductions that aren't included in your taxable income. For instance, if you contribute part of your paycheck toward your 401(k) retirement plan, the amount you contribute will reduce your federal wages.

Money that's taken out of your paycheck to cover the employee cost of health insurance coverage also comes out of federal wages, and if you choose to participate in a flexible spending account or health savings account program that your employer offers, then the money you set aside for those purposes also lowers your federal wages.

Even with all these deductions, your federal wages will usually be higher than your actual take-home pay. That's because some of the money that's taken out of your account is still subject to tax.

For example, the money that goes toward Social Security and Medicare payroll taxes doesn't reduce your taxable income, so it's included in federal wages even though it's taken out of your paycheck. The same thing goes for certain voluntary withdrawals that you arrange to have taken from you pay, such as contributions to a charitable fund.

When tax time rolls around, federal wages become much more important, because they reflect the amount on which you're going to pay income taxes. By being aware of deduction opportunities that are available to you, you can arrange to have your federal wage number be lower than it might otherwise be and save taxes in the process.

Gross wages vs. net wages

Processing payroll starts with your employees’ gross pay. From that amount, you subtract employee tax withholding and non-tax deductions. What’s left is your employees’ net pay, which is their paycheck amount.

As an employer, you’re required to keep a portion of employees’ earnings and remit them to federal, state, and local tax authorities. You also pay employer taxes, but they don’t come out of your employees’ paychecks.

Non-tax deductions include retirement and health plan contributions, fringe benefits, and wage garnishment. Check out our small business guide to payroll deductions.

Use gross wages when creating your annual business budget. When you add gross wages to your labor burden -- employer-paid payroll taxes and benefits -- you’re given a full picture of the cost of having employees.

How to calculate gross wages

You must calculate your employees’ gross wages every pay period, whether weekly, bi-weekly, or twice monthly.

You may be asked to put down your employees’ gross wages for loan applications. For example, the Paycheck Protection Program (PPP) uses gross wages from 2019 to calculate your eligible loan amount.

Gross wages include cash compensation, taxable fringe benefits, and tips.

Gross wages on a pay stub relate only to the pay period. If a salaried employee gets paid semi-monthly, twice per month, 24 times per year -- your employee’s total annual income gets divided by 24.

Sam earns $50,000 in cash and enjoys a gym membership that costs your business $2,000 per year. His gross annual income is $52,000. His gross wages per pay period are $2,166.67 ($52,000 / 24).

If you’re running payroll for a restaurant, your employees’ tips get added to the wages you pay them.

Take Peter, who works at a local restaurant and earned $350 in tips last week. He makes $10 hourly, works 40 hours a week, and is paid weekly.

Peter’s wages before taxes and deductions are his hourly pay plus his tips collected. His gross wages come out to $750 ($40 x 10 hours + $350 in tips).

Gross wages for hourly employees can fluctuate by the number of hours they work and whether their pay is subject to time and a half overtime pay.

How to use gross pay for payroll

Gross pay is critical to the payroll process. It’s the first number you calculate, and you use gross pay to calculate taxes like Medicare and Social Security, collectively called FICA.

To understand how you use gross pay for payroll, take a look at one of your company’s most recent employee earning statements, which should logically explain how payroll works. You can find this report in most payroll software.

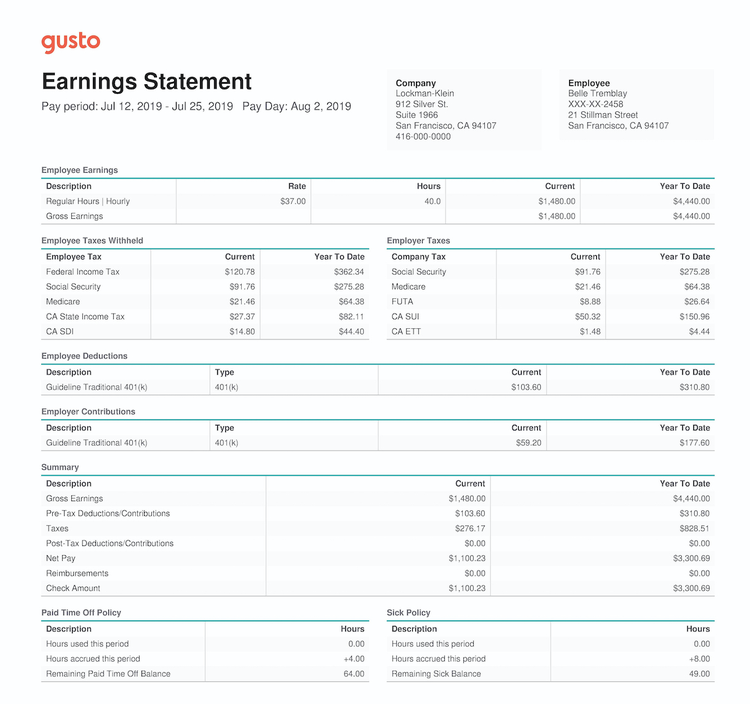

Belle’s earning statement begins with gross pay. She worked 40 hours at $37 per hour, leaving her with $1,480 gross pay for the two-week pay period.

The top of an earnings statement should list gross wages. Image source: Author

After calculating gross wages, you need to subtract taxes and other deductions. Some taxes, like FICA, are calculated as a percentage of gross wages. For example, employees pay Medicare tax at 1.45% of gross wages.

Belle’s Medicare taxes are $21.46 ($1480 gross wages x 0.0145 Medicare rate), which you can see on the next portion of the earnings statement.

Employer-paid taxes, for example, one-half of FICA and FUTA, are paid as a percentage of employee gross pay. The FUTA rate is 7% of gross wages but is generally reduced to 0.6% after you pay state unemployment tax (SUTA). That’s why the FUTA taxes are $8.88 for Belle’s pay ($1480 x 0.006 adjusted FUTA rate).

FICA and FUTA taxes are calculated as a percentage of gross wages. Image source: Author

At the end of every quarter, get in the habit of running payroll analytics for your company. Focus on gross wages and your business’s labor burden to determine whether you’re within budget or can afford to bring on a new employee.

There’s nothing gross about gross wages

When you calculate gross pay correctly, you’re making the first step in successfully managing your payroll.

Once you get gross wages right, you can move onto the next step: calculating each employee’s paycheck and recording payroll journal entries. There’s nothing gross about knowing how to do payroll manually.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.