There are a lot of perks you can offer your employees, whether that be imputed income in the form of a stipend to pay for a gym membership or other benefits such as snacks in the break room. But if you don't have a reliable payroll system in place to compensate your employees for their hard work, any other perks you offer won't be worth much.

A study by the Workforce Institute at Kronos found that payroll errors force more than a third of American workers to make a late payment on a bill, and that kind of financial insecurity may have your employees looking for another job -- even if they like the work and the pay.

That’s why every business needs to understand how payroll works and how to make sure theirs is rock solid. This article will walk you through how to run payroll. (Please note: This article is for informational purposes only and is not intended to serve as business or legal advice.)

How payroll works: Breaking down the payroll process

Companies may have different ideas on how to run payroll, but there are a few universal payroll steps that you can’t skip if you want to make sure your employees get paid on time.

- Step 1: Ensure the paperwork for all of your employees is complete and up to date.

- Step 2: Set up a payroll schedule. Do you want to pay employees twice a month, biweekly, or on some other schedule?

- Step 3: Calculate your employees' gross pay, taking into account if they're salaried, hourly, or have worked any overtime.

- Step 4: Make deductions for taxes, Social Security, a health care plan, or other reductions.

- Step 5: Pay your employees. Direct deposit is most common, but you can also issue paper checks.

- Step 6: Keep good records. Impeccable record-keeping allows you to more easily dispute claims and pay your taxes.

Let's look at each step in depth so you can be sure you're not missing anything important in your payroll process.

Step 1: Get your paperwork in order

This will only apply if you’re a new business just setting up your infrastructure, so skip this if you just want to determine if your existing payroll structure is sound. New businesses, though, will need the following basics:

- An employer EIN number, which you can get from the IRS.

- State and local tax IDs.

- Employee tax and financial information, including W-4s and W-9s (W-2s and 1099s are required at year’s end), depending on what type of workers you have (salaried vs. contractors, etc.).

Consult with a corporate employment attorney to make sure you have all the necessary paperwork in place.

Step 2: Set up a payroll schedule

The next step is to determine how often you plan to pay your employees. One popular option is to pay on the 15th and the last day of the month. Other companies might pay every week, or every two weeks, or they may opt to pay monthly.

Whatever the case may be, keep in mind that your employees have bills to pay, so you should avoid leaving long gaps between paydays.

There are a few other things to consider when setting up a payroll schedule:

- Take a look at your cash-flow situation. If you generally charge clients on the last day of the month, for example, it may be easier on your business to run payroll on the last day of the month and the 15th instead of, say, every two weeks on a Friday.

- Check state laws. While you may have flexibility when it comes to what time of the month you pay, different states have different laws on how often you must pay them. The Department of Labor has a helpful chart on its website.

- Consider direct deposit. If you use paper checks, you don't have any control over when an employee cashes that check, which can cause some cash-flow complications for a small business.

Step 3: Calculate gross pay

Each employee likely has their own wage, so you will need to calculate each employee’s gross pay individually. If an employee is salaried, this will be a simple calculation that will be the same every paycheck -- at least until there is a change in the worker’s pay.

For an hourly worker, the pay may differ, particularly if an employee logs fewer hours than usual, or if the employee works overtime and must be paid extra. You will need to add the overtime to the gross pay in the latter case.

Step 4: Make deductions

Once you’ve calculated gross pay, it's time to make deductions from the paycheck for things such as taxes, Social Security, health care, 401(k) contributions, and any other reductions in pay.

Some -- such as taxes and Social Security -- are mandatory and will apply to all employees, while others -- such as deposits into retirement accounts -- are elected by the employee and may not apply to everyone in your organization. You need to keep all of this information organized in order to properly manage payroll.

Step 5: Transmit net pay to employees

Now that the gross pay has been calculated and deductions have been processed, you’re left with the net pay figure -- that is, the amount the employee will actually receive.

How you transmit the money depends on your organization's policy, although most companies these days do it through direct deposit. You may choose to do it via check, although you should be aware of the potential cash-flow complications this can cause for a business when employees wait days, or even weeks to cash it.

Step 6: Keep good payroll records

Keeping your payroll records organized is absolutely vital to the health of your organization. If you make a mistake in payroll, you will want to be able to verify the information and act quickly. There’s nothing worse than an employee lodging a payroll complaint with the Department of Labor and your business not having the paperwork in order to dispute the complaint.

You will also need to file quarterly and annual taxes, so you should have payroll information at the ready for your company’s accountant (or whoever handles filing returns for the business).

The process for this and the forms you need to fill out will vary greatly depending on what kind of company you run, such as a limited liability company (LLC) or a corporation.

If you don't have a professional accountant on staff, and you don't have the expertise yourself, it's best to hire an outside tax professional to at least look them over if you do this step on your own.

Should you use payroll software to run payroll?

Payroll software is an absolute must for any business. You simply cannot rely on spreadsheets or, even worse, pen and paper to manage payroll. There are too many opportunities for costly mistakes that could sink your business.

There are plenty of payroll software options available that you can use to get your payroll organized and running efficiently, freeing up time to spend on other parts of the business.

The best payroll software for small businesses

If you don’t already have good payroll software in place, it’s time to go shopping. You need software that can organize your employees and automatically calculate their gross pay, net pay, and deductions -- all while keeping the paperwork easily accessible.

We’ve reviewed a number of payroll software options at The Ascent, and the following three have earned the highest ratings so far.

1. OnPay

Our top-rated payroll software solution, OnPay is perfect for small and mid-sized businesses looking to set up a payroll system. It offers a single plan, and it can be scaled up for those looking to get a bit more out of the software.

OnPay offers unlimited payroll runs, mobile accessibility, and even free direct deposit for your employees.

OnPay’s employee profiles are a handy way to keep your records in order. Image source: Author

2. Patriot Payroll

Patriot Payroll is a great small business option with easy onboarding and a quick setup to get your business up and running right away. This web-based option may have some limitations, but it's great for small operations that need a simple payroll setup and data entry.

More expensive plans can help you with filing and depositing taxes as well as other more advanced services.

Patriot Payroll’s forms are easy to understand and simplify data entry. Image source: Author

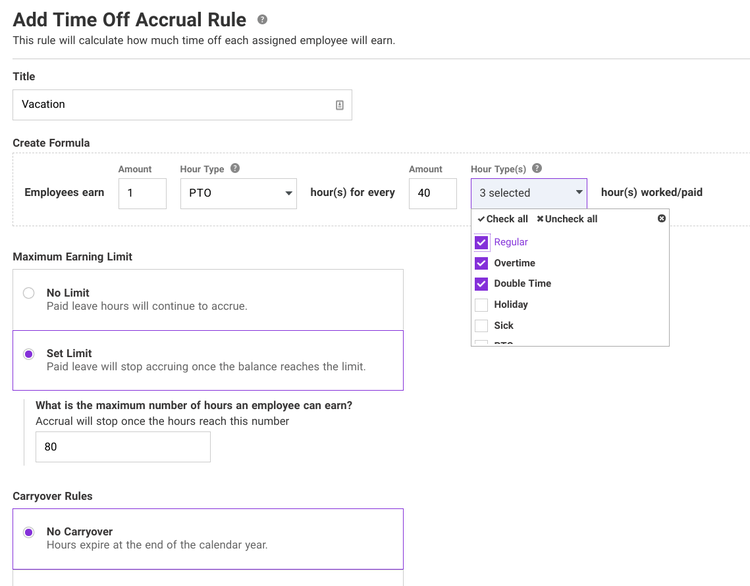

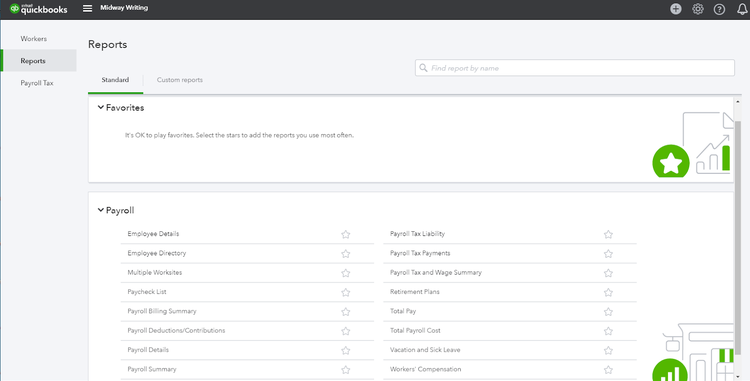

3. QuickBooks Online Payroll

Even if you aren’t in payroll or accounting, you’ve undoubtedly heard of Intuit’s QuickBooks. This version of that software does not disappoint, offering a clean, cloud-based payroll solution that’s easy to use and doesn't even have to be paired with QuickBooks if you use other financial applications. It has a number of plans, but all of them include full-service payroll features.

QuickBooks Online makes it easy to draw up payroll reports. Image source: Author

Review your payroll system

If you’re reading this, it’s probably because you’re either trying to set up a payroll system for your small business, or you feel like your current one could perform better. Either way, keep in mind that this is an important decision that shouldn’t be made lightly.

Your next step should be to try out some payroll software by creating a demo for a sample company to determine whether it’s worth the time and effort to make the massive switch to a new payroll system.

The sooner you do this, the sooner you can rest easy knowing that your employees are happy and your company is risk-free.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.