In a world where even making your morning coffee can be automated, you might wonder if there’s a reason to do payroll manually. For businesses with more than a few employees, manual payroll becomes a time-consuming, frustrating undertaking.

But for some small businesses with few employees, manual payroll makes sense.

Overview: What is manual payroll?

When you calculate payroll and cut paychecks without the help of payroll software, you’re doing manual payroll.

Small businesses with only a handful of employees are prime candidates to do their own payroll. Companies with more than five employees generally turn to payroll software to save time and reduce errors.

While manual payroll might save money, it likely won’t save time. Before you run payroll without the help of software, you must learn how payroll works and which payroll taxes apply to your business.

Manual calculations are more error-prone. If you make a mistake with tax withholding, you might face hefty government penalties.

Your business may be a candidate for manual payroll if:

- You have five or fewer employees

- You don’t plan to take a payroll tax credit

- You’ve done business payroll before

Most importantly, if you plan to do payroll manually, have a payroll professional on call. If you have an eleventh-hour question, you can avoid missing a payroll deadline by having someone to ask.

Benefits of running payroll manually

There are some benefits to running payroll manually, especially for small businesses with only a few employees.

1. No payroll software expenses

Payroll software can cost your business anywhere between $10 and hundreds monthly, depending on the software, the number of employees, and the features you choose.

You can run a high bill with payroll software. Sometimes there’s just no room in the business budget for another expense.

There are free payroll software options, such as Payroll4Free, but its paycheck calculation features can be found elsewhere.

2. You’ll understand payroll inside and out

You’ll hone your payroll processing skills by doing payroll manually.

Your intimate understanding of how to do payroll will continue to serve you even when you’re not handwriting the checks. Business owners who use payroll software should regularly check their employees’ earning reports to spot errors.

3. It’s manual payroll, not solo payroll

Calculating payroll taxes deters most business owners from doing their own payroll.

If you choose to do payroll by hand, you can still access trusted sources online to help with difficult payroll tax calculations.

How to manually calculate payroll for your small business

Get your green accounting visor on.

Step 1: Prepare your business to process payroll

Before you manually calculate payroll, check out our guide to managing payroll to get your business ready to process payroll.

In setting up payroll:

- Get an employer ID number and state tax ID number

- Open a payroll bank account to simplify payroll reconciliations

- Choose a payroll schedule: weekly, biweekly, or semimonthly

- Gather required forms like IRS W-4, IRS I-9, and state withholding from employees

Before you do payroll for the first time, decide where to record your payroll calculations.

Either keep a physical payroll journal or set up a Microsoft Excel spreadsheet where you can go back to check your work. Microsoft offers a free employee payroll Excel template.

Step 2: Calculate gross wages

Gross wages are your employees’ compensation before payroll deductions, including employee-paid payroll taxes and contributions to retirement and health plans.

Gross wages also include taxable fringe benefits, such as the personal use of a business vehicle or an employer-paid gym membership. If you’re doing payroll for a restaurant, tips are included in gross wages.

Hourly employees are generally entitled to time and a half when they work overtime. Check with your state’s labor department website to see what constitutes overtime in your jurisdiction.

Let’s calculate gross wages for Gertrude Grill, a chef at your posh California restaurant. She’s a full-time, non-exempt employee with a $66,000 annual salary, paid twice monthly.

Since Gertrude is a salaried employee, her gross wages calculation is relatively simple. Gertrude gets paid semimonthly and is offered no fringe benefits.

The semimonthly pay calculation starts with dividing your employee’s annual salary by 24 pay periods:

$66,000 ÷ 24 = $2,750

Gertrude’s gross wages are $2,750 per pay period.

Step 3: Subtract pre-tax deductions

Pre-tax deductions, like employee contributions to a 401(k) or health insurance plan, reduce federal and state tax withholdings.

Subtract these contributions before you calculate federal and state tax withholdings. Other payroll taxes are generally applied to gross wages.

Step 4: Calculate employee payroll taxes

Here comes the hard part. Steps 4 and 5 are the most critical to getting payroll right. If you’re reading this while doing payroll manually, grab a cup of coffee.

You can go down one of two paths: calculating each tax by hand or turning to an online paycheck calculator that spits out payroll tax calculations. Choose one method and stick to it for all tax calculations.

Federal and state tax withholding

You probably had your employees fill out a bunch of paperwork during the onboarding process. Among them were IRS Form W-4 and a state withholding tax form. States like Pennsylvania don’t have such a form because they have a flat state income tax rate.

These federal and state tax withholding documents tell you how much to withhold from each employee’s paycheck. The IRS rejiggered federal withholding starting in 2020. Workers hired before 2020 don’t need to fill out a new W-4 unless they want to change their withholding.

Gertrude, who began working in 2020, submitted the new Form W-4 and a California employee withholding allowance certificate.

She says on Form W-4 that she’s single, has no dependents, and plans to take the standard deduction when she files her taxes. Her pre-tax deductions are $125, so her adjusted wage amount is:

$2,750 - $125 = $2,625

You’ll be diving into tax tables in the manual method, which rounds dollar amounts to the nearest whole dollar. Paycheck calculators do more math behind the scenes than you might think, so you’ll see slightly different results depending on the method you choose.

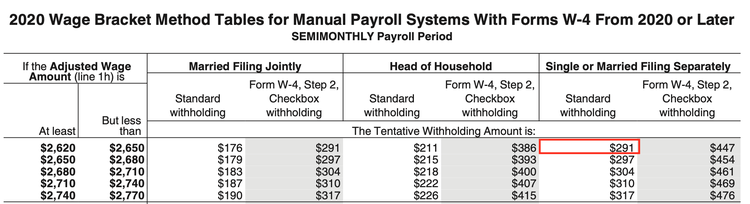

If you go the manual route, use IRS Publication 15-T to find the correct withholding amount according to the information on Gertrude’s Form W-4.

The 2020 IRS Form W-4 changed how federal income tax withholding works. Image source: Author

Gertrude’s federal tax withholding is $291, according to the IRS tax table. You’ll follow a similar process for state tax withholding using California tax withholding tables.

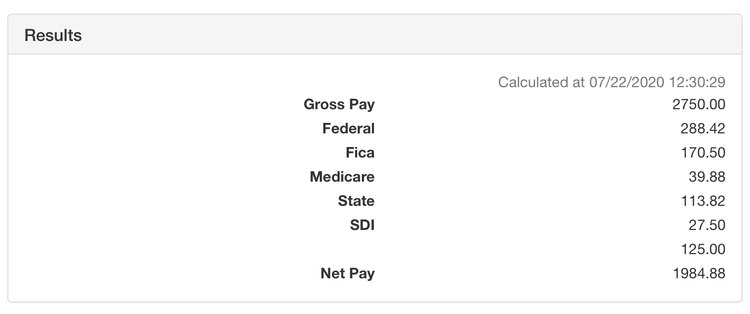

But, let’s look at an online paycheck calculator.

I turned to OnPay’s free California paycheck calculator, which gave me a similar -- but not the same -- result for Gertrude’s federal tax withholding compared to the tax table.

OnPay’s online paycheck calculator helps small business owners calculate payroll taxes. Image source: Author

Other employee payroll taxes

You’re responsible for withholding other payroll taxes, including:

- Medicare and Social Security taxes, collectively known as Federal Insurance Contributions Act (FICA) taxes

- Local taxes, like state disability insurance (SDI)

Check with a tax professional to see what other employee payroll taxes apply to your business.

Step 5: Subtract post-tax deductions and calculate net pay

Some employees have post-tax deductions, which are costs that come out of employee pay after federal and state income taxes are calculated.

The most common post-tax deductions are Roth 401(k) contributions, life insurance contributions, and wage garnishment.

Calculate net pay

Net pay is your employee’s paycheck amount. Use the following formula to calculate net pay:

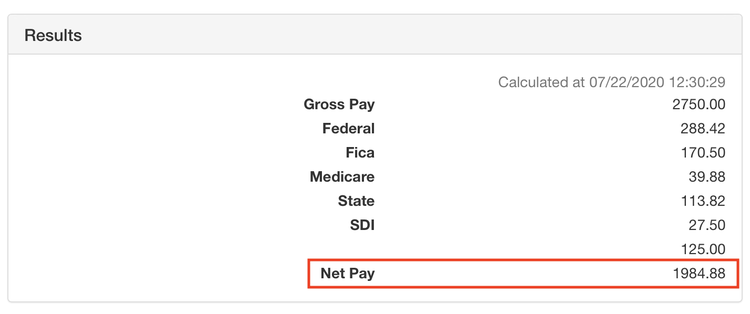

Paycheck = gross wages - pre-tax deductions - taxes and withholding - post-tax deductions

Gertrude’s paycheck comes out to $1,984.88, according to OnPay’s payroll calculator.

You can use an online paycheck calculator to check your work. Image source: Author

Step 6: Calculate employer payroll taxes

Your work is not yet done. Employers must pay payroll taxes, too. All employers pay one-half of FICA, federal unemployment tax (FUTA), and SUTA state unemployment tax. Depending on where your business operates, you may be subject to more taxes.

The FUTA rate for all U.S. businesses is 7% of eligible wages up to $7,000. Check out our guide to calculate FUTA wages. When you file and pay SUTA taxes on time, you get a FUTA tax credit that brings your FUTA rate down to 0.6%.

In most states, your business’s SUTA rate depends on the industry and the history of former employees filing for unemployment benefits.

Step 7: Prepare payroll journal entries

You have all the information needed to enter your payroll expenses into the general ledger, or business transaction journal.

If it’s been a while since you’ve taken bookkeeping 101, consider reaching out to a trusted payroll professional to show you how your payroll journal entries should look.

Unless your business switches from cash basis to accrual basis accounting or starts offering new benefits to employees, your payroll journal entries should look similar each pay period. Follow our guide to payroll journal entries.

Step 8: Check your work

Your forehead is sweating, but the hard part is done. When you’re doing payroll manually, you’re at a higher risk for errors than someone using payroll software. Take a second look at your payroll analytics to make sure your calculations are correct and that your inputs are errorless.

If you’re using an Excel spreadsheet, go into each formula and make sure everything is correct. Recalculate numbers if they look wrong.

You should also do a payroll reconciliation, which compares your Excel spreadsheet to your general ledger. When there are errors, recalculate payroll until you find the error. You should then compare those figures with your payroll bank statements and investigate any discrepancies.

Step 9: Cut the checks and pay stubs

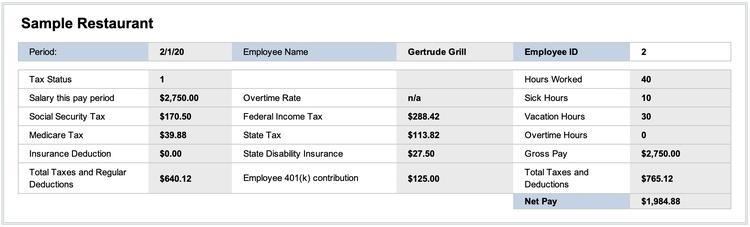

Once you’re confident in your payroll calculations, it’s time to write your employees’ paychecks.

Attach a pay stub to your employee’s check. A proper pay stub explains how you calculated the employee’s net pay and provides other important information. The Microsoft Excel template automatically creates pay stubs that include accrued vacation and sick time.

Attach a pay stub so your employees know how you calculated their paychecks. Image source: Author

Step 10: Remit payments and store documents

During the payroll process, you put money aside for payroll taxes and contributions to retirement and health accounts. Make sure the money goes where it needs to.

It is best practice to send out tax payments after every pay period, though some payroll taxes only require payment quarterly. If your employees contribute to a 401(k), send in those payments as soon as possible.

You’re also required to hold on to payroll documents for varying lengths of time, depending on what they are. To be safe, save anything payroll-related for seven years.

Also, you’re required to submit documents, like Form W-2, to federal and local tax authorities and your employees at the beginning of each year. Consult a tax professional so you don’t miss a filing.

I’m only sweating because it’s hot outside

You might break a sweat doing payroll manually.

But if your business payroll is simple, and budget is a concern, you might be a good candidate for manual payroll.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.