Are you an accountant looking for payroll software to make life a little easier? Here we outline the top seven payroll software options for accountants.

In many small businesses, your accountant also doubles as your payroll person. Whether that’s you or one of your employees, you can make things easier by using payroll services software that offers good integration with your accounting software.

If you’re looking for payroll for accountants, or just a good payroll application that will work with your accounting software, be sure to check out our list of the best seven payroll software applications for accountants.

The best payroll software tools for accountants, at a glance:

- OnPay

- QuickBooks Payroll

- Patriot Payroll

- SurePayroll

- Gusto

- RUN Powered by ADP

- Paychex Flex

Choosing the best Payroll software for you

Step through the following simple questions to begin to determine what the best payroll software is for you and your business needs.

What to look for in payroll software for accountants

If you know how payroll works, you’ll understand that in an ideal situation, your accounting and payroll software will come from the same vendor. Unfortunately this is not always an option.

The good news is that there are a variety of payroll software and services on the market that will seamlessly integrate with your accounting software.

1. Accounting software that includes payroll

The best scenario when looking for a payroll application is exploring whether your current accounting software offers payroll processing. Having an all-in-one application eliminates duplicate data entry and always ensures that your general ledger reflects the most recent activity.

Unfortunately, while many larger accounting applications do contain a payroll component, most of these applications are designed for larger businesses.

2. Integration options

Chances are that your accounting software and your payroll software are from two different vendors.

Today, that isn’t a large problem, simply because of vast integration options that most payroll software applications now offer. It’s also important to note that integration and import/export options are two very different things.

The first option syncs with your accounting software, so that payroll information is automatically entered.

The second option means that you can import data into the application, but you will still need to enter the data into your accounting software application in some fashion.

Always opt for complete integration, but being able to import data is better than nothing.

3. Tax reporting and remittance

Tax reporting and remittance is the number one reason why most businesses move to a payroll service.

Particularly important for small business owners who need to wear several different hats, having these reports prepared and taxes paid by a payroll service can save a considerable amount of time for an already overworked business owner.

Our 7 picks for the best accounting payroll software

While payroll software offers many of the same features from application to application, we’re taking a look at what payroll software is best from an accounting standpoint.

Since payroll transactions always end up in the hands of an accountant, whether that’s you, your staff accountant, or the CPA firm that you’re using, here are our picks for the best payroll software for accountants.

1. OnPay

If you currently use Xero or QuickBooks Online, OnPay offers terrific integration with both applications, with integration with FreshBooks expected shortly.

One of the biggest benefits of using OnPay is that access to various HR resources is included in the monthly fee, an option not offered by any of the other payroll applications.

OnPay lets you set up tax rates for as many states as needed. Image source: Author

OnPay offers payroll in all 50 states at no additional cost, with free direct deposit included, and includes complete tax processing from the initial report to filing and tax remittance.

You can also print and distribute year-end tax forms such as W-2s for your employees or have OnPay print and mail them for a small fee. OnPay will also help you migrate payroll data from another application at no charge.

OnPay offers one plan with all features included for $36/month, with a $4 charge for each employee.

2. QuickBooks Online Payroll

One of the biggest things to consider when choosing a payroll service or software is whether it will integrate with your accounting software. If you’re using QuickBooks Online, that’s one less thing to worry about.

The Review and Submit screen provides an overview of total payroll cost each pay period. Image source: Author

Designed for up to 50 employees, QuickBooks Online Payroll makes life a lot easier for your accountant (or you). It offers complete integration with QuickBooks Online Accounting, which updates your G/L with payroll-related expenses, eliminating the need to post entries manually.

Another advantage of using QuickBooks Online Payroll is that it calculates, processes, and files all payroll tax forms, including tax deposits for all the necessary states, saving you or your accountant a lot of time. It also processes year-end forms for your employees such as W-2s and 1099s.

QuickBooks Online Payroll offers three plans, starting at $22.50/month for the first three months, with all three plans offering full-service payroll.

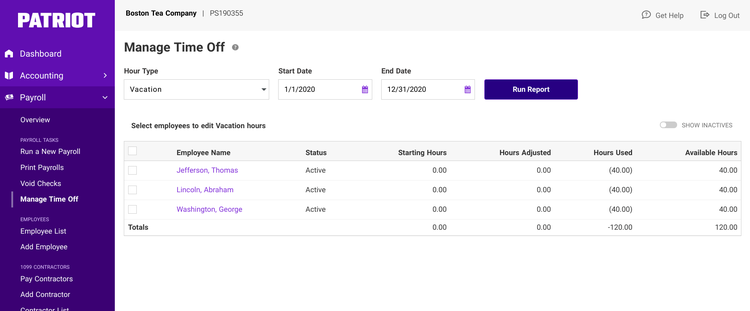

3. Patriot Payroll

If you use or plan to use Patriot Accounting, why not couple it with Patriot Payroll? Patriot Payroll offers two plans, Basic and Full Service. You’ll want to choose the latter in order to reap the benefits garnered by using both applications.

Patriot Payroll offers free product setup, as well as free product support. In addition, the application handles all filing and depositing of federal, state, and local payroll taxes, and processes year-end employee tax forms such as W-2s and 1099s.

Patriot Payroll offers an easily navigated interface for managing both accounting and payroll. Image source: Author

Patriot Payroll’s Full Service plan currently runs $30/month + a $4 charge per employee.

Best for smaller businesses with a limited number of employees to pay, Patriot Payroll used with Patriot Accounting will definitely save accountants a significant amount of time.

4. Gusto

Gusto offers three plans for small businesses, with all plans offering full-service payroll. Gusto takes care of everything from new hire reporting to supporting unlimited payroll runs along with multi-state payroll capability.

Gusto lets you easily add integration with your current accounting software. Image source: Author

Gusto currently integrates with popular accounting applications such as Xero, FreshBooks, and QuickBooks Online, so you’ll be able to import your payroll transactions into your accounting software. This will eliminate the need to enter payroll transactions separately.

In addition, Gusto handles all tax filing including creating reports, filling out forms, and submitting tax payments. Gusto also handles year-end filing of Form 940 and 941 as well as employee year-end forms such as W-2’s and 1099s.

Gusto’s Basic plan runs $19.99/month for a team of two, and the Core plan is $39/month. Both plans have a $6 per-employee charge.

5. SurePayroll

Of all of the stand-alone payroll software and services, SurePayroll offers the best integration with third-party accounting applications.

Sure Payroll’s mobile app lets you do payroll on your iOS or Android smartphone. Image source: Author

SurePayroll integrates with software applications such as AccountEdge, QuickBooks Desktop, QuickBooks Online, Sage 50, and Xero, eliminating the need to manually post payroll entries.

The Payroll Preview report provides you or your accountant with payroll liability including Gross Pay, Employee Deductions, Employee Taxes, Net Pay, and Employer Taxes, with this information easily exported to your accounting software application, eliminating the need to enter payroll details manually.

SurePayroll handles all payroll taxes, from initial report preparation and form filing to payment remittance. SurePayroll also prepares year-end forms such as W-2s and 1099s.

SurePayroll pricing starts at $29.99/month, plus a $4 per employee charge.

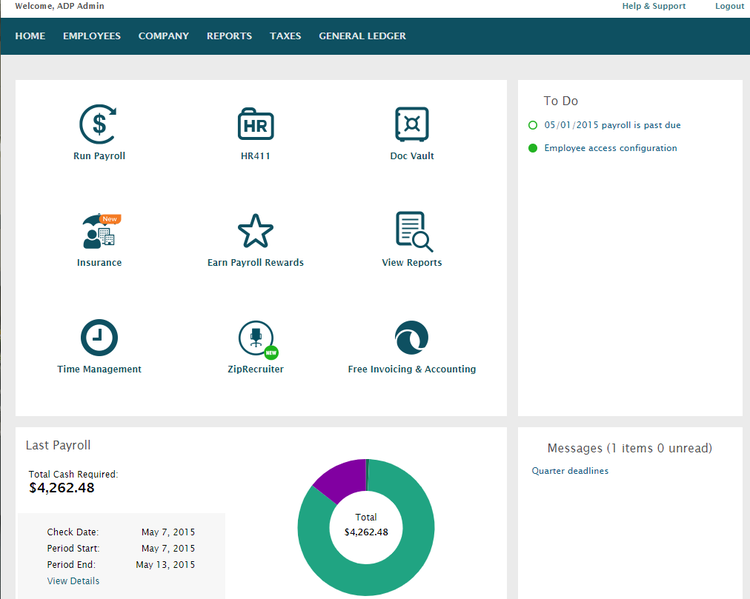

6. RUN Powered by ADP

Nearly everyone knows of, has heard of, or has been paid by ADP. RUN Powered by ADP was created specifically for businesses with up to 49 employees, with other ADP payroll options available for larger businesses.

RUN Powered by ADP offers four plans, with all four plans offering full-service payroll.

RUN Powered by ADP offers easy navigation from the payroll dashboard. Image source: Author

The General Ledger feature in RUN Powered by ADP allows you to easily create a G/L file, which can be exported into your accounting software, eliminating the need to process payroll journal entries manually.

RUN Powered by ADP handles all tax filing and payment remittance, including year-end employee forms such as W-2s and 1099s.

Pricing for RUN Powered by ADP varies widely, depending on the plan and add-ons purchased, with pricing for 10 employees generally running between $150/month to $180/month. If interested, be sure to contact ADP for a more accurate quote.

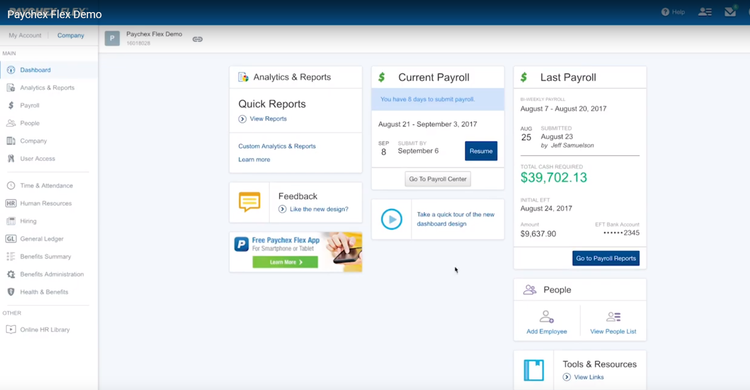

7. Paychex Flex

Paychex Flex is a full-service payroll application designed for small to mid-sized businesses. Paychex Flex offers four plans, ranging from the Express plan designed for 10 employees or less to Paychex Flex Enterprise, which can handle more than 100 employees.

Paychex Flex offers a customizable dashboard that displays all payroll totals. Image source: Author

Paychex Flex is very plan-driven, with available features very dependent upon the plan subscribed to, though all plans offer full-service payroll processing, including complete tax filing and remittance.

For an additional fee, employee tax documents such as W-2s and 1099s are also available from Paychex Flex. Though integration options have been limited in Paychex Flex, the company recently announced expanded integration options will become available in early 2020.

Paychex Go is designed for up to 10 employees and starts at $59/month, plus a $4 per-employee fee. Pricing for both Paychex Flex Select and Paychex Flex Enterprise is available directly from the company upon request on the Paychex Flex website.

In addition to the subscription, you’ll also have to pay a setup fee.

Accounting + payroll software = fewer headaches

If you know how to do payroll, you’ll want a payroll application that processes payroll with minimal work.

If you’re also an accountant, you know how important it is to track payroll totals, process paychecks and direct deposit, and file and pay your payroll taxes. These applications will help you accomplish both.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.