If the thought of processing payroll frightens you, relax and take a look at Gusto. Designed for small businesses, Gusto makes it easy to pay your employees and maintain your sanity in the process.

- Simple: $40/month, plus $6/employee/month

- Plus: $80/month, plus $12/employee/month

- Premium: Pricing available on request

-

Ease Of useRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

SupportRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

PricingRating image, 3.50 out of 5 stars.3.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

FeaturesRating image, 5.00 out of 5 stars.5.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

-

- Scalable, with three plans available

- Employee onboarding

- Integration with top accounting products

- Pricing can be prohibitive for smaller businesses

- Several key features only available in top two plans

- Businesses charged a fee for all employees whether paid or not

As a small business owner, you need to wear many hats. One of the most important hats (at least to your employees) is the payroll hat.

Payroll processing can be intimidating to anyone, especially if you've never had to manage payroll or process payroll taxes.

That's where Gusto comes in.

Designed for those initially overwhelmed by the thought of preparing payroll, Gusto offers a variety of tools and resources designed with small businesses in mind.

Who is Gusto for?

Gusto is designed for small business owners who wish to automate the entire payroll process, and it's a particularly good fit for small businesses such as local restaurants that are paying employees for the first time.

Gusto is also a good fit for businesses that would like administrative management for employee health and retirement benefits, or that are looking for easy access to human resources (HR) tools.

Though Gusto features are certainly robust enough for mid-sized businesses, pricing can be prohibitive for businesses with more than 20 employees.

Gusto's features

Gusto offers all of the features (gusto payroll features) you need, including the following:

- New hire reporting

- Flexible payroll schedules

- Unlimited off-cycle and bonus payrolls

- Contractor payments

- Multistate payroll capability (Plus and Premium only)

Gusto also supports direct deposit at no additional cost.

If you have more than 10 employees and you're using another payroll service, or are learning how payrolls work for the first time, no worries: Gusto personnel are available to help you with the initial setup process.

In addition to helping you learn how to run payroll, Gusto also includes healthcare and retirement plan administration as well as complete access to HR professionals and resources through its Premium plan.

Those using the Plus and Premium plans will also have access to time-tracking capability within the application, and managers can use their smartphones or tablets to run payroll from anywhere.

Below are some additional features you'll find in Gusto.

1. Employee onboarding

I think this is one of Gusto's most important features, particularly for small business owners who may not have as much time to spend on payroll and personnel-related details as they may like.

Gusto allows your new employees to access the system (with your permission) and onboard themselves. You'll have to enter them into Gusto yourself to get them started, but once you supply basic details, including an email address, Gusto will email the employee directly.

This allows them to complete the onboarding process themselves, which includes completing contact information and filling out a W-4 and direct deposit details.

2. Process tax forms

The No. 1 reason businesses use a payroll service is to help with payroll taxes. Processing and filing tax forms and the related remittance is time-consuming at best, and it can be confusing for those processing payroll for the first time. Gusto files all related tax forms and remittances, including:

- Form 941: This form reports wages, taxes withheld from employees, your (the employer's) portion of Social Security and Medicare tax, as well as the total tax deposit required.

- Form 940: This form is filed annually and reports all wages, tax liability, and payments that have been made under the Federal Unemployment Tax Act (FUTA).

- Form W-2: This form is provided to your employees at year end, and it reports all wages, tips, and other compensation received throughout the year. W-2s also have to be processed with the Social Security Administration.

In addition to these forms, Gusto also processes 1099s for any contract employees you may have, as well as both state and local taxes for all employees.

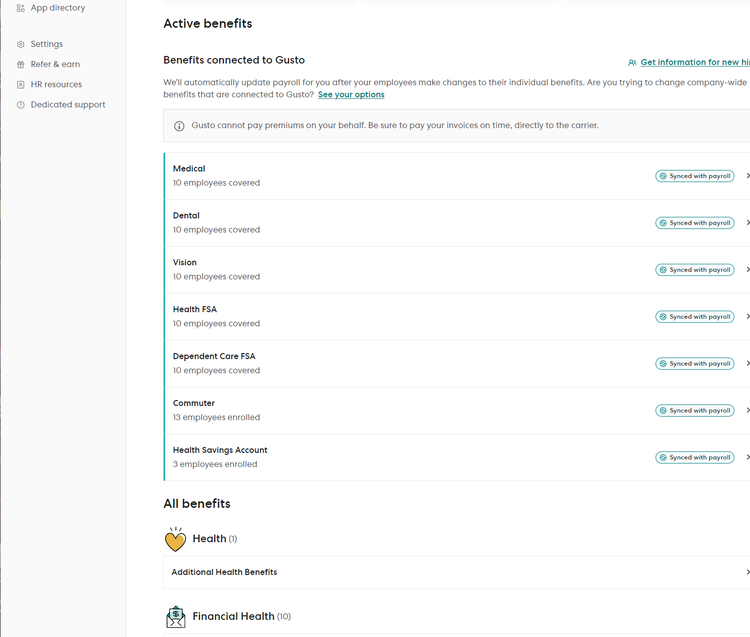

3. Handle pre-tax benefits

Along with medical, dental, and vision administration, Gusto can also administer additional benefits such as 401(k) plans, flexible spending accounts, health savings accounts, 529 college savings, and life and disability insurance.

The Benefits screen in Gusto lets you manage all employee benefits from one location. Image source: Author

Each benefit integrates with its respective administrator, making it easy to manage information from one location.

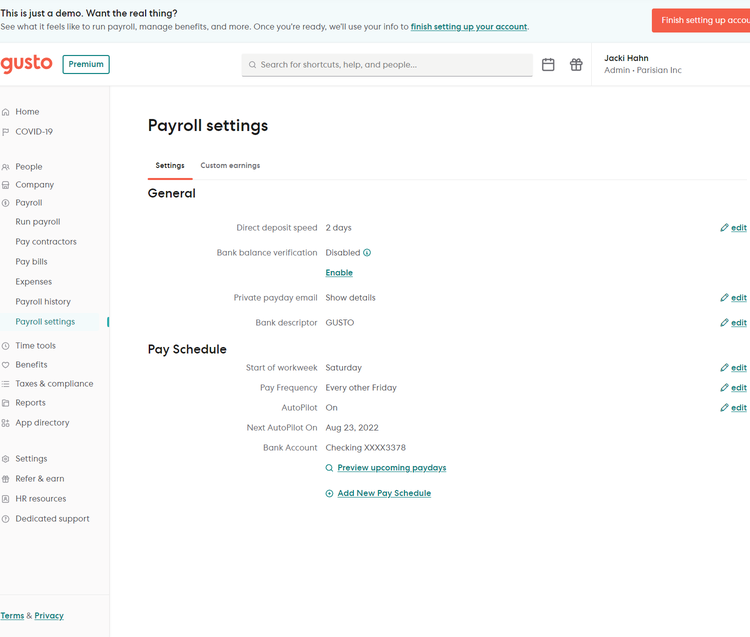

4. AutoPilot® payroll

If your business runs the same payroll with little change each pay period, AutoPilot is for you. AutoPilot lets you run payroll automatically at designated intervals without any action required from you. All you need to do is create the payroll information that will be used for each payroll, enable AutoPilot, and you're all set.

Enable AutoPilot on the Settings page of Gusto. Image source: Author

Payroll will process automatically one day before the deadline, so you'll have 24 hours to make any changes if they're needed. Changes made after the 24-hour period will be applied to the next payroll cycle. Unfortunately, you won't be able to pay your contractors using AutoPilot.

5. Digital pay stubs

Along with accessing their personal contact information, your employees can sign into their accounts to view digital pay stubs.

Each pay stub provides a wealth of information, including gross earnings, total taxes, benefits and deductions, and time off that has been used as well as accrued, along with the check amount. In addition to pay stubs, employees can also access year-end forms like their W-2s.

Employees will receive an email when the latest stub is available to view or download, and even former employees will have continued access to their historical pay stubs and W-2s.

6. Reporting

Gusto offers good reporting options, including a complete payroll journal, year-to-date employee earnings, an employee summary, a benefits report, a contractors report, and time-off balances.

Reports can be customized by year, and you can choose the data you wish to include in the report, which can be grouped by employee, state, or work location. Reports can be exported as a CSV file for further customization or saved as a PDF.

7. Account integrations

Gusto is a great payroll software for accountants because it integrates with small business accounting applications such as QuickBooks Online, FreshBooks, and Xero, making it easy to track all of your payroll-related expenses directly in your accounting software application.

In addition, Gusto also integrates with popular timekeeping software such as TSheets, When I Work, and Homebase.

Benefits of Gusto

Most of the best payroll software solutions offer similar benefits to those provided by Gusto, including federal and state tax processing and remittance, flexible payroll schedules, unlimited payroll runs, and direct deposit capability.

However, the difference between applications is usually how these features are presented.

Gusto is designed with the end user in mind and is a great payroll solution for those charged with handling payroll for the first time. Gusto is also great for business owners who don't have a lot of time to spend on payroll but still want access to a long list of features.

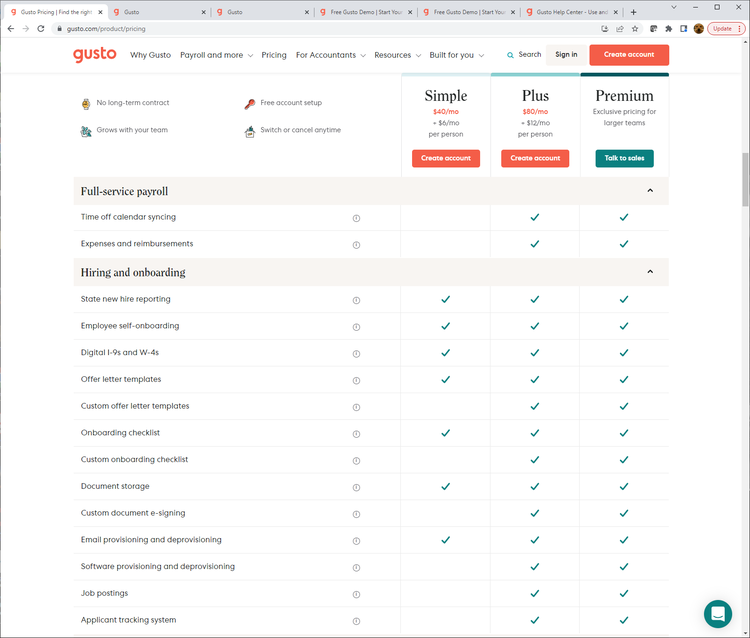

Gusto's pricing

Gusto offers three plans -- Simple, Plus, and Premium, -- with a monthly per-person fee assessed, along with a standard monthly fee. All plans offer unlimited full-service payroll processing. There is also a Contractor-Only plan for small businesses that need to pay contractors but have no W-2 employees.

Gusto offers three plans that are suitable for very small to very large businesses, along with a contractor-only plan (not shown). Image source: Author

Though the cost is initially within reach of very small businesses, the fee structure can become rather expensive for businesses with more than 20 employees.

You should also be aware that you'll be charged for all active employees whether that employee is paid or not.

- Simple: The Simple plan offers full-service payroll for a single state, as well as an employee self-service option, plus direct deposit.

- Plus: The Plus plan includes full-service payroll, next-day direct deposit, time-tracking, and project tracking capability. The Plus plan also includes employee self-onboarding capability, small business health insurance administration, and workers' comp administration.

- Premium: Along with all of the features found in the Plus plan, the Premium plan also includes performance reviews, direct access to HR experts, federal and state compliance alerts, and a dedicated customer success manager.

Gusto's ease of use

Gusto representatives have stated that based on a 2018 survey of over 600 Gusto customers, 85% stated that Gusto is easier to use than their last payroll provider.

We can see why.

Gusto features an intuitive interface that even new users will have no trouble navigating. The dashboard displays reminders to complete pending tasks, such as approving time-off requests or completing new employee offer letters.

A vertical menu bar to the left of the screen provides you with quick access to all of the features found in Gusto, including easy access to the help center, where users can find detailed instructions on system setup.

You can also upgrade to a more robust plan directly from the dashboard if you wish. Remember, if you find yourself overwhelmed, Gusto personnel are available to help throughout the entire setup process.

Working with Gusto support

Gusto offers telephone, email, and chat support during regular business hours. In addition to the support options available, Gusto offers a searchable knowledge base.

You can access additional information and step-by-step instructions for a variety of topics ranging from initial product setup to accounting and integrations. A FAQs page is also available.

Gusto works for you

If you think nothing is scarier than running a small business, try making an error on an employee's paycheck.

If you want a payroll service that does most of the work for you, offers benefit administration capability, and gives you access to HR tools and resources, Gusto may be the payroll service you've been searching for.

How Gusto Compares

| Online Access | Direct Deposit | Prepares Federal Tax Forms | Employee Access to Payroll Documents | |

|---|---|---|---|---|

| Gusto |

|

|

|

|

| Payroll4Free |

|

|

|

|

| Payroll Mate |

|

|

||

| RUN Powered by ADP |

|

|

|

|

| SurePayroll |

|

|

|

|

| Paycor |

|

|

|

|

FAQs

-

The Plus and Premium plans can handle payroll for all 50 states, while the Simple plan will only process payroll for a single state.

-

Yes, although not with Gusto's AutoPilot feature; it must be done manually.

-

Yes, your employees will be able to access both current and historical pay stubs, with former employees being able to access their pay stubs as well. Employees can also access their W-2s.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.