Whether you use QuickBooks Online or another accounting software, if you're in the market for an affordable, full-service payroll application, Intuit QuickBooks Online Payroll might be the solution.

-

Ease Of useRating image, 5.00 out of 5 stars.5.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

SupportRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

PricingRating image, 3.50 out of 5 stars.3.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

FeaturesRating image, 4.50 out of 5 stars.4.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

-

- Multiple plans available

- Can be used with or without QuickBooks financial applications

- All plans include full-service payroll

- Extra charges assessed in Core plan

- Auto Pay only available for salaried employees

- Limited report customization

Intuit QuickBooks Payroll offers an affordable, easily navigated payroll software application that is designed for small business owners.

Even better, if you're looking for affordable accounting software, you can subscribe to both QuickBooks Online Accounting and QuickBooks Payroll at significant savings. But not to worry, QuickBooks Payroll can still be used as a standalone payroll application, even if you use another accounting software application.

Who is Intuit QuickBooks Online Payroll for?

QuickBooks Payroll, like all Intuit applications, is designed with the small business owner in mind.

The application is designed for up to 50 employees, but because of the potential fees involved, it's really best suited for businesses with 15 or fewer employees. The application is scalable and offers three plans, so you can easily move up to the next plan if you're looking for additional product functionality.

Keep in mind that while you don't need to be using QuickBooks accounting applications in order to use QuickBooks Online Payroll, it can be really handy if you do.

Intuit QuickBooks Online Payroll's features

One of the things that sets QuickBooks Payroll apart from a lot of its competitors is that all its plans include full-service payroll capability, which is rare. QuickBooks Online Payroll currently offers three plans: Core, Premium, and Elite, with all three plans including the following features:

- Unlimited payroll runs

- Direct deposit

- Automated tax calculations and filing

- Employee portal

The application offers unlimited payroll runs, so you won't be charged if you need to do an additional run.

The application will automatically calculate, process, and file payroll tax forms, including tax deposits, for all 50 states, where necessary. It can handle both garnishments and deductions and allows you to add numerous employee pay types and designate multiple pay rates as well.

All Intuit QuickBooks Online Payroll plans include free direct deposit, and you can pay your contractors in the application as well. Another option lets you define policies for and automatically track paid time off, vacation, and sick time. A mobile app is also available for both iOS and Android devices that will allow you to run payroll, view employee information, and pay taxes, but you'll have to sign into the regular application if you wish to make any employee or pay rate edits.

Auto Payroll

Intuit QuickBooks Online Payroll(QuickBooks Payroll) includes an Auto Payroll option in all plans, which lets you run payroll without any additional entries. QuickBooks Online Payroll does allow you to review payroll before processing, and you can make any necessary changes or add additional compensation for commissions or bonuses.

The downside of Auto Payroll: It only handles salaried employees, and all of them must use direct deposit. In addition, all of your employees will need to be in the same state, and e-services must be enabled for you to use Auto Payroll.

QuickBooks Workforce

QuickBooks Workforce is a new feature that replaces the Paycheck Records option previously available in Intuit QuickBooks Online Payroll. QuickBooks Workforce gives your employees online access to important information: pay stubs and W-2s, year-to-date earnings and deductions, current tax information, and available time off.

To get your employees on QuickBooks Workforce, simply enter their current email address during the setup process, and they will receive an email invite that allows them to set up their account. Conveniently, QuickBooks Workforce is accessible from any device, including mobile phones.

Benefits

The Benefits option in Intuit QuickBooks Online Payroll provides an easy way to obtain quotes and sign up for medical, dental, and vision insurance. You can easily view all quotes without obligation and fill out an application in minutes. Once the application is approved, your employees will be able to enroll themselves in any benefit plan that you offer.

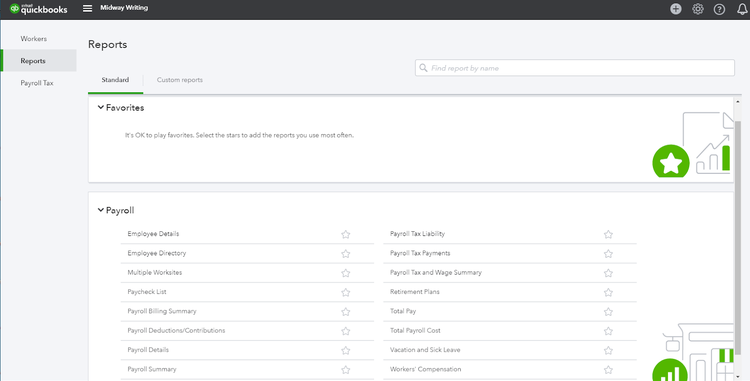

Reports

Intuit QuickBooks Payroll offers a rich selection of reports. One handy feature in Reports lets you click on the star next to any report, which then places the report at the top of the Reports screen for quicker access. You can also create and save custom reports for future access.

QuickBooks Payroll offers an excellent selection of payroll-related reports. Image source: QuickBooks Online Payroll software.

Intuit QuickBooks Online Payroll report customization is limited, but you can export reports to Microsoft Excel for further customization if needed.

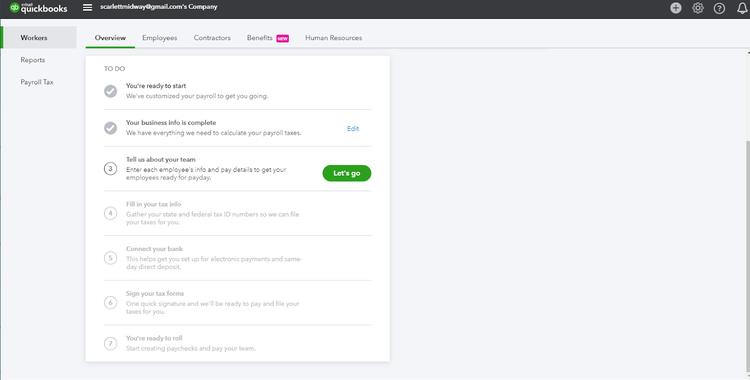

Intuit QuickBooks Online Payroll's ease of use

QuickBooks Payroll offers an easy onboarding process, the application guiding you step-by-step through each process. You do need to be prepared to enter the information requested, so be sure you have access to your federal and state tax ID numbers and banking information, which you'll need in order to complete the setup process.

Intuit QuickBooks Payroll offers an easy onboarding process. Image source: QuickBooks Online Payroll software.

Navigating through the application is easy, even for new users. Intuit QuickBooks Online Payroll offers intuitive system navigation, which includes an abbreviated menu bar, along with easy access to all included features from the main entry screen. Payroll can be processed in three steps, and with Auto Payroll, you can run payroll without entering any pay data.

Intuit QuickBooks Online Payroll's pricing

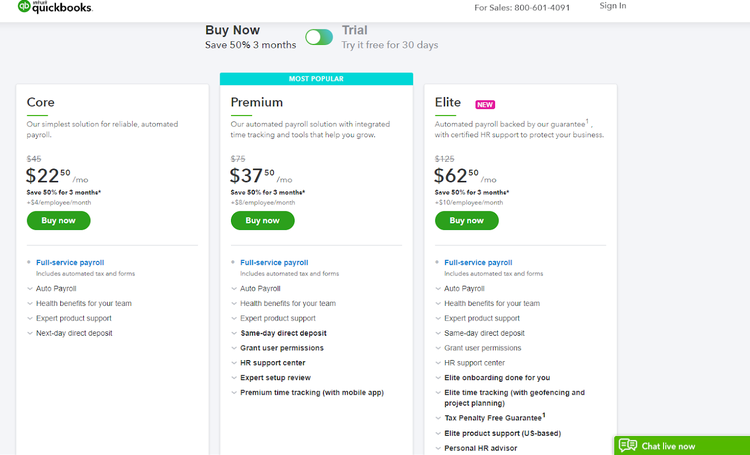

QuickBooks Payroll offers three plan levels, but what sets QuickBooks Online Payroll apart from other payroll providers is that even the lowest priced payroll plan offers full-service payroll processing.

QuickBooks Online Payroll offers three plans and all include full-service payroll. Image source: QuickBooks Online Payroll software.

This is a major bonus for small businesses that don't wish to handle their own payroll tax processing, filing, and remittance, but don't have a large enough budget to purchase one of the more expensive plans.

The Core plan is currently discounted 50% to $22.50 per month for the first three months, then goes to $45.00 per month, plus an additional $4 per employee. The Core plan does pay taxes, but it only files for one state, so if you pay employees in more than one state, you'll pay an additional fee of $12.

The Premium plan is currently discounted 50% to $37.50 per month for the first three months, then it goes to $75.00 per month, with an $8 per employee additional fee. In addition to the Core plan features, the Premium plan also offers same day direct deposit and the HR Support Center. The Center provides easy access to state and federal wage and overtime laws, assists with custom job descriptions and employee onboarding, and offers employee performance tools.

The Elite plan is currently discounted 50% to $62.50 per month for the first three months, which then jumps to $125 per month, plus a $10 per employee additional fee. The Elite plan offers onboarding, access to a personal HR advisor, plus all of the features found in the Core and Premium plans. The Elite plan also lets you pay employees in an unlimited number of states at no extra charge.

Special pricing is also available for those using QuickBooks Online.

Working with Intuit QuickBooks Online Payroll support

Phone and messaging support is included with all QuickBooks Payroll subscriptions. All payroll support is U.S. based, and available during regular business hours. In addition, QuickBooks Online Payroll offers easy access to numerous indexed support articles, as well as short, step-by-step training videos that guide you through various payroll tasks.

Benefits of Intuit QuickBooks Online Payroll

If you're a QuickBooks Online Accounting user, QuickBooks Payroll will allow seamless integration of your payroll application with your accounting software. Plus, you can automatically post payroll entries to your general ledger.

While the benefits may not be so obvious if you're a small business owner not using QuickBooks Online Accounting, you can still benefit from using Intuit QuickBooks Online Payroll. You will have affordable access to full-service payroll at any plan level, free direct deposit, and a portal that lets employees track vacation and sick time in the application.

Is Intuit QuickBooks Online Payroll Right for you?

While Intuit QuickBooks Online Payroll(QuickBooks Payroll) is optimally designed for small businesses that use QuickBooks Online Accounting, the application can also find a spot in businesses not currently using QuickBooks applications. If you have less than 15 employees and are looking for full-service payroll, QuickBooks Online Payroll may be worth a second look.

How QuickBooks Online Payroll Compares

| Online access | Direct deposit | Prepares federal tax forms | Employee access to payroll documents | |

|---|---|---|---|---|

| Intuit QuickBooks Online Payroll |

|

|

|

|

| Gusto |

|

|

|

|

| Payroll4Free |

|

|

|

|

| Payroll Mate |

|

|

||

| RUN Powered by ADP |

|

|

|

|

| Paycor |

|

|

|

|

FAQs

-

Yes, Intuit QuickBooks Online Payroll can be used as a standalone application, though you will reap more benefits including special pricing if you're a QuickBooks Online user.

-

Yes, next-day direct deposit is available for both employees and contractors, though you will have to pay an additional fee if paying contractors. The Premium and Elite versions of QuickBooks Online Payroll offer same day direct deposit, though it is only available for employees.

-

Yes. Support is U.S. based and both telephone and chat support is available at no additional cost.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.