It’s disheartening to get a notification that a customer has filed a credit card dispute resulting in a chargeback, especially when the client didn’t reach out to you first to give you a chance to respond to the situation.

A chargeback is time-consuming to fight and eats into your profits. However, you can -- and should -- develop prevention methods. Learn how to avoid chargebacks by including the six tactics below in your strategy.

Overview: What are chargebacks?

A credit card chargeback is what happens after a customer disputes a charge on their card and wins. The payment gets reversed, and you don’t get paid. Plus, you’ll also incur a chargeback fee. In some cases, it’s a valid complaint. Other times, it’s fraud.

The chargeback protection process began with the Fair Credit Billing Act of 1974 (FCBA). It gives guidelines to protect consumers from fraud, such as inaccurate or unfair billing practices. Individual credit card companies set rules for investigation timelines and procedures, which banks and payment service providers must follow.

Furthermore, many payment services revoke merchant accounts if you exceed a specified chargeback-to-transaction ratio, usually around 1% of your sales. Banks use reason codes to categorize disputes, which vary by the credit card company. Categories typically include issues with fraud, authorization, or processing.

Chargeback rates vary by industry, dispute resolution strategies, billing models, and transaction volumes.

6 ways your business can avoid chargebacks

Although some reversals occur from merchant error, fraudulent chargebacks continue to increase. As LexisNexis Risk Solutions’ “True Cost of Fraud Study” noted, “Retail fraud attempts have tripled since 2017,” with an average of $3.13 lost per $1 of fraud.

During and after a customer chargeback, businesses incur:

- Lost processing fees

- Chargeback investigation costs

- Merchandise redistribution expenses

- Management labor costs

- Chargeback fees

- Potential lost sales and customers

While it’s impossible to completely stop chargebacks, reducing payment reversals saves money and protects your business reputation. Use the best point of sale (POS) system and the following tactics to prevent credit card disputes.

1. Make your return and dispute process clear and easy

Many customers file a chargeback with a credit card company because it’s easy. By laying out your process from the get-go, you can show customers that it’s simpler and beneficial to contact you first.

Improve your return process by:

- Adding a return FAQ page: Review all returns and talk to your customer service teams to generate a list of frequently asked questions about your return process.

- Following up after purchases: Send a friendly email or text message post-purchase to verify receipt and satisfaction while asking customers if they have any questions or concerns.

- Automating your return process: Use a system where your customers can submit a return and track its progress online.

- Offering more ways to communicate: Provide 24/7 customer service via messaging, email, phone, and digital chatbots.

- Providing free return shipping: Although shipping is expensive, it may counter the fees incurred from chargebacks.

- Asking for reviews after a return: Share testimonials from buyers who have experienced your return process to encourage others to follow suit.

2. Use multi-layered payment protocols

A recent chargebacks report by Midagator found that Mastercard fraud disputes jumped by 9%, while Visa ones were up 5.4%. The majority of problems stem from card-not-present (CNP) transactions, which are common with online payments.

As fraud increases, so does the need for preventive measures, and 88% of surveyed businesses “use three or more fraud-fighting features or technologies,” according to a Kount and Chargebacks911 survey.

Prevent problems at checkout by taking a multilayer approach that uses:

- Chargeback prevention alerts

- Address verification services (AVS)

- Email verification methods

- Order validation tools, such as Shopify e-commerce plug-ins

- Phone number reverse lookups

- Shipping and billing address confirmations

- Device fingerprinting

- Buyer velocity limits for purchases

- Card security codes, also known as a card verification value (CVV)

Show consumers and employees where to find credit card CVV codes for purchases. Image source: Author

Also, your POS terminal may deploy various anti-fraud methods while keeping your business compliant with the payment card industry.

The LexisNexis report stated that for those who started using a multifaceted approach, 36% had to do fewer manual reviews, and 76% saw a reduction in fraud attempts.

3. Train staff on best practices

Your employees are the key to preventing credit card disputes. Any staff member who works with customer transactions or handles customer service should undergo training to help your company avoid chargebacks.

Implement an ongoing training program covering the best practices of handling Automated Clearing House (ACH) payments, such as teaching teams to recognize suspicious transactions and verify signatures.

It’s vital to collect evidence to prepare for disputes, so create protocols for both CNP and card-present situations. You may also need to set standards for getting signatures on various contracts or sales orders used in your business.

Many credit card processors provide notifications when customers dispute a charge. Set protocols for your customer service teams to ensure fast response times. Reach out to dissatisfied buyers as soon as possible to stop chargebacks.

4. Analyze your chargeback data

Collecting, assessing, and acting on data is crucial to all aspects of business, including for preventing chargebacks. Your POS system plays a big role here, and it must integrate with your payment solutions.

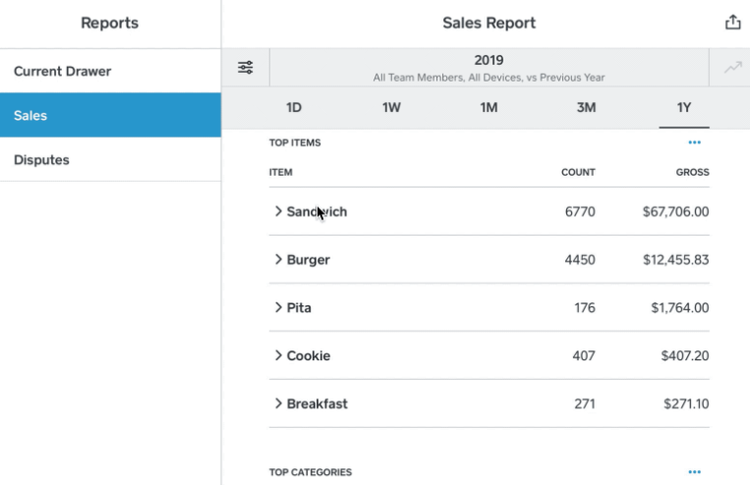

Explore your POS reporting options to find insights about your transaction data. Use your reports to identify trends indicating fraud from customers or employees. For instance, POS software, such as Square, offers advanced features, including fraud prevention and monitoring tools.

Keep an eye on transactions and dispute data from anywhere with mobile POS reporting features. Image source: Author

You may also want to use a chargeback management platform with real-time reporting. This software provides alerts to give you a heads-up about potential problems and reviews transaction data for deeper insights. Some integrate with other business software to supply a thorough look at your POS data.

5. Create a transparent shipping and billing process

A common complaint is that a customer didn’t receive the purchased item. While in some cases this is true, other times the customer doesn’t recognize the payment descriptor on their credit card bill or the product is still in the shipping process.

Clarify your process by:

- Offering enhanced shipment options: Provide delivery dates, package tracking, order status, and shipping insurance to set expectations and provide transparency.

- Updating customers about delays: Contact customers and post delays on your website so customers know when a package may be late.

- Alerting customers to out-of-stock purchases: If an item takes longer to deliver because it’s not in stock, give them an estimated date before purchasing.

- Using reputable dropshippers: If you use dropshipping, verify credentials and shipping process before selecting a company.

- Changing your payment descriptors: Dig into your POS features to figure out how to add extra information about purchases and your company on payment receipts.

6. Manage customer expectations

Customers have high expectations about delivery and response times. While it’s crucial to provide responsive customer service, it’s equally vital to set realistic expectations.

Each photo and description you use should reflect the actual product or service. Anything less and you’ll increase the risk of getting chargebacks for items not as described. Also, list your policies in multiple places on your website and immediately communicate to customers any variances to shipping times or product details.

Be proactive to avoid chargebacks

When it comes to chargebacks, the worst thing you can do is nothing. Develop a strategy to prevent payment reversals using information from your payment services, POS systems, and employees.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.