With the right tax software, your small business can save time and money when filing small business taxes. The size and complexity of your company are the most important factors when you're choosing tax software. Below, The Ascent compares some of the best tax software options on the market to help you make the right choice.

Filing your business taxes doesn't have to be difficult. Online tax software, sometimes referred to as an online tax service, can make the process much easier for small business owners, especially those who are filing business taxes for the first time.

The best tax filing services offer small businesses an easy way to track their business income, manage business expenses, and get the small business deductions they deserve. While these features are common, there are some major differences between tax preparation software applications that you should know about.

If you're looking for the best online tax filing software or service, read on. We'll highlight the best features of several tax software applications, making it easier to find the best software for your business.

| Product | Description | Next Steps |

|---|---|---|

|

H&R Block Self-Employed

Rating image, 4.60 out of 5 stars.

4.60/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

H&R Block recognized that people are interested in preparing their taxes themselves, so they offer both a downloadable application and an online tax preparation program easy enough for anyone to use.

|

|

|

TaxSlayer Self-Employed

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Though not a household name like its competitors, TaxSlayer is a worthy competitor in the online tax preparation category, offering four plans: Simply Free, Classic, Premium, and Self-Employed.

|

|

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

TurboTax is one of the most recognizable names when it comes to tax software, with good reason. They offer a variety of plans ranging from free, for simple returns, to business, for corporations.

|

|

|

TaxAct Self-Employed

Rating image, 4.30 out of 5 stars.

4.30/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

TaxAct Self-Employed is part of TaxAct’s suite of tax preparation applications that are available online, or as a download that can be installed on your desktop or laptop computer.

|

|

|

eSmart Tax

Rating image, 3.90 out of 5 stars.

3.90/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

eSmart Tax from Liberty Tax is one of the lesser known tax preparation offerings available on the market today. If you’re looking for something different, check out what eSmart Tax has to offer.

|

We’ve all heard of H&R Block. Founded by brothers Henry and Richard in 1955, H&R Block has been helping us prepare our taxes for more than half a century. Their online tax preparation software allows you to prepare and file your taxes using H&R Block expertise without ever leaving your house.

H&R Block offers a variety of plans suitable for first-time tax filers with uncomplicated needs to small business owners that want to maximize deductions for their small business.

H&R Block’s Self-Employed Online plan does just that, offering tools such as the Business Partner, which provides assistance in finding deductions and the Business Booster, which can help you calculate and deduct business-related costs for your startup.

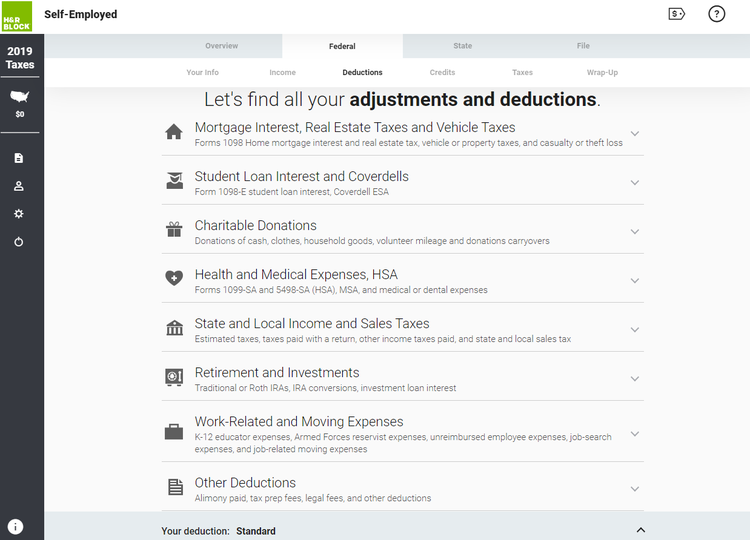

H&R Block lets you enter all appropriate adjustments and deductions for your business. Image source: Author

You can import W-2s and 1099s into H&R Block. If you want additional assistance, opt to purchase the Online Assist plan, which provides on-demand help from a tax professional when you need it.

H&R Block’s Self-Employed Online plan starts at $84.99. With Online Assist, the price goes to $153.99, with state filing costing an additional $36.99.

One of the biggest benefits of using H&R Block is the ability to go into one of their many locations across the country if you need assistance in preparing your return. And if you want to skip preparing taxes altogether, you can opt for the Tax Pro Go service, which allows you to have your taxes prepared online by a tax professional.

A mobile app for iOS and Android devices is also available.

Compared to industry giants such as H&R Block and TurboTax, TaxSlayer tends to fly a bit under the radar. Not the best fit for those filing business taxes for the first time, those more experienced in the tax preparation process will appreciate TaxSlayer’s no-nonsense approach.

TaxSlayer offers three plans, with all plans including complete credit and deduction capability, as well as an option to import W-2s. All plans include free phone and email support.

Another important feature in TaxSlayer is the Deduction Finder, which takes you through the process of exploring all possible deductions you may be able to take.

Another plus for self-employed and small business owners is TaxSlayer’s tax payment reminders, which are extremely useful for first time filers to avoid penalties for not paying quarterly taxes.

TaxSlayer offers excellent help options if you click on the question mark next to each option. Image source: Author

But what really sets TaxSlayer apart is their pricing. Right now, TaxSlayer is offering its Self-Employed plan for an incredibly low cost of $47, with state filing an extra $32.

Even more amazing is that this price includes access to a tax pro with self-employed expertise, as well as audit assistance and priority level email and phone support.

By far, the biggest benefit of using TaxSlayer is its low cost. While it doesn’t offer the bells and whistles found in some of its competitors, it offers everything needed to complete a tax return for your small business at a fraction of the cost. TaxSlayer also works on all iOS and Android devices.

In 2019, more than 40 million taxpayers filed their taxes with TurboTax. On the market for more than 30 years, TurboTax is designed to take you through the entire tax preparation process quickly and painlessly.

Especially well-suited for those preparing taxes for their small business for the first time, TurboTax also provides shortcuts for those comfortable with the tax preparation process.

TurboTax offers easy initial setup. Image source: Author

Some of the features found in TurboTax include the following:

- Asset depreciation

- Mileage tracking for ride-share drivers

- Charitable contributions

- Unlimited employee tax forms

- Education tax credits

TurboTax also integrates with QuickBooks Self-Employed, which can help sole proprietors with tasks such as invoice tracking, separating personal expenses from business expenses, and tracking quarterly tax payments.

TurboTax is one of the higher priced options for preparing your business tax return, coming in at $119.99. If you choose the Live version, which provides you with access to live support from a tax professional, it will set you back $199.99, plus an additional $44.99 to file a state return.

One of the benefits of using TurboTax is a free one-year subscription to QuickBooks Self-Employed.

A mobile app for both iOS and Android devices is available and can be used to snap receipt photos that can be imported into TurboTax if desired.

Founded in 1998, TaxAct is a reliable alternative to the more popular tax preparation applications. Better suited for those who are familiar with the tax preparation process, TaxAct Self-Employed is a good fit for small business owners, sole proprietors, and freelancers, and currently guarantees the maximum tax benefit for its users.

One of TaxAct’s most useful tools for small business owners is the Deduction Maximizer, which uses a step-by-step process to uncover deductions specific to your particular business. Data importing options are also available, including the option to import not just W-2s but donation receipts as well.

TaxAct makes tax preparation easy with the use of assistants including the following:

- Donation Assistant: Helps you create a donation event and add details on items donated.

- Stock Assistant: A must for those that own stock. The Stock Assistant helps you easily calculate your gains or losses on any stock transactions.

- Forms Assistant: Provides easy access to all available tax forms using the links provided in the Forms Assistant.

- Topics Assistant: The Topics Assistant is great for when you get stuck, or just want additional information on any tax topic.

TaxAct Self-Employed currently runs $64.95 plus an additional $44.95 for state filing. There are also separate pricing plans available for Partnerships, C Corporations, and S Corporations.

TaxAct offers easy deduction entry and review. Image source: Author

TaxAct benefits users as it’s priced lower than its competition. Its Assistants can be very helpful during the tax preparation process. TaxAct also offers a mobile device for both iOS and Android devices.

eSmart Tax from Liberty Tax offers easy online filing. The Premium plan, which is suitable for small business owners, sole proprietors, and freelancers, is best suited for those that are already familiar with the tax preparation and filing process.

eSmart currently supports Schedule D, which means that S Corporation owners can use the application to prepare and file their business tax return.

Other features available in eSmart Tax include the option to have their prepared return reviewed by a tax pro, as well as the ability to visit a Liberty Tax office to obtain additional assistance if needed.

eSmart Tax users can easily access their Tax Resources page, which provides access to Taxes 101, ACA forms, and filing instructions, as well as state and federal tax help.

eSmart Tax offers tax resources for subscribers on their website. Image source: Author

All eSmart Tax plans are currently priced at $44.95, including the Premium plan, with state filing an additional $36.95.

Benefits of using eSmart Tax include lower pricing, the ability to file an S Corporation return, and free audit assistance. eSmart Tax does not include a mobile app, though you can access the application using a web browser on your mobile device.

What The Ascent looks for in a great tax software

We all have different requirements when we're looking for great software of any kind, including tax software. Some may pay particularly close attention to how easy an application is to use, while others place more emphasis on the application's features.

Here are some of the things the Ascent looked for when reviewing these widely-used tax preparation applications.

Ease of use

We all want software to be loaded with cool features, but we also want it to be easy to access and use those features. In a perfect world, software applications would all be intuitive, so you don't have to spend hours staring at the screen wondering how to access a feature or perform a function.

That's why ease of use is so important. During a review, we pay particularly close attention to how easy a product is to use.

While tech-savvy individuals and those experienced in a particular software application will find navigation a breeze, for the rest of us, an application's ease of use can be the deciding factor in whether to purchase it.

Less is more

Instead of spending a lot of time entering a tremendous amount of data into a tax preparation application, wouldn't it be nice to be able to import the data found on your W-2 or 1099?

If you have only one 1099, it's probably not a big deal, but if you're self-employed, it's likely you're receiving at least a few 1099s at year end. Being able to import these forms can save you a tremendous amount of time.

Access to a tax professional

This can be particularly important to new business owners who have never filled out a Schedule C and have no idea which business expenses are deductible.

While all of the tax preparation software applications we examined do a good job (some better than others) at finding adjustments and deductions that your small business is entitled to, filling out a Schedule C for the first time is daunting. That's why having access to a tax professional can be key.

You may feel you've entered everything correctly, and chances are you have, but there's nothing better than having an experienced tax preparer or CPA look at your return prior to submitting it to the IRS. Chances are everything is correct, but with access to a tax professional, you don't have to take that chance.

How your business can benefit from using tax software

Your small business can benefit in many ways from using tax software. Here are just a few:

Save time

You'd be amazed at how quickly you can complete your tax return using tax preparation software. All tax preparation software is designed to be easy and efficient, taking you through the entire process in less time than you may expect.

If you're still preparing your taxes on paper, make the move to tax preparation software. You will never go back.

Maximize deductions

Unless you're a CPA or experienced tax preparer, you may not know what deductions are available to you. In fact, if this is the first year you'll be filing a tax return for your business, you may not know about any of the tax deductions you can take.

Tax software solves that problem immediately. It analyzes your answers to some simple questions asked at the beginning of the tax preparation process, guiding you to available deductions, credits, and adjustments that are all designed to reduce your tax liability.

Help avoid audits

The word "audit" can strike fear in the best of us. While no tax software can guarantee that you won't be audited, what they can do is reduce the risk of being audited by helping you prepare an accurate tax return. Not only that, but many of these applications also offer audit protection, guiding you through the entire audit process.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.