A Guide to Accounts Receivable Turnover Ratio

There are many accounting ratios that can be particularly helpful for your small business, but for those offering credit terms to their customers, none is as useful as the accounts receivable turnover ratio.

While it may sound complicated, calculating your accounts receivable turnover ratio is a lot easier than you may think. Read on as we provide you with easy steps and a formula for calculating your accounts receivable turnover ratio.

Overview: What is accounts receivable turnover?

If you’re familiar with bookkeeping basics and double-entry accounting, you know that accounts receivable is part of the accounting cycle. Calculating your accounts receivable turnover ratio helps you measure how effectively you manage your credit customers, and more importantly, how quickly you collect on their balances due.

Your staff bookkeeper or accountant or you can easily calculate your accounts receivable turnover using a simple formula which we will provide you along with tips on what the results mean.

Accounts receivable turnover ratio

Particularly useful when preparing financial projections, knowing your accounts receivable turnover ratio can give you greater insights into your business operations, allowing you to analyze and alter processes if necessary.

The accounts receivable turnover formula is easy to understand, even for small business owners without an accounting background, and all you’ll need is access to your financial statements to calculate your own ratio.

How to calculate accounts receivable turnover

Follow along as we give you step-by-step instructions on how to calculate your accounts receivable turnover ratio.

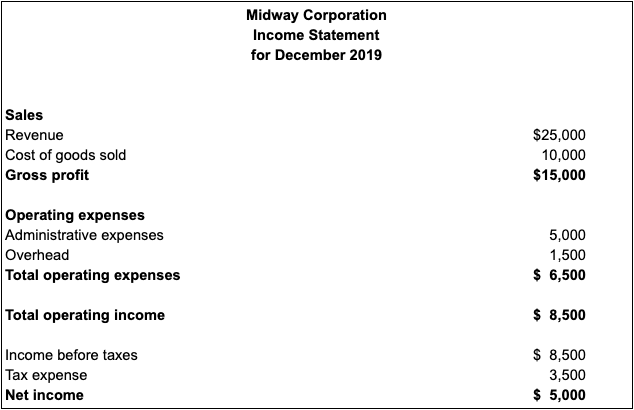

Step 1. Run an income statement

Your first step to calculating your accounts receivable turnover is to obtain your net sales for the year. You can get this number from your income statement or profit and loss statement.

Your income statement for the year will provide you with net sales for your business. Image source: Author

If you only sell on credit you won’t need to adjust your sales totals, but if you have cash sales as well, you will want to make an adjustment to your sales number before using it in your equation.

For instance, let’s use the following calculation to determine your net credit sales.

| Sales | $55,000 |

|---|---|

| Cash Sales | -$2,000 |

| Returns | -$550 |

| Net Credit Sales | $52,450 |

We will use $52,450 as our net credit sales total going forward.

Pro Tip: Be sure you only include credit sales in your calculation, since you are calculating your accounts receivable efficiency, you don’t want to include any cash sales. You will also want to subtract any adjustments such as returns.

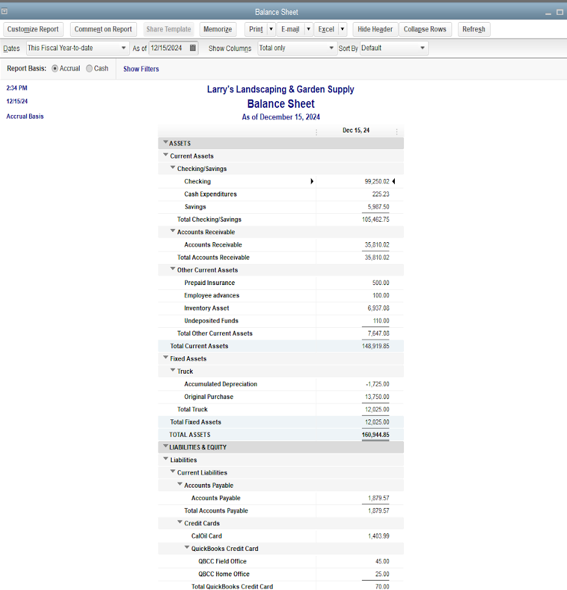

Step 2: Run a balance sheet

In order to complete the next step, which is calculating your average accounts receivable balance, you will need to run a balance sheet.

Your balance sheet is where you obtain the accounts receivable balance for a particular date. Image source: Author

You can run a balance sheet as of the first day of the year and the last day of the year, or you can run a comparative statement, which will give you totals for the last day of the previous year and the last day of the current year. Either method will give you your beginning and ending accounts receivable balances.

For the purpose of our calculation, we’ll say that our accounts receivable beginning balance as of 01/01/2019 was $2,700, with a 12/31/2019 ending balance of $2,500.

Pro Tip: Be sure that all of your transactions have been posted properly before you run your balance sheet in order to ensure that your calculations will be accurate.

Step 3: Calculate your average accounts receivable balance

Your next step is to calculate your average accounts receivable balance. This is done by adding your beginning accounts receivable balance from January of 2019 to your December 2019 ending balance, and then dividing the total by two to obtain your accounts receivable average. The formula would be:

($2,700 + $2,500) ÷ 2 = $2,600

That means that $2,600 is your average accounts receivable balance for the year.

Pro Tip: Be sure to complete the calculation by dividing the numbers by two in order to get your average, or your ratio will be incorrect.

Step 4: Calculate your accounts receivable turnover ratio

You have your net sales of $52,450 and your accounts receivable average of $2,600. You can now calculate your ratio. Here is the accounts receivable turnover equation or formula to use:

$52,450 net credit sales ÷ $2,600 = 20.17

Congratulations! You’ve calculated your accounts receivable turnover ratio. Now, what does it mean?

Pro Tip: Before you calculate this or any accounting ratio, be sure you understand what the result means.

Analyzing accounts receivable turnover

Accounts receivable turnover measures how effective your current accounts receivable collection processes are. But what exactly is A/R turnover, and what does it mean? A/R turnover is simply how quickly you collect on your accounts receivable balances.

If your customers frequently pay late, then chances are your number will be low. But if you rarely have a past-due customer, your accounts receivable turnover number will be higher.

But how do we know what the number means? In a nutshell, the higher the number, the faster you’re collecting on your accounts receivable.

To see how quickly, divide the number of days in the year by your result number, which in our case is 20.17:

365 ÷ 20.17 = 18.09

This means that your accounts receivable balances on average were being collected every 18 days.

- What a high accounts receivable number means: A high number means that on average you collect your accounts receivable balances frequently. Frequent accounts receivable turnover helps cash flow while also reducing the amount of bad debt you’ll have to write off at year-end. But too high of a number can mean that your current credit policies are too restrictive or that your sales department transactions are primarily cash based.

- What a low accounts receivable number means: A low number can indicate poor collection techniques or a lack of proper vetting of customers to indicate credit worthiness. It also means that your cash flow is likely hurting from the slow collection rate. If your number is low, revisit your credit policy to see if any adjustments need to be made.

The best accounting software for calculating accounts receivable turnover

While any accounting software that can track sales and accounts receivable can be used to determine your accounts receivable turnover ratio, these applications offer standout report capability, as well as a solid sales module to properly track your gross and net sales totals.

1. AccountEdge Pro

AccountEdge Pro is an on-premise application that offers small businesses everything they need to properly manage sales, including quotes, sales order processing, and invoice creation.

AccountEdge Pro offers excellent sales, invoicing, and reporting capabilities. Image source: Author

AccountEdge Pro lets you track both cash and credit sales, a necessity for calculating accounts receivable turnover ratio properly. It also offers excellent reporting capability including complete financial statements along with audit trail reports.

AccountEdge Pro is available starting at $149 annually. If you need remote connectivity, AccountEdge Pro Connect is available at an additional $25 per month.

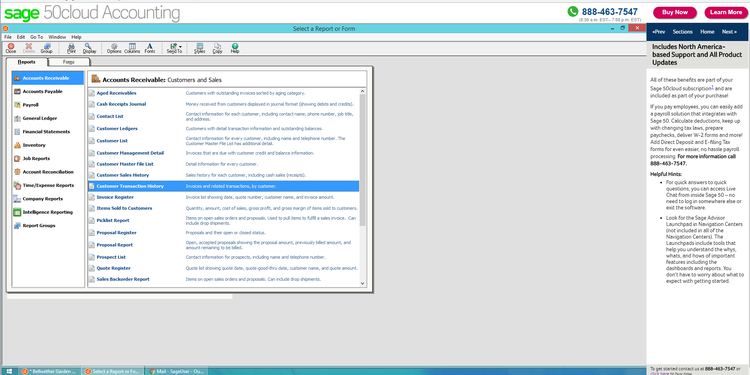

2. Sage 50cloud Accounting

Sage 50cloud Accounting is a hybrid small business accounting application that offers on-premise installation as well as online access via Microsoft Office 365.

Sage 50cloud Accounting includes a variety of accounts receivable reporting options. Image source: Author

The customer and sales navigation center in Sage 50cloud Accounting offers excellent management for all sales tasks, including quotes, proposals, sales orders, and invoicing.

You can easily track both cash and credit sales in the application, with easy accounts receivable tracking included. Reporting options are excellent in Sage 50cloud Accounting with complete financial statements, accounts receivable, and account reconciliation reports available.

Sage 50cloud Accounting starts at $278.95 annually for the Pro version of the application. Those interested in the more powerful Quantum Plan, which supports up to 40 users, can obtain pricing directly from Sage.

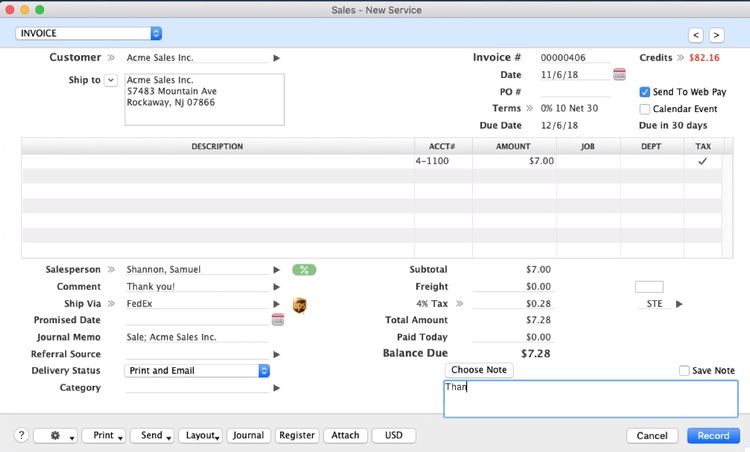

3. QuickBooks Online

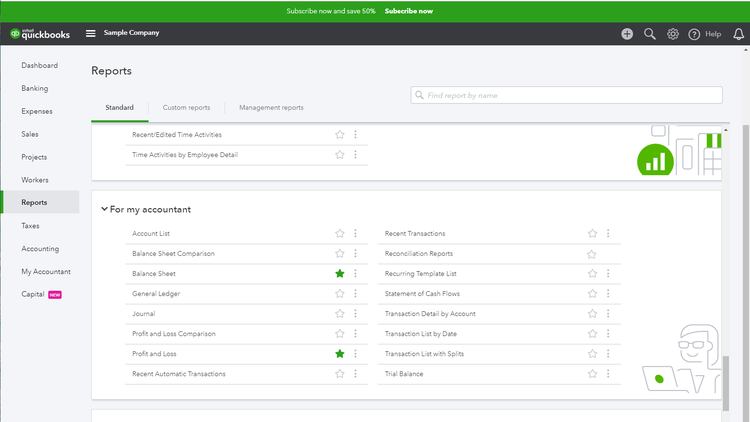

QuickBooks Online offers good sales and accounts receivable management in an easy to use application. Good for small and growing businesses, QuickBooks Online includes excellent reporting capability.

QuickBooks Online includes excellent reporting options for both you and your accountant. Image source: Author

QuickBooks Online Sales feature lets you assign customers credit terms, create invoices, and manage both customers and past due invoices from the sales screen. Reporting options are also good in QuickBooks Online, with the ability to create financial statements as well as various accounts receivable and sales reports.

QuickBooks Online starts at $10 per month for the first three months, with the Plus version running $35 per month for the first three months, with access to numerous apps available as well.

4. FreshBooks

FreshBooks is best suited for smaller businesses, particularly those that sell services rather than products, but offers excellent sales and invoicing capability, as well as integration with numerous apps in a variety of categories.

FreshBooks offers excellent reporting capability. Image source: Author

While FreshBooks doesn’t offer a structured sales module, it does include client estimates and invoicing, with the ability to track both cash and credit sales. FreshBooks reporting options are fairly basic, but both financial statements and sales reports are available.

FreshBooks starts at $15 per month for the Lite version, with the Premium plan priced at $50 per month.

Knowing your accounts receivable turnover ratio can help

Depending on the type of accounting you are doing, understanding accounts receivable turnover ratios can be useful.

Of course, if your business has limited customers or you rarely offer credit to customers, calculating your accounts receivable turnover ratio will likely be of little use to you.

But for those that sell on credit and have numerous customers, knowing how fast your accounts receivable balance turns over can be valuable, allowing you to make adjustments in your business operations if the number is too low, or even too high. It’s easy to calculate, and easy to interpret, so why not calculate your accounts receivable turnover ratio today?

To learn more about other small business accounting software that can help small businesses with accounts receivable management, check out our accounting reviews.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles