A Small Business Guide to Accumulated Depreciation

It’s been inculcated in many of our minds: A new car’s value declines the moment you drive it off the lot.

The same is true for many big purchases, and that’s why businesses must depreciate most assets for financial reporting purposes. Accumulated depreciation is one facet of the depreciation process.

Overview: What is accumulated depreciation?

Accumulated depreciation is a balance sheet account that reflects the total recorded depreciation since an asset was placed in service.

Bookkeeping 101 tells us to record asset acquisitions at the purchase price -- called the historical cost -- and not to adjust the asset account until sold or trashed. Businesses subtract accumulated depreciation, a contra asset account, from the fixed asset balance to get the asset’s net book value.

Net book value = Asset – Accumulated depreciation

The balance sheet provides lenders, creditors, investors, and you with a snapshot of your business’s financial position at a point in time. Accounts like accumulated depreciation help paint a more accurate picture of your business’s financial state.

How to calculate accumulated depreciation

To calculate accumulated depreciation, sum the depreciation expenses recorded for a particular asset.

Accumulated depreciation = Sum of depreciation expenses

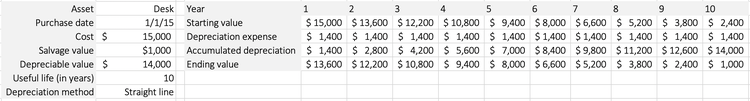

Say that five years ago, you dedicated a room in your home to create a home office. Your custom desk cost $15,000. You estimate the furniture’s useful life at 10 years, when it’ll be worth $1,000.

When you first purchased the desk, you created the following depreciation schedule, storing everything you need to know about the purchase. Like most small businesses, your company uses the straight line method to depreciate its assets.

Your depreciation schedule should track your accumulated depreciation balance. Image source: Author

To make sure your spreadsheet accurately calculates accumulated depreciation for year five, recalculate annual depreciation expense and sum the expenses for years one through five.

Straight line depreciation applies a uniform depreciation expense over an asset’s useful life. To calculate annual depreciation, divide the depreciable value (purchase price – salvage value) by the asset’s useful life. The desk’s annual depreciation expense is $1,400 ($14,000 depreciable value ÷ 10-year useful life).

Accumulated depreciation for the desk after year five is $7,000 ($1,400 annual depreciation expense ✕ 5 years).

How to record accumulated depreciation

At least annually, but preferably monthly, you should book a depreciation journal entry for each eligible asset. The accounts involved remain the same: debit to depreciation expense and credit to accumulated depreciation.

The journal entry looks the same every time you record annual depreciation for the $15,000 desk:

| Account | Debit | Credit |

|---|---|---|

| Depreciation expense | $1,400 | |

| Accumulated depreciation -- desk | $1,400 |

Accumulated depreciation is a repository for depreciation expenses since the asset was placed in service. Depreciation expense gets closed, or reduced to zero, at the end of the year with other income statement accounts. Since accumulated depreciation is a balance sheet account, it remains on your books until the asset is trashed or sold.

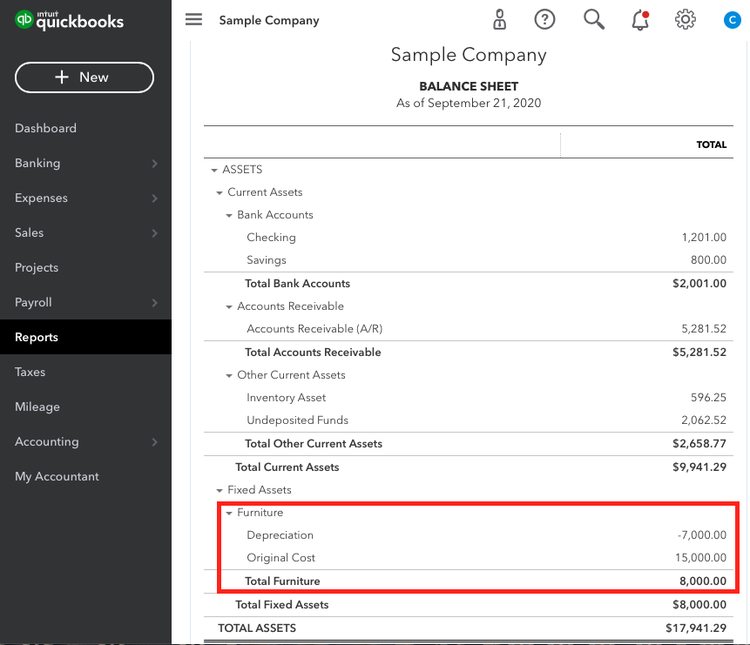

For year five, you report $1,400 of depreciation expense on your income statement. The accumulated depreciation balance on your balance sheet should be $7,000. The desk’s net book value is $8,000 ($15,000 purchase price – $7,000 accumulated depreciation).

Accumulated depreciation should appear next to its affiliated asset on your balance sheet. When you correctly set up an accumulated depreciation account, software like Quickbooks Online automatically calculates an asset’s net book value.

Accumulated depreciation should appear next to its affiliated asset on the balance sheet. Image source: Author

FAQs

-

Yes, you should have a dedicated accumulated depreciation sub-account for every asset your business is depreciating. Each account name should start with “accumulated depreciation” followed by the name of the asset.

Sub-accounts provide more detail for an account that encompasses many types of transactions. You can set up sub-accounts in your accounting software.

-

Depreciation for intangible assets is called amortization, and businesses record accumulated amortization the same as accumulated depreciation. They’re the same thing, but they go by different names.

Intangibles such as trademarks and email lists acquired from third parties must be amortized over their useful lives.

-

When you sell or dispose of an asset, you need to remove both the asset account and its accumulated depreciation from your books.

You can continue to accrue depreciation expense until you get rid of the asset, so don’t forget to book your last adjusting entry for depreciation before disposing of it.

Say your restaurant is selling a freezer for $1,000. According to your general ledger, the asset’s balance is $10,000 with accumulated depreciation of $6,000, for a net book value of $4,000.

From an accounting perspective, you’re selling the freezer at a $3,000 loss ($1,000 sale – $4,000 net book value). Record the sale and disposal in the same journal entry.

| Account | Debit | Credit |

|---|---|---|

| Cash | $1,000 | |

| Accumulated depreciation -- freezer | $6,000 | |

| Loss on sale of asset | $3,000 | |

| Freezer | $10,000 |

The journal entry adds cash from the sale, removes the asset from your books, and eliminates the accumulated depreciation associated with the asset. Finally, it recognizes either a gain or loss on the sale or disposal of the asset.

When you sell an asset at a gain, credit the account “gain on sale of asset.” Debits must equal credits: When everything else is correct, you can fit the gain or loss account as the last puzzle piece in your journal entry.

Accumulate accurately

Your accounting software stores your accumulated depreciation balance, carrying it until you sell or otherwise get rid of the asset. Each year, check to make sure the account balance accurately reflects the amount you’ve depreciated from your fixed assets.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles