The world of work is changing. With advancements in technology and the rise of the gig economy whereby people take on various “gigs” or projects for different employers, businesses are increasingly looking to hire contract employees.

Take a marketing agency that takes on different clients and projects. One project they take on requires Squarespace expertise and back-end programming skills. They don’t want to hire a full-time employee as they only need these skills for this project. So, they hire an independent contractor for a short period of time to work on this specific project.

But hiring a contract employee requires a different approach than hiring a salaried worker.

Overview: What is a contract employee?

First, let’s clear up the difference between freelancers and contractors. The words are often used interchangeably, but there is a slight difference. Contractors generally only work for one client at a time, often full time, while freelancers work for multiple clients at the same time.

Often people will switch between being a contractor and a freelancer as different projects come in, as they progress in their career, and as their situation changes, for example, they move home or have a child.

This matters to you because if you hire a contract employee full time on an ongoing basis, you could be misclassifying them as a contractor and get into trouble with the tax authorities. We’ll discuss misclassification later on.

Contracted vs salaried employee: What’s the difference?

There are a number of differences between permanent and contract employment that you need to be aware of before you make the decision about who to hire, as we’ll discuss below.

Tax Considerations

Contractors are responsible for their own tax, which means you don’t have to pay employment tax, social security tax (FICA), or unemployment tax. You also save time having to calculate tax on their paycheck. You only pay contractors the flat amount they charge, which is considerably easier to handle.

When you first hire a contractor, you have to send them a W-9 form, so they can fill out their tax details. You then use the information from this form to fill out a 1099-NEC federal tax form stating the amount paid to independent contractors by the company during that year. You have to send a W-9 form to all contractors at the start of every tax year to make sure you include the correct information.

If you’re hiring a contract employee from outside the US, then you need to send them a W-8 form to fill in to report their independent contractor taxes instead of a W-9.

Employer Costs

If you hire a contractor as opposed to a salaried employee, you don’t have to pay benefits or worry about paying minimum wage. This can extend to perks of the job, such as a company car, travel allowance or transport subsidy, meal tickets, or something as basic as coffee, tea, fruit, and milk.

You also don’t have to worry about providing equipment such as a laptop or business software or provide an office or any facilities.

As contractors set their own hours and availability, this means that they might not be able to carry out urgent tasks, or you have to pay more if you want them to complete a project in a short time frame.

While you might provide contractors you use regularly with some form of training depending on the project, this isn’t normally a requirement, whereas you will almost always train your salaried employees during the onboarding process.

What happens if you misclassify?

Misclassifying people as contractors when you really should be classifying them as salaried employees is a major mistake and one that can cost you dearly. Uber has been fighting lawsuits on several fronts over whether its employees should be classified as contractors or salaried workers, and they could face hefty fines if they are found to have misclassified their drivers.

If you misclassify workers, you’ll have to pay back taxes, unemployment and workers' compensation liabilities and any benefits you should have been providing during the period of employment.

You can’t choose how you want to classify workers. Instead, you have to classify them according to rules specified by the IRS. There are 20 factors you need to take into account when classifying your workers, including whether they’ve received training, how you pay them, whether they work in your office, and whether the worker is free to work for other companies.

And if you’re not sure how to put together a contract of employment for a freelancer then make sure you get legal advice to ensure that you don’t end up on the wrong side of the IRS.

Benefits of hiring a contracted employee

If you’re a fast-moving, agile startup or small business, hiring a contracted employee can provide more flexibility, give you access to a wider pool of talent, and save you time and money.

Find the best person for the job

When you work for a startup or small business, you end up doing work that is way outside your area of expertise. I once worked for a company where I ran the reception, reported the news, and was the backup IT manager. That’s because there wasn’t the budget or need to hire a full-time person for each of these roles.

That’s where hiring contract employees can help. You can hire a highly skilled worker for just a few hours a week to provide IT support or report on the news. You can also tap into a wide range of talent across the globe.

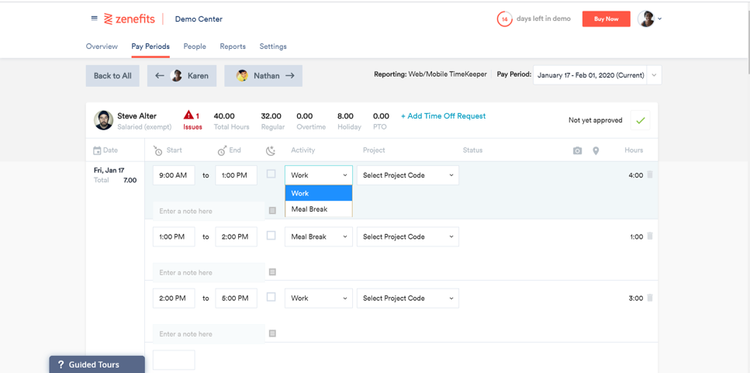

Leading HR software such as Zenefits allow you to manage contract workers and salaried employees within the same system, so you don’t need to worry about any extra admin involved with managing different types of employees.

Zenefits lets you manage salaried and contract workers within the same system. Image source: Author

Provides more flexibility

All businesses have peaks and troughs. One month they’re flush with work, the next there’s nothing happening. This means that your employees are either working round the clock or twiddling their thumbs.

If you hire contract employees, you can scale your workforce up and down according to your workload. It’s also easier if you decide to follow the contract-to-hire model and recruit one of your freelancers as a full-time employee. You know and like them, they’ve proven their skills, and they are familiar with your business.

Save time and money

You don’t have to pay taxes and social security and offer benefits when you hire a contract worker. You can save time, as contract workers require a lot less admin, for example when it comes to creating paychecks.

Another area where you can save time is in the hiring process. Recruiting a full-time employee takes a long time. You have to post a job ad, source candidates, screen and interview them, and then wait while they serve their notice. In contrast, you can hire a contract worker within days, especially if you already have some contacts or people who have worked for you before.

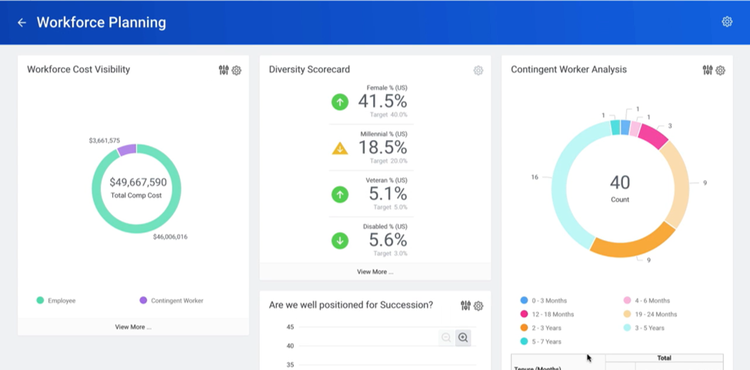

If you want to keep on top of how much money you’re saving (or spending) by hiring contract employees, you can track this in certain HR solutions. Workday, for example, provides an overview of the total cost of your workforce, as well as what percentage of that cost is being spent on contract workers.

Workday provides an overview of the cost of your contractors. Image source: Author

When should you not hire a contract worker?

Contract workers can be very beneficial for your business, but they aren’t always the right option. Here are some situations where you shouldn’t hire a contract worker.

When you need long-term support

The law specifies that contractors can only work 1,040 hours for any employer each year. If you need a lot of support over a long timeframe then you need to hire a salaried employee, or you’ll face the ire of the IRS over misclassifying your workers.

When you have a lot of short deadlines and urgent projects

One of the benefits of being self-employed is that you can set your own hours and schedule and decide how much time you will work for any company.

This means that you can’t rely on contractors to be available if you have an urgent piece of work. You can’t ask them to drop what they are doing and work on your project, as they have commitments to other clients. If they do agree to do an urgent project, then they will probably charge a lot more for it.

When you have specific staffing requirements

Contract workers might not be right for your business if you have to maintain specific business hours and when you need workers to change shifts regularly. You also don’t have the flexibility to upskill and retrain contractors, or to ask them to do different tasks than the ones you hired them to do.

Consider your business needs

While hiring contractors might seem very attractive due to the cost and time savings and access to a wider pool of talent, you need to consider the needs of your business first.

Do you have the processes in place to be able to manage contract employees? Are you sure you understand the law when it comes to classifying contract employees? How are you going to find and hire contract workers?

And if you’re thinking about hiring contract employees solely because you’re struggling financially, you should understand what the underlying issues are first.

When you have a strategy in place that takes into account these issues, then you can start to reap the many benefits of contract workers.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.