When I started my first job, I had a limited professional wardrobe. I remember carefully rotating my suits, careful not to wear the same combination to the office more than once per week.

As my salary grew, so did my wardrobe, with my closet quickly becoming crowded with suits, blouses, sweaters, and other items. And while my options grew, it made getting dressed for work more difficult, as I was now presented with so many different options, all stuffed together in my tiny, overflowing closet.

QuickBooks Online is kind of like my overflowing closet. It packs a ton of features into one small space (or screen), making it difficult to determine what it is you actually want to do. This is nowhere more obvious than on the sales screen, which also doubles as the accounts receivable feature.

Packing dozens of sales and accounts receivable options into a single screen, QuickBooks Online can quickly overwhelm new users who may spend minutes or hours trying to figure out what the heck they want to do. Worse, they may know what they want to do, but have no idea how to do it.

While some may see this consolidation of features as a convenient way to view all sales transactions, others may find themselves overwhelmed by the sheer volume of information displayed on the screen.

It includes overdue invoices, invoices coming due, invoices that show they’re paid, invoices that show funds deposited, along with options to send a payment reminder, print the invoice, void the invoice, delete the invoice, and even duplicate the invoice.

Too many options, too many choices, which can be overwhelming for new business owners jumping into the accounting arena for the first time.

When might QuickBooks Online’s accounts receivable function not be a good fit?

If you’re looking for any of the following options, you might be better off looking for an alternative to manage your accounts receivable. One terrific alternative is Sage Business Cloud Accounting, built specifically for small businesses, sole proprietors, and freelancers looking for an affordable, easier-to-use application.

1. Simplicity

If you want an easy way to view customer balances without a lot of unnecessary options, QuickBooks Online is likely not your best choice. While accounts receivable reporting options are good, customer balances and past due invoices tend to get lost in the application.

And new users will quickly find themselves overwhelmed by the numerous options and choices available on the sales screen when all they want is an accounts receivable balance.

2. Intuitive system navigation

Do you look at QuickBooks Online and instantly long for less? Less data, fewer choices, less everything? It’s great that the application offers so many different options, but it would be nice if they all weren’t offered on a single page.

3. Easier payment options

If you’re interested in accepting electronic payments using QuickBooks Online, you’ll have to subscribe to QuickBooks Payments. But Sage Business Cloud Accounting lets you easily set up and accept ACH payments from customers by simply setting up payment information in the customer profile.

Sage Business Cloud Accounting’s alternative to QuickBooks Online’s accounts receivable function

If you're looking for an easy-to-use accounting software application that offers the features you need in an accessible format, you may want to take a look at Sage Business Cloud Accounting, which offers many of the features found in QuickBooks Online at a reasonable price.

Overview of Sage Business Cloud Accounting

Designed to compete with accounting software applications such as FreshBooks and Xero, Sage Business Cloud Accounting offers intuitive navigation and a powerful mobile app, making this the perfect choice for on-the-go small business owners who never know when or where they’ll be managing their business.

Sage Business Cloud Accounting is probably best suited for sole proprietors, freelancers, and very small businesses who intend to remain small.

The application does offer a starter plan, Accounting Start, but even sole proprietors will be better served to skip the basic plan and go right to the full Accounting plan, which is offered at $25/month, affordable for just about any budget, and priced below the majority of QuickBooks Online plans.

Even with its low cost, Sage Business Cloud Accounting doesn’t skimp on features, offering sales, expenses, contacts, banking, and reporting options, with the ability to connect to an additional 100 apps if needed. The application also offers complete bank connectivity, with an option to connect to the bank completely, or just import bank statements at end of month (EOM) for easy reconciliation.

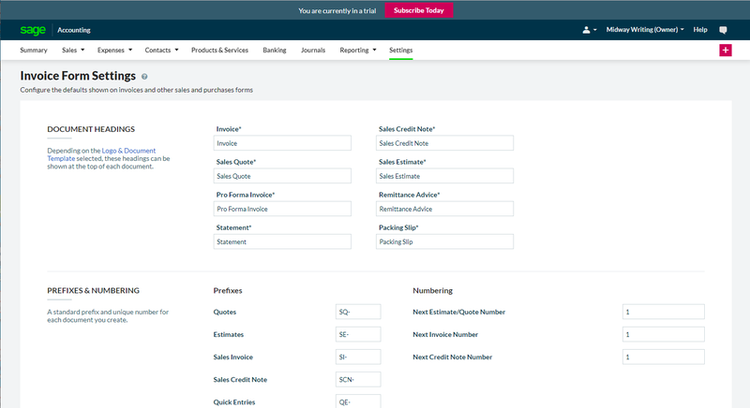

Everyone knows good accounts receivable management starts with solid invoicing capability. You can easily create a custom invoice in Sage Business Cloud Accounting, choosing invoice preferences before an invoice is ever created.

The Invoice Form Settings feature in Sage Business Cloud Accounting allows you to easily customize your customer invoices. Image source: Author

You can also create a batch of invoices simultaneously, a great option if you need to invoice multiple customers regularly. The application also offers complete integration with Stripe, making it easy for your customers to pay you directly from their emailed invoices.

Surprisingly, Sage Business Cloud Accounting also offers basic inventory management -- rare in such a low-cost application -- that allows you to track both inventory and non-inventory items as well as services, with the option to enter up to three pricing levels for each product or service you enter.

If you need to connect with other apps, Sage Business Cloud Accounting has made it simple, with an option to connect the apps from within the application using the built-in app integration setup option.

Read The Ascent’s complete Sage Business Cloud Accounting review

Overview of Sage Business Cloud Accounting’s accounts receivable function

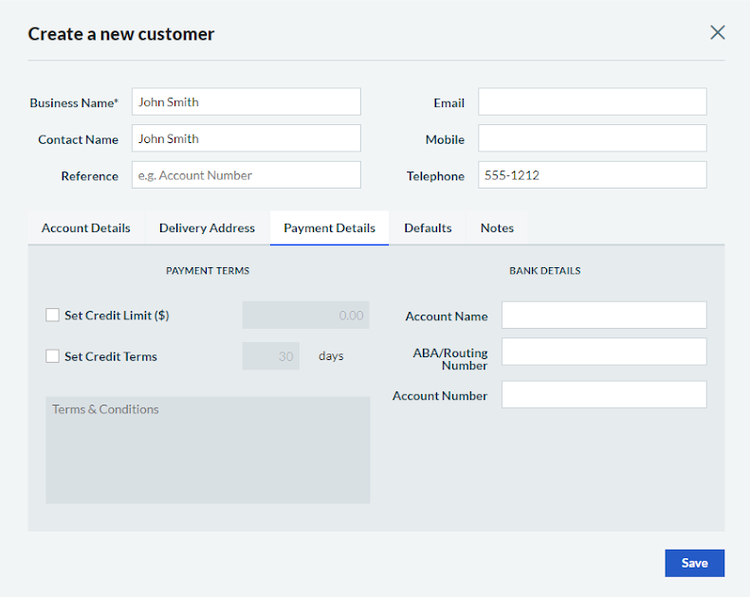

The accounts receivable function in Sage Business Cloud Accounting starts with invoicing. You can easily enter a new customer on the fly when creating an invoice. There’s also room to add additional customer details including tax rate, payment details, credit limits, credit terms, as well as a place to add customer bank details for ACH payment including the bank account name, routing number, and account number.

The Create a new customer option in Sage Business Cloud Accounting allows you to easily manage extensive detail for each customer. Image source: Author

You can also establish a price default as well as set the default language for each customer as well.

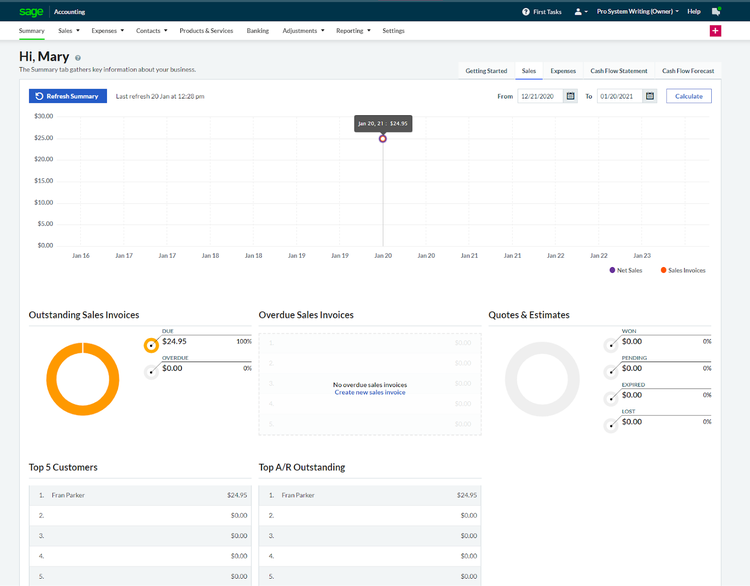

Once you enter an invoice, you can save and email the invoice directly to your customer, or print and mail the invoice if you desire. Once an invoice has been entered, it will be displayed on the Sales Summary page, where you can find a total of all invoices due, any that are past due, as well as a list of your top five customers and the top outstanding accounts receivable balances.

If you provide your customers with quotes or estimates, you’ll also be able to view those totals from the sales summary page as well.

The Summary screen in Sage Business Cloud Accounting includes a summary of important totals, such as outstanding invoices and overdue invoices. Image source: Author

Any outstanding balances can also be viewed directly from each customer’s individual account. When your customer pays, you can record the payment automatically by connecting your bank accounts with Sage Business Cloud Accounting, or you enter the payment manually by using the Receipt option, which is available in the banking feature.

In addition, you can add a credit to a customer’s account, make an adjustment to an account, or access the accounts receivable aging report, which provides you with an overview of all customer account balances. The accounts receivable report can be run for a single customer or all customers and is broken down into specific aging periods.

You can also choose a specific time frame that you wish to run a report for if you desire. Both summary and detailed accounts receivable aging reports can be run, and you can easily export the report as a CSV file or save it as a PDF if desired.

Other related reporting options available in Sage Business Cloud Accounting include a Receipts report, a Sales Revenue report, and an Online Payment report -- an excellent option that can be used to reconcile all incoming online payments to ensure they’re posted correctly.

While all the features make it easy for small business owners to manage their accounts receivable, perhaps the true value of Sage Business Cloud Accounting can be found in just how easy it is to use. Even those new to accounting software and the accounting process itself will find it easy to navigate the application, create a product or service, and process sales and accounts receivable balances for their customers.

Want to learn more? Check out The Ascent’s Sage Business Cloud Accounting review

Expensive isn’t always better

Don’t let Sage Business Cloud Accounting’s affordable price tag fool you. The application offers everything a new business owner needs to manage their accounts receivable -- and their entire business -- properly.

While QuickBooks Online may be a better choice for growing businesses, those looking for an accounting software application for the first time will appreciate Sage Business Cloud Accounting’s intuitive navigation, uncluttered data entry screens, and affordable pricing.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.