Your business’s financial position can’t be explained by just one financial statement. However, if you combine the balance sheet and income statement, you'll have a better understanding of your overall position.

Creditors and investors often turn to these statements to assess your business’s growth, profitability, and value. There are five types of accounts in the general ledger found in your accounting software, and they’re found on either the balance sheet or the income statement.

Overview: What is a balance sheet?

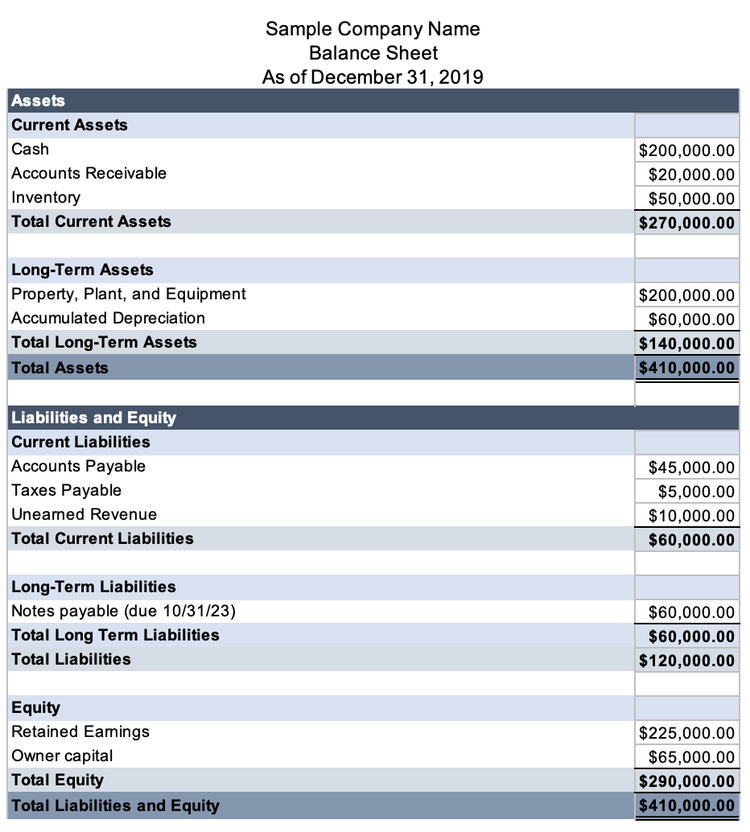

The balance sheet lists what your business owns and owes. Investors and creditors use the balance sheet to assess the health of your company’s finances. Think of the balance sheet as a snapshot of your business. It shows your company’s financial position as of a specific date.

Your business balance sheet covers three of the five account types: assets, liabilities, and equity. The balance sheet format proves a central accounting formula:

Assets = Liabilities + Equity

Assets are anything your business owns, including cash, accounts receivable, inventory, machinery, and property. Intangible assets, things of value that you can’t touch or feel, are included here, too.

There are two types of assets: current and long term. Current assets can be converted into cash quickly, like inventory, while long-term assets are items you plan to keep for many years, such as property.

Liabilities are your business’s debts, including accounts payable and notes payable. Like assets, liabilities are split into current and long-term categories. Current liabilities have due dates within the next year, and long-term liabilities are due farther in the future.

Equity is the amount of money you and your investors have put into the business. You'll know you've created an accurate balance sheet when the sum of equity and liabilities is the same as, or balances with, your assets.

The balance sheet proves a fundamental accounting equation: Assets = Liabilities + Equity. Image source: Author

Freshbooks Microsoft Excel template.

The balance sheet is a powerful analytical tool for investors and creditors, but it doesn’t provide a full understanding of your company’s value.

First, the value of individual assets on your balance sheet seldom increases: You must record assets at the cost you paid for them, and most long-term assets need to be depreciated. Assets remain at their historical value, or book value, and are not increased to market value.

Second, the balance sheet shows your company’s assets and liabilities on a certain date, but like your personal bank account, it can change daily.

Imagine if your balance sheet is produced right after you pay off a substantial debt and before you deliver a sizable order to a customer. Your cash position is only temporarily low, but you can’t always explain that in the balance sheet.

Finally, the balance sheet doesn’t show your company’s income. It’s harder to see growth in a balance sheet because not all businesses grow by acquiring more assets. Service businesses show growth through increasing revenue, for example.

What is an income statement?

Also called a profit and loss statement, an income statement shows your business’s earnings for a given timeframe. Accounts on the income statement are either revenue or expense accounts.

There are many income statement formats, but all of them demonstrate the income statement formula:

Revenue - Expenses = Net income

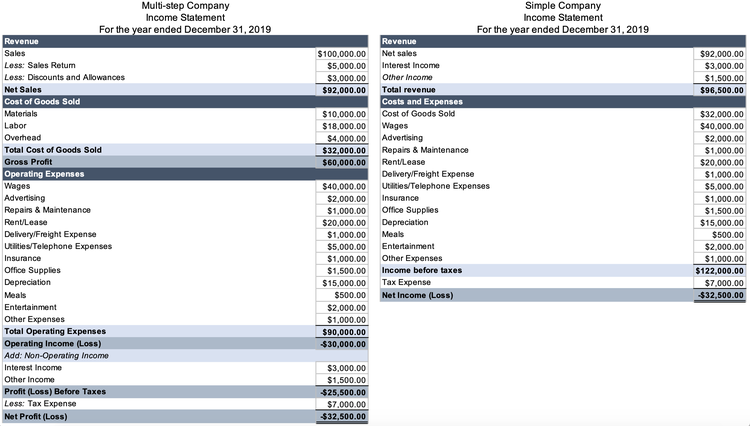

A traditional income statement outlines revenue, expenses, and net income in either a simple or multi-step format.

The multi-step income statement separates business operations from other activities, such as investing. The more detailed format gives readers insight into your business’s true health without influence from your business investments.

The multi-step income statement (left) calculates gross profit, unlike the simple income statement (right). Image source: Author

Freshbooks Microsoft Excel template

You’re looking at a multi-step income statement when you see gross profit, which is the difference between sales and cost of goods sold.

The most valuable line of a multi-step income statement is operating income. Since the format distinctly expresses operating expenses, it’s easy to see how your business is faring aside from investing.

Read alone, the income statement doesn’t give the full picture of a business’s health. There’s a net operating loss in the example above, but there’s no place to explain that it was due to a pandemic that closed the store for months.

The income statement doesn’t explicitly reference a company’s debt. Revenue might appear strong, but if the business has a looming debt payment and little cash, you might reconsider its health.

Balance sheet vs. income statement: What’s the difference?

The balance sheet and income statement are both part of a suite of financial statements that tell the story of a business’s history. The balance sheet is like a photo of your bank account and student loan account on a specific date. If you get paid the next day, or your student loan gets forgiven, the photo doesn’t change.

A balance sheet shows one point in time, whereas the income statement shows a company’s performance over some time, usually a quarter or year. The income statement is like your child’s report card: You’re looking at his or her final grades, but it reflects your child’s work over the year.

The five account types fall into two categories: balance sheet accounts (assets, liabilities, and equity) and income statement accounts (revenue and expenses).

While there's no overlap in balance sheet and income statement accounts, net income appears on the balance sheet as part of retained earnings, an equity account.

Unlike balance sheet accounts, income statement accounts get reset in the accounting cycle, where revenue and expense accounts get “closed” to zero at the end of the year so your business can start fresh next year. During the closing process, all revenue and expense account balances go to zero.

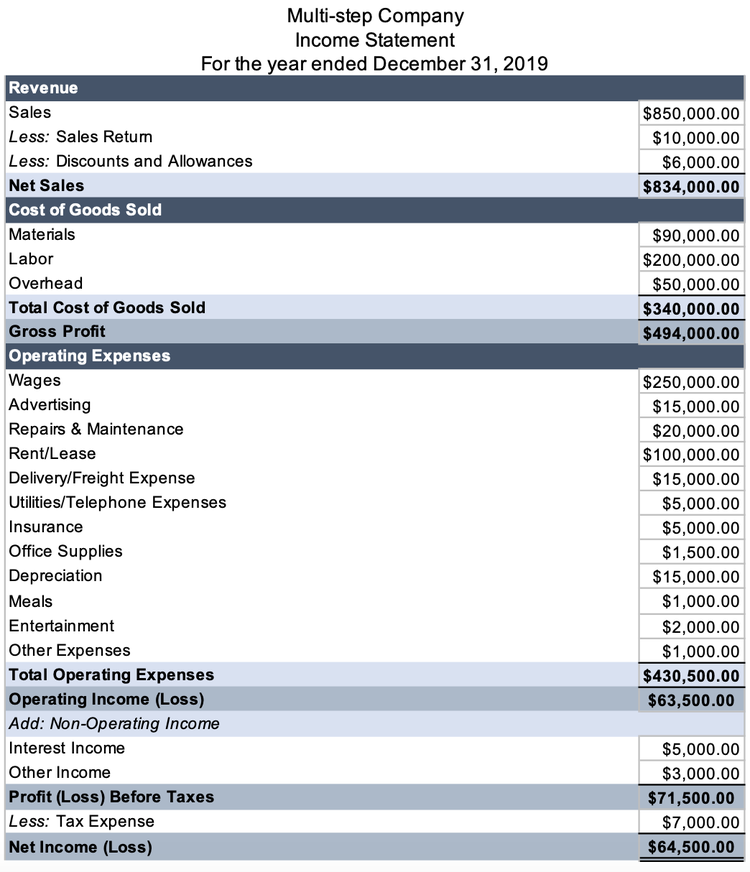

Consider the following income statement, where net income is $64,500.

The company’s multi-step income statement shows a net income of $64,500, which will increase retained earnings. Image source: Author

Before you create your balance sheet, calculate your retained earnings for 2019. At the end of 2018, retained earnings had a balance of $160,500.

From bookkeeping basics, we know revenue accounts have a normal credit balance, and expenses have a normal debit balance. When closing accounts, you do the opposite.

Revenue, including non-operating income, is $842,000 ($834,000 net sales + $5,000 interest income + $3,000 other income).

| Debits | Credits | |

|---|---|---|

| Dr. Net Sales | $834,000 | |

| Dr. Interest Income | $5,000 | |

| Dr. Other Income | $3,000 | |

| Cr. Retained Earnings | $842,000 |

Expenses are $777,500 ($340,000 cost of goods sold + 430,500 operating expenses + $7,000 tax expense).

| Debits | Credits | |

|---|---|---|

| Dr. Retained Earnings | $777,500 | |

| Cr. Cost of Goods Sold | $340,000 | |

| Cr. Expenses | $430,500 | |

| Cr. Tax Expense | $7,000 |

The new retained earnings balance is $225,000 ($160,500 beginning balance + $842,000 revenue – $430,500 expenses).

The effect on retained earnings is $64,500 ($225,000 - $160,500), the company’s 2019 net income.

Now, you can create a balance sheet where Assets = Liabilities + Equity.

Retained earnings increased by the net income amount to make the balance sheet accurate. Image source: Author

Together, they tell your business’s story

The balance sheet and income statement are two of the most important financial statements business owners can use to analyze their company’s financial position.

Look at them as a package because each one helps fill in the other’s blind spots. Add in the cash flow statement and you'll have a full picture of your business’s financial health.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.