This guide is designed to simplify the bookkeeping process for you, providing you with the basics from proper setup of all of your accounts to why it’s important to record transactions promptly.

Here are the bookkeeping basics you should know:

- Become familiar with and set up your chart of accounts.

- Begin to record all of your financial transactions.

- Reconcile bank accounts.

- Close the month and run financial statements.

Overview: What is bookkeeping?

Simply put, bookkeeping is the recording of a business’s financial transactions. Any transaction with financial implications needs to be recorded by a bookkeeper. Sounds fairly simple, doesn’t it?

However, for the novice, the introduction of bookkeeping-specific vocabulary and the rules that govern proper bookkeeping processes can be overwhelming.

Accountant vs. bookkeeper: What’s the difference?

While the job of bookkeeper may appear similar (or the same) as an accountant, they are only similar on the surface. A bookkeeper records all of the financial transactions for a business, while an accountant’s job is to interpret and analyze the data recorded by the bookkeeper.

Bookkeeping basics: The accounts you should know

There are five bookkeeping accounts you should know and understand:

- Assets: Anything of value in your business is considered an asset. This includes cash in your bank accounts, your accounts receivable (A/R), balance (since that is money owed to you by customers), as well as inventory, computers, and furniture.

- Liabilities: Any debts owed by your business are considered liabilities, such as your accounts payable (A/P) balance, (since that is what’s owed to vendors), as well as any loans the business owes.

- Revenue/income: Revenue, also called income, is simply any monies earned by your business either through products sold or services rendered.

- Expenses: We’re all familiar with expenses. Your electric bill, your employees’ salaries, and your working lunch with a potential client are all considered expenses.

- Equity: When you subtract your business liabilities from your business assets, you have equity, which reflects your financial interest in the business.

You also need to understand what debits and credits are before you can start to enter any transactions. Any transaction posted in your ledger or your accounting software will be a debit or a credit.

If you’re using double-entry accounting, which is recommended, you will have a corresponding credit entry for any debit entry you make, and vice versa.

| Account Type | To Increase Balance | To Decrease Balance |

|---|---|---|

| Assets | Debit | Credit |

| Liabilities | Credit | Debit |

| Revenue | Credit | Debit |

| Expenses | Debit | Credit |

| Equity | Credit | Debit |

Debits are recorded on the left side of an accounting ledger, while credits are recorded on the right side of the ledger.

A debit entry can increase the balance of some accounts, while a credit entry can increase the balance of other accounts. It will be helpful for you to understand this principle before posting any transactions.

How to handle bookkeeping for your small business

There are a few things you need to do in order to get started bookkeeping for your business. These steps are outlined below.

Step 1: Become familiar with and set up your chart of accounts

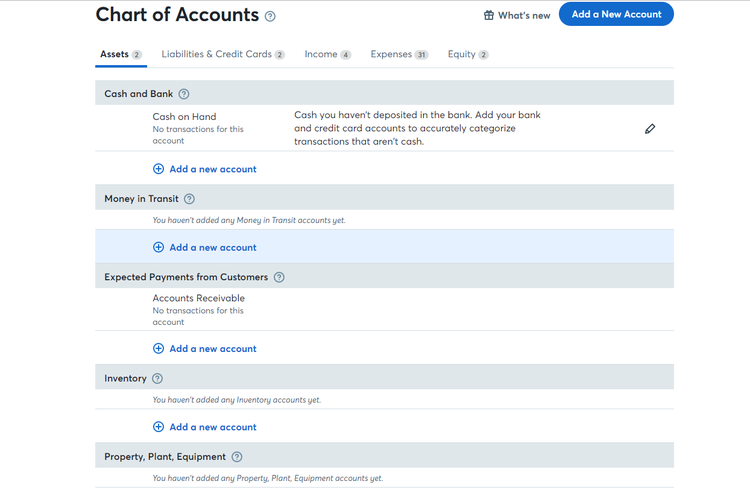

Your chart of accounts is the backbone of your business and is a necessity in order to properly record transactions. While you can certainly buy a ledger book at an office supply store, keep in mind that it’s much easier to set up your chart of accounts if you’re using an accounting software, such as Wave.

Wave's chart of accounts shows various asset accounts that can be added as needed. Image source: Author

Source: Wave Accounting software.

Most software that’s designed for sole proprietors and small businesses will include a default chart of accounts, so you won’t have to create one from scratch.

Keep in mind that in most cases, you can edit the chart of accounts to better suit your business. It’s also a good idea to become familiar with the accounts included in your chart of accounts, which will make it much easier when you begin to enter financial transactions.

Step 2: Begin recording financial transactions

Any and every transaction you make needs to be recorded, either in your ledger book or in your accounting software application.

This process can be as simple as preparing an invoice for a customer to setting up your electric bill to be paid. One of the great things about using a software is that the debits and credits involved in creating an invoice are all handled behind the scenes.

For example, if you prepare and post an invoice in the amount of $150 to John Brown for consulting, you’ll need to record that information in a journal entry.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 10-25-2019 | Accounts Receivable | $150 | |

| 10-25-2019 | Revenue/Income | $150 |

When John Brown pays the invoice, and the payment is posted, the correct entry will be as displayed below. You’ll notice that the A/R account, which was debited in the first entry, will be credited (reduced) because the invoice has been paid.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 10-31-2019 | Cash | $150 | |

| 10-31-2019 | Accounts Receivable | $150 |

Step 3: Reconcile your bank accounts

Traditionally, you would need to wait to receive your monthly bank statement and reconcile the transactions on the statement with those posted in your ledger or accounting software. The purpose behind completing a monthly reconciliation is to see what checks are still outstanding, post any bank transactions, and add additional charges such as account fees.

Reconciling provides you with an accurate cash balance, which can be particularly important to smaller businesses with limited cash flow.

One of the advantages of using accounting software is that much of the reconciliation process is completed by simply linking your bank accounts to your software of choice. This allows easy daily or weekly reconciliation, making the month-end process that much simpler.

If you opt to not link your software with your bank, you will need to reconcile you accounts manually. Whichever way you do it, it’s important to complete the process on a regular basis.

Step 4: Close the month and run financial statements

Once your bank accounts have been reconciled and any adjustments made in your recording tool of choice, you’ll want to close the month and print financial statements.

If you’re using a manual ledger, you’ll need to close each individual account and combine them into the proper account types -- a tedious process that strongly makes the case for using accounting software, which completes this process automatically.

Many of the newer products do not have a specific month-end closing process but instead allow you to choose a cutoff date for entering transactions and preparing financial statements that will accurately reflect the balances for that month.

Financial reporting is an important part of the bookkeeping process, as the statements provide you with an accurate view of the financial health of your business, which can be shared with your accountant or CPA.

The three basic financial statements include:

- Balance sheet: A balance sheet shows your business assets, liabilities, and equity on a particular date.

- Income statement: Income statements can be particularly useful to small businesses as they display net income over a specific period of time.

- Cash-flow statement: Cash-flow statements show incoming and outgoing cash during a specific period of time.

Should you use accounting software for your bookkeeping?

As a sole proprietor, freelancer, or small business owner, you can choose between using a traditional hand-written ledger, spreadsheet software, or accounting software.

Stick with pen and paper if:

- You don’t have a computer and don’t want to buy one.

- You don’t have access to the internet.

- Your business is more like a hobby.

Use accounting software if:

- You want an accurate picture of your business. While accounting software can feel intimidating to those with no bookkeeping or accounting experience, many products are designed specifically for the financial novice.

- You want to spend less time on record-keeping and more time on your business. Instead of writing everything down and having to manually reconcile all of your ledgers and accounts, using accounting software allows you to spend less time keeping track of your transactions, giving you more time to spend on your business.

- You want to grow your business. It’s time-consuming to keep up with multiple ledgers and maintain accuracy, so if your plans include growing your business, you’ll need to use accounting software.

Finding the right bookkeeping method for you

If you’re in business, whether as a freelancer, a sole proprietor, or a small business owner, you need to be able to invoice your customers, track your expenses, and know exactly how financially stable your business is. The best way to do that is by using accounting software.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.