Natural Disaster Resources for Small Businesses

From storm damage to pandemics, navigating unexpected disruptions is critical for business resilience. Unfortunately, “Up to 40% of businesses never reopen after a disaster," according to the Federal Emergency Management Agency (FEMA).

You can avoid being part of that statistic by preparing for disturbances using free toolkits, templates, and resources. Learn how to create a business disaster plan that helps you stay safe and connected during an emergency.

Why does your business need to prepare for a disaster?

You’ve spent a lot of time building your business and securing consumers’ trust. Yet, within minutes a natural disaster can wipe out a lifetime of hard work. Even if your location survives, you may be forced to evacuate for an extended period.

The economic losses and potential reputational damage create huge obstacles for small companies. While it's tough to predict the weather, you can and should anticipate your response to an emergency. Doing so provides peace of mind for owners, employees, and customers.

Plus, disaster preparedness planning puts all essential details at your fingertips so you can act quickly without leaving important decisions for the last minute.

What are some types of disasters that might affect your business?

People in certain zones, such as flood plains, hurricane-affected areas, or tornado alley, prepare for disaster-specific threats. Yet, power outages or widespread computer hacking can occur at any time.

Ready.gov classifies hazards into these four categories:

- Natural hazards: Earthquakes, hurricanes, wildfires, tornadoes, floods, severe storm-related damage.

- Health threats: Outbreaks of the flu, COVID-19, or other severe illness affecting staff, customers, and suppliers.

- Human-caused hazards: Accidental fires or hazardous waste spills, acts of violence, or other human-created situations.

- Technology-related threats: Power surges and outages, equipment failure, cybersecurity crimes, or data breaches.

5 tips for preparing for a disaster

How you respond to a crisis often determines your success at overcoming it. By assessing risks, reducing potential impact, and preparing to act fast, you can improve your company's chance of survival.

Businesses complete thorough evaluations such as:

- Risk management assessment: Outline all potential threats to your property, employees, and customers and determine each occurrence's probability.

- Business impact analysis (BIA): Review potential outcomes, list who and what is affected, and use your BIA to brainstorm recovery efforts.

- Business continuity plan (BCP): A complete strategy prioritizing critical business functions and identifying a process to return your business operations to normal.

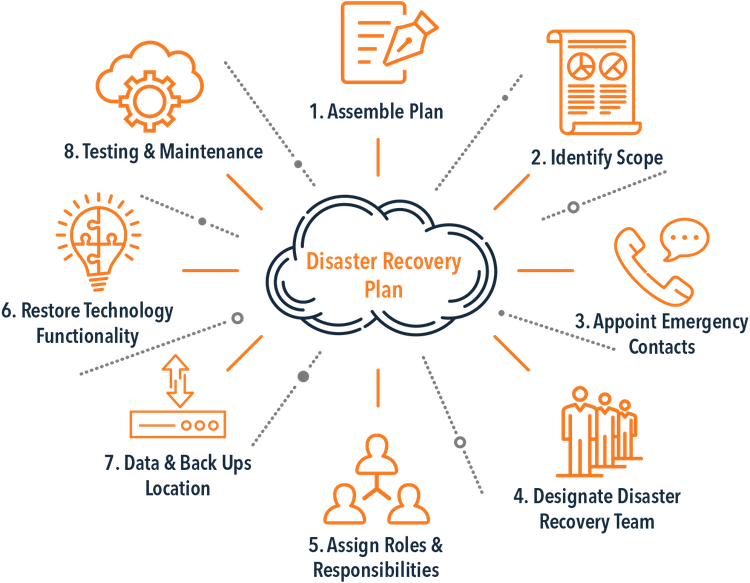

- Disaster recovery plan (DRP): Your DRP is a chapter in your BCP. It specifies how you’ll recover your business hardware, data, and equipment in the days following a disaster.

Use these five tips to develop a solid plan of action that will guarantee business continuity regardless of the emergency that strikes your company or area.

1. Above all else: Ensure the safety of your employees and customers

Keeping people safe isn’t just good business; it’s the moral thing to do. Along with response timelines for how you react to a tornado siren or evacuation orders, you need a blueprint to train employees for various situations.

Your staff should know where and how to access your business disaster plan documents and have a shared community space, whether virtual or on-site, to receive alerts or guidance on ongoing situations.

Start with a communications strategy, outlining the chain of command and expected actions. Your plan should designate how and when you’ll reach out to customers, employees, and suppliers.

Create a crisis communication plan that informs different audiences quickly and effectively. Image source: Author

2. Have a social media plan ready

As we’ve seen with COVID-19, people expect businesses to keep them updated, and social media is the quickest way to reach your audience.

Identify the person who will oversee your social media communications during an emergency and list:

- A backup person for that job

- Each social media site and password

- Mandatory posts for closures or other important information

- A general timeline for posting multiple messages on each channel

- Response times for social media customer service

3. Purchase the correct insurance

During your risk assessment, you’ll identify essential hardware and equipment requiring extra insurance coverage. Plus, you’ll need special riders to cover areas in flood plains.

The best thing you can do is contact your insurance agent to review what’s covered in your current policy, ask about business interruption insurance, and learn how to document every physical and digital asset.

4. Ensure business continuity

Disasters come in all shapes and sizes, so it’s best to plan for different scenarios. Moreover, during an emergency, it’s tough to think straight. Companies only have minutes or hours to make phone calls or shut off the gas at their storefront.

With a business continuity strategy, you have an exact list of steps required to secure your property while protecting lives and data. Get started by using this free template from FEMA.

5. Devise a disaster recovery process

Your business disaster plan describes how you’ll rebuild or get things back to normal after an emergency. Make a list of resources required to operate, including hardware and utilities.

Go through your operations to identify alternative ways to complete the tasks, such as manual workarounds for power outages. And keep a list of places where you can find a small business loan in an emergency.

Complete the full circle of actions to make sure your plan will work. Image source: Author

Other preparedness resources: Disaster toolkits

Map out a healthy recovery by putting together a well-documented plan that guarantees you can find vital information and phone numbers fast. This includes copies of your warranties, rental agreements, and insurance policies.

Experts recommend keeping a copy of your BCP in several places, such as cloud storage, a thumb drive, and an off-site hard copy.

Several government agencies supply toolkits, templates, and planning resources:

- Crisis communication strategy: Use this crisis resource to make sure you have a complete list of people to contact before, during, and after an emergency.

- IT disaster recovery guidelines: Take action immediately following an emergency by creating an IT recovery plan.

- Social media toolkit: You’ll find disaster-specific social media templates in Ready.gov’s toolkit.

- Tax and record-keeping: The Internal Revenue Service (IRS) offers guidance for preparedness, including a business casualty, disaster, and theft workbook.

Recovery resources

Getting through a disaster isn’t easy, but many local, state, and federal resources exist to help small business owners. The key thing to remember is that you’re not alone, and you have options to get your doors open again.

Apply for a disaster loan from the Small Business Administration (SBA)

Low-interest rate business loans help you recover after a catastrophe or even prepare for one. However, you need access to your financial documents to apply, so put this information in cloud storage for easy access.

If you’re affected by a disaster, the SBA offers a variety of loans for businesses:

- Physical damage loans: Get help covering the cost of replacing or fixing your building or property, equipment, and inventory.

- Mitigation assistance: Protect your business against future disasters by using funds for flood, wildfire, wind, and earthquake mitigation.

- Economic injury disaster loans: If you’re in a declared disaster area and suffer financial losses, you can receive help for operating expenses.

- Military reservist loan: This loan helps small businesses cover operating expenses if an essential employee is called to active duty.

Request disaster assistance from your local government

Depending on your location, your city, county, state, or township may offer extra support for small businesses via loans or grants. Check with your local chamber of commerce, business and industry associations, and your local SBA office.

Set up a relief project to benefit your community

As we’ve seen during the COVID-19 crisis, people want to support small businesses, and many communities have rallied around their local stores.

For example, in some areas, local business groups joined together to sell gift cards and promote curbside services by offering a local directory. Others hosted benefits for essential workers or vulnerable populations, which draws awareness to your organization while assisting others.

Be prepared with a business disaster plan

You've likely got too much invested in your business to leave anything up to chance. Instead, create a business disaster plan that protects your company while making sure employees and customers stay safe and ready to help you return to normal.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles