5 Business Loans Women Entrepreneurs Should Explore in 2024

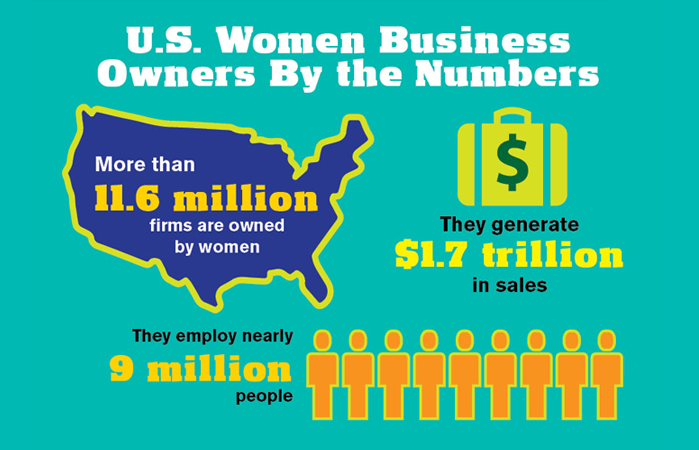

Women small business owners are a powerful -- and growing -- group.

You don’t have to look very hard to find a woman-owned business. They range from your favorite local cafe to the e-commerce clothing shop you adore and everything in between.

The National Association of Women Business Owners (NAWBO) estimates there are more than 11 million women-owned businesses across the country, and these businesses generated $1.7 trillion in sales as of 2017.

Women-owned businesses are an increasingly important part of the economy. Image source: Author

Many of these owners look to funding opportunities to help support and expand their businesses. It shouldn’t come as a big surprise. Small business loans are among the most common ways for business owners to get the help they need.

While there aren’t small business loans that exclusively cater to women, many lenders actively work to help underrepresented business owners, women included.

If you’re a woman-owned small business, here’s where you can start looking for loans.

What you’ll need to apply

As you start exploring lending options, you want to have your financial house in order. That means gathering your essential financial documents, such as profit and loss statements and income projections, as well as your credit score. You can get a free copy of your credit report from each of the three credit reporting bureaus every year.

Those are just the basics. Each lender is different, so be sure to explore what you’ll need before starting the application process.

Some lenders also require more, especially if you have poor credit. In that case, you might also need a business plan prepared for the lender. Your business plan describes your business goals, finances, and income projections. It also details the funding you need and what you plan to do with it.

Also, be prepared to have collateral -- assets that can help secure your loan, such as real estate or equipment -- at the ready. Some of the more traditional lenders might require collateral to get a loan, especially if you’re a new business or have a lower credit score.

Applying for a business loan isn’t always easy. But having this information and the related documentation prepared ahead of time can streamline the process and help you identify the best lenders for your particular situation. Here are a few lending options to consider:

1. Business loans from financial institutions

One of the first places many small business owners look for a loan is through a local lender. Your current bank or credit union is an excellent place to start. If you already have a business banking account with them, you might have the option of also securing a business loan.

Something to remember about loans from traditional lenders is they tend to be more difficult to get if you have poor credit, low revenue (typically less than $100,000), or haven’t been in business for at least a year or two.

If you already have a relationship with a local bank or credit union, that might give you a leg up, but not always. These loans can also take longer to process, and you might have to meet in person with the lender, adding a few weeks to the timeline.

Most financial institutions will have a few loan options, including standard term loans, lines of credit, and mortgages for real estate purchases. The exact terms and availability will vary from bank to bank.

2. The Small Business Administration

The Small Business Administration (SBA) is often synonymous with small business loans. While the SBA doesn’t give out funding directly, the federal government agency helps thousands of small business owners across the country to get financing through local lenders.

Your current bank likely offers SBA loans for women and other business owners. There are thousands of SBA lending-approved banks in the U.S., and these loans are often geared toward small business owners who might struggle to get traditional loans.

The SBA oversees a variety of loans, but these are the most common for small business owners:

- SBA 7(a) Loan: These loans are partially guaranteed by the SBA and offer financing options for working capital, equipment, and buying real estate.

- SBA 504 Loan: This loan provides fixed-rate financing for up to $5 million for use on fixed assets, such as buying land or facilities and improving equipment.

- SBA Microloans: The SBA also offers small-dollar loans up to $50,000, called microloans, for working capital, inventory, supplies, furniture, and equipment.

You’ll need to meet specific requirements to apply for any loans through the SBA, including being a for-profit business operating in the U.S., have equity invested in your business, and have tried other funding options.

There are several requirements for small business owners to apply for SBA loans. Image source: Author

Even if you aren’t applying for funding through the SBA, it pays to check out the opportunities and support the agency offers women business owners, including mentorship, advice, and women-owned business grants.

3. Online lenders

Another option for women-owned small businesses looking for funding is online lenders. For many small business owners, this could be an option when they can’t get financing from traditional banks or even the SBA.

Unlike those other options, online lenders have relatively simple and easy applications, as well as quick turnarounds for funding. It’s not uncommon to get approved and have the funds within a week. That’s much faster than more traditional loans, which can take weeks or even months.

Online lenders, such as Kabbage, OnDeck, and BlueVine, are all possibilities for small business owners. Many online lenders also offer loans if you have a lower credit score and struggle to get financing elsewhere. The terms and rates will vary by lender and loan, but you can often find fixed-rate term loans and lines of credit through online lenders that might meet your needs.

4. Peer-to-peer lenders

Peer-to-peer (P2P) lending has become increasingly popular over the years and has drifted into small business lending. P2P lending essentially removes the middleman from the loan process. Those willing to lend get matched with business owners. The system often works as a crowdfunding process, with multiple lenders teaming up to help one business.

One of the most popular P2P sites for small business owners is FundingCircle. If you choose to go this route, as with many online lenders, you can get approval and be matched with lenders very quickly, possibly in one business day. The application process also doesn’t have qualifications as strict as traditional banks.

Keep in mind that P2P lending is not available in every state, so you’ll want to check those regulations before applying. Additionally, many P2P sites have shorter terms for loans, ranging from six months to five years. You’ll want to decide if you can realistically meet those terms before applying.

5. Small business investment companies

A small business investment company (SBIC) is another option to find business loans for women. SBICs are privately-owned companies that use their own money for financing. However, through a regulated and licensed SBA program, they can work with qualifying small business owners via debt and equity financing.

There are a few primary ways a small business owner can work with an SBIC for funding:

- Loans (debt financing): SBICs can provide loans typically ranging between $250,000 and $10 million. While the SBIC uses its own money for the loan, the SBA guarantees a portion and provides a dollar match.

- Equity financing: This works very similarly to venture capitalist (VC) or angel investing. The SBIC will invest in your business for a share of ownership.

One thing to keep in mind is that interest rates might be higher with an SBIC than what you would expect from a traditional bank or online lender. You’ll also have to meet similar requirements as set by the SBA for small businesses.

For some small business owners, SBICs are alternatives to VC and angel investors. Still, they have specific terms and conditions for their investments that differ from traditional loans. Make sure you review these closely if you decide to go this route.

Women-owned businesses have loan options

Women small business owners are a growing force across the country. As you continue to expand your business, you might need to explore outside funding options. You might find that one of these loan options could be the perfect fit.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles