My first business class was taught by a crusty old guy who spent years as the comptroller for Pier 1, a home decor and furnishings retailer. He had wild white hair sticking out all over the place and waved his hands in the air as he tried to relay nuggets of wisdom to us.

One oft-repeated maxim was: "If you don't know your costs, you're going broke."

When it's time to calculate the cost of goods sold (COGS), the price per unit you paid for your inventory when buying in bulk isn't its total cost. Instead, secondary inventory costs can significantly increase your COGS.

We'll go over the different factors that contribute to inventory holding costs and how to calculate carrying costs so you can integrate these expenses into your accounting practices.

Overview: What are carrying costs?

Inventory carrying cost is the amount of money your business spends to keep products in stock over time, including expenses for warehousing, inventory control, insurance, and more. Your inventory holding cost should range from 20% to 30%, depending on your industry.

Lax inventory control processes increase this percentage, while robust inventory management minimizes these costs.

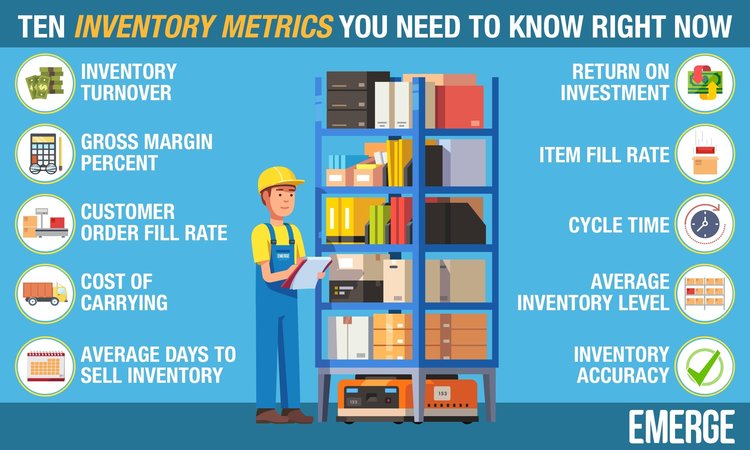

Multiple drivers contribute to your inventory carrying cost. Image source: Author

The key thing to avoid is inventory carrying costs that approach -- or worst, exceed! -- inventory value. That situation is analogous to people who pay to store personal items.

After a year, storage costs typically exceed the value of their possessions such as an old couch, boxes of clothes, and that extra mattress sitting unused in a warehouse.

The 4 components of carrying costs

Four expense categories make up your inventory carrying value: capital cost, storage cost, inventory service cost, and inventory risk cost. Understanding how each one affects COGS provides a more thorough financial picture and allows you to have better control over them.

1. Capital costs

Capital expenses are the largest contributor to your inventory carrying costs because they include the purchase price of the products you're storing. Related costs include financing fees, accrued interest, and loan maintenance fees.

Capital cost is stated as a percentage of the dollar value of total inventory. If your inventory is worth $10,000 and cost you $2,000, its capital cost is 20%.

2. Storage costs

Inventory storage expenses cover the physical storage infrastructure: your warehouse rent or mortgage, utilities, maintenance, and security. Related support expenses including handling costs to move products in and out of storage.

Before I was a textbook publisher, I thought "handling" fees were an underhanded ploy to increase a product's actual purchase price.

Once we started fulfilling book orders out of our office, however, I figured out even the simplest order required at least half an hour to produce an invoice, print a shipping label, pull books from inventory, pack them in an envelope or box, and notify our shipping company we had an order to pick up.

3. Inventory service costs

Inventory service expenses include software and hardware to monitor inventory, insurance, and any local taxes. Costs for employees to perform periodic inventory counts are also in this category.

Keeping more inventory on hand, especially when you stock fast-selling items, helps maximize sales, but may also lead to higher insurance and tax rates. Use the inventory management and control formulas we'll discuss below to find the sweet spot between adequate inventory levels and minimizing service costs.

4. Inventory risk costs

Inventory risk costs range from losses due to theft to product obsolescence to depreciation. Sales lost because items were out of stock, aka stockouts, also go in this category. Depending on your inventory type, such as barrels of crude oil, its value may fluctuate based on factors out of your control.

A textbook publishing rule of thumb is to release a new edition every two years to eliminate the used book market created by earlier sales. The exact timing of each new edition's release is critical, however, as older copies in stock instantly become worthless.

How to calculate carrying costs

Once you know your costs for each of the four categories above, add them together to find your total inventory holding cost. Then, use this formula to calculate your cost of inventory carrying as a percentage of total inventory value:

Carrying Cost Percentage = (Total Inventory Holding Cost / Total Inventory Value) x 100

For example, let's say you have a warehouse with inventory worth $100,000 and inventory costs in these four areas:

- Capital costs: $12,000 -- Cost to buy inventory, plus financial services

- Storage costs: $5,000 -- Warehouse rent/mortgage, handling costs to move inventory in and out, and infrastructure expenses

- Inventory service costs: $5,000 -- Inventory management software and hardware and the cost in time for the employees who use it

- Inventory risk costs: $3,000 -- Lost, damaged, obsolete, or stolen inventory

Plug your $25,000 inventory holding cost and your $100,000 total inventory value into the carrying cost formula:

Carrying Cost Percentage = ($25,000 / 100,000) x 100 = 25%

A 25% inventory carrying value is completely acceptable. If this percentage goes above 30%, however, find ways to lower your inventory carrying costs.

How to reduce carrying costs

If you don't set your prices based on total inventory costs, you can go broke selling a popular item priced too low. Inventory management deals with the big inventory picture: ensuring you have the correct amount of stock on hand, streamlining the reordering process, and identifying obsolete products.

Inventory control focuses more closely on picking, packing, and shipping orders, receiving inventory, and processing purchase orders.

Use inventory management software -- either a standalone application or your point-of-sale (POS) system -- and inventory control best practices to reduce your inventory carrying costs. Common inventory management and control formulas determine:

- Safety stock levels: The amount of extra stock to hold back for an unexpected sales surge or emergency

- Reorder points: The trigger point to order stock to avoid warehousing products longer than necessary

- Economic order quantity (EOQ): The amount of stock to order based on price points and sell-through rates

Once you drill down, multiple metrics exist to optimize your inventory practices and reduce carrying costs.

Inventory management metrics give you granular control over your inventory costs. Image source: Author

Once your inventory levels and carrying costs justify it, consider hiring a Certified in Production and Inventory Management (CPIM) inventory manager to oversee your inventory, warehouse, and logistics operations.

Know your inventory carrying costs

A thin line often separates profits from losses, so tracking your inventory carrying costs provides a more accurate picture of your COGS. Combined with effective inventory management, this information will ensure you'll have products in stock when you need them and sell them at prices that generate the profits you need.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.