A Guide to Calculating and Interpreting Your Debt-to-Asset Ratio

The debt-to-asset ratio can be useful for larger businesses that are looking for potential investors or are considering applying for a loan.

Calculating your business's debt-to-asset ratio can provide interested parties with the numbers they need to make a decision on investing in or loaning funds to your company.

Overview: What is the debt-to-asset ratio?

All accounting ratios are designed to provide insight into your company’s financial performance. The debt-to-asset ratio gives you insight into how much of your company’s assets are currently financed with debt, rather than with owner or shareholder equity.

Calculating your debt-to-asset ratio can show potential investors and creditors how your business has grown, and more importantly, what part of your current business assets have been funded by company equity and what portion have been funded with borrowed funds.

Knowing your debt-to-asset ratio can be particularly helpful when preparing financial projections, regardless of the type of accounting your business currently uses.

While your bookkeeper or staff accountant is responsible for handling the accounting cycle for your business, which includes entering financial transactions, including closing entries, it’s best that you have an experienced accounting professional handle ratio calculation and analysis.

The debt-to-asset ratio is considered a leverage ratio, measuring the overall debt of a business, and then comparing that debt with the assets or equity of the company.

If the majority of your assets have been funded by creditors in the form of loans, the company is considered highly leveraged. In turn, if the majority of assets are owned by shareholders, the company is considered less leveraged and more financially stable.

Though businesses of any size can use the debt-to-asset ratio to their advantage, it’s particularly important to larger businesses that are looking to obtain additional financing or apply for a loan in order to fund business growth, as both investors and creditors find the debt-to-asset ratio useful when determining credit risk. If you’re not using double-entry accounting, you will not be able to calculate a debt-to-asset ratio.

While an experienced accountant or financial professional is the best person to calculate and analyze a debt-to-asset ratio, as a business owner, it’s important for you to understand what the ratio is, how to calculate it, and what the results of that calculation mean.

What is the debt-to-asset ratio formula?

If you’re wondering how to calculate your debt-to-asset ratio, it’s actually a lot easier than you may think. All you’ll need is a current balance sheet that displays your asset and liability totals.

How to calculate the debt-to-asset ratio for your small business

The formula for calculating the debt-to-asset ratio for your business is:

Total liabilities ÷ Total assets

Pretty simple, isn’t it? If you’re ready to learn your company’s debt-to-asset ratio, here are a few steps to help you get started.

Step 1: Run a balance sheet

You will need to run a balance sheet in your accounting software application in order to obtain your total assets and total liabilities. The balance sheet is the only report necessary to calculate your ratio.

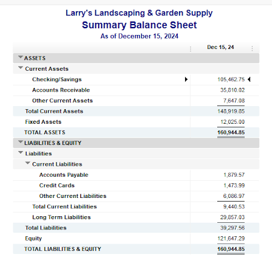

Use your balance sheet to obtain total assets and total liabilities. Image source: Author

Pro Tip: Your balance sheet will provide you with the totals you need in order to calculate your debt-to-asset ratio. Be sure to run the balance sheet for the appropriate time frame.

Step 2: Divide total liabilities by total assets

We’ll provide you with two examples for calculating your ratio of total debt to total assets:

Example 1: Your balance sheet shows total liabilities are $75,000, with total assets of $68,000.

$75,000 (liabilities) ÷ $68,000 (assets) = 1.1 debt-to-asset ratio

Example 2: On your balance sheet, your liabilities total $65,000, while your assets total $71,000.

$65,000 (liabilities) ÷ $71,000 (assets) = 0.91 debt-to-asset ratio

Pro Tip: Be sure to divide liabilities into assets, otherwise your results will be inaccurate.

Step 3: Analyze the results

While it’s important to know how to calculate the debt-to-asset ratio for your business, it has no purpose if you don’t understand what the results of that calculation actually mean. The debt-to-asset ratio is used by investors and financial institutions to determine the financial risk of a particular business.

For instance, if you’re actively seeking investors for your business, or looking to apply for a business loan, the debt-to-asset ratio would likely be calculated in order to determine how risky a particular loan or investment is for your business.

How to analyze your small business debt-to-asset ratio

If you’re still confused about what a good debt-to-asset ratio is, here are some guidelines:

- A ratio of 1 indicates that the value of your company’s assets and your liabilities are equal.

- A ratio higher than 1 indicates that your company currently carries more liabilities than assets. This places your business in a precarious situation and will likely be viewed as a high-risk situation by investors or financial institutions.

- A ratio less than 1 indicates that your company owns more assets than liabilities, making an investment in your company a less-risky venture. A ratio of less than 1 also means you have the assets available to sell should your company run into financial trouble.

Because a ratio greater than 1 also indicates that a large portion of your company’s assets are funded with debt, it raises a red flag instantly. It also puts your company at a higher risk for defaulting on those loans should your cash flow drop.

A ratio greater than 1 is also a big risk for those carrying variable rate debt, since a sudden rise in interest rates can affect your company’s ability to meet its repayment obligations, resulting in a default on any variable-rate loans you may have.

Pro Tip: It’s helpful to track your debt-to-asset ratio on a regular basis to determine if your number is trending up, down, or remaining the same.

FAQs

-

While the ratio is much more useful for larger businesses, it certainly doesn’t hurt to know the debt-to-asset ratio for your business. It can also be helpful to consistently track this ratio over a period of time in order to be aware of any trends.

-

Yes, you should understand what a debt-to-asset ratio is. While your accountant may be the one responsible for calculating business ratios, the more information and understanding you have about your company’s financial health, the better.

-

Being highly leveraged means your company is using a high amount of debt in the form of loans and other investments to finance company operations. The higher a company is leveraged, the riskier the operation is viewed. A lower-leveraged company means even though your business carries debt, it has enough assets to operate profitably.

Debt-to-asset ratio: What’s yours?

Knowing your debt-to-asset ratio can help you get a handle on your debt load while also keeping your company attractive to potential investors and creditors.

If you do choose to calculate your debt-to-asset ratio, do so on a regular basis so you can track any increases or decreases in your number and act accordingly.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles