As a small business owner, there are plenty of unexpected situations you may suddenly find yourself in: undergoing an IRS audit, responding to an Equal Employment Opportunity Commission (EEOC) complaint filed by a past or current employee, dealing with a vendor who insists you didn't make a payment, or resolving a workman's comp claim.

In each of these cases, you'll be required to provide business records to show exactly what you did or did not do. If you can't, you could easily face hefty fines or other penalties. That's why it's critical to create and maintain a document retention policy.

Overview: What is document retention?

Document retention is the process by which records required for ongoing business operations are identified and maintained. A document retention policy provides guidelines for the review, secure storage, and periodic destruction of unneeded records.

Your records will generally fall into the following categories:

- Business documents: Contracts, mortgages, deeds, and general correspondence

- Financial records: Financial statements, expense reports, financial audits, and cancelled checks

- Personnel records: Employee applications, performance appraisals, health benefits, and termination letters

- Tax records: IRS records and state tax returns, sales tax returns, payroll tax returns, and pension returns/information

- Purchasing and sales: Sales contracts, sales invoices, requisitions, and purchase orders

- Shipping and receiving: Freight bills, shipping and receiving reports, manifests, and bills of lading

- Insurance documents: Insurance policies, accident and safety reports, settlement claims, and group disability claims

The amount of paperwork and digital records generated will multiply over time as you add more customers, employees, products, and vendors.

An effective document management system will allow you to efficiently store and access records, reduce the cost of document production during legal cases, and follow all laws for the preservation of certain records.

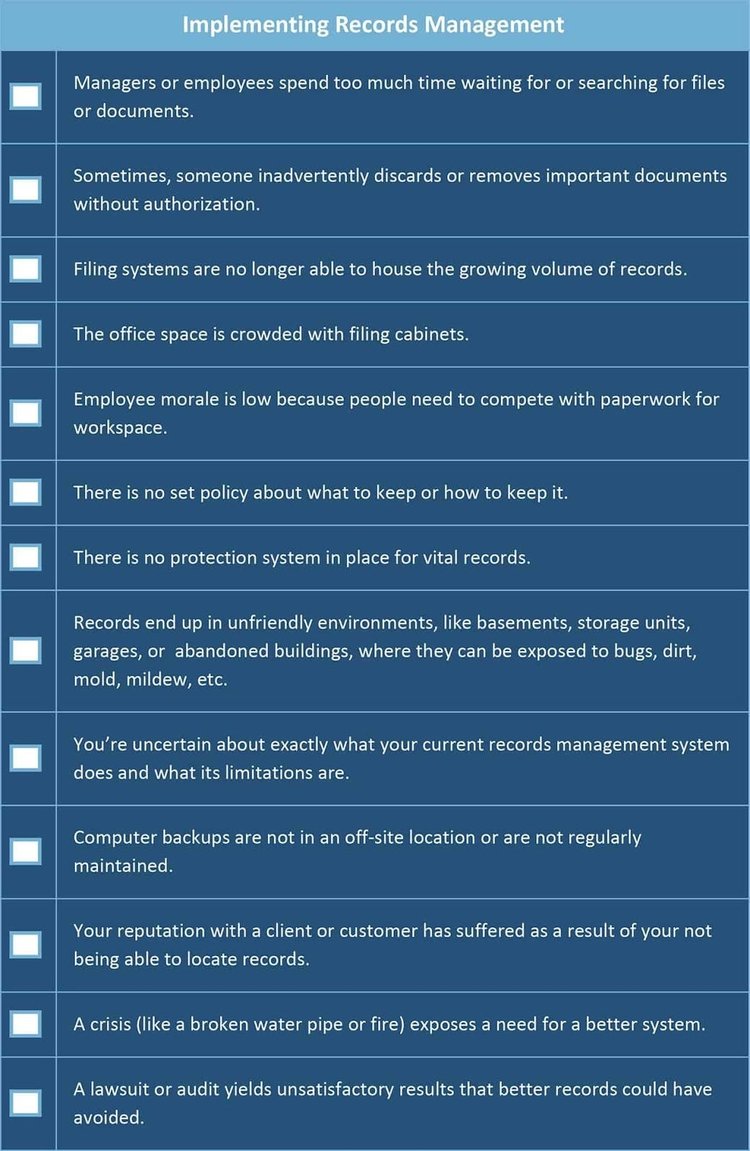

Plus, if one or more of the situations in the records management checklist below sounds familiar, you definitely need to set up a document retention and management system as soon as possible.

Documentation retention guidelines will help you avoid all of these problematic situations. Image source: Author

While a document retention policy will aid your internal business operations, it can also help externally. For example, customers want to know their data is being securely stored, so you might highlight the security and maintenance of your records as part of your website marketing.

How to create and implement a document retention policy

Creating and using your document retention policy is not a one-time endeavor -- it’s an ongoing activity. It's not part of the (perhaps more exciting) front-line activities you're likely more focused on, such as sales and customer service, so it may help, as you work through the steps below, to use one of the best productivity apps available to help keep your record-keeping on track.

Step 1: Inventory all business documents

First, you need to comprehensively catalog all of your existing documents to see exactly what you have as well as the quantity of physical and digital records you're dealing with.

Tips for inventorying all business documents

The key strategy with your initial document inventory is to be methodical. And while you may know -- or think you know! -- where everything of relevance is, you need to talk to all of your employees to discover any other formal or informal physical and digital repositories you may not be aware of.

- Document your existing inventory: Use inventory reporting forms to record where existing documents are located. While you can use hard copy forms for this, consider doing it digitally, perhaps using one of the best organization apps, so you can build an electronic record as you go.

- Categorize importance: During your initial inventory, also categorize documents as being general records (day-to-day business operations), vital records (needed after an emergency to maintain business operations), archival records (documents of historical value), or non-records (personal records, junk mail, duplicate copies) -- because that will help define your retention schedule.

Step 2: Establish a retention schedule

While a document may have been relevant at one point in time, that doesn’t mean it always will be. With a few exceptions -- deeds, patents, auditor reports, and annual financial records -- almost every document has a limited lifespan, usually no longer than 10 years.

Tips for establishing a retention schedule

Keeping records any longer than necessary has the potential to create legal liabilities for your business. For example, the discovery process during litigation could find additional damaging information in your records that should have been already deleted.

Plus, you don't want to be responsible for any confidential customer information being accessed that also should have been destroyed. That's why establishing a clearly defined document retention schedule is the backbone of your document management policy.

- Research applicable guidelines: There is no one-size-fits-all retention schedule for businesses. Instead, you'll need to research local, state, federal, and industry-specific guidelines to ensure you're in compliance.

- Keep IRS records: No matter what, you want to keep all tax- and IRS-related documents for a minimum of seven years.

Step 3: Store records securely

Effective storage of documents is critical to preserve records as well as ensuring access to them as necessary in a timely manner.

That includes everything from locking file cabinets and storage rooms at your business, to using a "secure drawer" as part of your website management, to other offsite options.

Tips for storing records securely

Digital documents require less storage space than their physical counterparts. On the other hand, you may have legacy paper or wet signature documents you want to maintain as hard copies.

- Use offsite storage: Using your business as a primary document storage location is problematic because it likely won't be optimally designed to withstand human intrusions or natural disasters. Instead, look into offsite physical storage that offers increased security as well as protection against storms, fires, floods, and earthquakes.

- Use data centers: Consider using a third-party data center for backup, or even primary storage of your electronic records. Commercial data centers are designed to be secure from a variety of threats, including computer hacks and natural disasters, and they can also increase upload speed when transferring large amounts of data.

Offsite storage of digital records in a data center can increase security and lessen the chances that documents are stolen, lost due to natural disasters, or accidentally destroyed. Image source: Author

Step 4: Purge documents annually

Just as you need to keep necessary business documents, you also need to destroy them according to your retention schedule. That will keep storage costs down and reduce the chances of business and customer data being accessed illegally or inappropriately.

Tips for purging documents annually

Minimize the chance of future legal issues by explicitly documenting chain-of-custody procedures when destroying paper documents and electronic files.

- Use a shredding service: Instead of leaving document destruction to the office intern or someone else who draws the short straw, a third-party shredding company can safely take care of this for you. You may need to deliver the materials to them, or they may be able to do it on site.

- Ensure National Association for Information Destruction (NAID) compliance: Make sure the document destruction process of a third-party vendor complies with NAID protocols to ensure the security of confidential materials throughout the entire process. This includes the transportation and storage of materials before destruction as well as disposing of materials responsibly after the process is complete.

Step 5: Educate employees about retention policies

Even the best document retention policy won't have a net positive effect if none of your employees know about it. That's why using effective communication strategies will be key, especially as the policy is updated over time.

Tips for educating employees about document retention policies

Your document retention policy also won't be particularly effective if there's only a printout of it in a three-ring binder that's sitting on the top shelf in a seldom-used storage closet. Instead, make it available online for easy access by your employees.

- Incorporate into onboarding: Include training on your document retention guidelines as part of the employee onboarding process to ensure new hires know their responsibilities from day one.

- Have annual training: Just as you (should) have annual sexual harassment training, have your employees complete an annual refresher course on document retention policies. You can even offer this online to minimize disruptions to day-to-day operations.

Begin the document retention process today

Don't wait until a critical event occurs -- an IRS audit, natural disaster, or lawsuit -- to realize you need a robust record retention schedule. Instead, begin the process outlined above to develop your document retention policy now.

Sure, you'll have to build the cost into your business budget, but over the long haul, it will definitely pay for itself -- and more! -- by saving you both time and money.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.