Double Taxation: What It Is and How to Avoid It

While there are plenty of advantages to incorporating as a C corporation, one of the biggest drawbacks business owners may experience is double taxation. Find out exactly what double taxation is, how it may impact your business, and how you can (legally) avoid it.

Overview: What is double taxation?

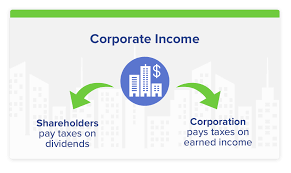

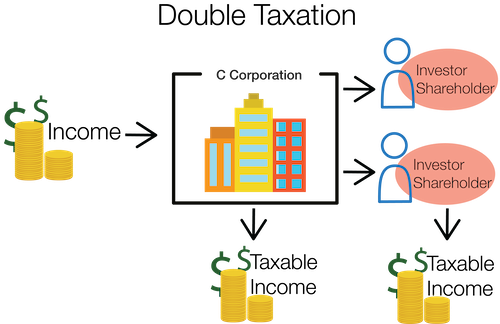

Corporate double taxation occurs when tax is paid twice on the same corporate earnings. With the exception of S corporations, double taxation affects both corporations and their shareholders.

For example, at the end of the fiscal year, a corporation will pay taxes on its earnings for that year. However, if the corporation pays out dividends to shareholders, the shareholders will also have to pay taxes on the same earnings when they file their personal income tax returns.

C Corporations are the only business structure that incurs double taxation. Image source: Author

Communitytax.com.

Double taxation mainly affects larger corporations that pay out dividends to shareholders regularly. In many cases, smaller corporations or corporations experiencing a growth phase can eliminate double taxation by electing to retain earnings in the business and forgo paying dividends for the foreseeable future.

Only C corporations and LLCs that elect to be taxed as a corporation are directly impacted by double taxation since the corporation is taxed as a separate entity. Sole proprietors, partnerships, S corporations, and LLCs do not have a separate tax, with any company earnings passed directly through to partners or LLC members to include on their personal tax.

If your business operates in more than one country, dual taxation is also a possibility. For example, if your business headquarters are located in Chicago, but you also operate a store in Berlin, you may be taxed for any earnings by German tax authorities while also having to pay taxes on those earnings in the U.S. Today, many countries have a double taxation agreement in place that eliminates the need to pay taxes in two countries.

Not all tax preparation software offers the ability to prepare corporate taxes, so you may want to consult a tax professional when filing your corporate tax returns.

How does double taxation work?

Corporations, like any business, pay taxes at the end of their fiscal year. Because corporations are considered a legally separate entity from their shareholders, the corporation is taxed on its annual earnings for the year.

However, if dividends are distributed, shareholders are also responsible for paying taxes on the amount of the dividend they receive. Because the corporation has already paid taxes on the dividends being distributed, when a shareholder has to pay taxes on the dividends, it’s considered double taxation.

An example of double taxation

In 2019, Dog Duds opened its doors, with the owners choosing to incorporate the business immediately. The first year in business, Dog Duds earned $250,000, which was taxed at the current corporate tax rate of 21%. Because it was a new corporation, Dog Duds did not pay out any dividends to its 12 shareholders in 2019.

In 2020, Dog Duds earned $750,000. The owners decided that while they would continue to put some of their profits into retained earnings, they would also pay dividends to their shareholders. Ultimately, Dog Duds placed $500,000 in retained earnings while paying out $250,000 in dividends.

The corporation’s tax liability was $157,500 in 2020, based on their 2020 earnings of $750,000. However, because they distributed $250,000 in dividends, their shareholders will also have to pay taxes on the dividends they received.

That is double taxation.

How to avoid double taxation in your small business

If your shareholders receive dividends, there is no legal way for them to avoid paying taxes on those dividends. However, there are ways for businesses to eliminate the possibility of double-taxed income.

1. Don’t structure your business as a C corporation

Because C corporations are considered separate legal entities, they offer many advantages to businesses. But C corporations are the only business structure that is taxed separately as a business, and then requires shareholders to pay tax on that same income. If you expect to distribute dividends to your shareholders and want to avoid double taxation, you may want to consider a different legal structure for your business entity.

- Sole proprietorship: A sole proprietorship is not an option for businesses looking to grow and expand. However, if you operate independently, a sole proprietorship might be a good choice.

- Partnership: A partnership is considered a pass-through entity, with the net income of the partnership passed through to each partner, who is then responsible for paying the appropriate taxes on the income.

- Single-member LLC: A single-member LLC, like a partnership, is a pass-through entity, with the sole member of the LLC taxed individually, rather than as a separate entity. The exception to this is an LLC that elects to be taxed as a corporation for legal purposes.

- Multi-member LLC: A multi-member LLC is also a pass-through entity, although the LLC can request to be taxed as an S corporation if desired. Like a partnership, a single-member LLC requires each member to report business taxes on their personal return.

- S corporation: An S corporation is taxed like a partnership, with the earnings of the corporation passed through to the owners and taxed on their personal tax return.

In the end, you may find that structuring your business as a C corporation is your best option, but it’s always best to be aware of all of your options before making that decision.

2. Put income into retained earnings

Business owners have the option of placing their income into retained earnings. Established businesses may get some resistance to this option since most shareholders expect a return on their investment.

However, smaller corporations can opt to retain profits in the business rather than paying out dividends to shareholders. This is particularly important in the early stages of a business since retained earnings are used to fund company growth and expansion. Of course, as your business and the number of shareholders grows, you will likely need to start paying out dividends.

3. Make shareholders employees

This may not always be an option, but if your shareholders are also employees you can pay them a higher salary rather than distribute dividends separately. While your employees will be paid from taxable earnings, and they will still have to pay taxes on their income, the cost of payroll is a legitimate expense deduction for any business, eliminating double taxation.

Both C corporations and investors are required to pay taxes on corporation income. Image source: Author

wyomingllcattorney.com.

Double taxation can’t always be avoided

If you determine that a C corporation is the best business structure for your small business, aside from not paying dividends or hiring shareholders as employees, there are not a lot of ways to avoid the issue of double taxation.

However, be sure to consult with a CPA or attorney to see if perhaps another business structure would better suit your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles