Is an EIDL Loan Right for Your Small Business?

Though SBA disaster loans have been available for years, the EIDL was signed into law in March of 2020 as part of the CARES Act, which was passed by Congress to provide emergency relief to American workers and small businesses struggling to survive due to the impact of COVID-19. EIDL loans carry a low interest rate and a 30-year repayment term and can offer a lifeline to struggling small businesses.

Right now, the EIDL can cover up to six months of working capital or operating expenses, with a cap of $150,000, provided that your business qualifies. With funding still available and a December 21, 2020, deadline rapidly approaching, it might be time to find out a little more about the EIDL loan.

What’s the difference between the EIDL grant vs loan?

When the EIDL loan was first offered, business owners were given an option to apply for a loan advance that the SBA would consider a grant, provided that all the necessary criteria were met. But the funds that were set aside to cover the advance were quickly depleted, with the SBA discontinuing the advances in July of 2020.

Does your business qualify for an EIDL loan?

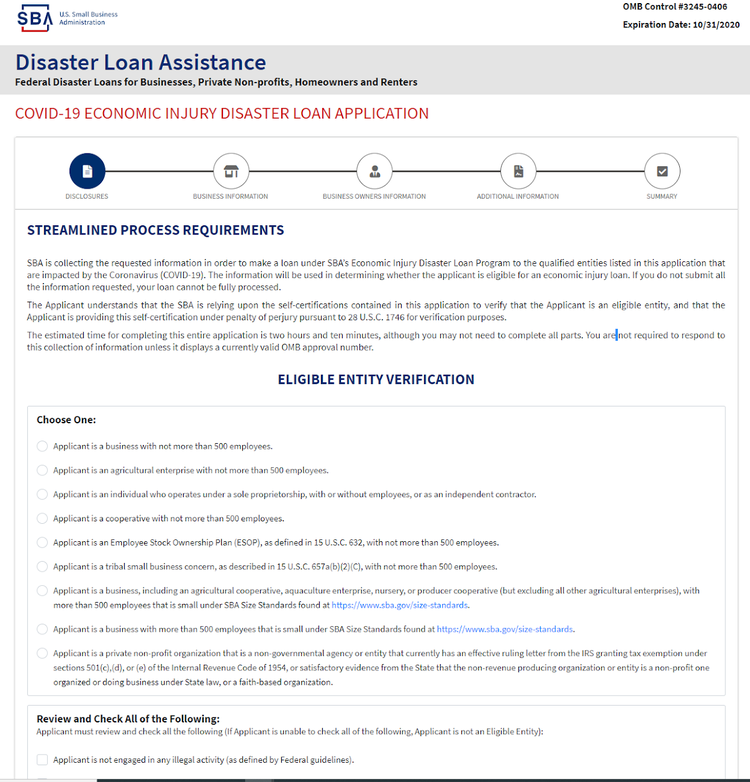

If you think that an EIDL loan may be right for your business, your first step should be to make sure that your business qualifies for a loan. Eligibility requirements are fairly broad, so chances are good that your business will qualify if designated as one of the following:

- A business

- An agricultural enterprise

- An individual who operates as a sole proprietorship or as an independent contractor

- A small tribal business concern

- A private nonprofit organization that is a nongovernmental agency or entity

1. You must have fewer than 500 employees

The 500-employee maximum applies to all the business types listed above. There are some exceptions, such as for a business with more than 500 employees that is considered small under SBA Size Standards.

2. Certain types of businesses are prohibited

The SBA prohibits you from obtaining an EIDL loan if your business engages in any of the following activities:

- Any illegal activity as defined by the federal government

- Any activities of a prurient sexual nature

- Lobbying

- Earning more than one-third of its gross income from legal gambling activities

Other things that may disqualify you from obtaining an EIDL loan is if any principal owner with a 50% or greater interest in your business is more than 60 days late on child support obligations. In addition, all state, local, and municipal government entities are prohibited from applying for an EIDL loan, as are all members of Congress.

You can verify eligibility on the first page of the EIDL application. Image source: Author

5 EIDL loan requirements, terms, and conditions you should know

Before you agree to a loan, be sure that you are aware of and understand EIDL loan terms and requirements adequately.

1. Loans are for a term of 30 years

All EIDL loans carry a term of 30 years, with an interest rate of 3.75%. Loans are automatically placed into deferment the first year of the loan, with repayment starting a year from when the initial loan was received.

2. Loan amounts have a cap

Although disaster loan assistance is available for up to $2 million, the EIDL for COVID-19 was capped at $150,000.

3. Collateral is required for loans over $25,000

If you obtain an EIDL loan for more than $25,000, you will need to pledge business collateral to guarantee the loan. Collateral can include assets such as inventory and equipment as well as intangible assets such as trademarks and copyrights.

It’s also important to understand that if you do pledge collateral, you’re placing a lot of temporary restrictions on your business including the stipulation that while your loan is still outstanding, you cannot sell, lease, or transfer any collateral that was used as a loan guarantee without the approval of the SBA.

4. EIDL loan recipients cannot change their business structure while the loan is outstanding

Your business structure must remain the same for the life of the loan. For example, if you’re looking to change your business structure from a sole proprietorship to an S corporation, you will first need the approval of the SBA.

5. Loans cannot be used for physical improvements to your business

There are strict guidelines about what you can and cannot use EIDL loans for. And because the SBA requires you to save the receipts of any purchases made with EIDL loan monies, you must track these purchases properly.

What you can spend EIDL funds on:

- Rent

- Utilities

- Inventory

- Accounts payable

- Office supplies

- Other operating expenses

What you can’t spend EIDL funds on:

- Relocation costs

- Bonuses

- Stockholder dividends

- Loan repayment, including federal loans

- Facility repairs or additions

- Refinancing long-term debt

Whatever monies you do spend, remember to save those receipts!

3 advantages of getting an EIDL loan

For small businesses impacted by COVID-19, an EIDL offers some distinct advantages that you should take into account when deciding whether to pursue the loan.

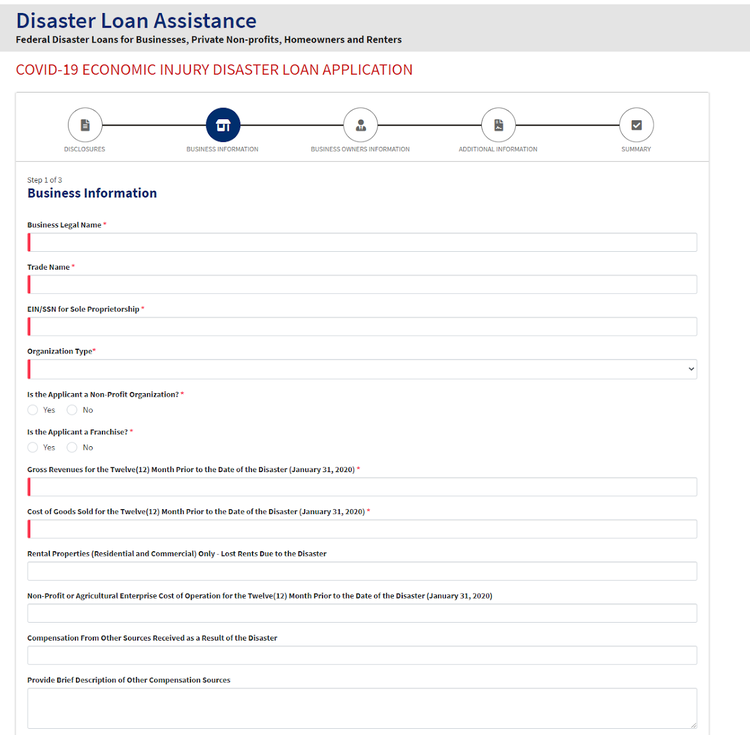

1. Easy application

We’ve all come to expect an overly complicated process when it comes to anything associated with government programs. That’s why the EIDL loan application is such a pleasant surprise. While the SBA states that the application can be completed in around two hours, others have stated that it took them around 45 minutes to an hour to complete.

And once you’re done, you just submit the application and wait for a response, which includes a loan quote. The loan quote represents the amount that you’re qualified to borrow, but you can change the amount when you electronically sign the application.

For example, if you’re qualified to borrow up to $50,000, you can change that amount to the amount you wish to borrow, up to $50,000.

The EIDL loan application is streamlined for easy completion. Image source: Author

Once your application is completed, a loan officer will review the application, with an approval or decline usually sent within days of the application. Once approved, money is usually transferred to your bank account, using the banking information that you provided in the application. Funds are usually available within 5 to 10 business days of approval.

2. Low interest rate

The interest rate on an EIDL loan is 3.75% APR (fixed) with a 2.75% APR available for nonprofit organizations.

3. Flexible, long-term repayment options

The EIDL has a 30-year repayment plan, and there is no prepayment penalty if you decide to pay early. In addition, the loan immediately goes into deferment, so you have a year before you need to start repaying the loan, although the SBA gives you the option to start repaying it immediately.

3 disadvantages of getting an EIDL loan

An EIDL can help small business owners weather the COVID-19 storm. But before signing on the dotted line, you should be aware of some of the disadvantages of this loan.

1. It’s not eligible to be forgiven

Unlike the PPP loan, EIDL loan forgiveness is not an option. The only portion of the loan that was able to be forgiven was the advance, which is no longer available.

2. It’s restrictive

As mentioned earlier, there are a lot of things that you cannot spend EIDL funds on, including employee bonuses, relocation costs, or loan repayments.

3. Cannot be used for repairs

If someone took the drive-through option literally at your restaurant, you cannot use an EIDL loan to repair the damage. Likewise, if your deep fryer goes on the fritz, or your roof springs a leak, you’ll have to rely on other funds to take care of those repairs.

Is an EIDL loan in your future?

If your business has been hurt by COVID-19, it may be worth applying for an EIDL loan. While taking out any loan requires serious consideration, an EIDL loan offers good repayment terms, a low interest rate, and an easy application process. Like any loan, there are disadvantages to obtaining an EIDL loan, so it’s up to you to determine whether the advantages outweigh the disadvantages.

If your financial projections are looking grim, it might be worth considering applying for an EIDL loan before the December 21, 2020, deadline arrives.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles