IRS Form 14157: What It Is and Why You May Need It

Many small business owners and sole proprietors turn to professionals to prepare their annual business tax returns. A lack of experience and the complexity of a business tax return are just a few of the reasons why business professionals seek out help.

And even though there are good tax preparation software applications available for those that prefer to prepare their taxes themselves, others find they’re more comfortable handing over the reins to a professional tax preparer.

But what happens when the preparer makes an error? The unfortunate truth is that if a preparer messes up your tax return, you are still liable for the errors.

For example, John decided to use a tax preparation service to prepare his business taxes. Since John is a carpenter by trade, he knows nothing about taxes and trusts that the preparer he chooses will complete the return accurately, so he hands over his checklist of tax documents to the preparer. When John gets the return back, he assumes that it’s correct, signs it, and it is submitted to the IRS.

Unfortunately, the tax preparer has left off a zero on John’s income for the year, giving him a refund to which he is not entitled. John, not knowing what to look for, has no idea that anything is wrong until he receives a letter from the IRS requesting additional information on his income. When John provides his actual income, he is then sent another letter stating that he owes the IRS more than $3,000.

Even though the preparer is the one that made the error on the return, John is responsible for taxes owed and will have to make arrangements to pay the $3,000 tax bill.

There is one thing that John can do: He can learn how to file a complaint against the tax preparer by using IRS Form 14157 or Form 14157-A. Both of these IRS complaint forms are designed to report tax preparer fraud or other tax complaints, but they need to be completed properly.

Overview: What is IRS Form 14157?

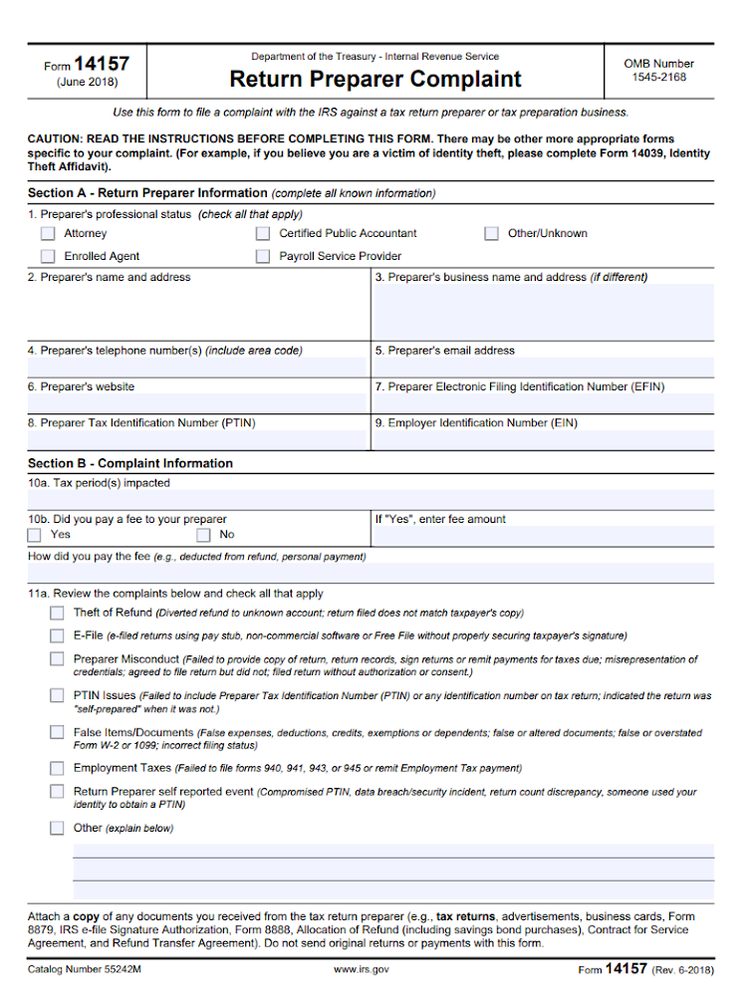

Form 14157 and Form 14157-A are tax preparer complaint forms that can be used by individuals, sole proprietors, and single-member LLCs to report a tax preparer’s misconduct.

And while mistakes can happen in any profession, the repercussions of mistakes made by tax return professionals can severely impact your business. Form 14157 is used to report general misconduct, while Form 14157-A is used when your taxes have been impacted by the behavior of the preparer.

While these tax preparer complaint forms don’t let you off the hook for paying taxes owed, they allow you to anonymously report tax preparer misconduct.

Form 14157 allows you to identify and state the reason for your return preparer complaint. Image source: Author

When you should (and should not) use Form 14157

The most glaring errors are those that impact your tax return or your refund. If you’re using an unenrolled preparer, which is a preparer that is not an attorney, CPA, accountant, or enrolled agent, the chances of impropriety increase since the preparers are not licensed by the IRS.

Be particularly wary if your preparer charges you based on the amount of your refund, which can result in a multitude of falsified information being included on your return.

If your tax return or refund is directly impacted by the actions of a return preparer, you can use Form 14157 and Form 14157-A to report the following issues.

1. Unauthorized filing

Since filing information is retained in a preparer’s computer system, there is nothing to prevent an unscrupulous preparer from filing a tax return the following year without your authorization. While this is not a common occurrence, if you receive a duplicate filing notice from the IRS, check to see if a return was filed without your permission.

2. Falsifying exemptions or dependents

In some cases, tax preparers will try to boost your refund (and their fees) by increasing your exemptions or dependents. Be sure to review this area prior to signing the return.

3. Falsifying income

Decreasing the amount of income earned on a tax return can frequently result in an increased refund. However, remember that leaving off income from a 1099 or W-2 will only result in the IRS flagging your return for an audit.

4. Creating false deductions or expenses

Adding false tax credits, deductions, or fictitious expenses can result in an audit. Be sure that your preparer is adding only documented information to your return.

4. Altering documents

Be wary if your preparer tries to alter any of your tax documents, such as deductions or proof of income.

While it’s reassuring to know that there is a mechanism in place for reporting return preparers who have scammed you, if you suspect it’s an honest mistake, approaching the preparer to have them file an amended return on your behalf may be a better approach.

If you suspect erroneous tax returns were filed as a result of identity theft, you will need to file Form 14039, Identity Theft Affidavit instead of Form 14157.

Other reasons to file Form 15157

Even if your tax return has not been negatively impacted, you can still report improper tax preparation practices committed by a tax preparer, including the following infractions.

1. Neglecting to include a Preparer Tax Identification Number

Ghost preparers prey on clients by not providing a copy of their Preparer Tax Identification Number (PTIN), do not sign the return, and request that the taxpayer file the return themselves. If electronically filed, these preparers will also refuse to digitally sign the return. If any of these occur, find a new preparer.

2. Failing to provide clients with a copy of their return

Any preparer who refuses to provide you with a copy of your return should be reported. Without a copy of the return, you’re unable to see exactly what was submitted to the IRS. Sneaky preparers can request that your refund be sent directly to them.

3. Refusing to return client tax records

Some tax preparers have withheld client documentation pending payment. If a preparer is being paid from your return, they cannot withhold tax records from you until they are paid.

4. Falsifying credentials

Does your preparer present themselves as a CPA, attorney, or enrolled agent? If so, make sure that you’re able to view their credentials yourself. If they cannot provide proof of their claims, you can report them to the IRS.

5. Using off-the-shelf tax software to prepare the return

Professional tax preparers should be using proprietary software and not off-the-shelf tax preparation software designed for individual use. Regardless of whether it affects your return or not, this practice should be reported.

Best practices when reporting a tax preparer

No one wants to report a preparer, but if you find yourself the victim of shoddy practices, keep these suggestions in mind.

1. Complete both Form 14157 and Form 14157-A if necessary

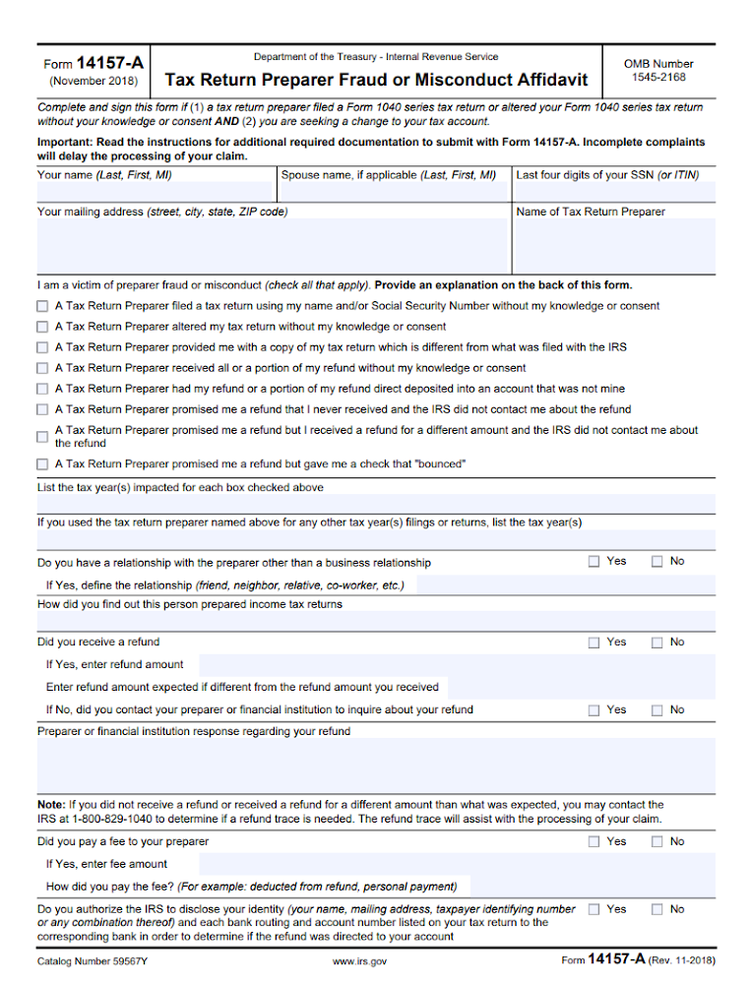

For general complaints, you can file Form 14157, but If you suspect that a return preparer filed or altered a return without your prior consent, you will have to file both Form 14157 and Form 14157-A.

You’ll have to file Form 14157-A along with Form 14157 if a preparer submitted a return on your behalf without your knowledge. Image source: Author

To be sure that your complaint is processed without delay, provide all the information requested on both forms, including a written explanation of the circumstances surrounding your complaint, as well as details regarding your interaction with the tax preparer.

2. Be sure to include copies of all relevant documents

When submitting Form 14157-A along with Form 14157, be sure that you have copies of all relevant documents regarding your complaint, including a copy of the prepared return, any advertisements or business cards received from the preparer, as well as copies of any agreements or contracts you may have signed.

The IRS provides a list of required evidence that needs to be included with the complaint. Image source: Author

You’ll also have to submit evidence of your interaction with the preparer. This evidence can include:

- A copy of tax return that identifies tax preparer

- A copy of a receipt from the tax preparer

- A copy of documents received from the tax preparer

Depending on the type of fraud committed, other information may be required as well.

3. Include the details

The details surrounding your complaint are just as important as the documents you submit. Be as detailed as possible when describing your interaction with the preparer. These details can help produce a stronger case against the preparer. While the IRS does provide you with a section to include these details, feel free to elaborate on a separate piece of paper as well.

4. Keep a copy for your records

Form 14127 and Form 14127-A can be submitted via fax or by mail. If mailing, be sure to keep a copy of the completed form, as well as any documents or information that you provided in your initial complaint.

Choose a preparer carefully

Don’t just drop off your tax documents and hope for the best. An unscrupulous tax preparer can cause a multitude of problems for you and your business. When looking for a preparer, be sure to choose wisely. Ask for recommendations from other business owners, and when you do find a preparer, due diligence is important; so check their credentials and qualifications before turning over valuable financial data.

Doing these things can eliminate the need to ever file Form 14157.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles