Form 940 vs. Form 941: What’s the Difference?

I’ll keep this brief because we have a lot to discuss. We’re talking about two tax forms that business owners need to fill out to make sure they’re accurately paying their employment taxes. Grab your favorite caffeinated beverage, and let’s get started.

Overview: What’s the difference between IRS Forms 940 and 941?

Forms 940 and 941 are IRS returns where businesses report their payment of employment taxes. The filings true up what you’ve already remitted to the IRS with what you owe. When there’s a discrepancy, you can ask for a refund, put the overpayment toward your next payment, or pay what you owe.

The difference between Forms 940 and 941 lies in the type of employment tax reported. Form 940 is for federal unemployment, and 941 is for Medicare, Social Security, and federal income tax withholding. Form 940 is an annual form due every Jan. 31, and Form 941 is due quarterly, one month after the end of a quarter.

| Form 940 | Form 941 | |

|---|---|---|

| Federal unemployment taxes |

|

|

| Medicare tax |

|

|

| Social Security tax |

|

|

| Federal income tax withholding |

|

|

| Due quarterly |

|

|

| Due annually |

|

3 documents are required for filing IRS Forms 940 and 941

Gather these three documents before diving into Forms 940 and 941.

1. Quarterly and annual payroll report

Look for or create a payroll report that contains the following information:

- Gross pay

- Wages subject to Federal Unemployment Tax Act (FUTA) and FUTA taxes paid

- Wages subject to State Unemployment Tax Act (SUTA) taxes and SUTA taxes paid

- Wages subject to Social Security tax and Social Security tax paid

- Wages subject to Medicare tax and Medicare tax paid

- Federal income tax withholding based on employee Forms W-4

When filing Form 941, you only need information from the most recent quarter. Form 940 wants to see data from the past tax year, so you’ll need to pull the annual report for the filing tax year.

2. Outstanding tax liability report

As long as it’s set up correctly, your payroll software remits employment taxes and other deductions after every payroll run. However, hiccups with a payment portal’s servers or your taxpayer ID credentials might cause your software to miss a payment.

Unfortunately, you can’t count on an email with the red siren emoji that screams “We forgot to pay your taxes!” when you open it. Look for an outstanding tax liability report to see if your payroll software couldn’t remit a payroll tax.

3. List of credit reduction states

This one is just for Form 940. To calculate your FUTA tax liability, you need to know whether any states where you pay SUTA are a credit reduction state. Credit reduction states refer to the states and territories that have not repaid federal government loans they took out to fund their unemployment programs.

When you pay your state unemployment taxes, you’re eligible for up to a 5.4% credit on FUTA, which otherwise taxes the first $7,000 of each employee’s eligible wages at 6%. Credit reduction states don’t get the full credit as a penalty for being in the federal government’s debt.

The Virgin Islands is tax year 2020’s only credit reduction state, a status it’s had since 2011, according to U.S. Department of Labor (DOL) data. Companies with employees in credit reduction states must fill out Form 940 Schedule A to adjust their FUTA liability.

You should check the DOL website before filing Form 940 to make sure you don’t owe SUTA taxes to a credit reduction state.

4. Previous Forms 940 and 941

When filling out any IRS form, it’s best practice to pull up a previous filing of the same form. Much of the company information won’t change from year to year, and some of the information on the most recently filed form can remind you of tax overpayments relevant to your newest filing.

How to fill out Form 940

Form 940 is an annual tax form due on Jan. 31 to report FUTA payments based on the previous year’s wages. You can file Form 940 with payroll software, tax software, the IRS e-file service, or by mail.

You’re required to make quarterly FUTA tax payments to the IRS when your FUTA liability grows higher than $500. Businesses with annual FUTA tax liabilities of $500 or less can attach a payment with Form 940.

1. Company information

Not much explanation is required here. Fill out your company’s name -- or your name if you run a sole proprietorship or single-member LLC -- your employer identification number (EIN), and address.

It’s only downhill from here, so I hope you brought your toboggan.

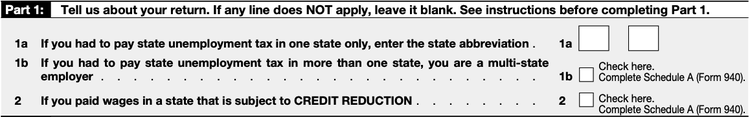

2. Part 1

Part 1 asks whether you pay SUTA tax in one or more states. It also requires that you check whether any of the states are credit reduction states. Check the appropriate box or boxes for your business’s situation.

You might have to attach Schedule A with Form 940. Image source: Author

Say you run a business in the District of Columbia and have employees who live there and also in Virginia and Maryland. Since your employees live in three different states or territories, put a check on line 1b. If you operate a business in Oklahoma with employees who all live in-state, check line 1a.

When you check 1b or 1c, or both, you need to fill out Form 940 Schedule A to delineate where and what you’ve paid.

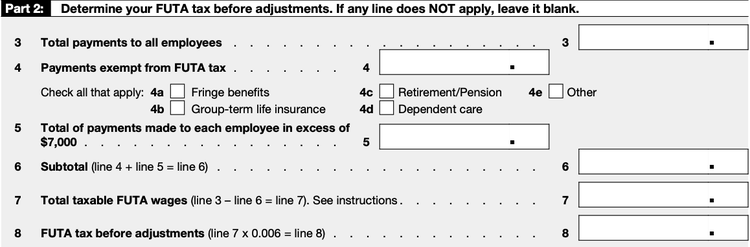

3. Part 2

The crux of Form 940 begins in Part 2. We’re going to calculate all the wages subject to FUTA before making some tweaks in Part 3.

Use Form 940 Part 2 to determine your FUTA tax before adjustments. Image source: Author

Line 3. Enter the total compensation your employees received during the year, including fringe benefits, employer retirement contributions, and tips.

Line 4 through 7. Now it’s time to take out the compensation exempt from FUTA, such as health insurance and employer 401(k) contributions. Check out our FUTA guide for help calculating FUTA wages.

Line 8. Multiply eligible FUTA wages on the line above by the effective FUTA rate of 0.6% (6% FUTA rate - 5.4% FUTA credit).

4. Part 3

Here’s where you make adjustments to your FUTA tax liability. You can skip this section unless you have employees in a credit reduction state or a part of employees’ FUTA wages were exempt from SUTA.

Your FUTA tax liability may be adjusted for SUTA payments or a credit reduction. Image source: Author

Check your annual payroll report for a difference between the amounts that were subject to FUTA and SUTA. If they’re the same number, keep it moving. If there’s a difference, you’ll have to figure out the additional amount you owe by filling out the worksheet in the Form 940 instructions.

In the unlikely situation that your employees’ wages are entirely exempt from SUTA, you have to pay the full 6% in FUTA taxes. Multiply line 7, the wages subject to FUTA, by the remaining 5.4% and put it on line 9.

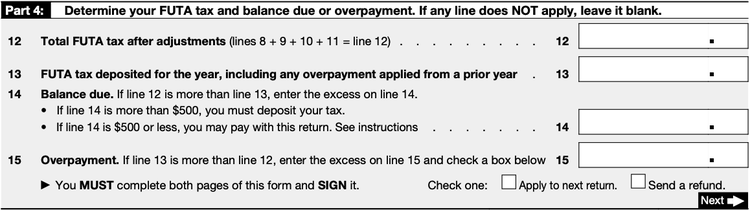

5. Part 4

Part 4 determines when you overpaid, underpaid, or accurately paid FUTA taxes last year. There’s no prize for paying FUTA taxes on the nose, although you should know that I’m immensely proud.

Part 4 shows whether you owe more in FUTA taxes with your Form 940 filing. Image source: Author

Line 12. Add up lines 8 through 11 to arrive at the actual amount your business owes in FUTA taxes based on last year’s wages.

Line 13. Enter the amount you’ve already paid in FUTA taxes, plus any overpayment you’re carrying over from the previous year. Your annual report should have your FUTA taxes paid, and last year’s Form 940 filing will show whether you have an overpayment to apply.

Line 14. If you paid less in FUTA taxes during the year than you owe, you report the amount here.

Line 15. Overpayment goes here. Check, “Apply to next return,” if you’re OK with rolling the extra amount into next year’s 940. Otherwise, check “Send a refund,” and the IRS will send the overpayment back to you.

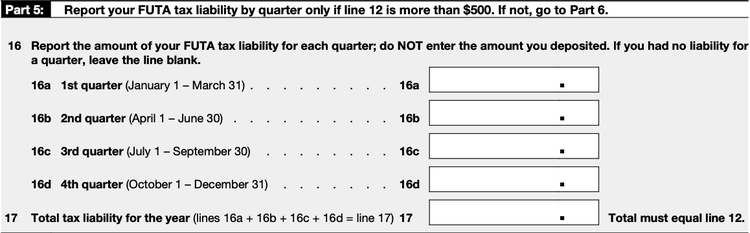

6. Part 5

Part 5 tests your bookkeeping skills. You’re asked to enter your FUTA liability by quarter. Be careful not to enter the amount you deposited for FUTA each quarter. They want to know how much you owed, not how much you sent in. You can skip this section if your FUTA liability listed on line 12 is $500 or less.

Say the Payroll Taxes account in your accounting software shows you incurred $400 in FUTA taxes in the first quarter of 2020, and your payroll tax deposit records show you sent in $450 on March 31. You’d report $400, since that’s how much you owed despite overpaying.

You know you’ve correctly filled out Part 5 when line 17 matches line 12. Image source: Author

7. Parts 6 and 7

It’s time to wrap it up.

Part 6 allows a business owner to designate an employee or outside accountant to discuss the Form 940 filing with the IRS on behalf of the company. Part 7 is your standard IRS form signoff, requiring a signature, date, and phone number.

How to fill out Form 941

Now let’s turn to Form 941. You’ll fill out Form 941 quarterly to report Medicare tax, Social Security tax, and federal tax withholding.

Most businesses remit payroll taxes after every pay period and use Form 941 to reconcile the payments with their liabilities. Companies with employment tax liabilities of $1,000 or less use the annual version of Form 941, Form 944.

In a bid to put more cash in American workers’ pockets amid the COVID-19 pandemic, Congress passed legislation in 2020 that allowed business owners to defer collecting Social Security tax from some employees from Sept. 1, 2020, until Dec. 31, 2020. That, and the addition of paid sick and family leave tax credits, caused a series of changes to Form 941.

If you decided not to collect Social Security tax in the last quarter of 2020, your Form 941 might look a little wonky for the next few quarters. Talk to an accountant before filing Form 941 on your own.

So, let’s get on with Form 941.

1. Company information

This section should have you feeling some déjà vu. Forms 940 and 941 share the same top section. Fill out your business’s name, EIN, and address.

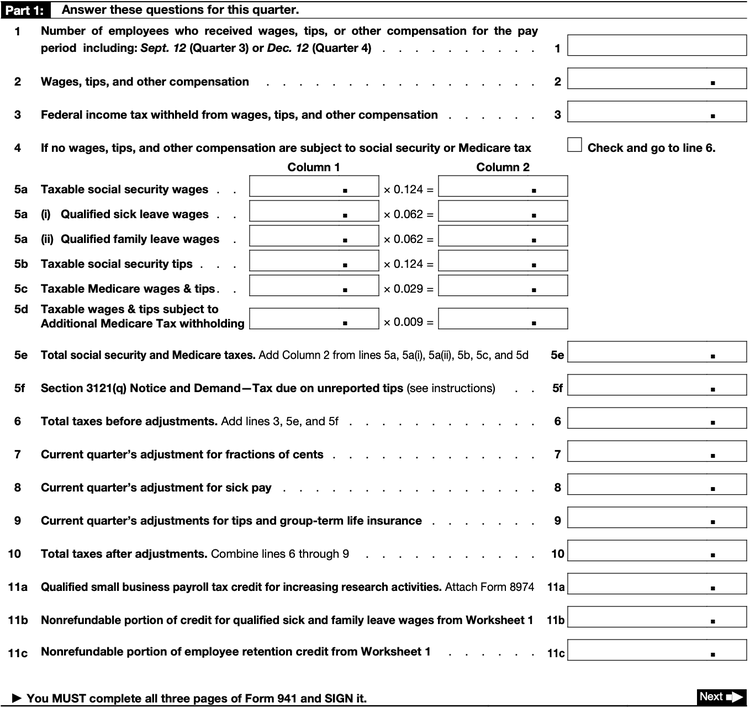

2. Part 1

Here’s where the similarities between Forms 940 and 941 cease.

Part 1 has you calculate the employee and employer sides of Social Security and Medicare taxes and report how much you withheld for employees’ federal income taxes. Most lines in Part 1 can be taken directly from your quarterly payroll report, but check out our guide to FICA taxes for help with any last-minute calculations you need to make.

The IRS revised Form 941 in July 2020 to reflect COVID-19 relief funding for qualified sick leave and family leave and the Social Security tax deferral for employees. If you’re claiming tax credits for employee sick or family leave, find an accountant to take the lead in filing Form 941.

The IRS revised Form 941 in July 2020 to accommodate COVID-19 tax relief. Image source: Author

Businesses whose employee compensation was untouched by COVID-19 tax deferrals or tax credits can skip most lines in Part 1.

Lines 14 and 15 reveal whether you overpaid or underpaid your FICA taxes. Same as with Form 940, you may choose to put an overpayment toward next quarter’s payment or get it back in a refund check.

3. Part 2

Part 2 wants you to break down your employment tax liabilities over the quarter. Most businesses must fill out and attach Form 941 Schedule B to delineate their employment tax liabilities by payday.

“Semi-weekly” and “monthly” don’t mean what you expect on Form 941. Image source: Author

Part 2 talks about “monthly” and “semi-weekly” depositors, but I promise these terms don’t mean what you think they do. Your depositor schedule depends on the amount of taxes you reported in a previous tax period, IRS Notice 931 explains. If this is your first time completing a Form 941, ask a professional to determine your depositor schedule.

To fill out Schedule B, input the amount of employment taxes -- federal tax withholding, Medicare tax, and Social Security tax -- owed on each payday in the quarter. Depending on how many times you pay your employees, you’ll fill out between one and four boxes for each month.

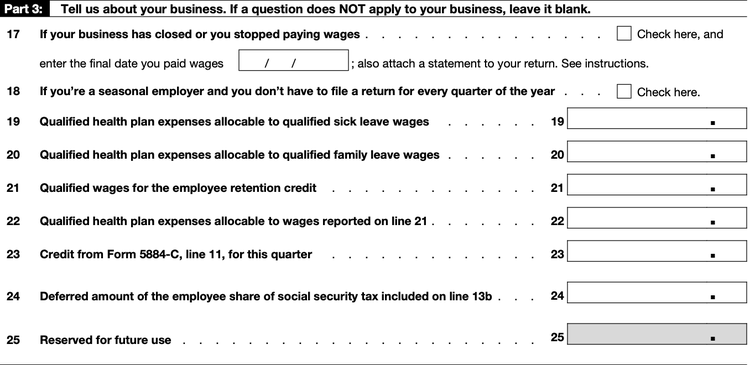

4. Part 3

Most businesses will leave Part 3 empty. The section expanded considerably after legislators introduced the employer retention credit (ERC) and the paid leave program in the first COVID-19 relief package. If your business took advantage of these economic life rafts, you’d want a professional to help you here.

Most businesses can skip Part 3 on Form 941. Image source: Author

5. Parts 4 and 5

And just like that, you’re ready to sign another IRS form. You can grant a paid preparer or employee the privilege of discussing your Form 941 with the IRS in Part 4. Finish off the form in Part 5 with your John Hancock.

May the forms be with you

Filing IRS return forms is not for the faint of heart. When the thought of filling out quarterly tax forms weighs heavily on your psyche, it might be time to invest in payroll software to help out.

Payroll software does more than create pay stubs and direct deposit your employees’ earnings. It also files required IRS tax forms like Forms 940 and 941 as it quietly hums in the background.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles