If you know how to balance a checkbook, you’re more than halfway to learning how to balance a general ledger.

Overview: What is general ledger reconciliation?

The general ledger stores business transactions organized by account. Reconciling the general ledger ensures you correctly recorded each transaction by comparing source documents -- statements, checks, and invoices -- with accounting records.

Before accounting software existed, businesses would record every business transaction in a “general journal,” a chronological transaction log. The same transaction gets written down in another book called the “general ledger,” which keeps a running balance of every account.

Say it’s 1999, and your business receives a $500 utility bill. You’d open up the general journal and record a journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 10/15/20 | Utilities Expense | $500 | |

| Accounts Payable | $500 | ||

| For electricity in September - Invoice #1044 |

Then, you’d open the general ledger to update the affected account balances. Your general ledger’s accounts payable section will look like this.

| Date | Transaction | Debit | Credit | Balance |

|---|---|---|---|---|

| Opening balance | $1,000 | |||

| 10/1 | Telephone bill - Invoice #4194 | $100 | $1,100 | |

| 10/5 | Office supplies (paid) - Invoice #33 | $300 | $ 800 | |

| 10/15 | Utilities - Invoice #1044 | $500 | $1,300 |

You can imagine how easy it would be to make mistakes recording the same transaction in two places. Accountants regularly conducted general ledger reconciliations to catch errors.

The general journal and general ledger still exist in the modern era of accounting, just not in an analog format. Instead of recording each transaction in two places, you record transactions once, reducing the likelihood of transposition errors.

Now, a general ledger reconciliation looks different -- and is easier -- thanks to the advent of accounting software. Your business should still conduct general ledger reconciliations at least quarterly to catch errors in transaction amounts and categories. Technology is not immune to mistakes.

How to prepare a general ledger reconciliation

Accounting demands precision and patience. Take a few cleansing breaths before getting to step one.

1. Compare beginning and ending account balances

Before you begin the deep dive into your business transactions, verify that asset, liability, and equity accounts’ prior period ending balances equal this period’s beginning balances, down to the penny. If you use accounting software, you’ll be able to complete this step quickly since it’s unlikely your software made a mistake, yet it can happen.

Temporary accounts -- revenues and expenses -- start at zero at the beginning of every period. Accounting software can automatically prepare closing entries at the end of each accounting period, zeroing out revenues and expenses for a fresh start in the upcoming period. Close your books at least annually, but it’s best practice to do it monthly.

Those who keep their books manually should take their time in this first step. You don’t want to be wracking your brain later trying to find what turns out to be a senseless clerical error.

To compare beginning and ending account balances, look at your company's adjusted trial balance from the previous accounting period and the general ledger from this accounting period. For asset, liability, and equity accounts, match the ending balance on the trial balance to the general ledger's beginning balance. Revenue and expense accounts should start with a zero balance.

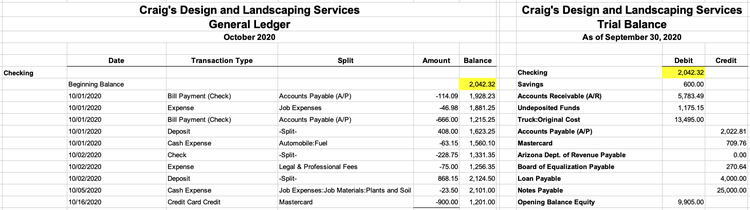

I’m conducting a general ledger reconciliation for a sample company that uses QuickBooks Online. I matched the company's cash account balance as of September 30, 2020, to the October general ledger's opening balance.

Compare the ending trial balance and the opening general ledger balance for each account. Image source: Author

2. Reconcile accounts to the general ledger

It’s time to roll up your sleeves for the general ledger audit. Account by account, comb through all the transactions listed on your general ledger for the period. Make sure you have documentation supporting the date, dollar amount, and accounts involved.

Your bank account is probably the most active, meaning it’ll take the longest to reconcile. Most accounting software packages have a bank reconciliation feature that automates part of the process.

If you’re not the only person with access to your business funds, you should match approval documentation to each transaction. An auditor somewhere will thank you.

After you’ve reconciled your cash accounts, you can move onto your other, smaller accounts. Some accounting software, QuickBooks Online, for example, have an account reconciliation tool for non-cash accounts.

Manual bookkeepers need to add an extra step here. Since you store transactions in the general journal and the general ledger, there’s a chance you’re missing a transaction in one place. Create a column in your books to place a checkmark when transactions in the general ledger and general journal match. You should also recalculate each account total to weed out clerical errors.

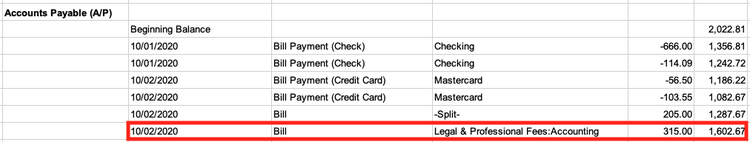

Let’s say I want to reconcile the last transaction in our sample company’s accounts payable account.

Investigate each transaction using source documentation. Image source: Author

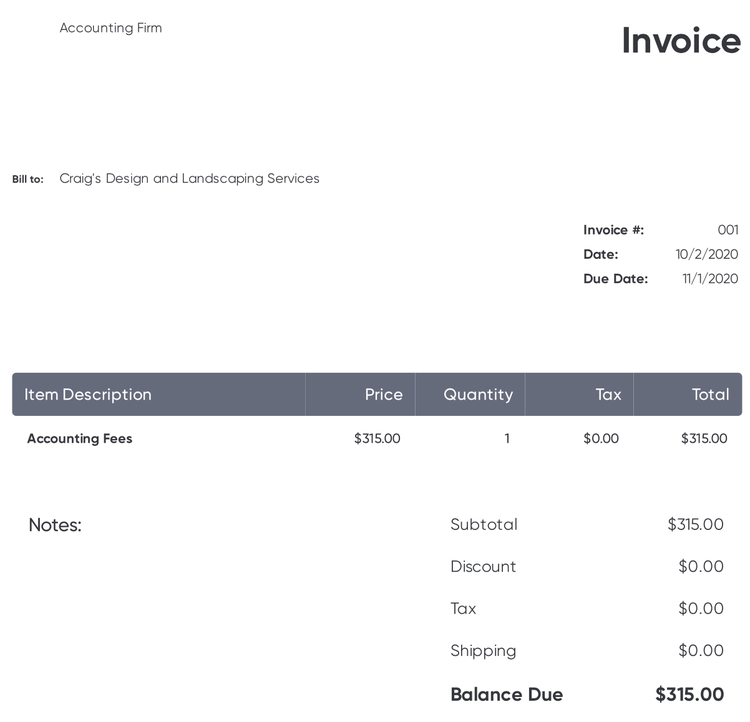

To complete the reconciliation, I pulled up the company's invoice, which corroborates the transaction's date and amount

Use invoices, checks, and receipts to verify transactions in your general ledger. Image source: Author

.

3. Create correcting entries

So, you completed an account reconciliation and noticed an amount was entered incorrectly. Don’t panic: You can fix it with a correcting entry.

It's best practice not to edit an incorrect entry. Instead, record a correcting entry. You can either reverse the erroneous transaction and create a new entry. Or, you can create a new entry that fixes the error in one fell swoop. You're less likely to make another error if you try the former method.

For example, I discovered someone incorrectly recorded payment from a customer named Travis. The general ledger says he paid $81, but the check shows he paid $810.

Reverse the incorrect entry by swapping the accounts you originally debited and credited:

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable - Travis | $81 | |

| Cash | $81 |

Then, record the correct entry:

| Account | Debit | Credit |

|---|---|---|

| Cash | $810 | |

| Accounts Receivable - Travis | $810 |

If you identified a missing transaction in your books, record a journal entry as if you hadn’t missed it in the first place.

4. Prepare adjusting entries

It’s customary to record depreciation and other adjusting entries at the end of the accounting period, after you’re sure there are no errors in your books. Your accounting software can automatically generate recurring journal entries when it’s appropriate.

For example, the sample company set up a recurring journal entry that records $500 in machinery depreciation at the end of every month.

| Account | Debit | Credit |

|---|---|---|

| Depreciation Expense - Machine | $500 | |

| Accumulated Depreciation - Machine | $500 |

Adjusting entries for accrued expenses and deferred revenue must eventually be reversed to avoid misstating your financial position.

5. Run reports

Congratulations, you’re done! I feel like some sort of superhero movie type music should start playing in the background.

Now that you’re confident in the accuracy of your account balances, you can generate the basic financial statements to analyze your general ledger transactions.

In essence, you just conducted an income statement and balance sheet reconciliation. When you use accounting software to draft financial statements, you shouldn’t have to do another GL account reconciliation… until next month.

Don’t wait

Tax season is not the only time you should think to reconcile the general ledger. Filing your taxes is stressful enough, and trying to correct errors made months ago at the same time will only add to your stress.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.