A Beginner's Guide to Accepting Credit Card Payments

As a small business owner, you know you have to keep your costs as low as possible to minimize overhead as you grow your sales and customer base. A day off? What kind of crazy idea is that? Credit card payments? Cash and checks still do the job, right?

Sure, as you first got your business off the ground, setting up the process to take credit card payments may have seemed like a "nice to have" feature as opposed to a "must have." Given the multiple benefits from accepting credit card payments, however, there's no time like the present to select a point of sale (POS) system to allow these transactions.

Why your small business should accept credit card payments

While the cost to accept credit card payments 15 or more years ago was prohibitive for smaller merchants, that’s not true today, thanks to multiple, web-based POS system providers. Plus, beyond just adding a new payment method, there are additional advantages for your business.

1. Increased sales

It's simple: To maximize potential revenue, you must take the kinds of payments your customers use the most. Checks? Unless you're fulfilling a purchase order leading to a future payment by a company check, who uses checks anymore? The same goes for cash. Plus, credit and debit cards allow people to make impulse purchases at your business without the hassle of finding an ATM.

2. Sales analytics

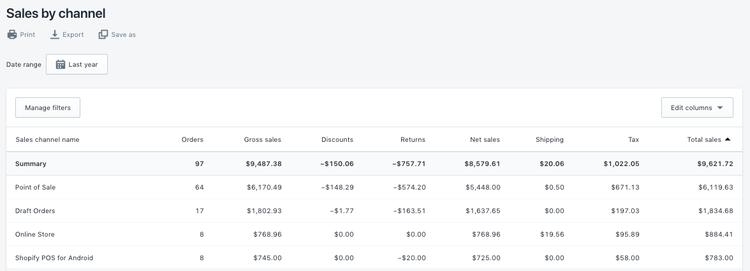

Sales by cash and check offer you very little actionable information once you make an end-of-day bank deposit. Instead, as the screenshot below shows, your typical POS system can break out sales by channel for different time periods -- day, week, month, quarter, or year -- along with other important information such as returns, number of orders, discounts applied, and more.

This Shopify POS sales by channel report provides key information about different sales metrics including discounts and returns. Image source: Author

In addition, almost all POS systems will have options to run product- and employee-specific reports. That way you can see what's selling, how well your marketing campaigns are working, and which employees know how to close a sale and can share their sales techniques and sales tactics with coworkers. Plus, if you tie inventory management to sales, you'll know when to order new inventory as well as make sure you're not perpetually overstocked with other items.

3. Customer management

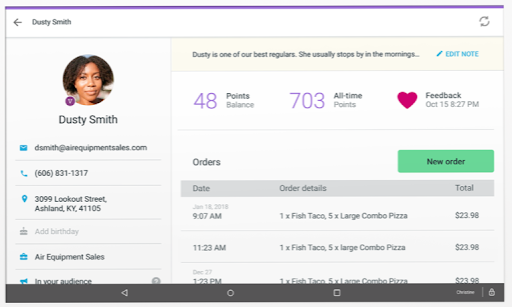

Customer acquisition is critical to grow your business, but customer retention is equally important because it costs significantly more to find each new customer than to keep the ones you already have. A good POS system will allow you to create customer accounts to better serve repeat customers and increase revenue.

This sample customer record in Clover's POS includes information such as loyalty points and recent order information to help with marketing efforts. Image source: Author

Available options with many POS systems include shipping/delivery information, loyalty programs, and targeted marketing and sales offers for customers. For example, depending on how much information you capture, you could create automated emails that offer a birthday greeting and coupon for a favorite food item.

How you can start to accept credit card payments

When you're looking for the best point of sale system to accept credit cards, there's one important fact to keep in mind: There is no absolute one best system. Instead, you'll have to do some careful research to find the best one for your business.

Step #1: Determine your POS needs

Even a cursory search will turn up multiple POS systems for businesses of all sizes. That's why you must first assess your current needs as well as look ahead to the future.

Tips for determining your POS needs

Knowing exactly what you do, and don't do, will keep you from overpaying for features you may not require.

- Determine the scope of your POS use: How many physical locations do you need to do POS sales simultaneously? How many employees will be using the system? Do you have, or want to have, a website with sales capabilities integrated into your POS?

- Project your sales: Looking at your current sales, how many transactions do you currently have per day? How many could convert to credit card sales? How many additional sales do you anticipate generating?

Step #2: Choose a POS provider

Once you know your specific POS requirements, you can evaluate the wide range of providers. That includes options like Square, which will let you process individual sales on your smartphone with a plug-in card reader, all the way to ones like Shopify Plus that have the capability to handle thousands of transactions per minute.

Tips for choosing a POS provider

Make sure you understand the exact fee structure for each potential POS plan. Is there an annual and/or monthly subscription fee? What percentage will be taken out of each sale? Will there be an additional transaction fee? Are there any other fees to know about? Do you have to buy vendor-specific hardware?

- Industry-specific software: Depending on your industry, you might consider a system designed specifically for it. While Shopify is designed primarily for retail sales and inventory management, Clover and Toast POS are meant for use in the restaurant industry so that you can track orders by table and other restaurant-specific elements.

- Hardware requirements: Low-end plans will likely offer a free card reader for use with a smartphone like the Square reader below, but for other options, such as tablet register, cash drawer, printed receipts, or tap readers, you'll probably have to invest several hundred dollars or more in addition to your POS plan.

Square's basic swipe card reader can be connected to a smartphone. Image source: Author

Step #3: Set up the software and hardware

Once you've selected a POS plan, you'll need to configure the software and hardware as necessary to ensure dependable performance. That's why another key factor in choosing a provider is the depth and breadth of their onboarding process.

Tips for setting up hardware and software

You must protect both the credit card information you're collecting from customers as well as your software and hardware, so you don't suffer any internal or external losses.

- Internal security: Set up personal identification numbers (PIN) for each employee to log in and out of your POS system if that option is available. Not only will this tie them to specific shifts and transactions, you'll probably be able to track their hours for payroll purposes. You can also set up specific permissions for different workers or job positions, so everyone can only access what they need to do their job.

- External security: Fraud prevention services use AI and machine learning to identify potentially fraudulent transactions, and breach protection insurance will reduce your liability if customer data is compromised.

Step #4: Train your employees

Unless you're always operating by yourself, you'll have one or more employees who will be using the POS system to process credit card payments as part of the sales process. You'll have to train them on how to open the POS each day, use it for sales, and close it out at the end of the day to ensure the consistency you need.

Tips for training employees

Don't fall victim to "the curse of knowledge." That is, once you're familiar with your POS, it will be second nature to operate it. The same will not be true, however, for your employees, especially new ones, so you need to thoroughly train all of them in its use.

- Use POS provider resources: In addition to walking employees through your POS, also have them look at resources available from the POS provider such as training videos and related documentation.

- Document workflow: The specifics of your POS workflow will be unique to your business, so document its various permutations. That way employees have a hard copy guide to refer to when you're not around, especially for those functions they may not use that often such as refunds or discounts.

Step #5: Use the metrics

A good POS will offer more than the capability to process credit card payments. Even most low-end plans will have the ability to produce basic reports for both sales and inventory as well as customer management. At the same time, you have to consistently make the time to analyze this data to aid your sales management efforts.

Tips for using metrics

Don't wait to set up your relevant sales-related reports. Instead, decide from the get-go which ones you want to produce so this doesn't get perpetually pushed back due to the day-to-day realities of running your business.

- Schedule reports: Decide what information you need to know on a daily, weekly, monthly, and quarterly basis and then set up reminders to run those reports or, if possible, have them automatically generated and sent to you.

- Act on key performance indicators (KPIs): Adjust your business strategy according to the data. For example, maybe you need to modify your pricing strategy for certain products or sales locations. Or maybe you can identify your employees who know how to be a good salesman and can pass their sales techniques on to others.

You need all the benefits from accepting credit cards

If you weren't convinced before, you should be by now: You need a POS system to accept credit card payments. That's because you'll be doing more than just adding another payment method, you'll also be significantly increasing your overall sales and marketing capabilities, customer management, and inventory control.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles